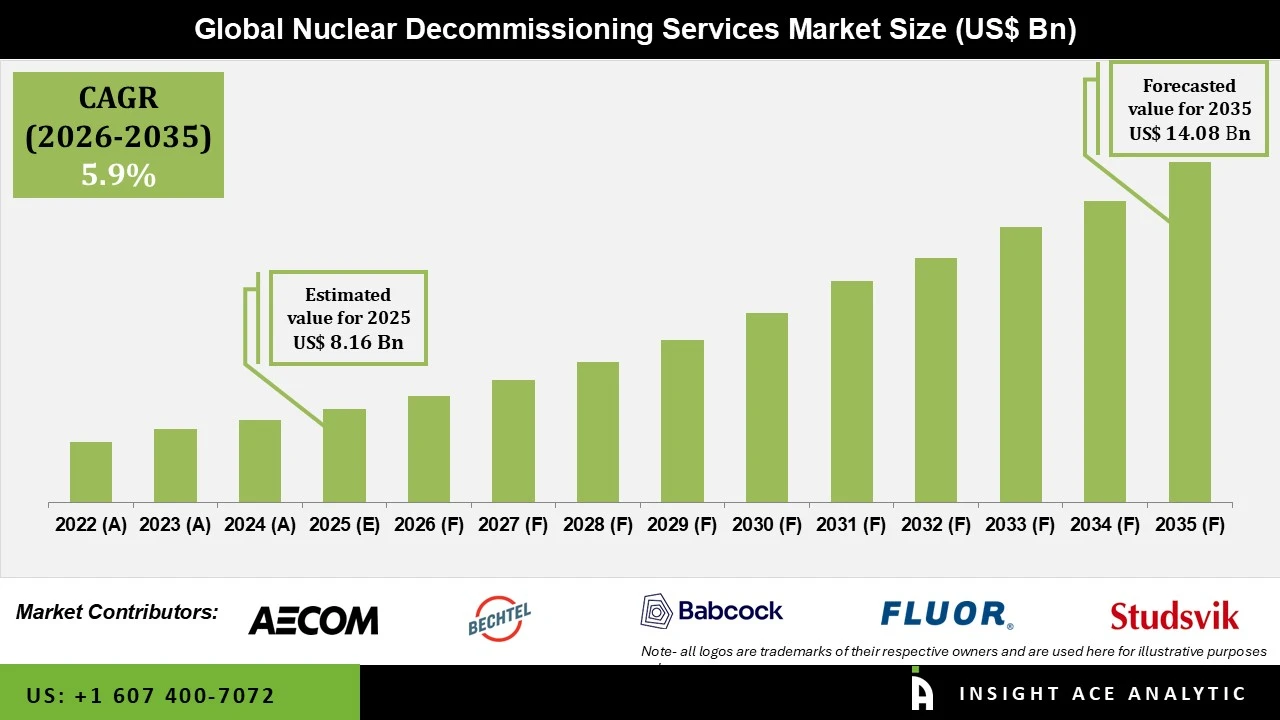

Nuclear Decommissioning Services Market Size is valued at USD 8.16 Bn in 2025 and is predicted to reach USD 14.08 Bn by the year 2035 at an 5.9% CAGR during the forecast period for 2026 to 2035.

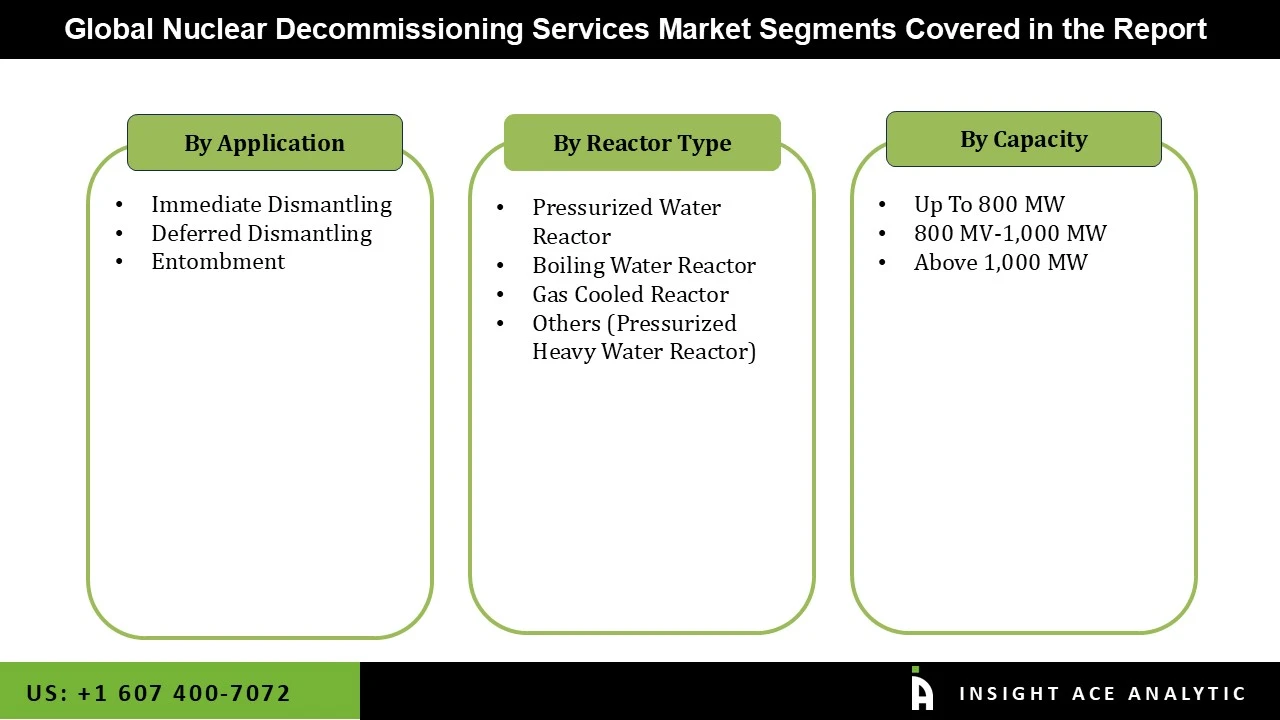

Nuclear Decommissioning Services Market Size, Share & Trends Analysis Distribution by Application (Immediate Dismantling, Deferred Dismantling, Entombment), Reactor Type (Pressurized Water Reactor, Boiling Water Reactor, Gas Cooled Reactor, Others (Pressurized Heavy Water Reactor)), Capacity (Up To 800 MW, 800 MV-1,000 MW, Above 1,000 MW) and Segment Forecasts, 2026 to 2035

The Nuclear Decommissioning Services Market is planned to safely and methodically dismantle nuclear facilities at the end of their operational life. Nuclear decommissioning refers to the process of closing a nuclear facility and managing its radioactive materials in a manner that ensures human health and environmental safety. This process typically includes stages like planning, fuel removal, decontamination, structural dismantling, and site restoration with the aim of achieving safe removal of radiological hazards. It includes services in project planning, radiological assessments, waste management, dismantling, demolition, and environmental restoration that are needed to manage the safety, regulatory, and technical challenges of such services.

The aging nuclear facilities around the world have been a primary driver for the nuclear decommissioning services market. As most nuclear power plants now reach or surpass their designated operational life, especially those in Europe and North America, there is an increasing demand for specialized decommissioning services. These services are also critical for research reactors and legacy sites with historic or contamination issues, ensuring safe dismantling while adhering strictly to regulatory frameworks created to protect both public health and the environment.

The nuclear decommissioning services market is segmented by application, reactor type, capacity. By Application the market is segmented into immediate dismantling, deferred dismantling, and entombment. By reactor type market is categorized into pressurized water reactor, boiling water reactor, gas cooled reactor, others (pressurized heavy water reactor). By capacity the market is categorized into up to 800 MW, 800 MV-1,000 MW, above 1,000 MW.

Based on its presence, complexity, regulatory requirements, and technological advancement, Pressurized Water Reactor is one of the primary growth drivers in the Nuclear Decommissioning Services Market. PWR is the world's most common type of nuclear reactor, with over 300 units approaching the end of their design life; hence, significant decommissioning demand services are required. These include the deconstruction of the reactor vessel, radioactive waste management, and site restoration with which requires specialized skills in conformity to strict regulatory standards.

In addition, organization through international cooperation in collaborative networks such as the IAEA supports knowledge sharing as a strategy to increase the efficiency and safety of decommissioning operations. Advancements in robotics and virtual modeling also enhance PWR decommissioning by making remote operations safer and creating better accuracy in planning. Overall, all these would further boost growth in the demand for specialized services in the market.

Immediate Dismantling is on the growth curve in the nuclear decommissioning services market because of its proactive safety benefits, regulatory alignment as well as its economic advantages. It is an approach which involves the rapid removal of nuclear facilities from regulatory control after shutdown, thus ensuring less long-term radioactive risks and reducing the time used in improving safety. Most countries, particularly in Europe, prefer this method because it aligns with stringent safety standards as the time for which radioactive materials stay in the plant is decreased, thus further protecting humans. In addition, immediate deconstruction is cheaper since operators can use the land shortly, reap income, and decrease costs for maintenance compared to delayed methods.

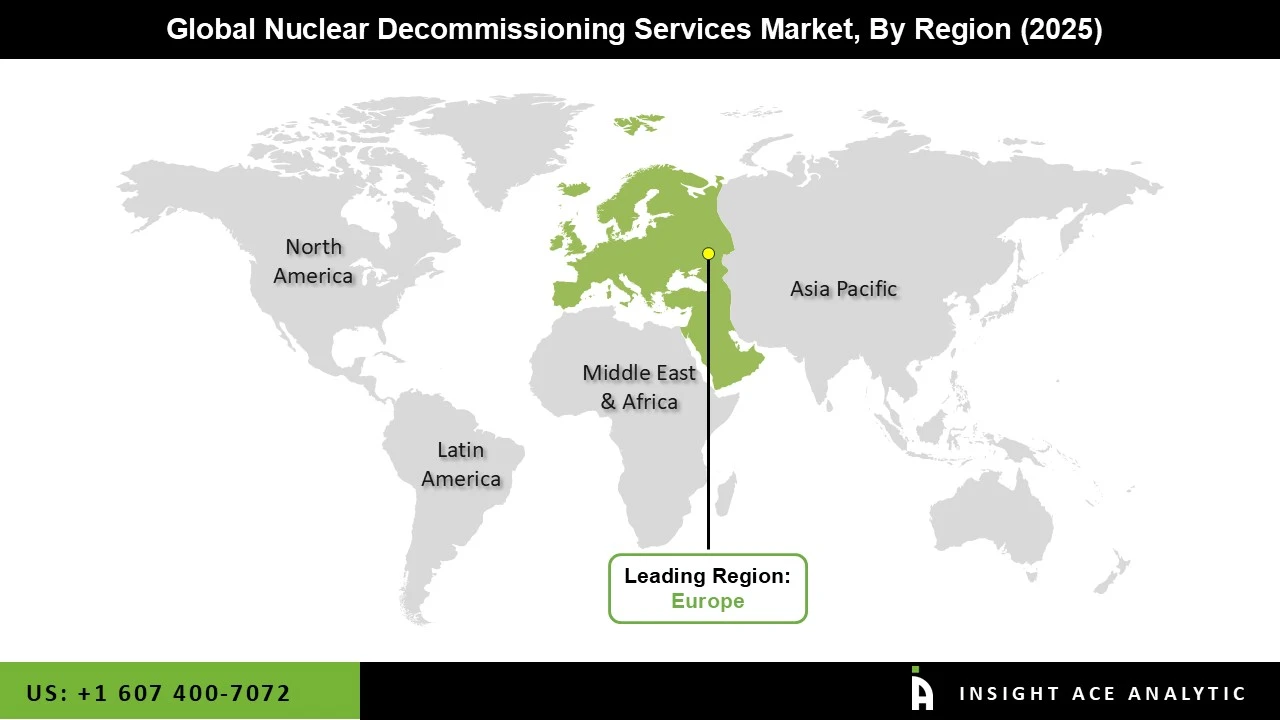

Europe dominates the nuclear decommissioning services market primarily due to high count aging nuclear facilities, stringent regulations, government support, and safety issues emanating from awareness in the public. As Germany, France, and the UK have numerous reactors that are either due to or already nearing the end of their operational life cycles, decommissioning services can be expected to stay on the high-demand list for some time ahead.

The regulatory bodies have strictly mandated timely decommissioning to ensure nuclear safety and protect the environment in the region. In addition, European governments facilitate funding as well as policies for shifting away from nuclear energy towards decommissioning. Another boost towards market demand was the growing concern over safety issues in nuclear sectors with the Fukushima experience and such events that have urged decommisioning the older reactors safely.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 8.16 Bn |

| Revenue Forecast In 2035 | USD 14.08 Bn |

| Growth Rate CAGR | CAGR of 5.9% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, Reactor Type, Capacity, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | AECOM Technology Corporation, Babcock International Group PLC, Bechtel Group Inc., Fluor Corporation, Studsvik AB, Westinghouse Electric Company LLC, Ansaldo Nes (Nuclear Engineering Services Limited), Areva Group (Orano), EDF-CIDEN, Enercon Services Inc., EnergySolutions, GD Energy Services-Nuclear, KDC Contractors Limited, Nuvia Group, Onet Technologies, Sogin S.P.A (Società Gestione Impianti Nucleari) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Nuclear Decommissioning Services Market by Application -

Nuclear Decommissioning Services Market by Reactor Type -

Nuclear Decommissioning Services Market by Capacity -

Nuclear Decommissioning Services Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.