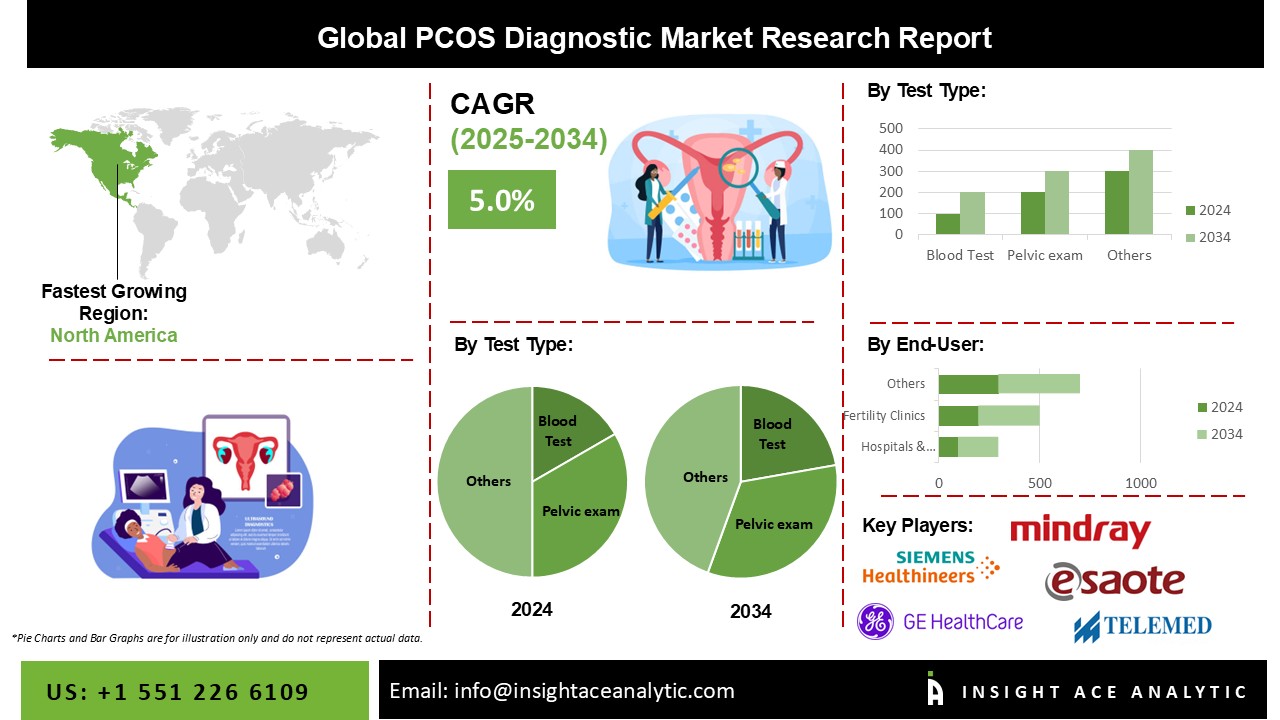

PCOS Diagnostic Market Size is predicted to witness a 5.0% CAGR during the forecast period for 2025-2034.

PCOS (polycystic ovarian syndrome) is a hormonal condition affecting many women of reproductive age. PCOS is characterized by irregular or prolonged menstrual cycles as well as high levels of male hormones. Although there is no cure for PCOS, various medications are used to regulate the menstrual cycle and manage the condition's symptoms. It is also caused by high levels of androgens, low-grade inflammation, ovarian cysts, too much insulin, and hereditary abnormalities. The polycystic ovarian syndrome diagnostic industry is growing due to increased PCOS prevalence, patient awareness, and increased usage of combination therapy. Furthermore, simple access to PCOS treatments, rising demand for PCOS drugs, and technical developments in PCOS screening all have an impact on market growth.

However, the COVID-19 outbreak had a huge influence on the healthcare industry. The polycystic ovarian syndrome (PCOS) therapy market is not immune to the pandemic's consequences, which impacted various surgical procedures, including laparoscopic ovarian drilling. To combat the COVID-19 pandemic, various governments-imposed lockdown and social distancing restrictions, which resulted in the suspension of multiple operations, supply chain disruptions, stifling business growth, and the shutdown of new developments, which had a negative impact on the market.

The PCOS diagnostic market is segmented on the basis of test type and end user. Based on test type, the market is segmented as blood tests, pelvic exams, and ultrasound (transvaginal). The end-user segment includes hospitals & clinics, fertility clinics, and others.

The ultrasound (transvaginal) category is expected to hold a major share of the global PCOS diagnostic market in 2022. This can be attributable to the fertility issues that women suffer as a result of this illness, as well as the fact that women's responses to drugs often wane over time. Furthermore, this process is inexpensive and simple to carry out, propelling the segment's rise worldwide.

The hospitals & clinics segment is projected to increase in the global PCOS due to the rising frequency of PCOS and associated operations that are performed more frequently in hospital settings. Hospitals are the first choice for diagnosing and treating PCOS. Because no single test can specifically diagnose polycystic ovarian syndrome (PCOS), clinicians must first diagnose PCOS patients. The doctor or patient's health care provider will most likely begin by discussing their symptoms, medications, and any other medical conditions they may be experiencing. The doctor may also ask about menstrual cycles and weight swings. Search for signs of acne, insulin resistance, and excessive hair growth during a physical exam.

The North American PCOS Diagnostic Market is expected to register the highest market share in revenue in the near future. The rising prevalence of obesity and overweight is increasing the number of people suffering from PCOS, which is one of the primary reasons driving market expansion in North America. Furthermore, increased knowledge of the benefits of frequent checkups is contributing to an increase in the number of new cases detected in this region each year.

Moreover, Europe is expected to grow at a significant rate. These governments are working on reducing the rising prevalence of PCOS by implementing programs that assist PCOS diagnosis and treatment, as well as the necessary lifestyle changes. These programs are raising awareness about PCOS and its related concerns, such as the development of insulin resistance, obesity, and, in some circumstances, infertility.

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 5.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Test Type And End User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Siemens Healthineers AG, GE Healthcare, Mindray Medical International Limited, Esaote S.p.A, Telemed Medical Systems, Shantou Institute of Ultrasonic Instruments Co., Ltd. (SIUI), BK Medical, Alpinion Medical Systems, Mindray ZONARE Medical Systems, and Xianfeng Ultrasound Medical |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

PCOS Diagnostic Market By Test Type-

PCOS Diagnostic Market By End User-

PCOS Diagnostic Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.