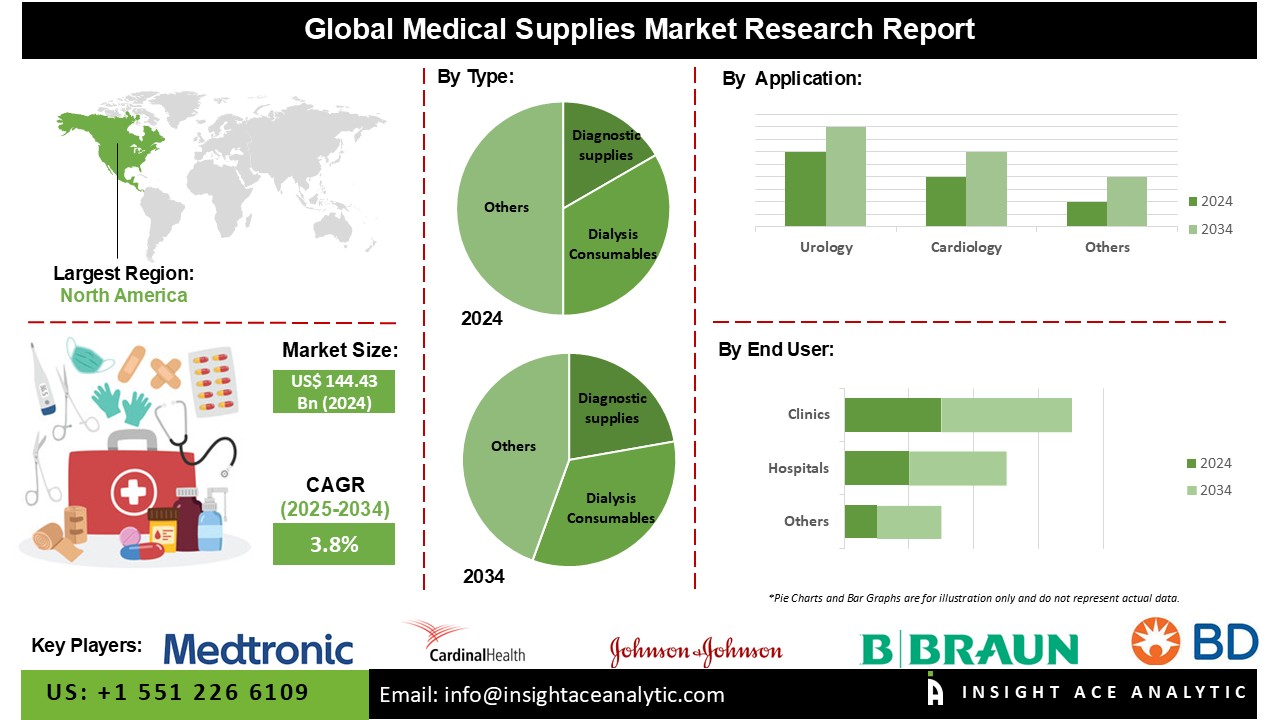

Global Medical Supplies Market Size is valued at USD 144.4 Billion in 2024 and is predicted to reach USD 208.3 Billion by the year 2034 at a 3.8% CAGR during the forecast period for 2025-2034.

Medical supplies comprise one-time-use or disposable items used during operations and other medical procedures. These goods are only intended for one-time usage. Medical supplies are made and provided to healthcare facilities to ensure patient safety. It is used in clinics, ambulatory surgery centers, nursing homes, hospitals, and facilities for assisted living.

Blood processing, wound care, monitoring, and personal protective equipment are examples of medical instruments utilized as medical supplies. The market for medical supplies is anticipated to grow due to factors like the rise in the prevalence of epidemic and pandemic diseases and chronic diseases in general. Furthermore, future market expansion is anticipated to be fueled by increased public and private investment in infrastructure projects and healthcare programs. A few key factors propelling the market expansion for hospital supplies are the creation of technologically advanced devices and the expanding healthcare industry.

Additionally, the substantial elderly population base and the rising prevalence and incidence of related ailments among them are driving the market for hospital supplies to grow. It is expected that the healthcare sector would offer several opportunities throughout this time due to growing advanced technology. However, throughout the projection period, factors such as strict regulatory requirements and compliances for medical supplies and increased product recalls are anticipated to limit market growth for medical supplies to some extent.

The medical supplies market is divided based on type, application and end user. Based on the type, the market is segmented as diagnostic supplies (blood collection consumables and other sample collection consumables), infusion & injectable supplies, intubation & ventilation supplies, disinfectants (hand disinfectants, skin disinfectants, surface disinfectants, and instrument disinfectants), personal protective equipment (hand & arm protection equipment, eye & face protection equipment, protective clothing, foot & leg protection equipment, surgical drapes and other protection equipment), sterilization consumables, wound care consumables ( surgical wound care, advanced wound dressings, and traditional wound care), dialysis consumables (hemodialysis consumables and peritoneal dialysis consumables), radiology consumables, catheters (cardiovascular catheters, intravenous catheters, urological catheters, specialty catheters and neurovascular catheters), sleep apnea consumables and other medical supplies.

As per the application, the market is segmented into urology, wound care, radiology, respiratory, infection control, cardiology, IVD and other applications. Based on end user, the market is bifercated into hospitals, clinics/physician offices and other end users.

The catheters category will hold a major share of the global medical supplies market in 2022. An increase in diabetes and elderly individuals is to blame for this. Chronic conditions like diabetes, chronic obstructive lung disease, stroke, and dementia can all lead to urinary incontinence. For instance, Argon Medical Inc. released SKATER Mini-Loop Drainage Catheters for sale in August 2021.

Under imaging guidance, a discharge catheter is introduced from the skin to remove an unwelcome fluid accumulation. Adopting a 40% shorter loop to help anchor the catheter and empty fluid from smaller places, the Catheters Drainage Catheter broadens Argon's Catheters Nephrostomy evacuation product line. Therefore, the elements are fueling the segment's expansion.

The IVD category is predicted to exhibit the greatest CAGR among all categories due to the increasing usage of real-time diagnostic tests to precisely detect chronic diseases, including diabetes, cancer, and HIV/AIDS. The other sector predominated due to rising market demand and usage of masks, medical gear, fetal monitors, gloves, surgical lights, and other hospital supplies. Wound treatment is being driven by the growing financial commitment made by medical device companies to developing cutting-edge wound therapeutics and bioactive devices.

The development of surgical robot technology and the growing use of these tools by healthcare professionals are further factors that are projected to boost the expansion of the minimally invasive surgery market.

The North America medical supplies market is expected to record the major market share in revenue in the near future. The increased elderly population, rising chronic illness prevalence, expanding healthcare spending, established healthcare infrastructure, and rising surgical demand among the populace are characteristics of North America. Additionally, increased health and medical insurance use pushes people to choose hospital facilities. All of these elements are anticipated to benefit the expansion of the North American market for medical supplies.

In addition, Asia-Pacific is expected to grow at the quickest rate. Increased government and private sector investments in the development of healthcare infrastructure. The large population, rising awareness of non-invasive operations, rising healthcare spending, and rising awareness of hospital-acquired infections are some factors that would drive the growth of the medical supplies market within the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 144.4 Billion |

| Revenue Forecast In 2034 | USD 208.3 Billion |

| Growth Rate CAGR | CAGR of 3.8 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Medtronic plc (Ireland), Cardinal Health (US), BD (US), Johnson & Johnson, Inc. (US), and B. Braun Melsungen AG (Germany). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Medical Supplies Market By Type

Medical Supplies Market By Application

Medical Supplies Market By End User

Medical Supplies Market By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.