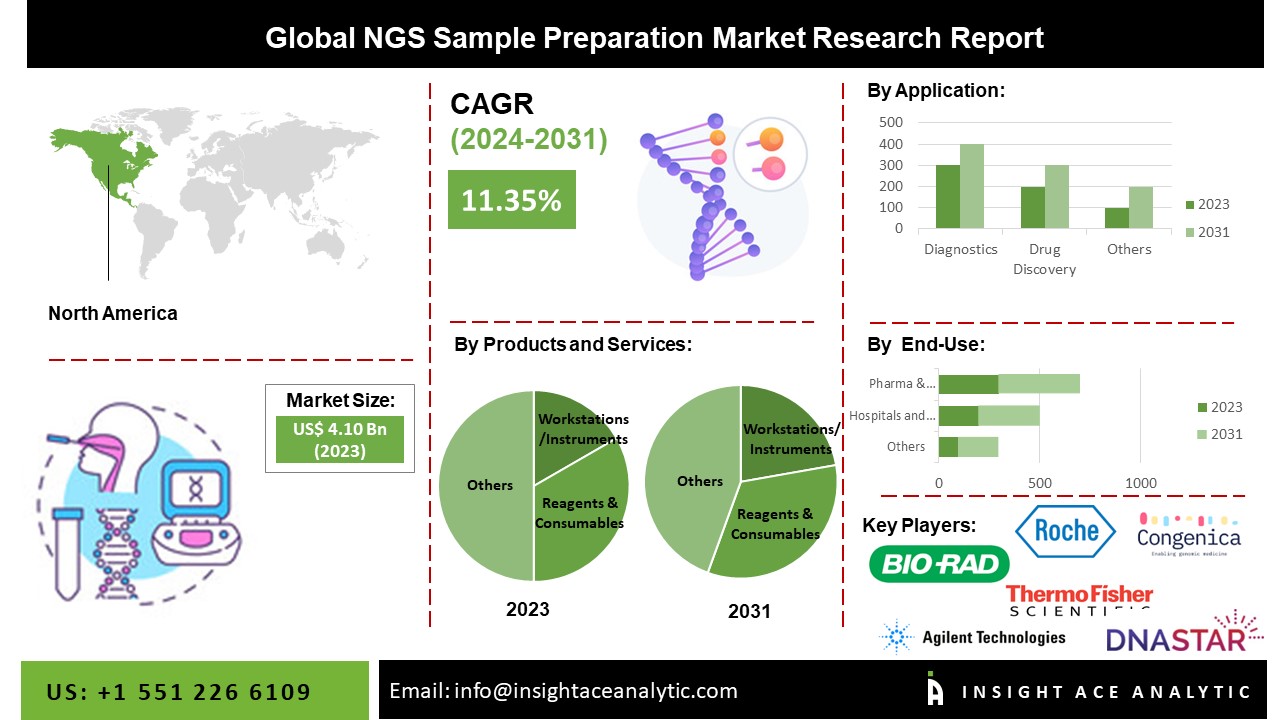

The NGS Sample Preparation Market Size is valued at 4.10 Billion in 2023 and is predicted to reach 9.51 Billion by the year 2031 at an 11.35 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Next-generation sequencing is one of the high-throughput DNA sequencing techniques that use the concept of massively parallel processing (NGS). Another name for it is "massively parallel sequencing." Different sequencing, chemical, and engineering setups are available for NGS platforms. NGS methods make it possible to determine RNA structures. NGS allowed for the rapid sequencing of the entire human genome in just one day. NGS technology has increased the precision and speed of genome sequencing.

Global market revenue growth is fueled by essential factors like growing acceptance for NGS in diagnostics due to lower costs of NGS products and the advent of low-cost sequencing methodologies. A few fundamental drivers driving the NGS Sample Preparation Market growth include the increasing prevalence of genetic disorders of infectious and chronic diseases and using NGS in cancer diagnoses and therapy.

Additionally, it is anticipated that factors like improved products for producing high-quality libraries with a high yield for effective sequencing would create more attractive prospects for top companies and accelerate market expansion in the upcoming years. However, the high cost of NGS and strict NGS-related restrictions in some countries may limit the growth of this worldwide sector.

The NGS Sample Preparation Market is segmented into Products & Services, Workflow, Sample Type, Method, Application and End-user. The Products & Services segment comprises Workstations/Instruments, Reagents & Consumables, and Services. According to workflow, the market is categorized into DNA Fragmentation & Library Preparation, Target Enrichment, and QC. The Sample Type segment includes DNA and RNA. By Method, the market is segmented as Manual Sample Preparation, Microfluidic Sample Preparation, and Automated Liquid Handling-based Sample Preparation. According to application, the market comprises Diagnostics, Drug Discovery, Agricultural & Animal Research, and Other applications. Lastly, the End User segment is categorized into Academic Institutes & Research Centers, Hospitals & Clinics, Pharma & Biotech Companies, and Other End Users.

The DNA category dominated the market according to the sample type. The DNA segment is anticipated to experience expansion during the projected period due to an increasing number of cancer cases and greater spending on research and development for DNA samples.

Based on the product & services, The workstation/instruments segment record the largest market revenue share in 2022. The market growth is expected to be driven by the rising need for Next-Generation Sequencing (NGS) automation.

Based on the application, The diagnostics segment has generated the largest earnings in the application segment in 2022. A significant portion of the disease diagnostics sector can be ascribed to the growing existence of cancer worldwide and the early detection of several infectious diseases and monogenetic disorders, as well as its role in precision medicine.

The North American NGS Sample Preparation Market is expected to register the highest market share in revenue shortly due to several variables, including the growing need for diagnostic tools for detecting health disparities, public knowledge of accessible technologies, the concentration of market players in the United States, and the expanding burden of infectious diseases and chronic diseases in the area.

The biotechnology and auxiliary markets in this region are also being driven by considerable R&D expenditure, a technologically advanced healthcare research framework, and the presence of significant companies. In addition, Asia Pacific is projected to grow rapidly in the global NGS Sample Preparation Market . The predicted growth tendency is attributed to changes in the legal framework, affordability trends, and technology advancements in the region's developing economies. Additionally, the existence of a diseased population boosts regional clinical trial-related activity, which raises the demand for NGS sample preparation.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 4.10 Billion |

| Revenue Forecast In 2031 | USD 9.51 Billion |

| Growth Rate CAGR | CAGR of 11.35 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Products and Services, By Workflow, By Sample Type, By Method, By Application, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), PerkinElmer Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (US), Danaher (US), Becton, Dickinson and Company (US), Merck KGAA (Germany), QIAGEN (Germany), Bio-Rad Laboratories, Inc. (US), Promega Corporation (US), Eurofins Scientific (Luxembourg), BGI (China), 10x Genomics (US), Sysmex Corporation (US), Psomagen (US), Zymo Research Corporation (US), Takara Bio Inc. (Japan), Novogene Co., Ltd. (China), New England Biolabs (US), Tecan Trading AG (US), Oxford Nanopore Technologies PLC (UK), PacBio (US), Medgenome (US), and Swift Biosciences Inc. (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

NGS Sample Preparation Market By Products & Services

NGS Sample Preparation Market By Workflow

NGS Sample Preparation Market By Sample Type

NGS Sample Preparation Market By Method

NGS Sample Preparation Market By Application

NGS Sample Preparation Market By End User

NGS Sample Preparation Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.