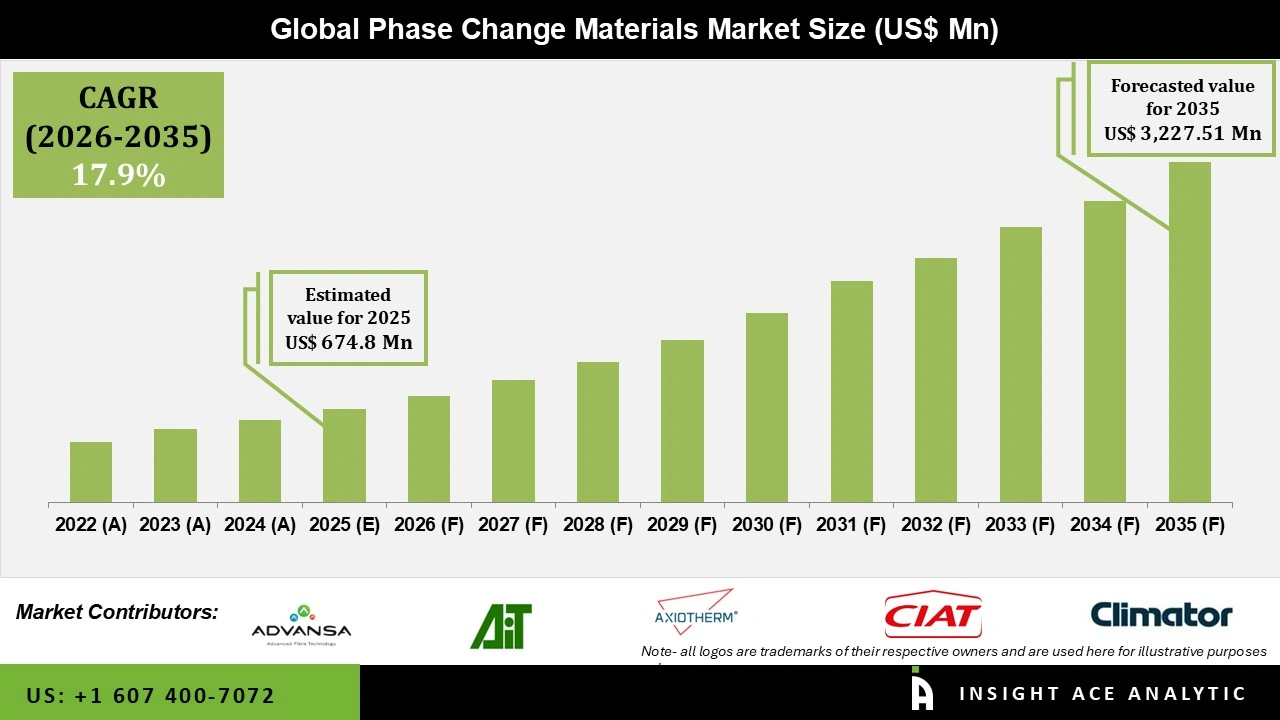

Global Phase Change Materials Market Size is valued at USD 674.8 Mn in 2025 and is predicted to reach USD 3227.51 Mn by the year 2035 at 17.90% CAGR during the forecast period for 2026 to 2035.

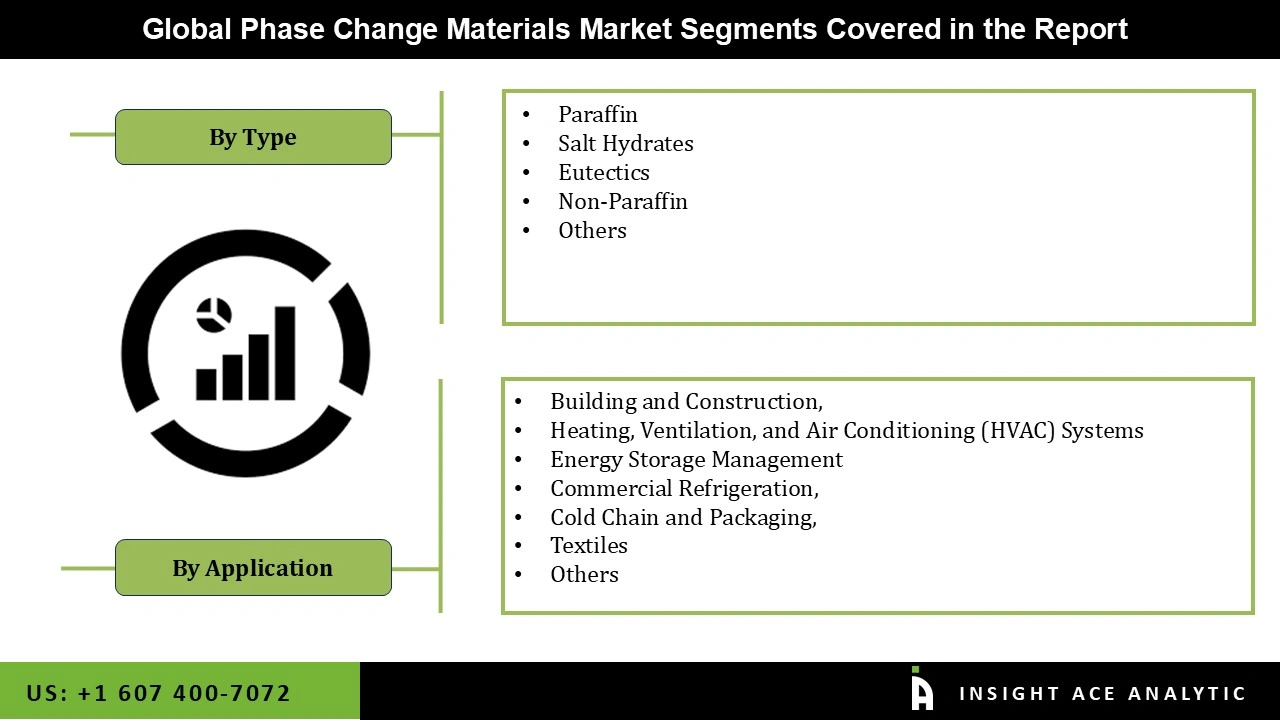

Phase Change Materials Market Size, Share & Trends Analysis Report By Type (Paraffin, Salt Hydrates, Eutectics, Non-Paraffin, And Others), By Application, By Region, And Segment Forecasts, 2026 to 2035.

Compounds that absorb and release heat energy are phase-changing materials (known as latent heat). Melting is the process through which a substance changes from a solid to a liquid state. A significant amount of heat energy can be efficiently absorbed by a wide variety of materials during the phase change. The substance will, however, release the heat it took in during melting when it freezes and solidifies. Different materials may absorb different amounts of heat energy, and they will melt and solidify at different temperatures.Phase change materials are increasingly being used to regulate temperature, which is one of the key drivers driving the market for these materials. When phase change materials are employed in the building, the environment's temperature will be regulated. The material's phase changes as a result of variations in the ambient temperature throughout the day and night, releasing and absorbing Energy in the process.

The use of phase change materials for temperature control lessens the demand for conventional heating and cooling systems. The growing usage of phase change materials for temperature control is one of the key drivers driving the market for these materials. When phase change materials are employed in the construction, the temperature of the area can be regulated. Phase changes in the substance are utilised to Energy emitted and absorbed as a result of differences in outside temperature between day and night.

The use of phase change materials for temperature control lessens the demand for conventional heating and cooling systems. Additionally, a significant market driver may be the growing demand for PCMs to offer drugs, vaccines, and therapeutic hypothermia employing PCMS in rheumatic and neonatal disorders.

The phase change materials market is divided into two parts: type and application. It is classified into five types: paraffin, salt hydrates, eutectics, non-paraffin, and others. Application segment is classified into building and construction, energy storage, HVAC, shipping and transportation, electronics, cold chain and packing, ventilation, commercial refrigeration, textiles, and others.

The Inorganic category led the phase change material (PCM) market in 2021, and it is likely to maintain its dominance by the end of the forecast period. An inorganic phase change material has a relatively high heat of fusion, high thermal conductivity, low cost, and is non-flammable. The majority of them, however, are corrosive to most metals and suffer from supercooling and phase breakup. Hydrated salts are the most common inorganic PCMs, driving category development.

The application for cold chain and packaging held the largest market share and is anticipated to experience the highest CAGR between 2021 and 2026 in terms of value growth. Due to the rise in demand for pharmaceutical packaging globally, the cold chain & packaging segment is experiencing growth in demand for phase change materials, which can be attributed to this expansion. Temperature-sensitive materials are transported using phase change materials. Perishable goods are transported and stored using cold chains, as are raw materials purchased, production, and transportation of the final product to the consumer.

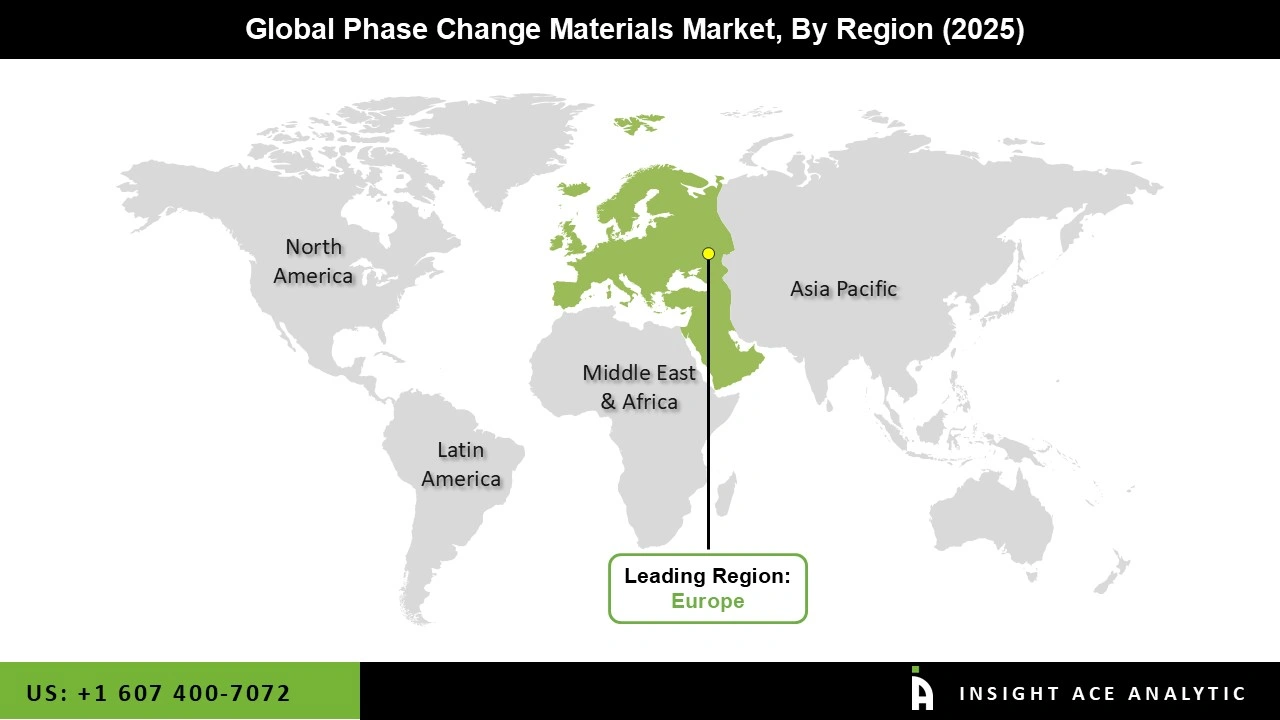

The largest market for phase change material in terms of value and volume in 2021 is expected to be in Europe, which is predicted to dominate the market at the end of the forecast period. The demand for phase change materials in the building and construction industry, as well as stringent government regulations on carbon emissions, are what is primarily fueling the market's expansion in the region. Since phase change material helps each project save carbon credits granted, government initiatives to develop green buildings supported the market growth.

Europe has high energy costs as well, which increases the demand for phase change materials there. Additionally, Europe is a developing market for phase change materials due to significant economic growth and significant industry investment. A few examples include chemical, electronics, automotive, oil and gas, and infrastructure. Phase change materials are now more necessary than ever because of the region's strict building regulations as well as advancements in energy efficiency. In addition, there is a huge demand for smart clothing and fabrics that can be used in both hot and cold climates in Europe due to the region's changing climatic conditions. The market in Europe is impacted by all of these factors.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 674.8 Mn |

| Revenue forecast in 2035 | USD 3227.51 Mn |

| Growth rate CAGR | CAGR of 17.90% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Workflow, Application, End-use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Henkel AG & Co. KGaA, Honeywell International.Inc., Croda International Plc, PureTemp LLC, Laird Technologies, Inc., Rubitherm Technologies GmbH, PCM Products Ltd, Climator Sweden AB, Cryopak, Shin-Etsu Chemicals Co.,Ltd., PLUSS, Phase Change Products Pty.Ltd, Microtek Laboratories Inc., Shanghai Tempered Entropy New Energy Co., Ltd, Phase Change Solutions, Sasol, Axiotherm GmbH, Hangzhou New Material Technology Co., Ltd. (‘RuhrTech’), Rovilus |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.