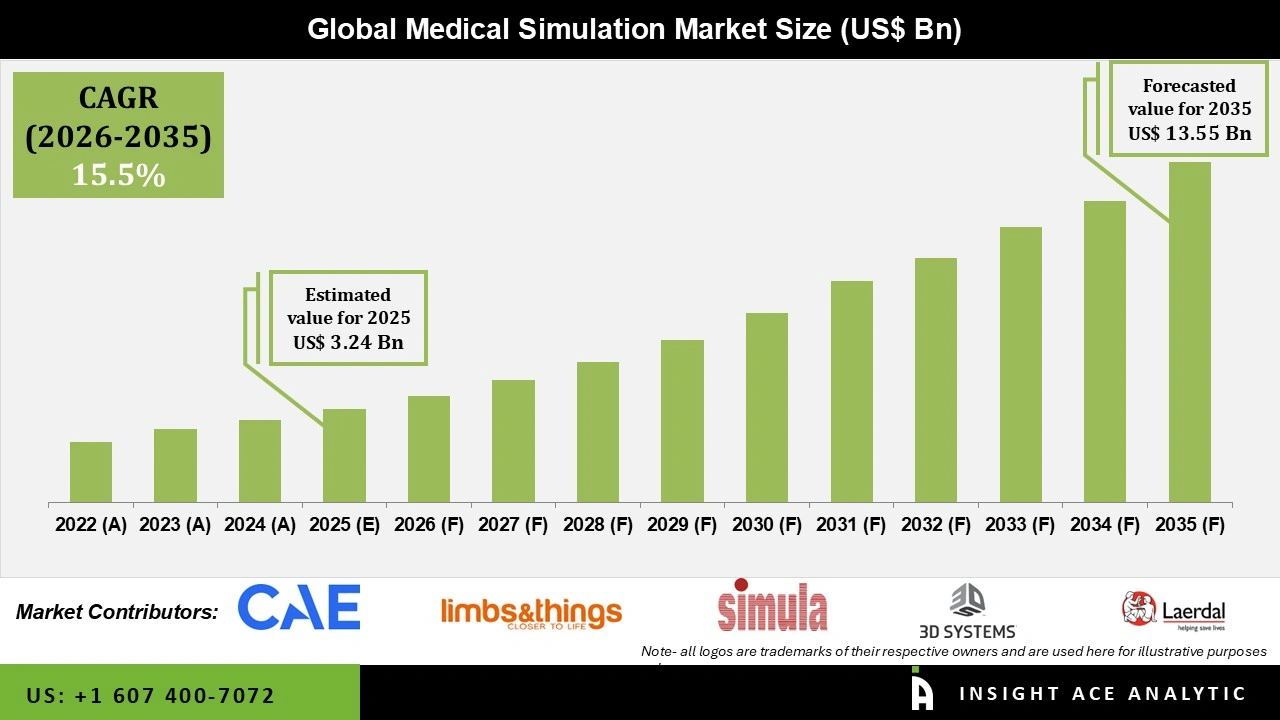

Global Medical Simulation Market Size is valued at USD 3.24 Bn in 2025 and is predicted to reach USD 13.55 Bn by the year 2035 at a 15.5% CAGR during the forecast period for 2026 to 2035.

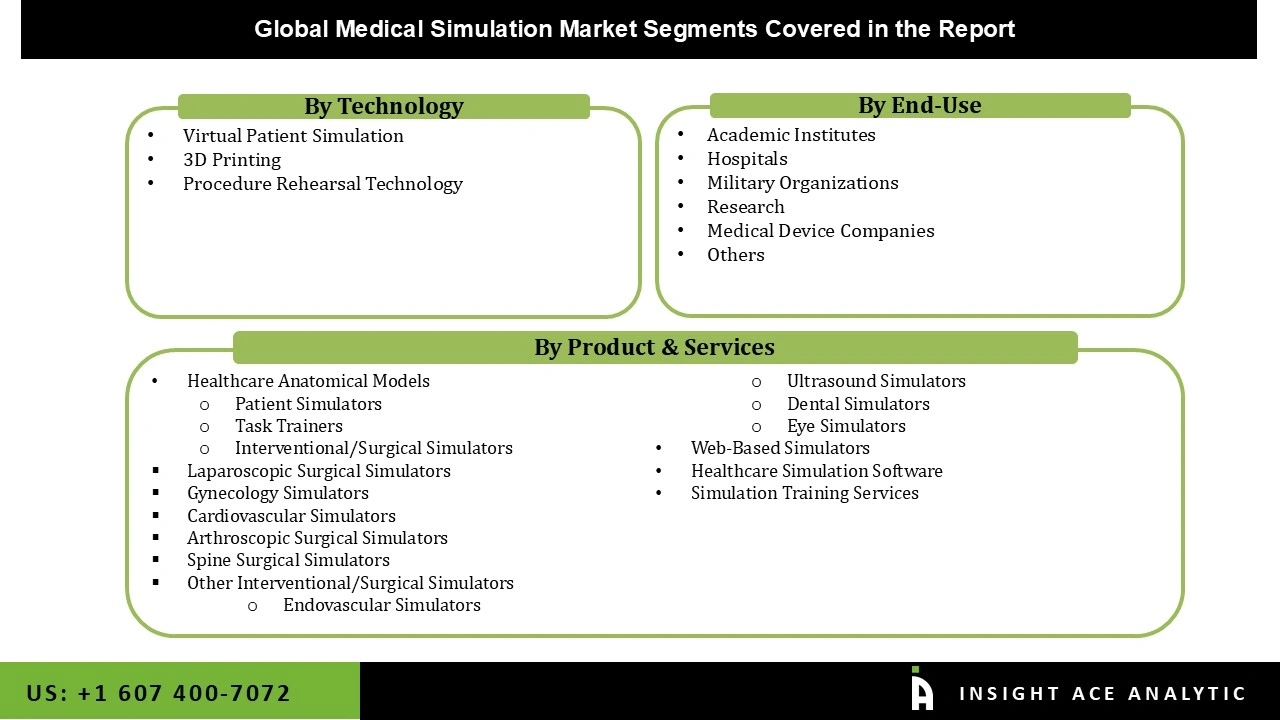

Medical Simulation Market Size, Share & Trends Analysis Report By Product & Services (Medical Simulation Anatomical Models, Web-Based Simulation, Medical Simulation Software, And Simulation Training Services), Technology (Virtual Patient Simulation, 3d Printing And Procedure Rehearsal Technology), By End-Use, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

According to research on patient safety, learning can benefit from simulation. More broadly, medical simulation, or healthcare simulation, is employed in medical education and training across several industries. The context for an experiment can be a tactical setting, a classroom, or a special location. Its main objective in the past was to instruct medical personnel on reducing mistakes in clinical practitioners, prescriptions, crisis interventions, and surgery. When paired with debriefing techniques, it is used to teach students anatomy, physiology, and communication throughout their academic careers.

Several variables influence the healthcare/medical simulation market expansion, including the rising number of medical students and the scarcity of human bodies. Medical simulation is a teaching strategy that uses augmented world or simulation models to let health workers practice procedures and methods in real-world settings.

In contrast to the journeyman learning approach, medical simulation permits the purposeful deployment of clinical skills. The market is projected to boost due to increasing patient safety awareness, a preference for minimally invasive treatments, and technological advancements. Several market participants have suffered because of the COVID-19 outbreak. The medical simulation market growth is expanding due to the increasing focus on alternatives to traditional teaching.

The medical simulation market demand is growing due to the adoption of cutting-edge framework technologies. The medical physician procedure training expenditure is also reviving the medicinal simulation market. The demand for improving patient safety outcomes, an rise in the use of simulation in the healthcare sector, and an increase in the death rate from medical errors are all factors contributing to the medical simulation market growth. Virtual and augmented reality are gaining popularity and useful for communicating with and training healthcare professionals.

The medical simulation market is segmented based on Product & Services, Technology, End-use. Based on products & services, the market is segmented as medical simulation anatomical models, web-based simulation, medical simulation software, and simulation training services. The Healthcare Anatomical Models category is again divided into Patient Simulators, Task Trainers, Interventional/Surgical Simulators, Endovascular Simulators, Ultrasound Simulators, Dental Simulators and Eye Simulators. By technology, the market is segmented as virtual patient simulation, 3d printing and procedure rehearsal technology. By end users, the market is further segmented into academic institutes, hospitals, military organizations, and others.

The anatomical model category will hold a major share of the global medical simulation market in 2022. These simulators are proven useful for conducting tests and permutations before settling on designs, procedures, or systems in the research and manufacturing sectors, particularly in the medical devices sector. These variables are predicted to support the segment's expansion for the forecast period. Given the unappreciated risk of injuries that can come from poor positioning across disciplines, the anatomical model is just as crucial for practicing situating the patient in the right posture before the surgery begins. Another factor to consider is that all surgical procedures require close teamwork, including the interaction of various tools and the appropriate positioning of team members around the patient.

The academic research segment is projected to grow rapidly in the global medical simulation market. Several academic research groups that use computerized models to analyze complicated biological systems suggest that the market for academic research institutions will continue to expand over the coming years. The medical simulation market is expanding due to the increasing focus away from conventional learning. The use of cutting-edge simulation-based technologies is also aiding the medical simulation market development. The expense of professional physician operational instruction also revives the market for medical simulations.

According to studies on patient safety, simulation can aid students in their clinical practice preparation without endangering patients. This has been researched in various areas, including technical approaches, clinical assessment, teamwork, and interaction. Simulation is a competency-based learning and assessment substitute for the variable clinical setting since it enables students to follow a predetermined curriculum and complete a standardized test.

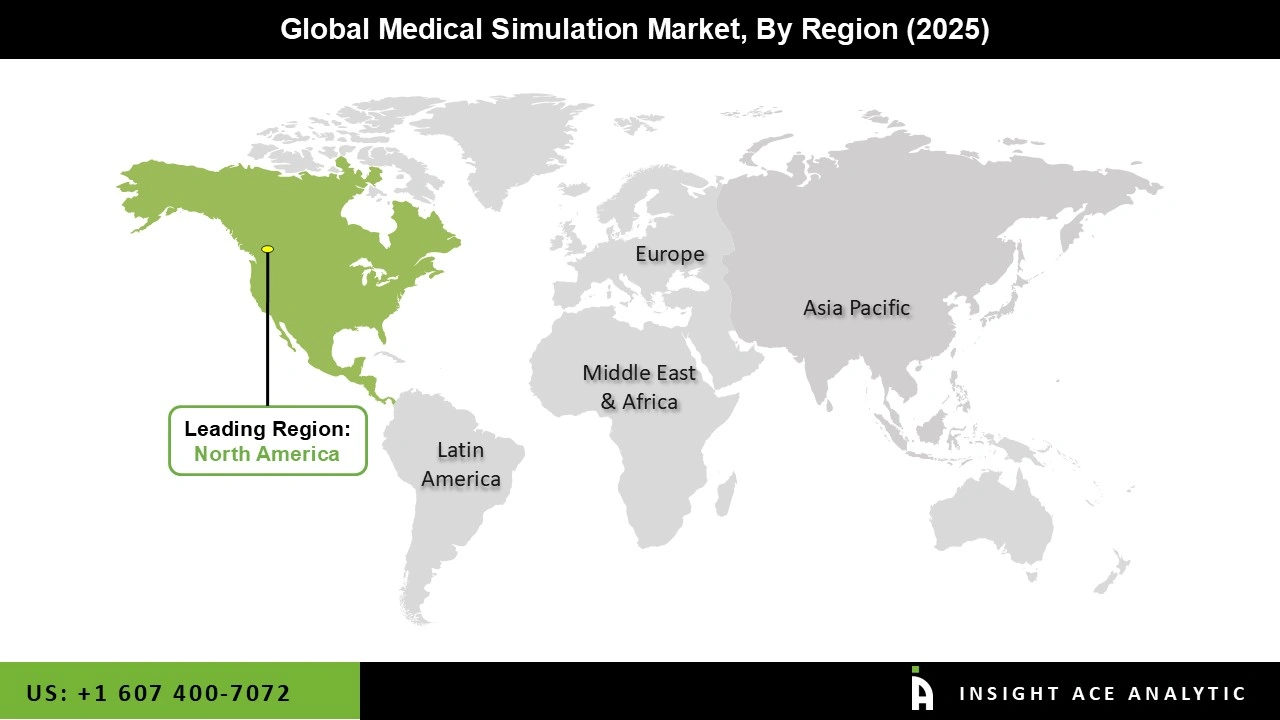

The North America, medical simulation market is expected to record the highest market share in revenue soon. The market's primary driver is growing medical education in North America's hospitals and institutes, which emphasize standardizing their teaching strategies to improve patient safety. The medical simulation industry is expanding profitably due to the large population. The market for medical simulation is expanding due to a growing emphasis on medical education.

The medical simulation market progress is increasing due to rising healthcare costs. In addition, Asia Pacific is projected to increase in the global Medical Simulation market. Because patient care is receiving more attention in this region's burgeoning economies and increased attention to medical education, training, and research, this is due to the increased use of simulation technology by hospitals, rising government spending on care, clinics, and educational facilities, and prominent industry players operating in this area.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3.24 Bn |

| Revenue forecast in 2035 | USD 13.55 Bn |

| Growth rate CAGR | CAGR of 15.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product & Services, Technology, End-use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | CAE; Laerdal Medical; 3D Systems; Simula Corporation; Limbs & Things Ltd; Entice AB; Simu aids; Guard Scientific Company; Surgical Science Sweden AB; Kyoto Kagaku Co., Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Medical Simulation Market By Product & Services

Medical Simulation Market By Technology

Medical Simulation Market By End-use

Medical Simulation Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.