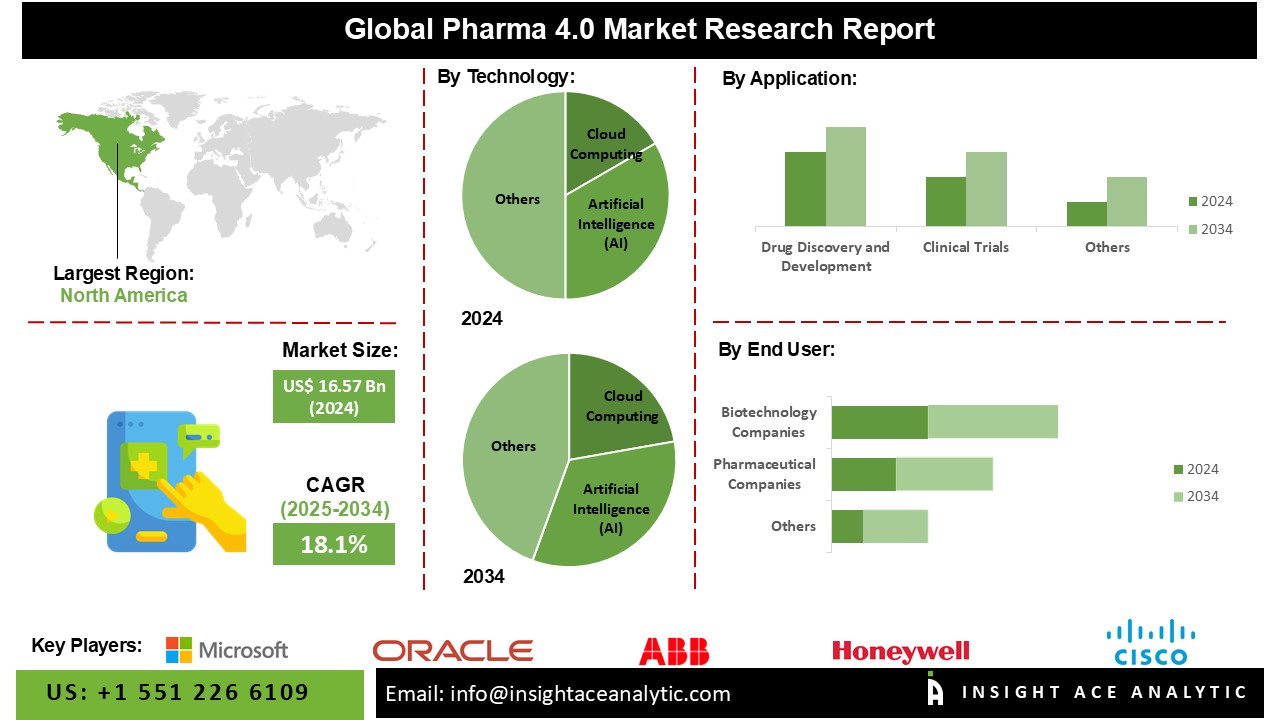

Pharma 4.0 Market Size is valued at USD 16.57 billion in 2024 and is predicted to reach USD 87.03 billion by the year 2034 at an 18.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Pharma 4.0, also known as smart factories tailored to the pharmaceutical sector or applied industry 4.0, is an industry-specific initiative. Among the primary objectives of adopting Industry 4.0 in the pharmaceutical industry is to help predict regulatory practices so that the industry can run more efficiently. Pharmaceutical organization development is the primary focus of Pharma 4.0, which maximizes the potential of digital integration to improve production processes, speed up therapeutic innovation, and lower costs.

The pharmaceutical business is undergoing a digital transition, emphasizing replacing outdated labs with state-of-the-art smart labs and factories. Technology 4.0 allows for real-time system operations and quicker decision-making. The market for pharma 4.0 should expand in tandem with the increasing digitization within the pharmaceutical industry. Furthermore, the pharmaceutical industry is seeing a movement toward pharma 4.0 technology adoption as a means to improve workflow and boost production.

However, the market growth is hampered by the strict regulatory criteria for the safety and health of the consumers and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity acrylic acid because the pharmaceutical business may incur significant costs as they adapt to this new technology. The upfront costs of implementing 4.0 technology are substantially greater than those of the conventional system. Because of the high costs, small or medium-sized pharmaceutical companies do not widely use the technology.

In addition, the upkeep of such technologically sophisticated devices can be rather costly. Ongoing system maintenance can necessitate the services of trained experts. The 4.0 technology's high initial investment and ongoing maintenance costs limit the market's potential. The COVID-19 epidemic has disproportionately negatively impacted countries that play a significant role in Industry 4.0. Many various regions' governments are responding to the pandemic in different ways.

The pharma 4.0 market is segmented based on technology, application, and end-user. The market is segmented based on technology includes artificial intelligence (AI), cloud computing, big data analytics, and the Internet of Things. The market is segregated by application into drug discovery and development, clinical trials, and manufacturing. By end-user, the market is segmented into pharmaceutical companies, biotechnology companies, and CROs and CMOs.

The cloud computing pharma 4.0 market is expected to hold a major global market share in 2022. Cloud computing allows the pharmaceutical industry to store massive volumes of data without the high expenditure of deploying devices on their physical infrastructure. Because cloud computing offers a cheaper platform for better data storage, allows remote access to data and apps, and minimizes operating expenses, organizational departments can collaborate more efficiently.

Pharmaceutical companies make up the bulk of pharma 4.0 usage because pharmaceutical businesses are increasingly utilizing new technology to boost operational efficiency and product and service quality. Worldwide, pharmaceutical companies are primarily focused on shortening and reducing the overall cost of drug development to meet the increasing demand for medications and therapies, especially in countries like the US, Germany, the UK, China, and India.

The North American pharma 4.0 market is expected to record the highest market share in revenue in the near future. The growth can be attributed to rising technological innovations in the pharmaceutical industry, and investment opportunities are plentiful. In addition, Asia Pacific is projected to improve in the global pharma 4.0 market because there is a greater need for new drug research, and the pharmaceutical sector has upgraded its infrastructure.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 16.57 Bn |

| Revenue Forecast In 2034 | USD 87.03 Bn |

| Growth Rate CAGR | CAGR of 18.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Technology, Application, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Microsoft Corporation, Oracle Corporation, ABB, Honeywell International Inc., Cisco Systems, Inc., Siemens Healthcare GmbH, GE Healthcare, IBM Corporation, and Amazon Web Services, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Technologyology and Scope

1.1. Research Technologyology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Pharma 4.0 Market Snapshot

Chapter 4. Global Pharma 4.0 Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Technology Estimates & Trend Analysis

5.1. By Technology, & Market Share, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Technology:

5.2.1. Cloud Computing

5.2.2. Artificial Intelligence (AI)

5.2.3. Big Data Analytics

5.2.4. Internet of Things (IoT)

Chapter 6. Market Segmentation 2: By Application Estimates & Trend Analysis

6.1. By Application & Market Share, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Application:

6.2.1. Drug Discovery and Development

6.2.2. Clinical Trials

6.2.3. Manufacturing

Chapter 7. Market Segmentation 3: By End User Estimates & Trend Analysis

7.1. By End User & Market Share, 2024 & 2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By End User:

7.2.1. Pharmaceutical Companies

7.2.2. Biotechnology Companies

7.2.3. CROs and CMOs

Chapter 8. Pharma 4.0 Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Pharma 4.0 Market revenue (US$ Million) estimates and forecasts By Technology, 2021-2034

8.1.2. North America Pharma 4.0 Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

8.1.3. North America Pharma 4.0 Market revenue (US$ Million) estimates and forecasts By End User, 2021-2034

8.1.4. North America Pharma 4.0 Market revenue (US$ Million) estimates and forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Pharma 4.0 Market revenue (US$ Million) By Technology, 2021-2034

8.2.2. Europe Pharma 4.0 Market revenue (US$ Million) By Application, 2021-2034

8.2.3. Europe Pharma 4.0 Market revenue (US$ Million) By End User, 2021-2034

8.2.4. Europe Pharma 4.0 Market revenue (US$ Million) by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Pharma 4.0 Market revenue (US$ Million) By Technology, 2021-2034

8.3.2. Asia Pacific Pharma 4.0 Market revenue (US$ Million) By Application, 2021-2034

8.3.3. Asia Pacific Pharma 4.0 Market revenue (US$ Million) By End User, 2021-2034

8.3.4. Asia Pacific Pharma 4.0 Market revenue (US$ Million) by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Pharma 4.0 Market revenue (US$ Million) By Technology, (US$ Million) 2021-2034

8.4.2. Latin America Pharma 4.0 Market revenue (US$ Million) By Application, (US$ Million) 2021-2034

8.4.3. Latin America Pharma 4.0 Market revenue (US$ Million) By End User, (US$ Million) 2021-2034

8.4.4. Latin America Pharma 4.0 Market revenue (US$ Million) by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Pharma 4.0 Market revenue (US$ Million) By Technology, (US$ Million) 2021-2034

8.5.2. Middle East & Africa Pharma 4.0 Market revenue (US$ Million) By Application, (US$ Million) 2021-2034

8.5.3. Middle East & Africa Pharma 4.0 Market revenue (US$ Million) By End User, (US$ Million) 2021-2034

8.5.4. Middle East & Africa Pharma 4.0 Market revenue (US$ Million) by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Microsoft Corporation

9.2.2. Oracle Corporation

9.2.3. ABB

9.2.4. Honeywell International Inc.

9.2.5. Cisco Systems, Inc.

9.2.6. Siemens Healthcare GmbH

9.2.7. GE Healthcare

9.2.8. IBM Corporation

9.2.9. Amazon Web Services, Inc.

Pharma 4.0 Market By Technology-

Pharma 4.0 Market By Application-

Pharma 4.0 Market By End-User-

Pharma 4.0 Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-