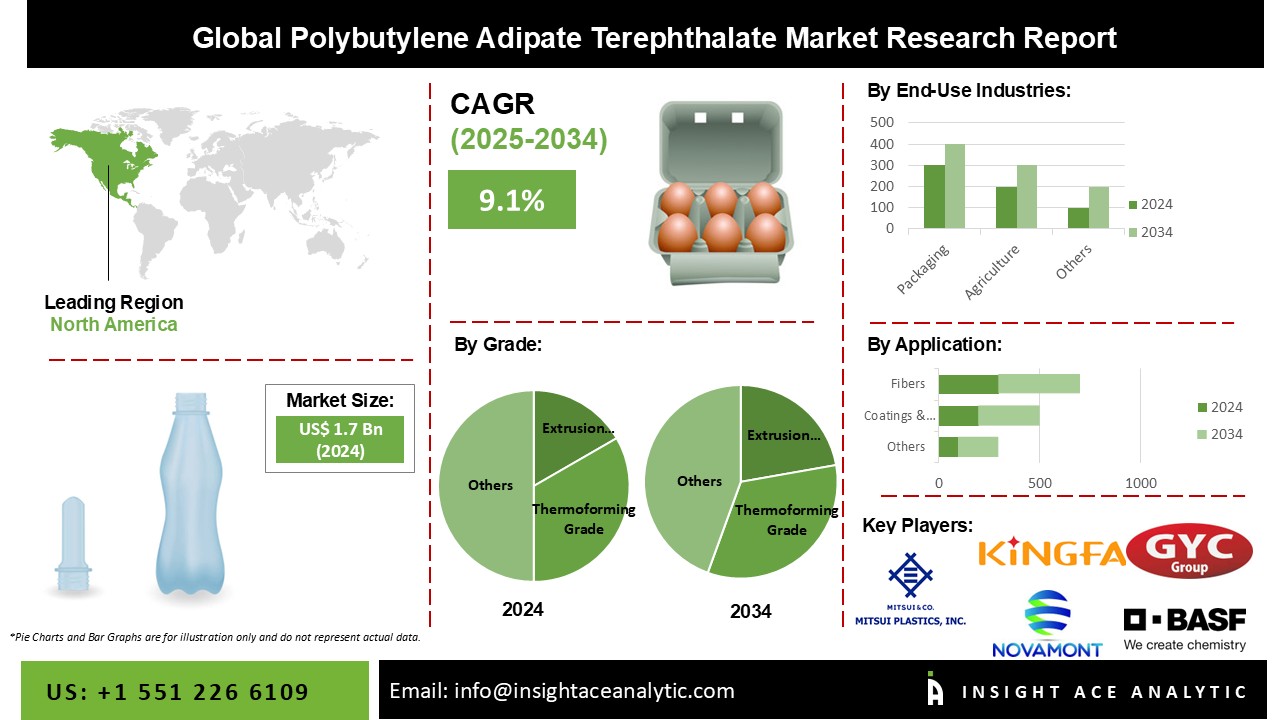

Polybutylene Adipate Terephthalate Market Size is valued at USD 1.7 Bn in 2024 And is predicted to reach USD 4.1 Bn by the year 2034 at a 9.1% CAGR during the forecast period for 2025-2034.

Adipic acid, 1,4-butanediol, and DMT monomers randomly copolymerize to form Polybutylene Adipate Terephthalate (PBAT), poly (butylene adipate-co-terephthalate), a biodegradable, semi-aromatic thermoplastic copolyester. Because of its characteristics, including biodegradability, high heat resistance, and mechanical strength, PBAT is greatly favored over other plastic goods. These characteristics of PBAT make it the perfect material for producers to use when creating biodegradable goods to address the growing environmental issues brought on by traditional plastics. Low-density polyethylene is touted as a biodegradable alternative to polybutylene adipate terephthalate.

Additionally, the rise in CRS initiatives to reduce reliance on fossil fuels, the increased emphasis on finding environmentally friendly alternatives, and the quick changes in the consumer products, packaging, and the beverage and food sectors contribute to the global market's revenue growth. During the forecast period, growth in the market is anticipated to be boosted by additional factors, including rising disposable income, high preference for packaged food, beverages, and online shopping, rising demand for composite bags, bin bags, mulch films, and cling films, and rising investments in R&D activities.

The Polybutylene adipate terephthalate market is segmented based on grade, applications and end user. Based on grade, the polybutylene adipate terephthalate market is segmented into extrusion grade, thermoforming grade and other grades. The application segment consists of films sheets & bin liners, coating & adhesive, molded products, fibers and other applications. By end user, the market is segmented as packaging, consumer goods, agriculture, bio-medical, and other end users.

The packaging category will record a major share of the global Polybutylene Adipate Terephthalate market in 2021. because of the world's rapidly growing population, shifting consumer tastes, increasing demands for packaged foods and other products, and the explosive growth of the food and beverage industry and e-commerce. Other elements anticipated to contribute to the segment's revenue growth during the projected period include growing consumer awareness of sustainable packaging, high usage of intelligent packaging for fruits and vegetables, and rising demand for single-use plastics and packaging solutions in the wake of the COVID-19 pandemic.

The extrusion grade segment is projected to grow rapidly in the global polybutylene adipate terephthalate market. A particular variety of polyethylene called extrusion grade is utilized in producing pipes, tubes, and films. It has several qualities crucial for pipe and tube fittings, including color, strength, and stiffness. The standard or everyday grades can be distinguished from the extrusion grade by looking at their physical traits, such as color and molecular weight. The rising demand from the automotive, industrial, and electronics industries is responsible for the market's expansion. Because of the greater need for complicated, lightweight, high-quality products, injection molding grade dominates the market.

The Asia Pacific polybutylene adipate terephthalate market is expected to Record the maximum market share in revenue shortly. As consumer spending grows dramatically and administrations worldwide promote bioproducts over petrochemical ones, there are expanding markets for PBAT. Packaging and bags made of polybutylene terephthalate are employed, and the fast food industry's expansion and consumer expenditure on purchasing things online have fueled market expansion. In addition, Asia Pacific is estimated to develop rapidly in the global Polybutylene Adipate Terephthalate market. A result of government attempts to promote PBAT products, expanding urbanization, a sizable consumer base, growing consumer knowledge of biodegradable products, and sustainability.

In addition, the region's expanding needs for mulch bags, composite bags, and cling films, as well as a growing preference for packaging that breaks down and rising investments in creating more advanced PBAT products, are anticipated to propel market growth in European region.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.7 Bn |

| Revenue Forecast In 2034 | USD 4.1 Bn |

| Growth Rate CAGR | CAGR of 9.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Ton) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Grade, By Application, By End-Use Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE (Germany), Novamont S.p.A (Italy), Willeap (South Korea), Kingfa (China), Hangzhou Peijin Chemical Co. Ltd (China), Zhejiang Biodegradable Advanced Material Co. Ltd (China), Anhui Jumei Biotechnology (China), Go Yen Chemical Industrial Co., Ltd (Taiwan), Jinhui Zhaolong Advanced Technology Co. Ltd (China), Mitsui Plastics, Inc (US), Chang Chun Group (China), and Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Polybutylene Adipate Terephthalate Market By Grade-

Polybutylene Adipate Terephthalate Market By Application-

Polybutylene Adipate Terephthalate Market By End-Use Industry

Polybutylene Adipate Terephthalate Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.