The One Step RT-qPCR Kits Market Size is valued at USD 109.3 Mn in 2023 and is predicted to reach USD 152.0 Mn by the year 2031 at a 4.3% CAGR during the forecast period for 2024-2031.

A one-step RT-qPCR kit integrates reverse transcription and quantitative PCR (qPCR) into a single reaction, facilitating swift and effective detection and quantification of RNA targets. This kit is frequently utilized for applications such as virus detection, gene expression analysis, and mutation detection, as it facilitates workflow by enabling the conversion of RNA to cDNA and subsequent amplification within a single tube. One-step RT-qPCR kits optimize time efficiency, mitigate contamination risks, and are esteemed in clinical diagnostics, research, and high-throughput testing settings.

The growing need for quick and accurate molecular biology diagnostics is anticipated to propel the one-step RT-qPCR kits market's growth over the next ten years. These kits play a crucial role in the real-time identification of genetic material, bacteria, and viruses in clinical diagnostics, research, and biotechnology. Moreover, new developments in RT-qPCR kits, such as improved sensitivity, specificity, and quicker turnaround times, are increasing the use of these products in both healthcare and research environments.

Government spending on pandemic preparedness and healthcare infrastructure is also driving market expansion by guaranteeing the supply of superior diagnostic instruments worldwide. Furthermore, new possibilities for the one-step RT-qPCR kits market are anticipated due to increased interest in genomics and personalized medicine, notably in pharmaceutical development, cancer research, and genetic condition screening.

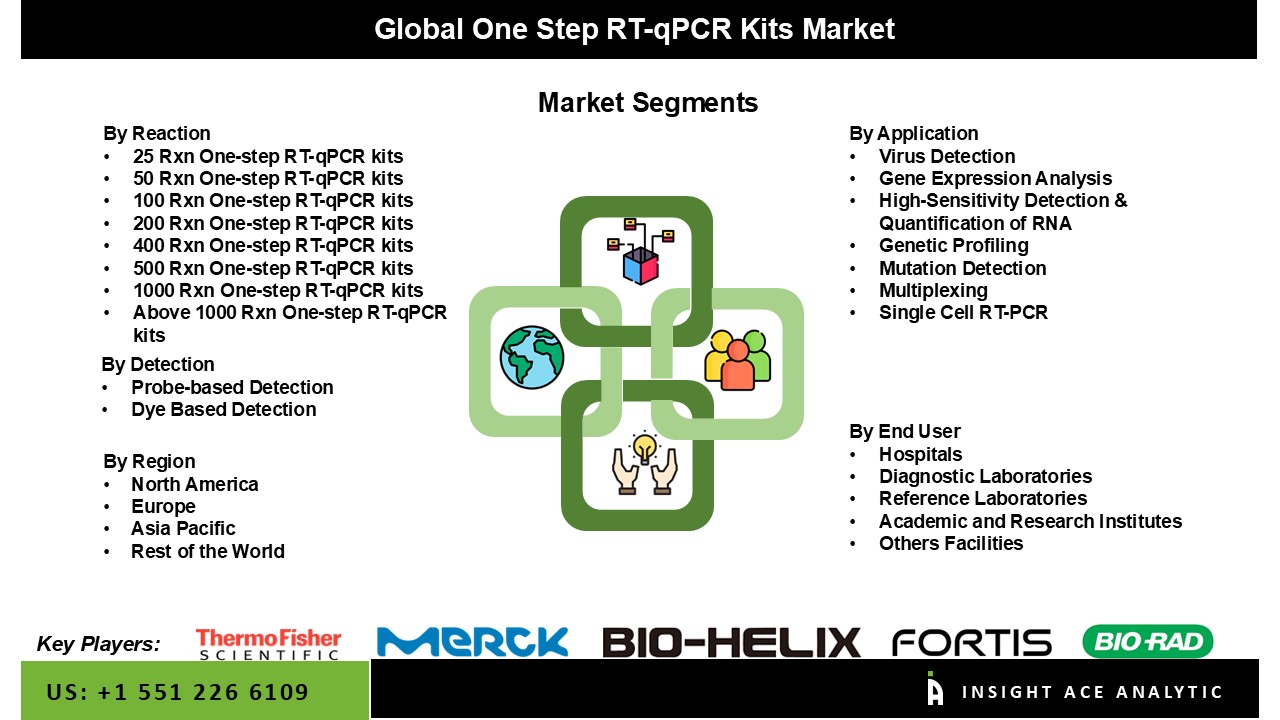

The one-step RT-qPCR kits market is segmented based on reaction, application, detection, and end-user. Based on the reaction, the market is segmented into 25 Rxn one-step RT-qPCR kits, 50 Rxn one-step RT-qPCR kits, 100 Rxn one-step RT-qPCR kits, 200 Rxn one-step RT-qPCR kits, 400 Rxn one step RT-qPCR kits, 500 Rxn one step RT-qPCR kits, 1000 Rxn one step RT-qPCR kits, and above 1000 Rxn one step RT-qPCR kits. The application Virus Detection, Gene Expression Analysis, High-Sensitivity Detection & Quantification of RNA, Genetic Profiling, Mutation Detection, Multiplexing, and Single Cell RT-PCR. By detection, the market is segmented into Probe-based Detection and Dye Based Detection. By end-user, the market is categorized into Hospitals, Diagnostic Laboratories, Reference Laboratories, Academic and Research Institutes, and other facilities.

The virus detection category is expected to hold a major global market share in 2023. The current pandemic has brought to light some flaws in the healthcare system, such as the dearth of rapid point-of-care diagnostic tools that everyone can use, with or without medical supervision. Large-scale diagnostic solutions were required during the pandemic since the number of cases increased dramatically. Although the pandemic danger has decreased, a significant number of tests are still performed as part of routine examinations intended to avoid the resurgence of COVID-19. Apart from Covid-19, there were other viruses that contributed to the global burden, such as Hepatitis B, pneumonia, Herpes simplex virus, measles, etc. Owing to the pandemic effect and the global viral burden, one-step RT-qPCR kits have been adopted worldwide for virus detection. Seasonal viruses, such as seasonal influenza, the common cold, etc., present the kinds of loads that are required to be diagnosed every day.

The government is spearheading the development of nationwide healthcare infrastructure. Creating hospital surroundings is the goal of this project. Hospitals can also accommodate the greatest number of patients and provide high-quality medical care. Hospitals also have a significant need for medical devices, equipment, and supplies, such as the one-step RT-qPCR combination. Diagnostic testing is also conducted in-house in many medium-sized and big hospitals. Regular period testing may be necessary in some circumstances to track the patient's development. Because of this, a considerable number of tests are conducted in hospital settings, which necessitates the widespread use of testing kits, including one-step RT-qPCR kits. The reasons listed above all contribute to this.

The North American one-step RT-qPCR kits market is expected to record the most elevated market share in revenue in the near future. This region's government is encouraging innovation in molecular diagnostics. The Breakthrough Devices Program was started by the FDA. The program's goal is to expedite the approval of ground-breaking goods. New fast antigen tests approved by the FDA were used to detect COVID-19 during the epidemic. The popularity of at-home testing kits was further accelerated by the outbreak. This move has opened the door for proactive healthcare and given people the ability to diagnose themselves from the comfort of their own homes. When complicated data are involved, future technological developments like the incorporation of AI and ML into the diagnostic process can upgrade the ability to interpret the results. Laboratory laboratories are also adopting automation technologies. In addition, Asia Pacific is estimated to grow rapidly in the global one-step RT-qPCR kits market. The COVID-19 epidemic has boosted demand for quick and precise diagnostic solutions. Healthcare providers needed a solution that could produce findings in minutes. There were many cases necessitating the testing of many samples. Rapid viral infection detection is possible using one-step RT-qPCR kits. Since Asia Pacific began making investments in the construction of high-quality healthcare facilities, life expectancy has grown. As a result, the number of elderly people has increased, which has raised the need for quick diagnostic fixes because persistent infections are more common in older people.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 109.3 Mn |

| Revenue Forecast In 2031 | USD 152.0 Mn |

| Growth Rate CAGR | CAGR of 4.3% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Reaction, Application, Detection, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Takara Bio Inc., Bio-Rad Laboratories, Inc., Promega Corporation, Thermo Fisher Scientific Inc., QIAGEN, TIANGEN Biotech(Beijing)Co., Ltd, EnzyQuest, Canvax, New England Biolabs, MP Biomedicals, Avantor, Inc., Intact Genomics, Inc., Fortis Life Sciences, Quantabio, BIO-HELIX, Abbexa, Boca Scientific Inc., Solis BioDyne, Applied Biological Materials Inc., Merck KGAA, Zymo Research Corporation, NZYtech, and GeneDireX, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

One Step RT-qPCR Kits Market By Reaction-

One Step RT-qPCR Kits Market By Application-

One Step RT-qPCR Kits Market By Detection-

One Step RT-qPCR Kits Market By End-User-

One Step RT-qPCR Kits Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.