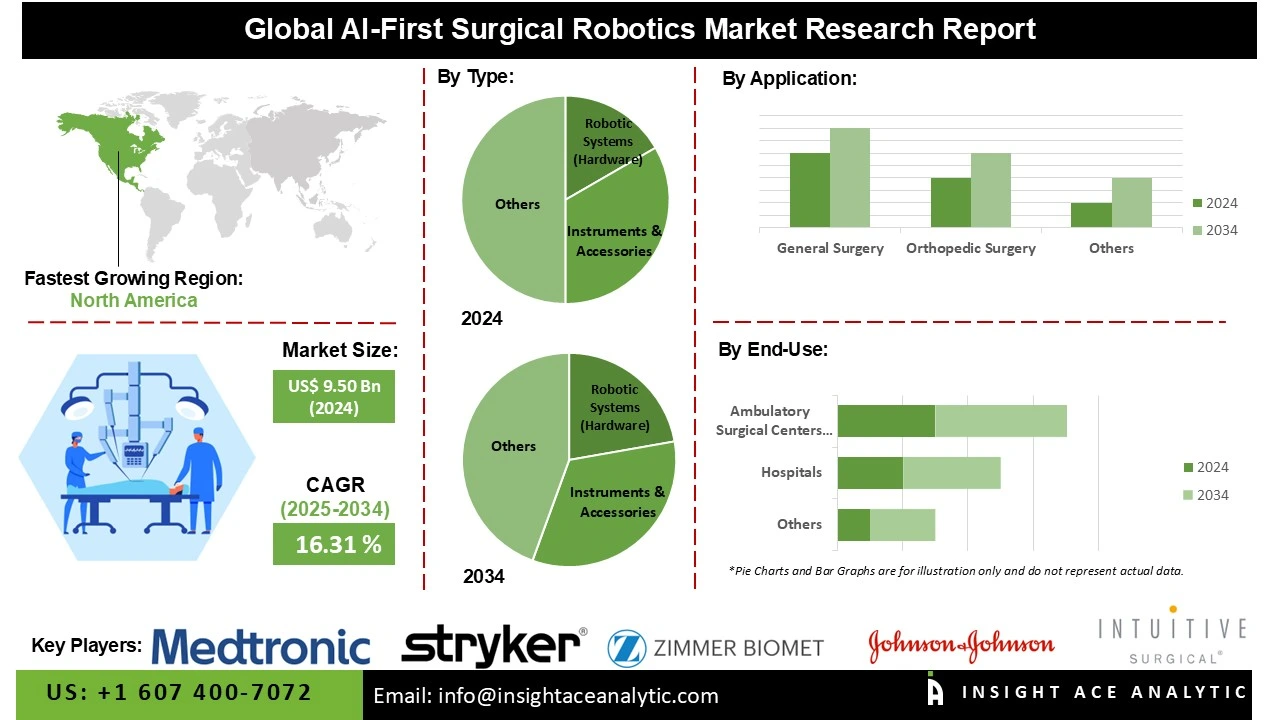

Global AI-First Surgical Robotics Market is valued at US$ 9.50 Bn in 2024 and it is expected to reach US$ 42.25 Bn by 2034, with a CAGR of 16.31% during the forecast period of 2025-2034.

The field of surgery is undergoing a paradigm shift with the advent of AI-first surgical robotics. This new class of medical technology moves beyond traditional robotic assistance, where instruments are merely extensions of a surgeon's hands. Instead, AI is embedded as the central nervous system of these platforms, creating an intelligent partner that provides cognitive support, enhances decision-making, and enables new levels of precision and safety. This evolution from a tool to a collaborator is poised to redefine standards of surgical care worldwide.

AI-first surgical robotics systems leverage continuous, multi-source data—from pre-operative scans and real-time imaging to intra-operative sensors and historical surgical outcomes. This data is processed by sophisticated algorithms to empower surgeons with dynamic guidance, predictive insights, and the ability to execute autonomous or semi-autonomous actions for specific, repetitive tasks. Core capabilities include predicting subsequent surgical steps, recommending optimal instrument trajectories, and issuing real-time alerts for potential hazards such as unexpected anatomical variations or bleeding. The result is a significant elevation in procedural accuracy, consistency, and ultimately, patient outcomes.

The convergence of several powerful drivers is fueling the rapid expansion of the global AI-first surgical robotics market. The increasing prevalence of chronic diseases demands more precise and efficient surgical interventions, while a strong clinical and patient-driven preference for minimally invasive procedures creates a natural synergy with robotic platforms. Furthermore, the proven value of AI in enhancing clinical decision-making is accelerating its integration into surgical workflows. This growth is actively amplified by strategic initiatives from leading medical technology companies, including targeted partnerships, mergers, and acquisitions, which are consolidating expertise and accelerating the development of next-generation intelligent systems, ensuring their continued adoption across the global healthcare landscape.

Some of the Key Players in the AI-First Surgical Robotics Market:

The AI-First Surgical Robotics market is segmented by Type, Technology, Application, and End-use. By Type, the market is segmented into Instruments & Accessories, Robotic Systems (Hardware), and Services & Software. By Technology, the market is segmented into AI-assisted, Autonomous, and Semi-Autonomous. By Application, the market is segmented into General Surgery, Neurosurgery, Orthopedic Surgery, Gynecology Surgery, and Urology Surgery. The End-use segment includes Hospitals, Ambulatory Surgical Centers (ASCs), and Others.

In 2024, the general surgery category held the highest share in the AI-first surgical robotics market. Globally, a significant number of surgical procedures are performed in the general surgery category. The need for effective, dependable surgical solutions, such as AI-first surgical robotics, is driven by the growing demand for these procedures, especially as the population ages and lifestyle-related conditions become more common. Additionally, general surgeons often need to focus for extended periods and exert significant physical effort. By helping with high-precision tasks, AI-first surgical robotics can lessen this strain and improve overall surgical results by lowering surgeon fatigue.

The hospitals category has the largest share in the AI-first surgical robotics market in 2024 due to increasing demand for intricate surgical procedures. Hospitals that offer specialized surgical treatments, including cardiology, neurology, and cancer care, will particularly benefit from AI-first surgical robotics. These robots help with challenging surgeries that require high levels of accuracy and fast decision-making. Hospitals are seeking scalable, diverse surgical solutions that can be applied across many types of surgeries.

The AI-first surgical robotics market in North America had the largest revenue share in 2024. The market is rapidly growing due to the increasing utilization of advanced medical technologies and a well-established, cutting-edge healthcare infrastructure. Additionally, the increasing adoption of AI-first surgical robotics and minimally invasive surgical techniques will boost the region's market growth. The US regulatory framework supports the use of AI-first surgical technologies. Regulatory agencies like the FDA offer expedited procedures for approving medical devices, such as AI-first surgical robotics, to hasten their market release.

Over the forecast years, the Asia Pacific region is expected to grow at the fastest rate in the AI-first surgical robotics market. The rise in patients with chronic illnesses and the growing awareness of the need for minimally invasive, automated robotic medical devices are the main drivers of this expansion. Furthermore, with rising private sector investment and government-backed healthcare reforms, China, Japan, South Korea, and India are the top adopters in this region. The need for better surgical options is fueled by an expanding middle-class population and an increase in medical tourism. In general surgery, gynecology, and cancer care, hospitals are increasingly using robotic platforms.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 9.50 Bn |

| Revenue Forecast In 2034 | USD 42.25 Bn |

| Growth Rate CAGR | CAGR of 16.31% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Technology, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Medtronic plc, Zimmer Biomet Holdings Inc., Intuitive Surgical Inc., Stryker Corporation, Johnson & Johnson, Siemens Healthineers AG, Asensus Surgical Inc., Smith & Nephew plc, Accuray Incorporated, Renishaw plc, Meerecompany Inc., Beijing Baihui Weikang Technology Co. Ltd., CMR Surgical Ltd., Moon Surgical SAS, PROCEPT BioRobotics Corporation, Robocath Inc., Globus Medical Inc., Venus Concept Inc., Curexo Inc., and Surgical Automations Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI-First Surgical Robotics Market by Type-

· Instruments & Accessories

· Robotic Systems (Hardware)

· Services & Software

AI-First Surgical Robotics Market by Technology -

· AI-Assisted

· Autonomous

· Semi-Autonomous

AI-First Surgical Robotics Market by Application-

· General Surgery

· Neurosurgery

· Orthopedic Surgery

· Gynecology Surgery

· Urology Surgery

AI-First Surgical Robotics Market by End-use-

· Hospitals

· Ambulatory Surgical Centers (ASCs)

· Others

AI-First Surgical Robotics Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.