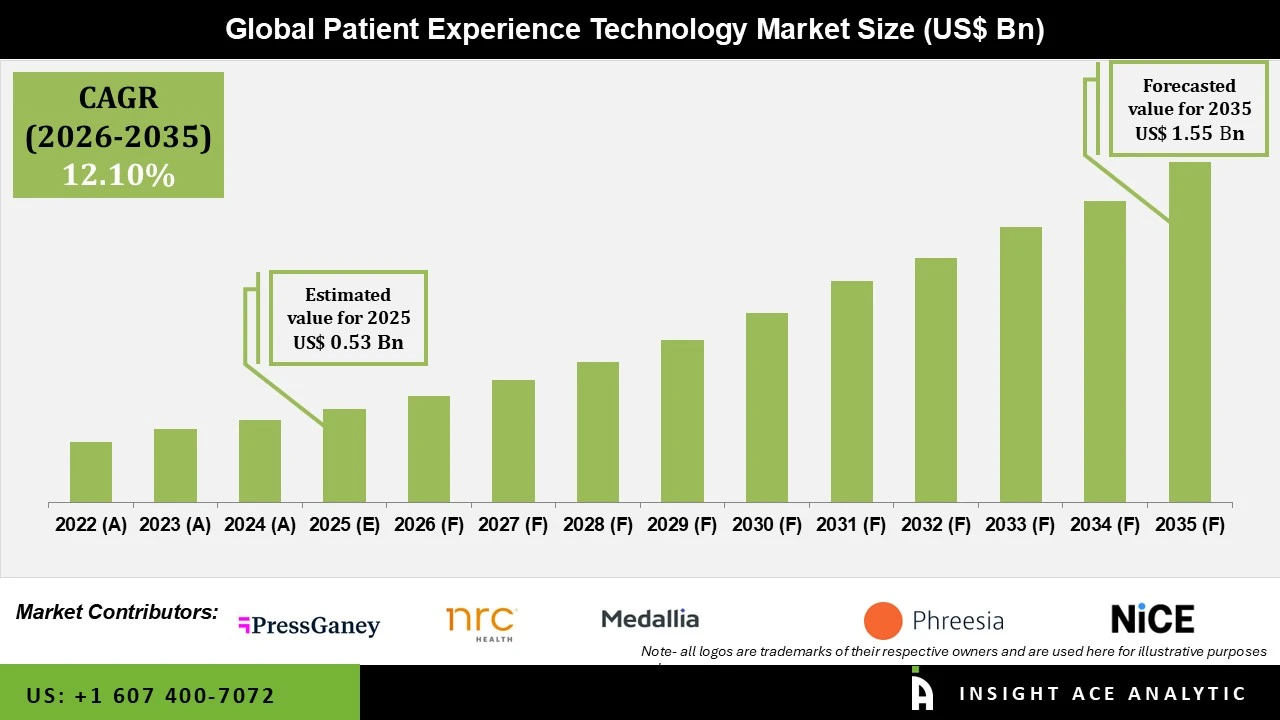

Patient Experience Technology Market Size is valued at US$ 0.53 Bn in 2025 and is predicted to reach US$ 1.55 Bn by the year 2034 at an 12.10% CAGR during the forecast period for 2026 to 2035.

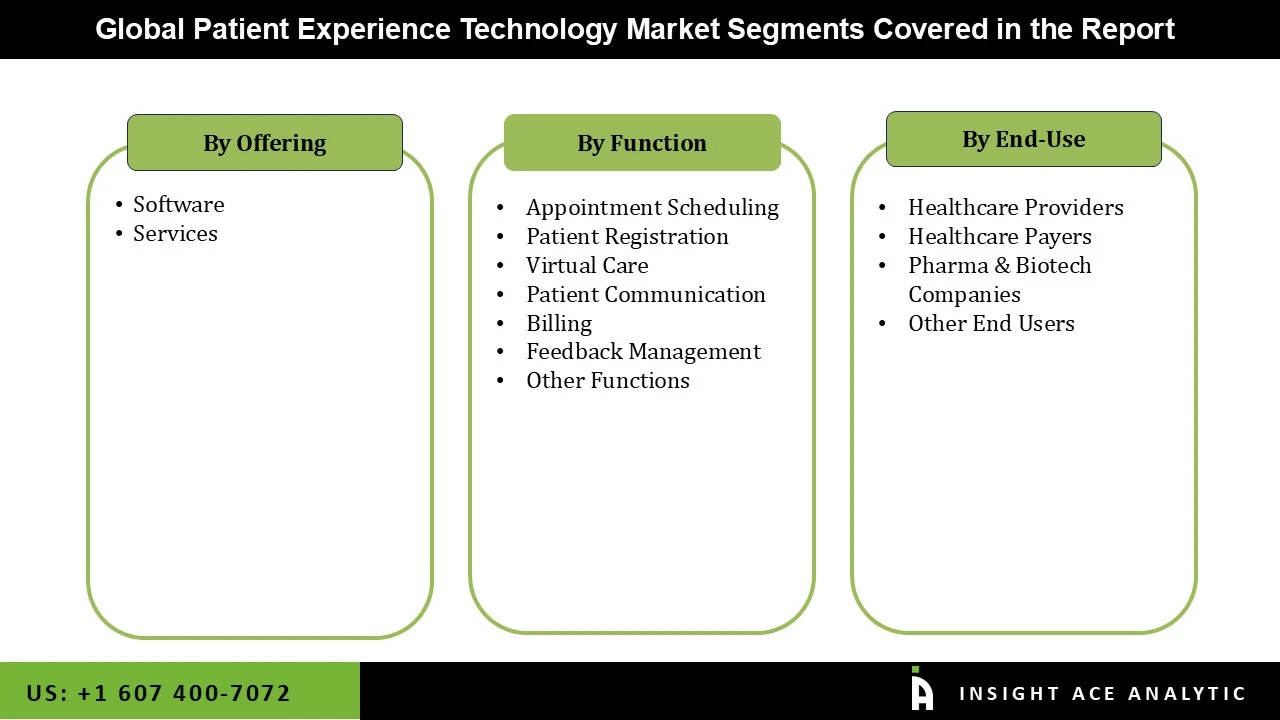

Patient Experience Technology Market Size, Share & Trends Analysis Distribution By Offering (Software and Services), By Function (Appointment Scheduling, Patient Registration, Virtual Care, Patient Communication, Billing, Feedback Management, and Other Functions), By End User (Healthcare Providers, Healthcare Payers, Pharma & Biotech Companies, and Other End Users), and Segment Forecasts, 2026 to 2035

Hospitals and clinics leverage patient experience technology to simplify care delivery, enhance personalization, and reduce stress for patients. Tools such as digital check-in systems, smartphone applications, bedside communication tablets, and automated feedback platforms help shorten wait times and improve transparency. These solutions allow patients to communicate easily with providers, manage appointments, and access test results more efficiently. Healthcare facilities also use them to monitor satisfaction levels, address concerns quickly, and streamline operational workflows. As hospitals face increasing demands to offer faster, smoother, and more customized care, the global patient experience technology market continues to grow rapidly.

The trend toward digital healthcare is another element propelling the patient experience technology market. The patient experience technology market is expanding because trend toward digital healthcare, where hospitals seek to provide more efficient, quicker, and transparent services. In March 2022, the European Health Initiative, the world's most significant public-private partnership in life sciences with a USD 2.46 billion budget, aims to involve patients in all research stages. However, high price of digital platforms and the difficulty of integrating them with current hospital systems are some of the obstacles impeding the growth of the patient experience technology sector. Over the course of the forecast period, opportunities for the Patient Experience Technology market will be created by as healthcare infrastructure modernization and digital access expansion.

· Press Ganey

· National Research Corporation (NRC Health)

· Medallia Inc.

· Phreesia

· NICE

· R1

· Epic Systems Corporation.

· IQVIA

· Qualtrics

· Relias LLC

· GetWell Network, Inc.

· CipherHealth Inc.

· Kyruus, Inc.

· Twilio Inc.

· Avaamo

· Luma Health Inc.

· Solutionreach

· Salesforce, Inc.

· Others

The patient experience technology market is segmented by offering, function, and end user. By offering, the market is segmented into software and services. By function, the market is segmented into appointment scheduling, patient registration, virtual care, patient communication, billing, feedback management, and other functions. By end user, the market is segmented into healthcare providers, healthcare payers, pharma & biotech companies, and other end users.

The software segment led the patient experience technology market in 2024. This convergence is fueled by demand for digital tools that record, evaluate, and respond to patient feedback in real time. Hospitals, outpatient clinics, and healthcare networks frequently deploy cloud-based, on-premise, and hybrid solutions. On-premise solutions support major health systems that require strong data protection, whereas cloud platforms are more popular due to scalability, remote access, EHR integration, and lower costs. Hybrid models combine conformity and flexibility. Al analytics, voice-activated assistants, and mobile portals, combined with expanding telehealth, patient-centered care, and regulatory requirements for participation, all contribute to increased use.

Patient Communication is the largest and fastest-growing segment, driven by a strong industry shift toward personalized and patient-centered care. These tools empower individuals to engage more actively in their treatment journey, ultimately improving satisfaction, adherence, and clinical outcomes. The segment’s growth is further supported by hospitals and payers increasingly using communication and engagement platforms that enable shared decision-making, remote monitoring, and continuous feedback. With value-based care models and regulatory bodies placing greater emphasis on patient experience metrics, the demand for robust patient communication solutions continues to rise.

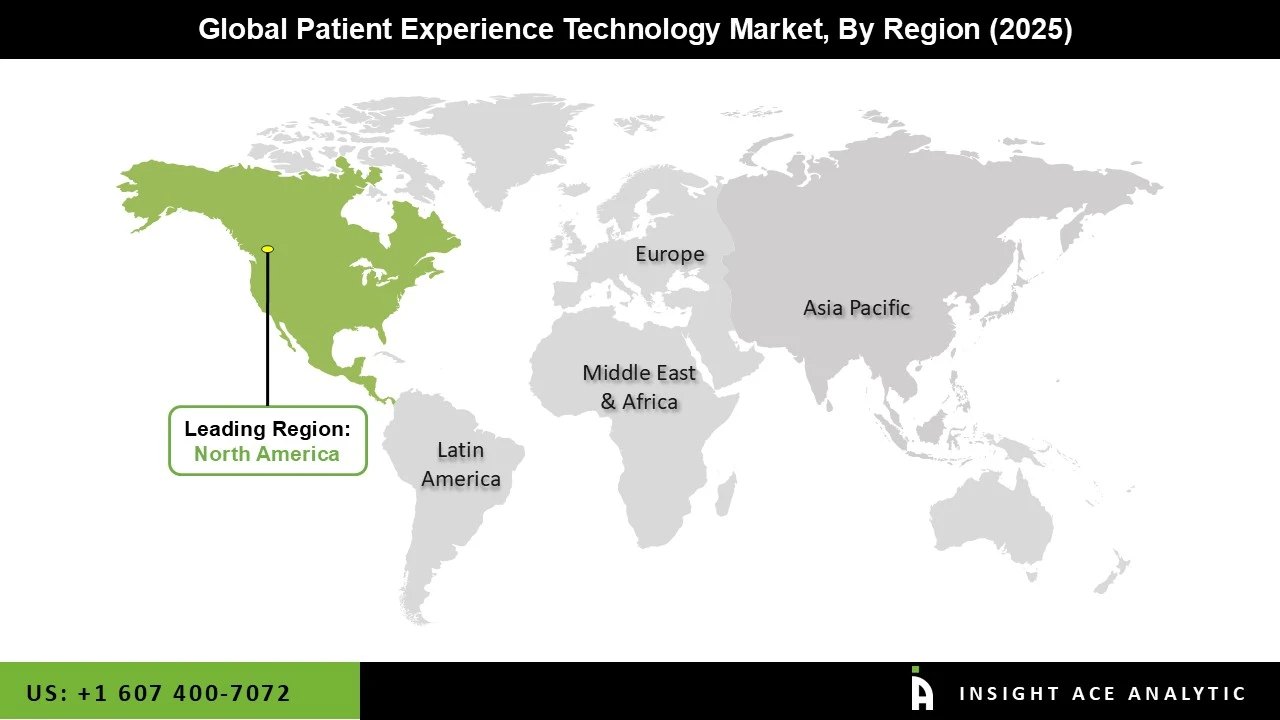

North America dominated the patient experience technology market in 2024. The United States is at the forefront of this expansion. This is due to hospitals in the region prioritize patient satisfaction scores and make significant investments in digital transformation. North America has the biggest market share for patient experience technology. Early adoption of contemporary tools like digital check-ins, mobile health apps, and real-time feedback platforms is encouraged by the existence of sophisticated healthcare systems, robust IT infrastructure, and encouraging compensation structures.

Rapid digitization of healthcare systems becoming more and more common in the Asia-Pacific area, the patient experience technology market is expanding at the strongest and fastest rate in this region. Additionally, the rapid digitization of healthcare systems throughout the region in response to growing patient loads and contemporary service demands. Uptake is also being accelerated by growing urban populations, expanding health insurance coverage, and rising telemedicine acceptance. The need for these technology keeps growing as hospitals look to improve transparency and lessen crowding.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.53 Bn |

| Revenue Forecast In 2035 | USD 1.55 Bn |

| Growth Rate CAGR | CAGR of 12.10% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, By Function, By End User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Press Ganey, National Research Corporation (NRC Health), Medallia Inc., Phreesia, NICE, R1, Epic Systems Corporation., IQVIA, Qualtrics, Relias LLC, GetWell Network, Inc., CipherHealth Inc., Kyruus, Inc., Twilio Inc., Avaamo, Luma Health Inc., Solutionreach, and Salesforce, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Patient Experience Technology Market by Offering

· Software

· Services

Patient Experience Technology Market by Function

· Appointment Scheduling

· Patient Registration

· Virtual Care

· Patient Communication

· Billing

· Feedback Management

· Other Functions

Patient Experience Technology Market by End User

· Healthcare Providers

· Healthcare Payers

· Pharma & Biotech Companies

· Other End Users

Patient Experience Technology Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.