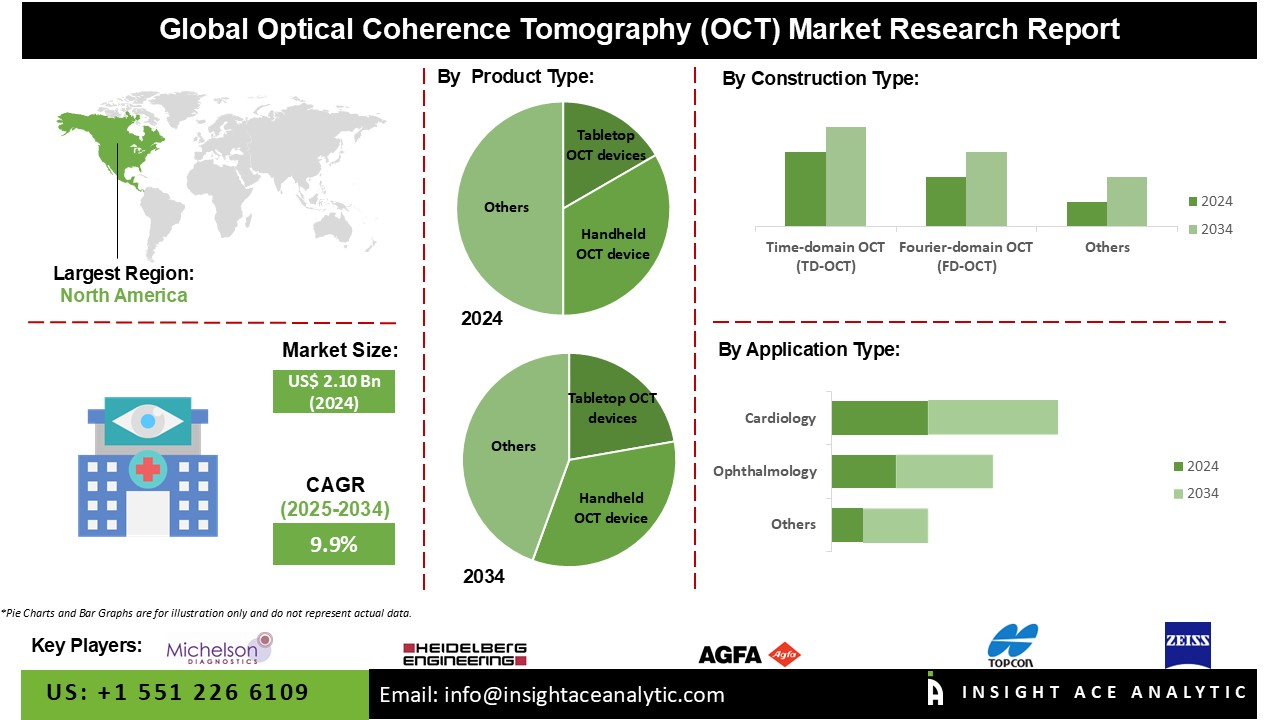

Optical Coherence Tomography (OCT) Market Size is valued at USD 2.10 Bn in 2024 and is predicted to reach USD 5.37 Bn by the year 2034 at a 9.9% CAGR during the forecast period for 2025-2034.

OCT is a non-invasive imaging test that employs light waves to capture detailed cross-sectional images of the retina, enabling a thorough examination of its distinct layers. The expansion of the optical coherence tomography (OCT) market is being driven by increased awareness among physicians and patients about the benefits of this non-invasive imaging technique. Additionally, the rising investments in developing advanced and sophisticated OCT technologies are expected to support the market's growth.

However, it's worth noting that the initial cost of investment may hinder the growth of the OCT market in the near term." Furthermore, growing public awareness of retinal illnesses will also likely create new chances for the optical coherence tomography (OCT) market to expand in future years. The optical coherence tomography (OCT) market may face further challenges soon due to the lack of infrastructure in some clinics.

The Optical Coherence Tomography (OCT) market is segmented based on construction, product, and application types. The market is set to Time-domain OCT (TD-OCT), Spatial Encoded Frequency Domain OCT, Frequency Domain OCT (FD-OCT) and Others based on construction type. The market is segmented by application into Catheter-based OCT Devices, Doppler OCT Devices, tabletop OCT devices and handheld OCT devices.

The urology category will hold a major share of the global (OCT) market. Urology researchers and medical institutions increasingly incorporate OCT into their studies and educational programs. This contributes to a deeper understanding of urological conditions and fosters the development of new diagnostic and treatment approaches. Urologists are increasingly turning to minimally invasive techniques for diagnosis and treatment. OCT's non-invasive nature and ability to provide real-time imaging make it a valuable tool in urological procedures, reducing the need for more invasive diagnostic methods.

The talestop OCT devices segment is projected to grow rapidly in the global Optical Coherence Tomography (OCT) market. Tabletop OCT devices are often designed with user-friendly interfaces, making them accessible to a broader range of healthcare professionals. This ease of use can facilitate the adoption of OCT technology in different medical specialities. Tabletop OCT devices often come at a lower price than larger systems. This makes them a cost-effective choice for healthcare providers who may have budget constraints but still want to offer OCT imaging services to their patients. Many tabletop OCT devices are versatile and can be used for various applications, including ophthalmology, dermatology, and cardiology. This versatility allows healthcare providers to use a single device for multiple purposes.

The North American optical coherence tomography (OCT) market is expected to register a tremendous share. The optical coherence tomography (OCT) market will expand in the area during the forecast period due to the rise in eye-related diseases and the presence of significant key players. Due to the increased healthcare costs, the European regional market is projected to develop rapidly in the global Optical Coherence Tomography (OCT) market. The growing understanding of eye illnesses is also projected to fuel the optical coherence tomography (OCT) market's expansion in the area for the forecast year.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.10 Bn |

| Revenue Forecast In 2034 | USD 5.37 Bn |

| Growth Rate CAGR | CAGR of 9.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Construction Type, By Product Type, By Application Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Carl Zeiss AG, Heidelberg Engineering GmbH., Agfa Healthcare India Pvt. Ltd., Leica Microsystems, TOPCON CORPORATION, Agiltron Inc., Insight., Michelson Diagnostics Ltd, OPTOPOL Technology Sp. z o.o, Shenzhen MOPTIM Imaging Technique Co., Ltd., Thorlabs, Inc., Miniprobes, HAAG-STREIT GROUP, Abbott., Canon Inc., Nikon Instruments Inc., Novartis, Edmund Optics Inc., Bausch Health., and MedLumics |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Optical Coherence Tomography (OCT) Market By Construction Type

Optical Coherence Tomography (OCT) Market By Product Type

Optical Coherence Tomography (OCT) Market By Application Type

Optical Coherence Tomography (OCT) Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.