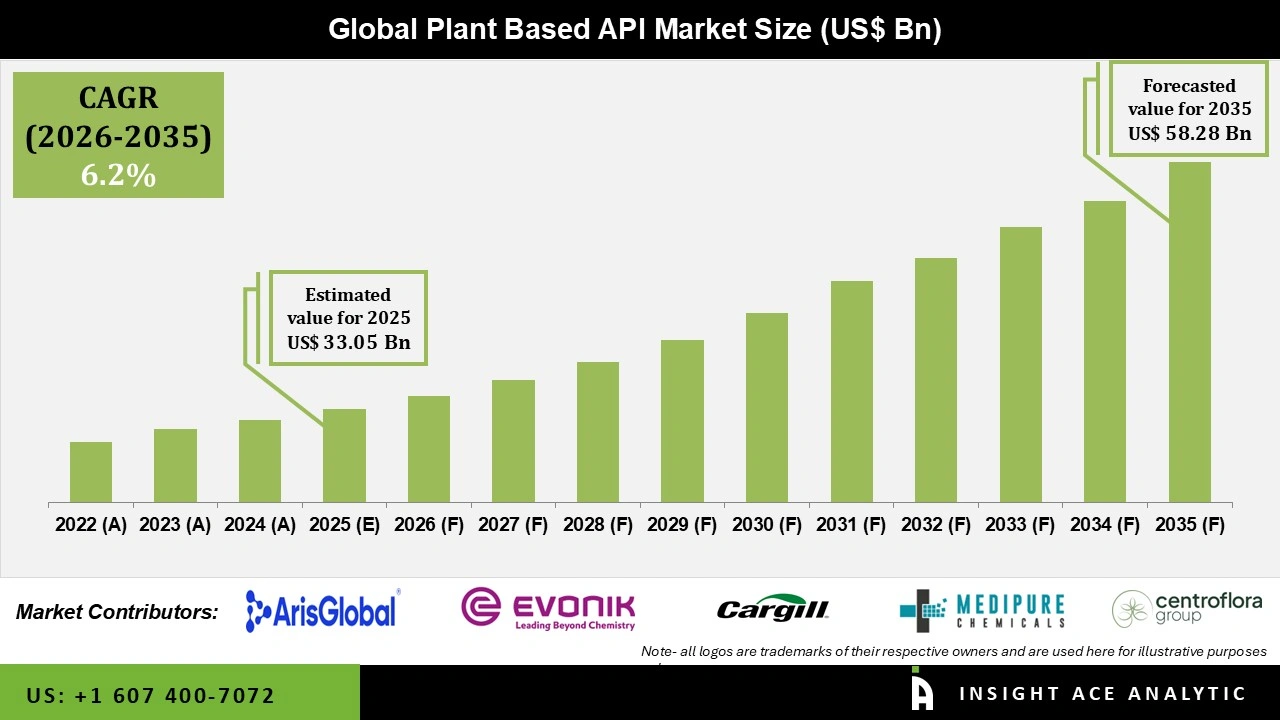

Global Plant Based API Market Size is valued at USD 33.05 Billion in 2025 and is predicted to reach USD 58.28 Billion by the year 2035 at a 6.2% CAGR during the forecast period for 2026 to 2035.

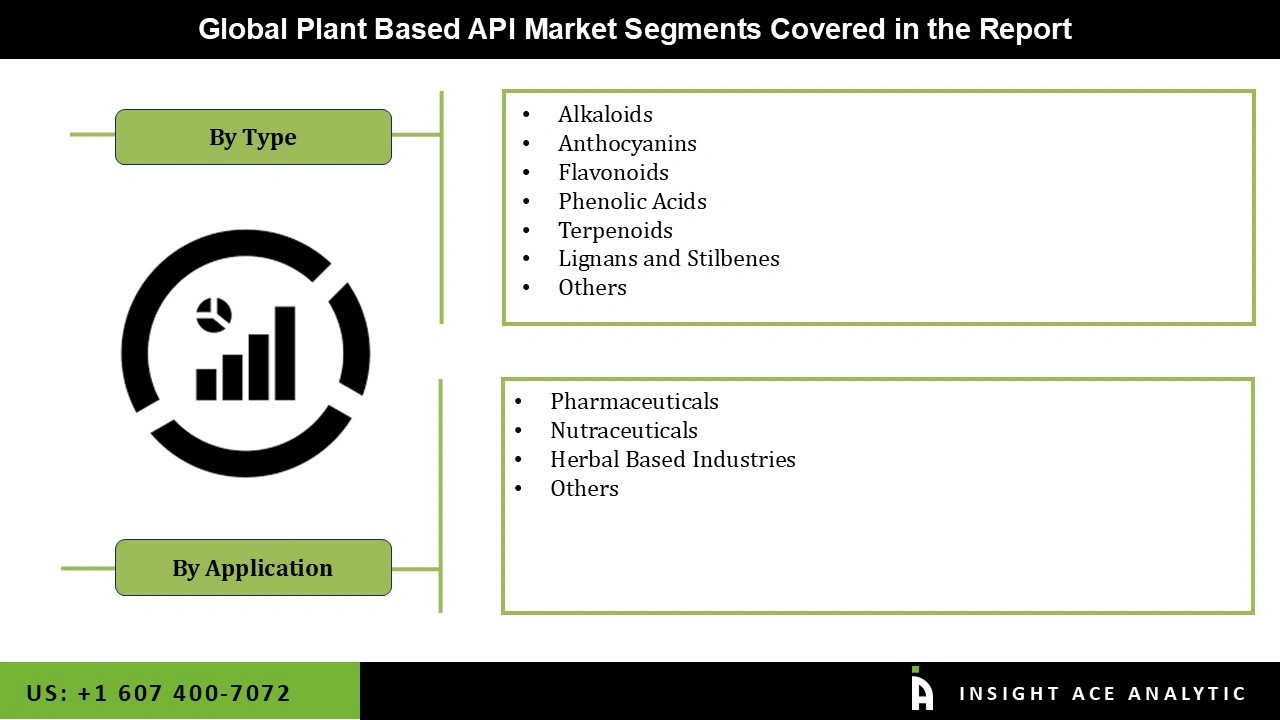

Plant Based API Market Size, Share & Trends Analysis Report By Type (Alkaloids, Anthocyanins, Flavonoids, Phenolic Acids, Terpenoids, Lignans and Stilbenes), By Application (Pharmaceuticals, Nutraceuticals, Herbal Based Industries), By Region, and Segment Forecasts, 2026 to 2035

Active Pharmaceutical Ingredients (APIs) and excipients are the two most essential components in the manufacture of medication. The API is the chemical from which the medication is created. In contrast, the excipient is a component that isn't the drug but works as a medium that allows the body to absorb the medicine, including lactose or mineral oil, in a pill. The rising rate of chronic illnesses and the growing importance of generics are some of the vital drivers driving the growth of the Indian APIs industry.

Advances in active pharmaceutical ingredient (API) manufacture and the growth of the biotech sector are driving the market growth. The aging population positively impacts the development of several chronic and acute ailments that necessitate more advanced pharmaceuticals to mitigate their effects. This is why the global Active Pharmaceutical Ingredients (API) Market has been growing. COVID-19 has also had a major effect on the Active Pharmaceutical Ingredients (API) industry's growth.

Pharmaceutical companies have become the most significant industry in the globe during the pandemic due to the widespread use of various drugs to treat COVID-19 patients' symptoms and various medical conditions, including high fever, cough, and cold.

Recent Developments:

The Plant-Based API market is segmented based on product and application. Based on the product, the Plant-Based API market is segmented as alkaloids, anthocyanins, flavonoids, phenolic acids, terpenoids, lignans, and stilbenes. By application, the market is segmented into pharmaceuticals, nutraceuticals, herbal-based industries, and others.

The flavonoids category will hold a major share of the global Plant Based API market in 2022. Because of its high amount of antioxidants and good anti-inflammatory properties, the flavonoid market has remained stable in recent years. It is one of the best on the market. Plant flavonoids have potential medicinal uses, which has led to their increased use in the pharmaceutical and nutraceutical businesses. Consumer demand for nutraceuticals is consequently driving the worldwide flavonoid market. Furthermore, the growing demand for convenience foods has expanded the usage of flavonoids in functional foods.

The herbal-based industries segment is projected to grow rapidly in the global Plant Based API market. Herbal treatments are used as alternative medicines in herbal therapy. They treat or prevent ailments, relieve symptoms, increase energy, relax, or lose weight. Herbs, unlike medicines, are not subjected to rigorous testing and regulation. Herbal medications are mostly used to treat chronic diseases and promote health. Still, their popularity is growing despite ineffective modern medicine for serious illnesses such as advanced cancer or new infectious diseases. This increased demand for herbal medication would broaden the worldwide market and open doors for other sellers to meet comparable demands. ,

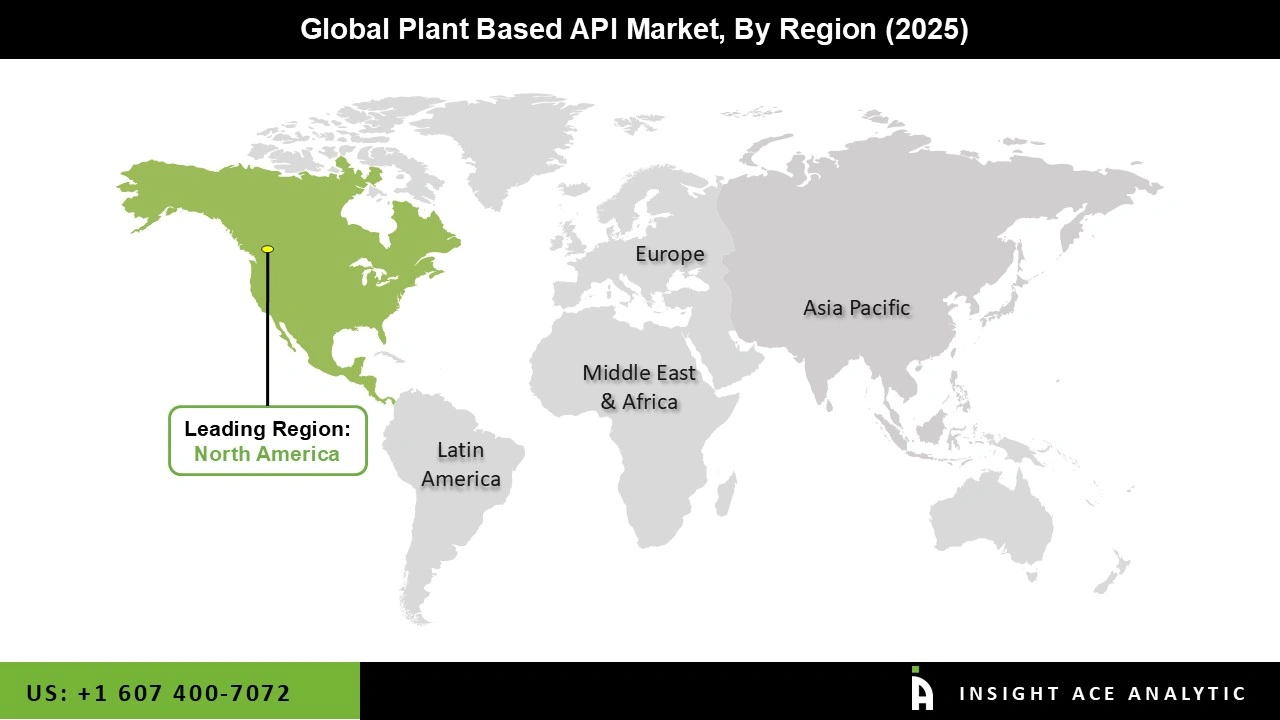

The North America Plant Based API market is expected to register the highest market share in revenue soon. Substantial market participants, significant healthcare spending, and early product availability influence the market in North America. Furthermore, the U.S.'s vast patient population and rising supply of active pharmaceutical ingredients (API) fuel the industry there. The U.S. administration supports the creation of plant-based APIs by sponsoring and awarding research grants. In a similar vein, Canada is funding the creation of plant-based APIs. The nation is concentrating on creating new technologies to extract plant-based APIs effectively. The Canadian government is awarding funds to scientists and beginning to encourage the development of the market for plant-based APIs.

In addition, Asia Pacific is projected to grow at a rapid rate. One of the top nations for the manufacture of herbal medicines is China. Currently, China is concentrating on creating plant-based APIs for the pharmaceutical sector. The market in the region is boosted by favorable government initiatives, changing lifestyles that lead to the emergence of diseases, an increase in R&d expenditures, and technological innovations in drug production processes.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 33.05 Billion |

| Revenue Forecast In 2035 | USD 58.28 Billion |

| Growth rate CAGR | CAGR of 6.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Roquette Frères SA, EVONIK Industries, AG, Cargill, Inc., Kothari Phytochemicals & Industries Ltd, Medipure Pharmaceuticals Inc., Centroflora Group, Arboris, LLCs, BASF SE, Novartis AG, Sanofi SA, GlaxoSmithKline, plc, F. Hoffmann-La Roche AG |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.