Global Non-Dairy and Plant-Based Beverages Market Size is predicted to develop a 15.2 % CAGR during the forecast period for 2025-2034.

Non-dairy and plant-based beverages have rapidly gained popularity as appealing alternatives to conventional dairy milk, offering consumers a wide range of choices tailored to their dietary needs and personal preferences. Derived from sources such as nuts, grains, legumes, and seeds, these drinks often referred to as plant-based, non-dairy, or alternative beverages present unique flavors, textures, and nutritional profiles. They are particularly attractive to individuals. Varieties like almond, soy, oat, rice, and coconut milk have emerged to meet the rising demand for dairy-free options.

In addition to their health appeal, these beverages are also recognized for their environmental benefits, as their production generally requires fewer natural resources and results in lower greenhouse gas emissions compared to traditional dairy. With both nutritional and ecological advantages, non-dairy & plant-based beverages continue to reshape consumer preferences and drive innovation in the beverage industry.

In December 2024, Danone’s plant-based brand Silk introduced Silk Kids, a specially formulated oat milk blend designed for children aged five and older. Developed in collaboration with pediatricians, this beverage aims to deliver enhanced nutritional benefits for growing kids. Each serving contains 8 grams of plant-based protein from a creamy oat and pea blend to support muscle development, along with 2 grams of prebiotics to promote gut health, and added DHA omega-3 and choline for brain function.

The launch reflects a broader trend fueled by increasing health consciousness among consumers, driven in part by rising obesity rates and a growing demand for functional, low-calorie, nutrient-rich foods. Additionally, the market for non-dairy & plant-based beverages is expanding due to factors such as rising disposable incomes, a greater interest in natural and organic products, a growing preference for fermented herbal teas over traditional tea, increased social acceptance of alcohol alternatives, and a global rise in lactose intolerance. These dynamics are contributing to the rapid growth and diversification of the overall industry.

Some of the Major Key Players in the Non-Dairy and Plant-Based Beverages Market are:

The non-dairy and plant-based beverages market is segmented based on product type, functions, and distribution channel. Based on product type, the market is divided into plant-based milk, plant-based juices, RTD tea & coffee, and others. Based on source, the market is divided into nuts, grains, legumes, fruits & vegetables, and others. Based on the distribution channel, the market is divided into online, and offline.

Based on product type, the market is divided into plant-based milk, plant-based juices, RTD tea & coffee, and others. Among these, the plant-based milk segment is expected to have the highest growth rate during the forecast period. This category includes alternatives like almond, soy, oat, and coconut milk, which have gained significant popularity among consumers seeking dairy-free options. The prominence of plant-based milk is driven by factors such as increasing lactose intolerance, dietary preferences, and a growing emphasis on health and sustainability. The growing adoption of vegan and vegetarian diets is driving consumers to seek non-animal-based alternatives. Additionally, people with dairy allergies or those looking for cholesterol-free options are increasingly turning to plant-based milk

Based on source, the market is divided into nuts, grains, legumes, fruits & vegetables, and others. Among these, the nuts segment dominates the market. Nut-based beverages, especially almond milk, have been among the earliest and most widely adopted alternatives to traditional dairy milk. Their mild, slightly sweet taste and smooth texture make them highly appealing to a broad range of consumers, leading to their widespread use in both households and café settings. Among plant-based milk, almond milk in particular gained early commercial traction, which provided it with a significant advantage in terms of market presence, consumer familiarity, and availability. This early entry has helped solidify nut-based beverages as a dominant force in the non-dairy beverage segment.

Consumers in the Asia-Pacific region are increasingly prioritizing health and wellness, prompting a shift toward more nutritious and functional beverage options. Plant-based milk, widely perceived as a healthier alternative to dairy, is gaining popularity among health-conscious individuals. The region's traditional diets, which have long included plant-based foods and beverages such as soy products, have helped ease the acceptance and integration of plant-based milk into everyday consumption. Additionally, a growing awareness of environmental sustainability is influencing purchasing decisions, with many consumers viewing plant-based products as a means to adopt more eco-friendly lifestyles.

|

Report Attribute |

Specifications |

|

Growth Rate CAGR |

CAGR of 15.2% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Mn,and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Product Type, Source, Distribution Channel |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

|

Competitive Landscape |

Pacific Foods of Oregon, LLC, Blue Diamond Growers, Inc., SunOpta, The Hain Celestial Group, Inc,Noumi Ltd, Califia Farms, LLC, Harmless Harvest, Koia,Vitasoy International Holdings Ltd, Thurella AG, GOOD KARMA FOODS, INC, Health-Ade Kombucha,Fentimans, GT’S LIVING FOODS, Lifeway Foods, Inc, KeVita, Nestlé, Bionade GmbH, Danone, Biosa Inc, DuPont, Chr. Hansen Holding A/S, Chobani, LLC, Earth’s Own, Oatly AB |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Non-Dairy and Plant-Based Beverages Market Snapshot

Chapter 4. Global Non-Dairy and Plant-Based Beverages Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2024-2034

4.8. Competitive Landscape & Market Share Analysis, By Key Player (2023)

4.9. Use/impact of AI on Non-Dairy and Plant-Based Beverages Market Industry Trends

4.10. Global Non-Dairy and Plant-Based Beverages Market Penetration & Growth Prospect Mapping (US$ Mn), 2021-2034

Chapter 5. Non-Dairy and Plant-Based Beverages Market Segmentation 1: By Product Type, Estimates & Trend Analysis

5.1. Market Share by Product Type, 2024 & 2034

5.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Product Type:

5.2.1. Plant-Based Milk

5.2.2. Plant-Based Juices

5.2.3. RTD Tea & Coffee

5.2.4. Others

Chapter 6. Non-Dairy and Plant-Based Beverages Market Segmentation 2: By Source, Estimates & Trend Analysis

6.1. Market Share by Source, 2024 & 2034

6.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Source:

6.2.1. Nuts

6.2.2. Grains

6.2.3. Legumes

6.2.4. Fruits & Vegetables

6.2.5. Others

Chapter 7. Non-Dairy and Plant-Based Beverages Market Segmentation 3: By Distribution Channel, Estimates & Trend Analysis

7.1. Market Share by Distribution Channel, 2024 & 2034

7.2. Market Size Revenue (US$ Million) & Forecasts and Trend Analyses, 2021 to 2034 for the following Distribution Channel:

7.2.1. Online

7.2.2. Offline

Chapter 8. Non-Dairy and Plant-Based Beverages Market Segmentation 5: Regional Estimates & Trend Analysis

8.1. Global Non-Dairy and Plant-Based Beverages Market, Regional Snapshot 2024 & 2034

8.2. North America

8.2.1. North America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.2.1.1. US

8.2.1.2. Canada

8.2.2. North America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.2.3. North America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Source, 2021-2034

8.2.4. North America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Distribution Channel, 2021-2034

8.3. Europe

8.3.1. Europe Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.3.1.1. Germany

8.3.1.2. U.K.

8.3.1.3. France

8.3.1.4. Italy

8.3.1.5. Spain

8.3.1.6. Rest of Europe

8.3.2. Europe Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.3.3. Europe Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Source, 2021-2034

8.3.4. Europe Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Distribution Channel, 2021-2034

8.4. Asia Pacific

8.4.1. Asia Pacific Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.4.1.1. India

8.4.1.2. China

8.4.1.3. Japan

8.4.1.4. Australia

8.4.1.5. South Korea

8.4.1.6. Hong Kong

8.4.1.7. Southeast Asia

8.4.1.8. Rest of Asia Pacific

8.4.2. Asia Pacific Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.4.3. Asia Pacific Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Source, 2021-2034

8.4.4. Asia Pacific Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Distribution Channel, 2021-2034

8.5. Latin America

8.5.1. Latin America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.5.1.1. Brazil

8.5.1.2. Mexico

8.5.1.3. Rest of Latin America

8.5.2. Latin America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.5.3. Latin America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Source, 2021-2034

8.5.4. Latin America Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Distribution Channel, 2021-2034

8.6. Middle East & Africa

8.6.1. Middle East & Africa Wind Turbine Rotor Blade Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.6.1.1. GCC Countries

8.6.1.2. Israel

8.6.1.3. South Africa

8.6.1.4. Rest of Middle East and Africa

8.6.2. Middle East & Africa Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.6.3. Middle East & Africa Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Source, 2021-2034

8.6.4. Middle East & Africa Non-Dairy and Plant-Based Beverages Market Revenue (US$ Million) Estimates and Forecasts by Distribution Channel, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Pacific Foods of Oregon, LLC

9.2.1.1. Business Overview

9.2.1.2. Key Product Type/Service Overview

9.2.1.3. Financial Performance

9.2.1.4. Geographical Presence

9.2.1.5. Recent Developments with Business Strategy

9.2.2. Blue Diamond Growers, Inc.

9.2.3. SunOpta

9.2.4. The Hain Celestial Group, Inc.

9.2.5. Noumi Ltd.

9.2.6. Califia Farms, LLC

9.2.7. Harmless Harvest

9.2.8. Koia

9.2.9. Vitasoy International Holdings Ltd.

9.2.10. Thurella AG

9.2.11. GOOD KARMA FOODS, INC

9.2.12. Health-Ade Kombucha

9.2.13. Fentimans

9.2.14. GT’S LIVING FOODS

9.2.15. Lifeway Foods, Inc

9.2.16. KeVita

9.2.17. Nestlé

9.2.18. Bionade GmbH

9.2.19. Danone

9.2.20. Biosa Inc

9.2.21. DuPont.,

9.2.22. Chr. Hansen Holding A/S

9.2.23. Chobani, LLC

9.2.24. Earth’s Own

9.2.25. Oatly AB.

Segmentation of Non-Dairy and Plant-Based Beverages Market

Global Non-Dairy and Plant-Based Beverages Market- By Product Type

Global Non-Dairy and Plant-Based Beverages Market – By Source

Global Non-Dairy and Plant-Based Beverages Market – By Distribution Channel

Global Non-Dairy and Plant-Based Beverages Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

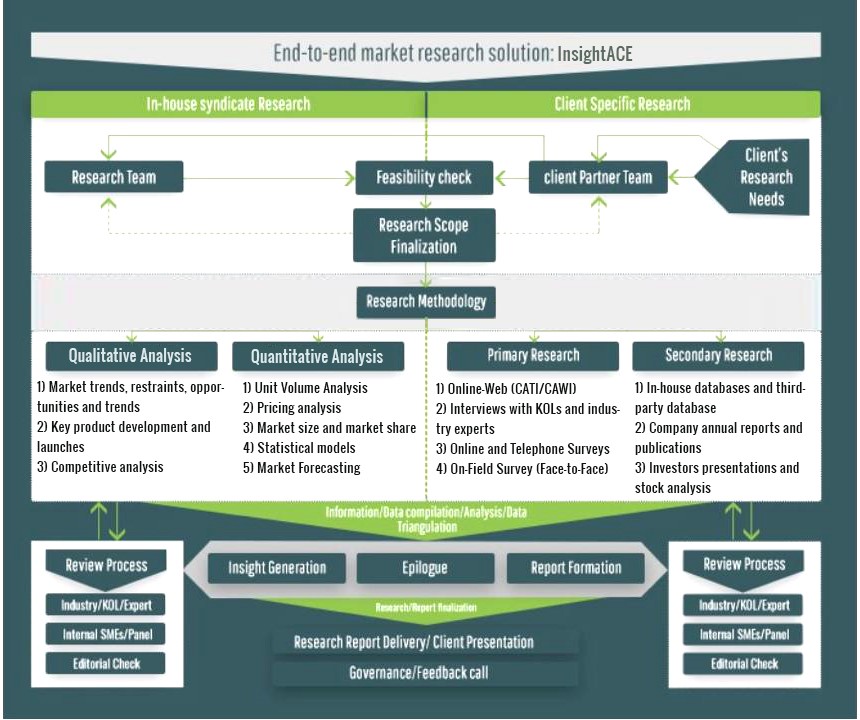

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.