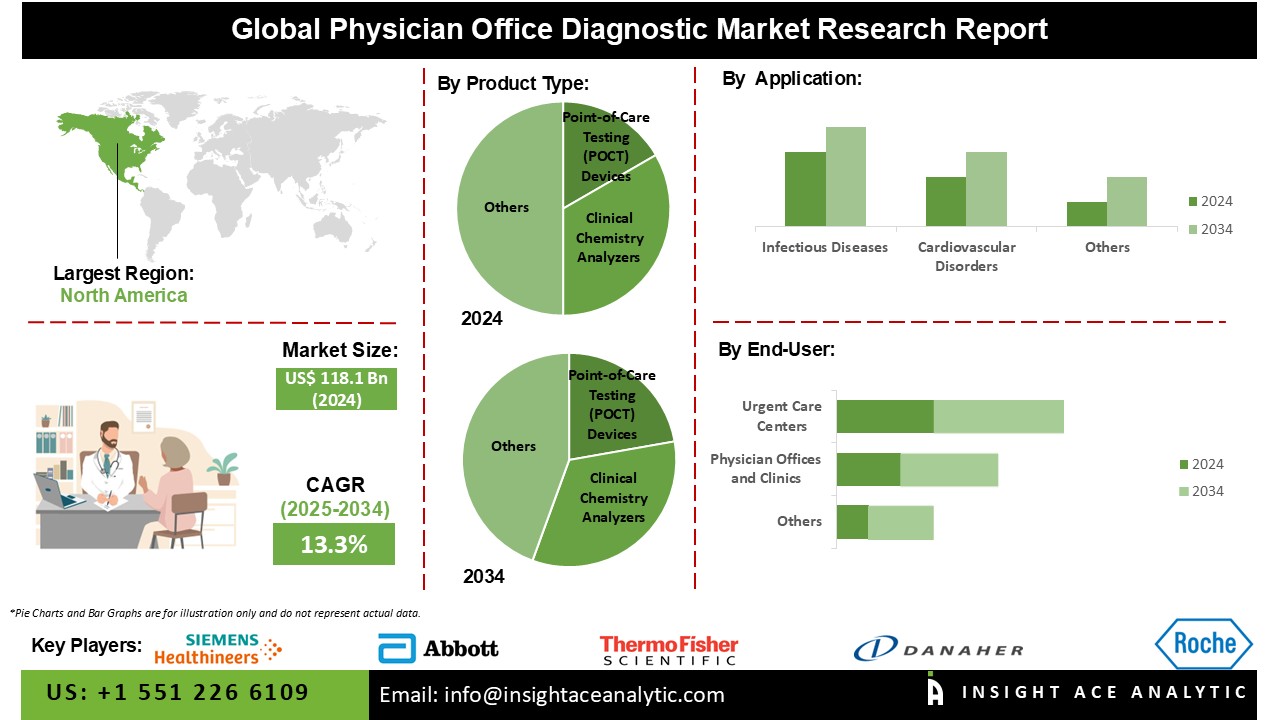

Physician Office Diagnostic Market Size is valued at USD 118.1 Bn in 2024 and is predicted to reach USD 407.2 Bn by the year 2034 at a 13.3% CAGR during the forecast period for 2025-2034.

Physician office laboratories are increasingly being utilized by independent practises to effectively handle the expanding patient population afflicted with chronic medical ailments. By adopting this approach, practises are also strategically positioned to thrive within value-based care (VBC) programmes and quality payment programmes (QPPs) that incentivize practises for effectively maintaining patients' health and minimizing costly hospital emergency room visits.

To accomplish the two goals, it is imperative for healthcare providers to implement appropriate measures that guarantee the provision of diagnostic laboratory testing of significant value to patients with chronic medical illnesses and those who are at a heightened risk of nonadherence to such tests. These tests are normally carried out by healthcare professionals such as physicians, nurses, and medical technicians.

The rising occurrence of chronic diseases such as diabetes, cardiovascular disease, and infectious diseases is driving up demand for diagnostic testing in doctor's offices. Timely diagnosis and monitoring are critical for properly managing these disorders. The emphasis on preventive healthcare has resulted in an emphasis on early detection and monitoring. This, in turn, increases the demand for diagnostic tests at medical offices to uncover health issues before they develop.

However, certain diagnostic tests and testing supplies were unavailable due to disruptions in worldwide supply chains. Shortages of testing reagents, swabs, and other supplies hampered medical offices' ability to complete tests. Moreover, the economic issues created by the pandemic resulted in financial limits for both healthcare professionals and patients.

The Physician Office Diagnostic Market is segmented on the basis of product type, end-user and application. As per the product type, the market is segmented as Point-of-Care Testing (POCT) Devices, Clinical Chemistry Analyzers, Immunoassay Systems, Molecular Diagnostics, and Urinalysis Systems. The end-user segment includes Physician Offices and Clinics, Urgent Care Centers, and Ambulatory Care Centers. According to the application segment, the market is divided into Infectious Diseases, Cardiovascular Disorders, Metabolic Disorders, Cancer Diagnosis, and Pregnancy and Fertility Testing

The Point-of-Care Testing (POCT) Devices category is expected to hold a major share in the global Physician Office Diagnostic Market in 2022. Point-of-care testing is becoming increasingly popular in physician offices and other primary care settings. Point-of-care testing allows for rapid diagnosis and prompt availability of test findings, allowing for swift medical decisions and treatment commencement. The need for faster and more convenient diagnostic options, particularly in emergency rooms, primary care clinics, and remote or resource-limited settings, is driving this need.

The Physician Offices and Clinics segment is projected to grow at a rapid rate in the global Physician Office Diagnostic Market. Preventive healthcare and early disease identification are becoming increasingly important. Physician office diagnostics are critical in identifying diseases and risk factors early, allowing for timely action and improved patient outcomes. Preventive healthcare practices, such as routine screenings and diagnostic testing, are being encouraged to lessen the burden of chronic diseases and the associated healthcare expenses.

The North America Physician Office Diagnostic Market is expected to record the major market share in terms of revenue in the near future. Due to its well-established and advanced healthcare system, North America is a significant market for physician office diagnostics. The region is distinguished by high rates of adoption of new diagnostic technology, significant investment in healthcare R&D, and favorable reimbursement systems.

The presence of important industry participants in the region, as well as a proactive attitude to preventative care, contribute to the development of the physician office diagnostic market. The physician office diagnostic market is expanding rapidly in the Asia-Pacific region. Factors such as rising healthcare expenditure, increased awareness of early disease detection, and improved access to healthcare services are driving market growth. Because of their enormous population bases, expanding healthcare spending, and increasing need for point-of-care testing solutions, countries such as India, Japan and China are important contributors to market growth.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 118.1 Bn |

| Revenue Forecast In 2034 | USD 407.2 Bn |

| Growth Rate CAGR | CAGR of 13.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, Abbott Laboratories, Thermo Fisher Scientific Inc., Danaher Corporation, Sysmex Corporation, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Quidel Corporation, Hologic, Inc., Ortho Clinical Diagnostics, Beckman Coulter, Inc. (a subsidiary of Danaher Corporation), BioMérieux SA, Trinity Biotech plc, EKF Diagnostics Holdings plc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Physician Office Diagnostic Market By Product Type-

Physician Office Diagnostic Market By End-User-

Physician Office Diagnostic Market By Application-

Physician Office Diagnostic Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.