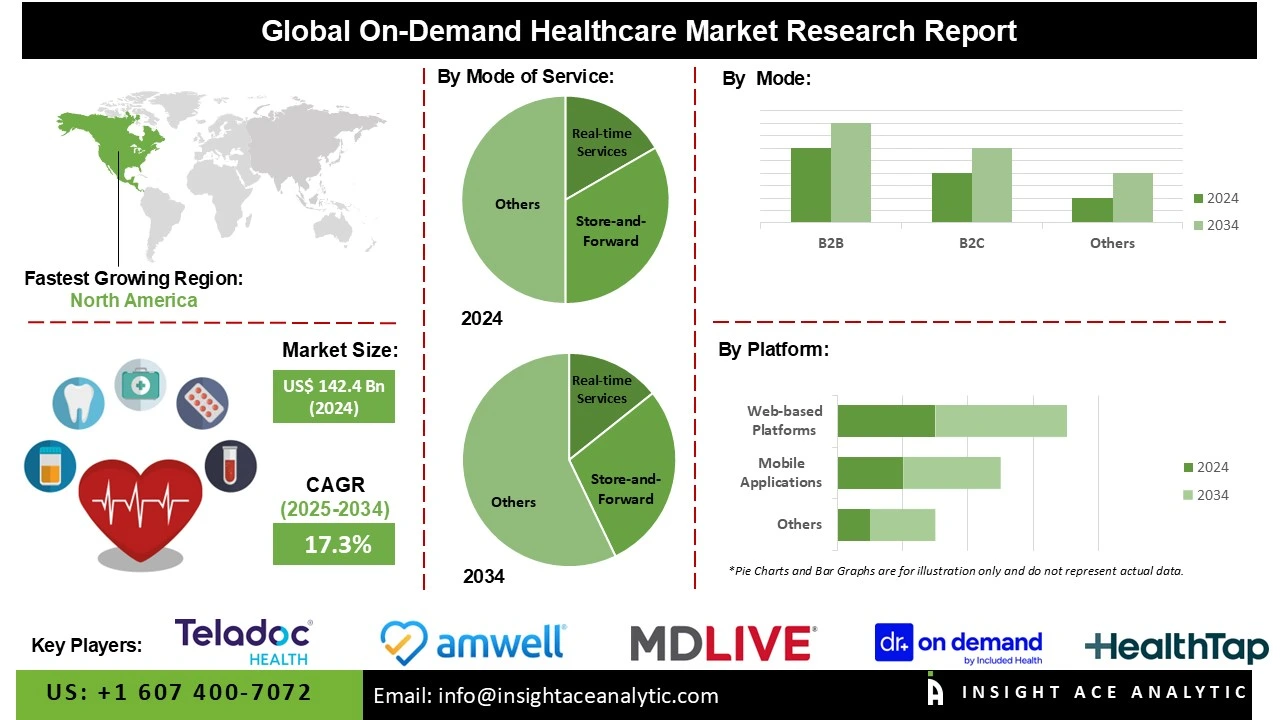

Global On-Demand Healthcare Market Size is valued at US$ 142.4 Bn in 2024 and is predicted to reach US$ 666.3 Bn by the year 2034 at an 17.3% CAGR during the forecast period for 2025-2034.

On-demand healthcare connects patients with medical professionals who are currently available in real-time through websites, mobile apps, or even in-home visits. Follow-up appointments, mental health counselling, certain speciality treatments, and an assortment of minor illnesses and accidents are part of an on-demand healthcare service. Due to pollution, unhealthy lifestyle habits, and excessive consumption of fast food, the demand for healthcare is on the rise.

Through mobile applications or web portals, users gain access to and utilise healthcare goods and services in real-time, making healthcare accessible to their fingertips. The on-demand healthcare market is growing worldwide due to the ageing population and the increasing adoption of advanced technologies, such as mobile and internet-enabled devices, in the healthcare sector.

The aging population is a factor driving the on-demand healthcare market. The on-demand healthcare market is growing due to the increasing preference for on-demand healthcare among older adults who are unable to visit hospitals or clinics. There were an estimated 125 million individuals aged 80 years and older in 2018, according to the WHO. The WHO estimates that the share of people aged 60 and above will almost double between 2015 and 2050, from 12% to 22%. Nonetheless, the on-demand healthcare industry faces several challenges that hinder its growth, including high investment requirements, a shortage of skilled IT personnel, and issues related to patient data security. During the forecast period, market opportunities will be developed by certain technological developments, including mobile solutions and customer-oriented systems.

Through websites, mobile applications, or even in-home visits, on-demand healthcare connects patients with medical professionals who are available in real-time. Support for follow-up appointments, mental health therapy, some speciality care, and a range of minor illnesses and injuries is included in an on-demand healthcare service. Due to pollution, bad lifestyle choices, and excessive fast-food consumption, the need for medical care is growing. Through the use of mobile applications or web portals, users can access and utilise healthcare services and products in real-time, putting healthcare at their fingertips.

The global market for on-demand healthcare is expanding due to the ageing population and the growing adoption of increasingly advanced technologies, such as mobile and internet-connected devices, in the healthcare industry.

The ageing population is another factor driving the on-demand healthcare market. The on-demand healthcare market is expanding because older adults who are unable to visit hospitals or clinics prefer on-demand healthcare services. The WHO estimates that there were 125 million people aged 80 years or older in 2018.

According to WHO estimates, between 2015 and 2050, the percentage of people aged 60 and above is expected to double, from 12% to 22% nearly. However, large investments, a shortage of qualified IT workers, and patient data security concerns are some of the obstacles impeding the growth of the on-demand healthcare sector. Over the forecast period, specific technological advancements, such as mobile solutions and customer-centric systems, will create opportunities for the on-demand healthcare market.

Some of the Key Players in On-Demand Healthcare Market:

· Teladoc Health, Inc.

· Amwell (American Well Corporation)

· PlushCare, Inc.

· Ping An Good Doctor

· MDLIVE, Inc.

· Zocdoc, Inc

· Oscar Health, Inc.

· Babylon Health

· Practo Technologies Pvt. Ltd.

· 1mg Technologies Pvt. Ltd. (Tata 1mg)

· Doctor on Demand, Inc.

· HealthTap, Inc.

· Medici Technologies, LLC

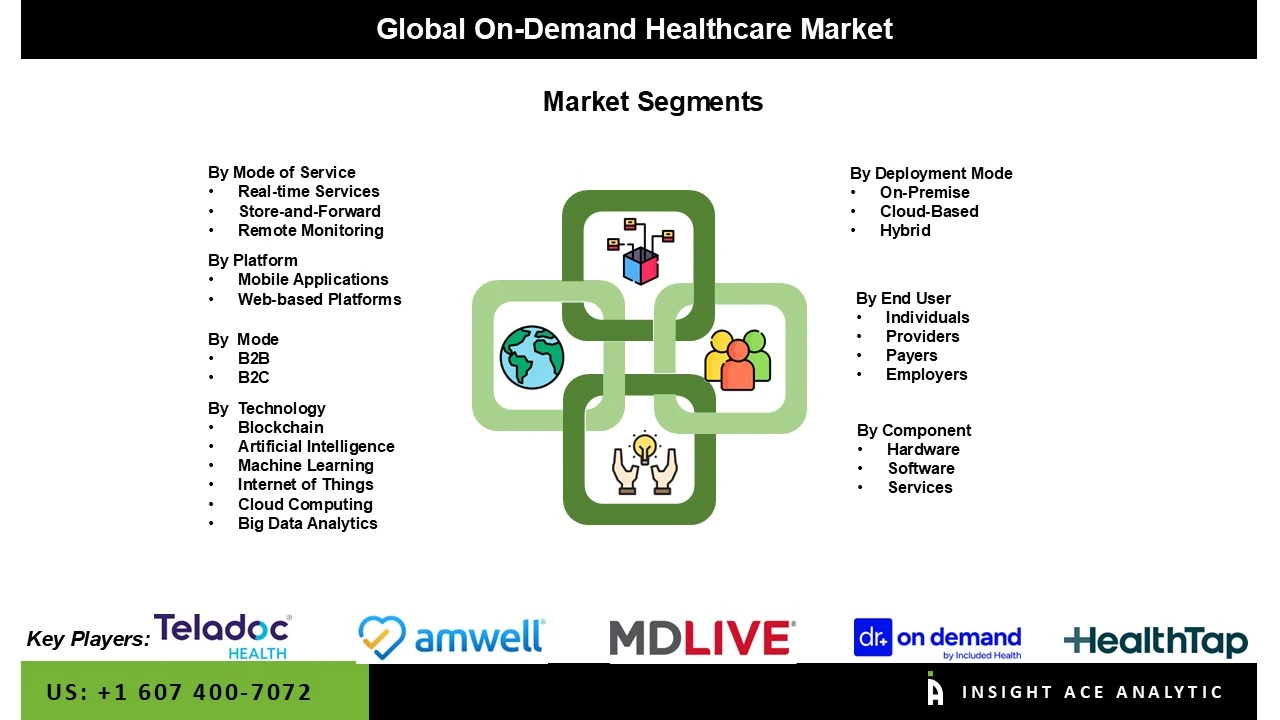

The on-demand healthcare market is segmented by mode of service, component, deployment, platform, technology, mode, and end-use. By mode of service, the market is segmented into remote monitoring, real-time services, store-and-forward. By component, the market is segmented into software, hardware, and services. By deployment, the market is segmented into cloud-based, on-premise, and hybrid. By platform, the market is segmented into mobile applications and web-based platforms. By technology, the market is segmented into big data analytics, blockchain, machine learning, artificial intelligence, internet of things, and cloud computing. By mode, the market is segmented into B2B and B2C. By end-use, the market is segmented into providers, individuals, payers, and employers.

The mobile applications category led the on-demand healthcare market in 2024. This convergence is fueled by mobile apps because smartphones are widely used, user-friendly interfaces keep users interested, and push features encourage everyday involvement. Patients can initiate video visits, schedule clinics, access e-prescriptions, record workouts, and pay bills all from a single dashboard.

Additionally, more people are using apps for primary care, mental health, and chronic illness management as a result of post-pandemic familiarity with teleconsultations, growing payer reimbursement, and improving employment benefits. While chat assistance, symptom checkers, and AI-driven triage lessen wait times and the workload for clinicians, integration with wearables and remote monitoring devices allows for continuous data collection and proactive interventions. Moreover, the quick adoption of the mobile health paradigm by urban consumers worldwide can be attributed to flexible, real-time access, which is complemented by alerts and adherence nudges.

In the on-demand healthcare market, the individual segment is growing quickly as patients start acting more like retail buyers and want control, speed, and transparency. Beyond metropolitan regions, virtual consultations, e-pharmacy, and at-home diagnostics are now accessible thanks to widely used cellphones, less expensive data, and user-friendly apps. Shorter wait times, round-the-clock accessibility, and post-pandemic comfort with telehealth all contribute to high repeat usage rates. Continuous monitoring and individualized care plans are made possible by integration with wearables and household electronics, while AI-based symptom triage reduces barriers to entry and directs patients to the appropriate clinician.

North America led the on-demand healthcare market in 2024. The United States leads in this growth. This is because of the extensive use of smartphones and the sophisticated healthcare system. Telehealth services are extensively used. Medical specialists are desired to be seen by patients immediately and in a convenient manner. Government support for pursuing digital health strategies is helping Canada follow closely behind. This raises access in rural regions. Execution of virtual health programs by provincial authorities that cover urban and rural populations is also gaining ground in this direction.

The Asia-Pacific region's on-demand healthcare market is rapidly expanding in both developed and emerging countries. Teleconsultations, e-pharmacies, and home diagnostics are all contributing to the creation of a dynamic digital health ecosystem in India. Government initiatives such as ABDM and platforms like Practo help to foster this ecosystem.

China is a pioneer in the development of highly integrated platforms, such as Ping An Good Doctor, which are underpinned by state-led healthcare digitisation under the Healthy China 2030 program. These platforms rely on artificial intelligence and mobile technology. The elderly population and regulatory changes resulting from the COVID-19 epidemic are driving the normally conservative Japanese healthcare sector to embrace telemedicine and remote care. Collectively, these countries represent a regional shift in healthcare delivery that is more patient-centered, technology-enabled, and accessible.

On-Demand Healthcare Market by Mode of Service-

· Remote Monitoring

· Real-time Services

· Store-and-Forward

On-Demand Healthcare Market by Component -

· Software

· Hardware

· Services

On-Demand Healthcare Market by Deployment-

· Cloud-Based

· On-Premise

· Hybrid

On-Demand Healthcare Market by Platform-

· Mobile Applications

· Web-based Platforms

On-Demand Healthcare Market by Technology-

· Big Data Analytics

· Blockchain

· Machine Learning

· Artificial Intelligence

· Internet of Things

· Cloud Computing

On-Demand Healthcare Market by Mode-

· B2B

· B2C

On-Demand Healthcare Market by End-use-

· Providers

· Individuals

· Payers

· Employers

On-Demand Healthcare Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.