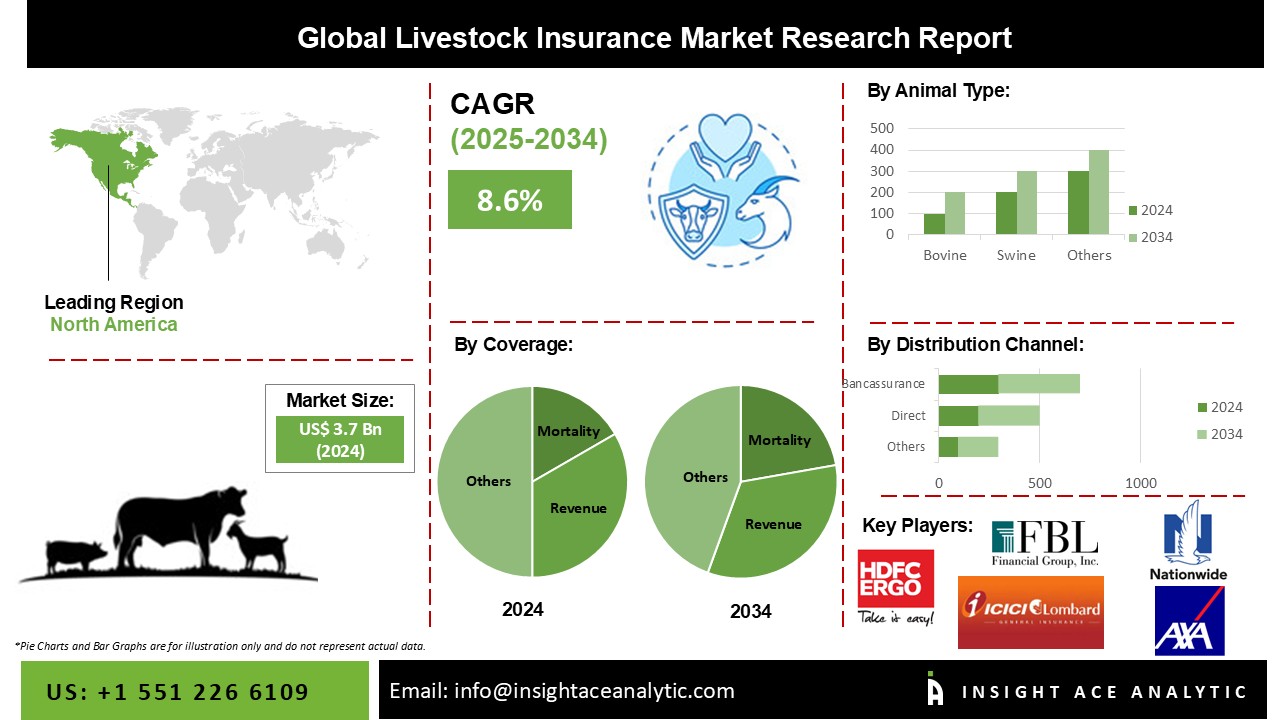

Livestock Insurance Market Size is valued at USD 3.7 billion in 2024 and is predicted to reach USD 8.1 billion by the year 2034 at a 8.6% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Farmers and livestock owners now require insurance at greater rates due to the rise in diseases in livestock animals, such as the flu, ringworms, and fever. Their protection against unforeseen risks like fire, smoke, earthquakes, and other dangers is provided by this insurance coverage. Liability protection for accidental property damage or bodily injury to third parties is another benefit of livestock insurance. Moreover, the market for livestock insurance is expanding as a result of these causes.

For small-scale farmers in rural areas who might be unable to afford it, the high premium rates connected with livestock insurance provide a considerable barrier. On the other hand, many governments offer subsidies for livestock insurance to reduce risks and dangers encountered by the livestock business, realizing the significance of the livestock sector in the economy. Due to this government backing, the future growth potential for the livestock insurance sector is anticipated to be lucrative.

The Livestock Insurance market is segmented based on coverage, animal type, and distributional channel. The market is segmented by coverage as mortality, revenue and other coverage based on coverage. The Livestock Insurance market is segmented by animal type into bovine, swine, sheep & goats, poultry and other animals. Based on the distributional channel, the market is segmented as follows. The market is segmented by distributional channel into direct, agency/broker, bancassurance and others.

The mortality category is expected to hold a major share in the global Livestock Insurance market in 2022 due to the large number and variety of insurance companies offering livestock mortality insurance. For instance, well-known insurance businesses use their standing, resources, and underwriting knowledge to attract clients. Livestock insurance is a service provided by companies specializing in agricultural insurance, such as crop insurers. These insurers enter the market by utilizing their current infrastructure, distribution networks, and knowledge of agricultural risk management.

The bovine segment is projected to grow rapidly in the global Livestock Insurance market. The use of bovine insurance plans to reduce production risks and rising awareness of them is to blame for this. Bovine insurance covers livestock losses brought on by unfavorable weather, such as death, injury, or productivity loss owing to a lack of feed or infrastructure. Additionally, it provides defense against market turbulence and price risk, giving some degree of financial security for cattle and dairy producers. By covering cattle mortality, medical costs, and biosecurity measures, bovine insurance is essential in reducing financial losses brought on by disease outbreaks. It is anticipated that these advantages will aid in the segment's expansion.

The North American Livestock Insurance market is expected to register the highest market share. The agricultural landscape in North America is diversified, and the market for livestock insurance is essential to the expansion and stability of the livestock sector. The industry is fueled by elements like the desire for financial security against probable losses, the rising understanding of risk management among livestock farmers, and improvements in insurance technology.

In addition, Asia Pacific is projected to grow rapidly in the global Livestock Insurance market. Market dynamics may be impacted by shifting climatic trends, developing diseases, and changing regulatory frameworks. However, the potential for the market to grow and develop in the area is boosted by government backing, technical developments, and the increasing importance of livestock farming.

Recent Developments:

| Report Attribute | Specifications |

| Market size value in 2024 | USD 3.7 Bn |

| Revenue forecast in 2034 | USD 8.1 Bn |

| Growth rate CAGR | CAGR of 6.83% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Deployment Mode, Application, End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Nationwide Mutual Insurance Company; AXA SA; FBL Financial Group, Inc; HDFC ERGO General Insurance Company Limited; ICICI Lombard General Insurance Company Limited; ProAg (Tokio Marine HCC group of companies); The Hartford; Reliance General Insurance Company Limited (part of Reliance Capital); Sunderland Marine (NorthStandard Limited); Royal Sundaram General Insurance Co. Limited |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Livestock Insurance Market By Coverage

Livestock Insurance Market By Animal Type

Livestock Insurance Market By Distribution Channel

Livestock Insurance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.