Global PEM Electrolyzer Market Size is valued at USD 243.5 Mn in 2024 and is predicted to reach USD 6078.7 Mn by the year 2034 at a 38.2% CAGR during the forecast period for 2025-2034.

PEM Water Electrolyzers are electrochemical devices that use electricity to divide water into oxygen and hydrogen. Due to its rapid use in many application sectors such as power plants, steel plants, electronics and photovoltaic, industrial gases, energy storage, or fueling for FCEVs (fuel cell electric vehicles), and others, the need for PEM water electrolyzers has increased in recent years. Commercial use of hydrogen is also developing as a major development factor for the electrolyzer market.

Substantial growth in the transportation business has been observed in recent years, assisting the market in generating significant income over time. This fuel is used to cool the generators in power plants, allowing the need to develop considerable money over time. The use of this gas can result in the stabilization of the electrical grid. To obtain hydrogen gas, the coal gasification process is used.

However, The global health emergency triggered by the rapid breakout of COVID-19 has had a substantial impact on a variety of industries. Since 2020, nearly all countries have seen a significant increase in the number of impacted cases. The pandemic's consequences have also affected the economics of many rapidly emerging countries. The COVID-19 epidemic had a direct impact on this market as well. The oil refining, chemical, and steel production industries are currently experiencing high levels of hydrogen consumption, which has been affected by the COVID-19 outbreak.

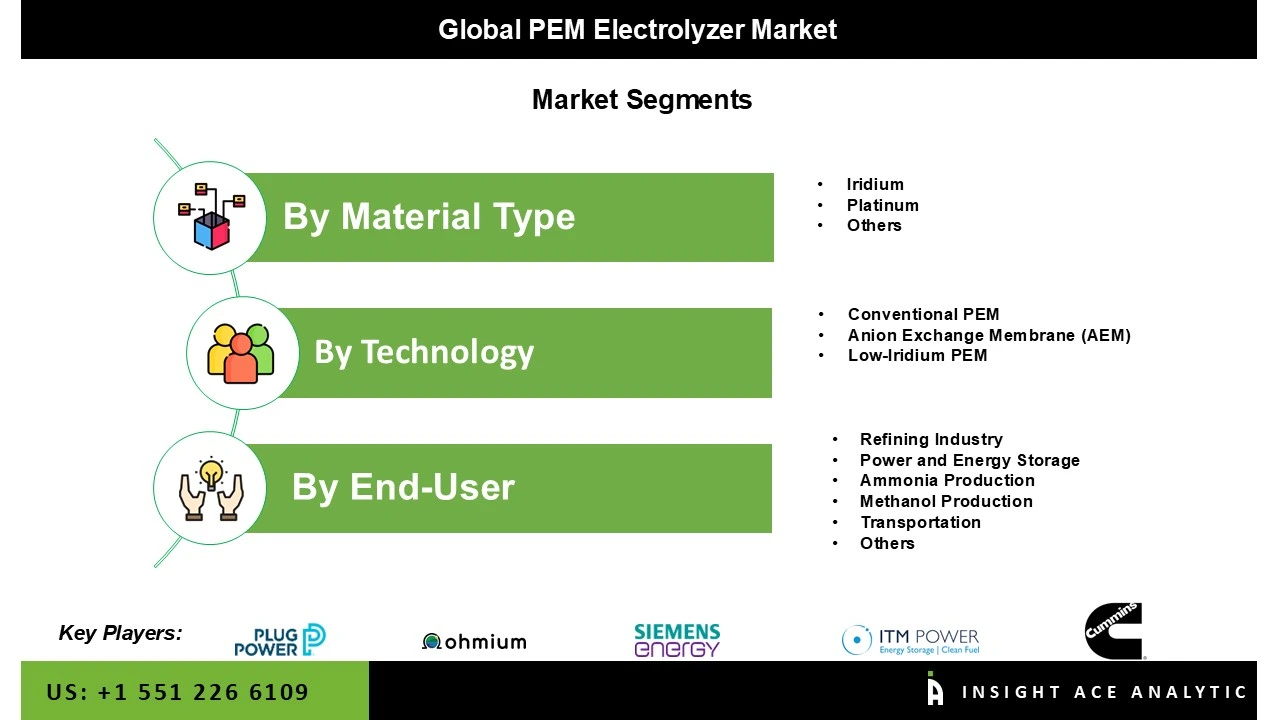

The PEM electrolyzer market is segmented on the basis of end-user and material type. Based on end-user, the market is segregated into the refining industry, power & energy storage, ammonia production, methanol production, transportation, and others. By material type, the market is segmented into iridium, platinum, and others.

The power and energy storage category is expected to hold a major share of the global PEM Electrolyzer Market in 2024. This is due to the elevated demand for power in numerous industries, such as steel plants, photovoltaic, electronics, and industrial gases has significantly boosted the market for this specific category. The manufacture of electric fuel cells has also expanded in recent years as a result of the rapid shift in people's preference for electric vehicles over traditional fuel vehicles. To generate more energy, the power-producing equipment is combined with hydrogen.

The platinum segment is projected to grow at a rapid rate in the global PEM electrolyzer market. A diaphragm serves as a separator between the electrodes and the hydroxide ions. Compared to other solutions on the market, the durability of these systems is rather considerable. This method is used extensively by power plants to generate electricity on a big scale. This technique is also widely used in industries dealing with photovoltaics of plastics. The classic alkaline system is widely used in the electronics industry for a variety of purposes.

The North America PEM electrolyzer market is expected to register the highest market share in terms of revenue in the near future. This regional growth is due to the growing demand for hydrogen in numerous uses such as manufacturing, power, and others. North America has built manufacturing infrastructures for a variety of worldwide brands, and there is an increasing interest in energy storage or fueling for FCEV operations. Furthermore, the region has seen significant investment in the production, exploration, and refining sectors, which is expected to significantly boost demand for hydrogen gas in the future. Similarly, increased investment benefits Europe's market size. It intends to develop and reinforce grid infrastructure networks to support the growing renewable energy installation, which is expected to boost the industry even further.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 243.5 Million |

| Revenue forecast in 2034 | USD 6078.7 Million |

| Growth rate CAGR | CAGR of 38.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Mn,, Volume (MW), and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material Type, Technology and End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Cummins Inc. (USA), ITM Power, Nel ASA, Siemens Energy, Plug Power, John Cockerill Hydrogen, McPhy Energy, Ohmium International, Linde plc, Air Liquide, Teco 2030, Hystar, Elogen (GTT Group), Sunfire GmbH and Other Prominent Players |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

PEM Electrolyzer Market By Material Type-

PEM Electrolyzer Market By Technology-

PEM Electrolyzer Market By End-User-

PEM Electrolyzer Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.