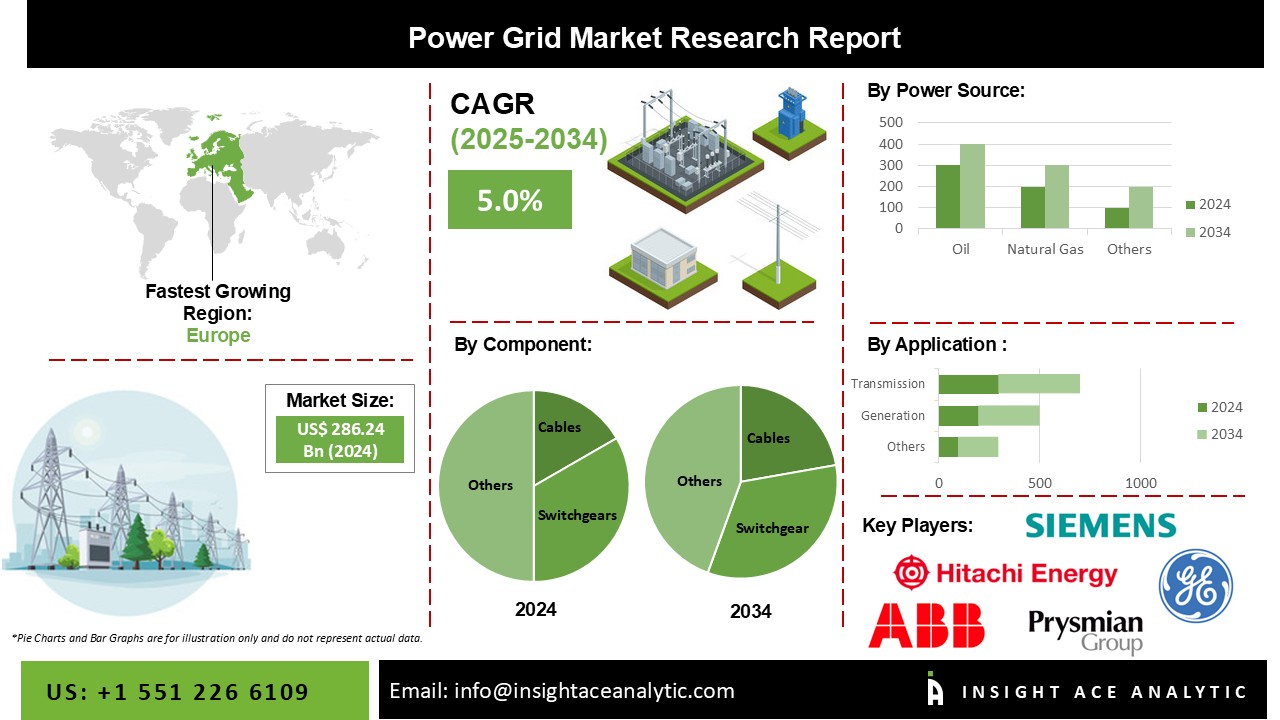

Power Grid Market Size is valued at 286.24 billion in 2024 and is predicted to reach 457.91 billion by the year 2034 at a 5.0% CAGR during the forecast period for 2025-2034.

The power grid is a physical system that transports electricity from its source to its destination. The power grid, which consists of producing stations (also known as power plants), and transmission and distribution systems, provides electricity on demand. Captive generation, wind power, and other power suppliers are the three primary categories of power sources in the market for the power grid. Any power plant built by an individual, cooperative society, or group of people (including enterprises) with the primary purpose of generating electricity for their use is referred to as a captive generating plant.

Over time, there has been a huge increase in demand for electrical grids, and it is projected that this demand will continue to grow dramatically for the foreseeable future. It is projected that factors such as expanding government initiatives for offshore renewable energy generation and the pressing need to cut carbon emissions and increase system stability and efficiency, would drive demand for the power grid industry.

Other factors influencing the growth of the power grid industry include growing government allocations and private investment market players for power grid systems. The power grid market is being constrained by a lack of technical workers in the sector, the low cost of onshore energy generation, and environmental issues related to the operation of offshore wind farms.

The power grid market is segmented on the basis of component, power source and application. The component segment includes Cables, Varaible Speed Drives, Transformers, Switchgear and Others. Power source segment includes Oil, Natural Gas, Coal, Hydro Electric, Renewables and Others. Application segment includes Generation, Transmission and Distribution.

The cables category is expected to hold a major share in the global power grid market in 2024. The offshore oil and gas and high-voltage power transmission industries have been major drivers of the use of subsea power cables. Additionally, connecting shore-based power systems using subsea power cables are common. The market size for power grid systems is highlighted as a result. These cables ensure the grid's stability and dependability by guaranteeing optimal power delivery. The probability of power outages can be decreased by using cables to stabilize voltage, balance the demand on various grid components, and prevent voltage swings.

The distribution segment is projected to grow rapidly in the global power grid market. Power distribution, which transports electrical energy from the transmission network to homes, businesses, and industrial sites, is a significant component of the power grid's architecture. Besides, during the forecast period, the transmission segment is anticipated to grow the fastest. Electrical energy would have to be produced close to where it is used, which would be excessively expensive and impracticable without an effective transmission network. Power transmission is crucial to guarantee that electrical energy is delivered consistently and without interruption.

Europe's power grid market is expected to register the highest market share in terms of revenue in the near future because these regions have good government policies and significant demand for renewable energy sources. Furthermore, strict energy efficiency regulations are driving up offshore wind farm construction in countries like Norway, the UK, and the Netherlands.

The intense focus of most European countries on utilizing renewable energy sources for power generation is driving up European market growth. Additionally, the significance of the market for the power grid system in Europe is highlighted by the growing requirement to comply with climate change legislation and policies combined with booming E&P activity in the Norwegian North Sea. For instance, to support the Green Deal, the EU will invest more than €1 billion in energy infrastructure in January 2022.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 286.24 Bn |

| Revenue forecast in 2034 | USD 457.91 Bn |

| Growth rate CAGR | CAGR of 5.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Component, Power Source And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | ABB (Switzerland), Siemens (Germany), General Electric (US), Prysmian Group (Italy), Nexans (France), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton (Ireland), Hitachi Energy (Switzerland), Powell Industries (US), Havells (India), LS Elctric (South Korea), Hubbell (India), Toshiba Energy Systems & Solutions Corporation (Japan), Fuji Electric (Japan), Sumitomo Electric (Japan), NKT (Denmark), Hyundai Electric & Energy Systems Co, Ltd (South Korea), Secheron (Switzerland), and Southwire Company (US). |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Power Grid Market By Component-

Power Grid Market By Power Source-

Power Grid Market By Application-

Power Grid Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.