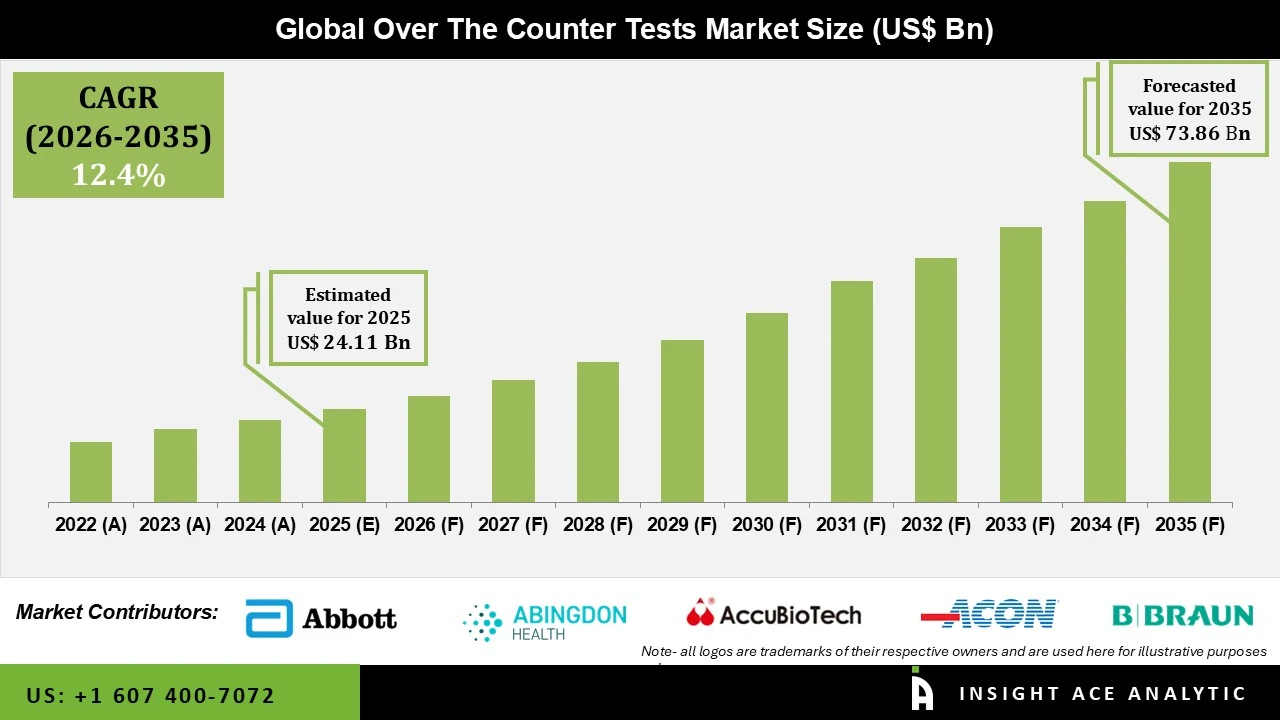

Over The Counter Tests Market Size is valued at 24.11 billion in 2025 and is predicted to reach 73.86 billion by the year 2035 at a 12.4% CAGR during the forecast period for 2026 to 2035.

Over The Counter Tests Market Size, Share & Trends Analysis Report by Technology (Lateral Flow Assays, Immunoassays, Dipsticks), By Product (Infectious Disease Tests, Glucose Monitoring Tests, Pregnancy and Fertility Tests), Region And Segment Forecasts, 2026 to 2035

Counter tests are devices that anyone can use with ease to conduct the desired test. These test kits are readily available and provide results right away. Additionally, these kits are offered at neighborhood pharmacies, making it simple for clients to buy the product. These test kits are frequently used for urine testing, infection detection, pregnancy detection, and glucose testing. Medical testing equipment that is sold over-the-counter (OTC) is immediately accessible to the consumer and does not need a prescription. They can be used in places other than hospitals, like homes, schools, workplaces, and communities.

The over-the-counter testing products are correctly branded and come with clear instructions so that the user can use them independently of a doctor. Food and Drug Administration (FDA) contends that the advantages of having an accessible over-the-counter device outweigh the hazards due to the safety margin of over-the-counter medical devices and testing goods.

The main factors influencing market expansion include rising incidences of infectious illnesses and other chronic conditions. The most common chronic conditions that demand quick and accurate testing are diabetes and infectious illnesses. As a result, the market for over-the-counter tests is driven by rising demand for testing such disorders. Additionally, the rising incidence of HIV and urinary tract infections presents substantial growth prospects for the market. The ease of use and accessibility of these test kits are benefits that help the industry expand.

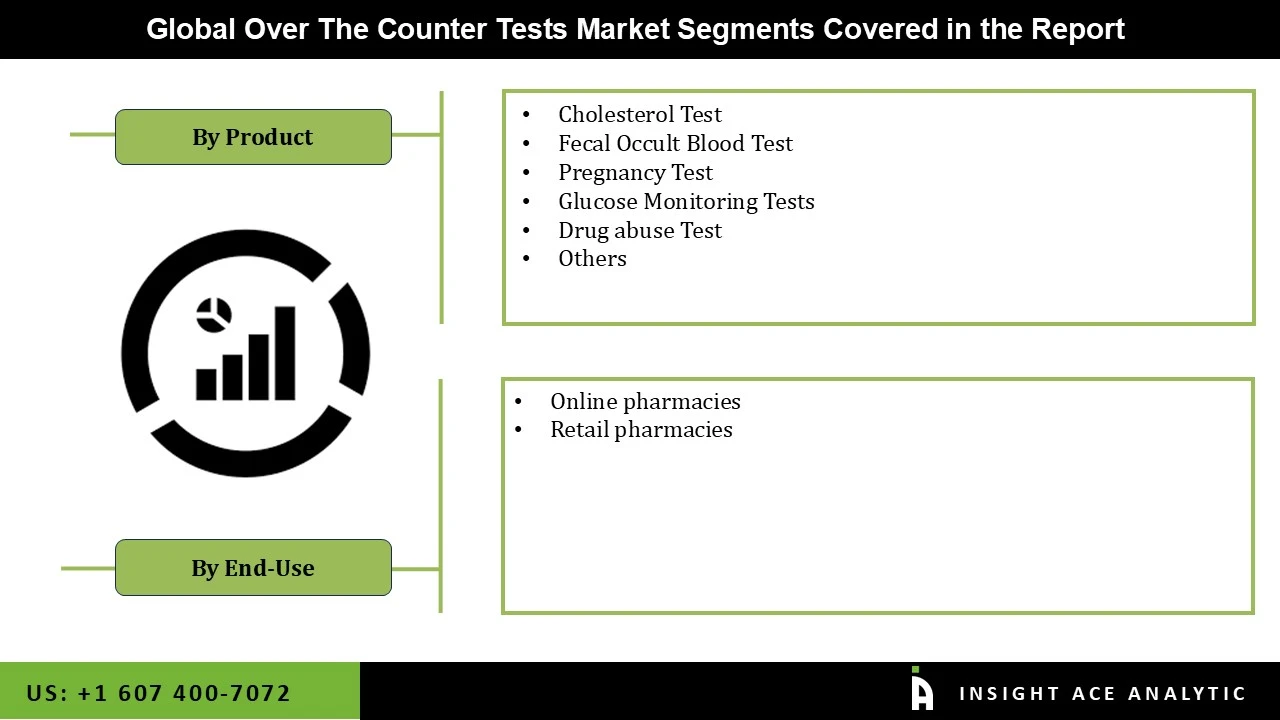

The Over The Counter Tests market is segmented on the basis of product and end-use. Product segment includes cholesterol test, fecal occult blood test, pregnancy test, glucose monitoring tests, drug abuse test, and others. By end-use, the market is segmented into online pharmacies and retail pharmacies.

Infectious illness tests, coagulation monitoring tests, urinalysis tests, cholesterol tests, drug-of-abuse tests, and other tests are some segments of the global OTC tests market. In 2022, the segment with the most significant revenue share was glucose monitoring tests. Over-the-counter glucose monitors are in hot demand right now. There is a strong demand for at-home glucose monitoring devices that are user-friendly, precise, and affordable due to the rising occurrence of diabetes and the significance of routinely checking blood glucose levels. A low-cost, risk-free solution is to use a home blood glucose test to diagnose diabetes preventatively. This is important because diabetes frequently starts out without any symptoms.

Due to the rise in the number of diabetics, the surge in demand for self-monitoring devices, and government initiatives to improve hospital pharmacy, the online pharmacies category was the largest contributor by end-use in 2022 and is anticipated to continue its lead during the projection period. However, due to technological advancements in the healthcare industry and an increase in demand for remote service, the online pharmacies category is anticipated to have significant expansion throughout the projection period.

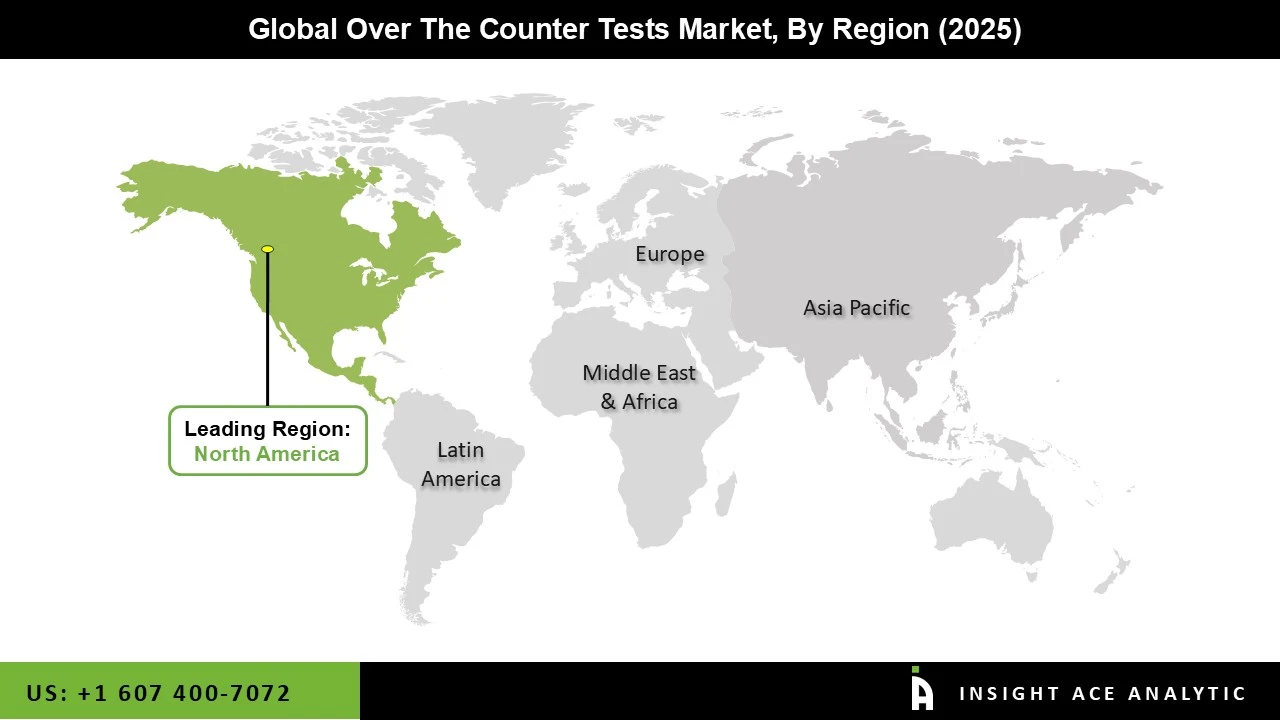

In the United States, the over-the-counter (OTC) Testing market is anticipated to grow rapidly during the forecast period. Due to the rising prevalence of chronic illnesses, the rise in the number of over-the-counter test products receiving approval, the presence of key players, and advancements in healthcare technology in the region, North America commanded the majority of the over-the-counter test market in 2022 and is anticipated to retain its dominance throughout the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 24.11 Bn |

| Revenue Forecast In 2035 | USD 73.86 Bn |

| Growth Rate CAGR | CAGR of 12.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product And End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Abbott Laboratories, Abingdon Health PLC, AccuBioTech Co., Ltd. , Acon Laboratories Inc. , B. Braun Melsungen AG, Becton Dickinson and Company, Clip Health, Dario Health Corp, Ellume Health Ltd, Eurofins Scientific Group, F. Hoffmann-La Roche AG, Lia Diagnostics Inc, Lifescan IP Holdings, LLC, Lucira Health, Inc, Now Diagnostics Inc, Orasure Technologies Inc, PHC Holdings Corporation, Quidel Corporation, SD Biosensor Inc., and Sinocare Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By End-Use-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.