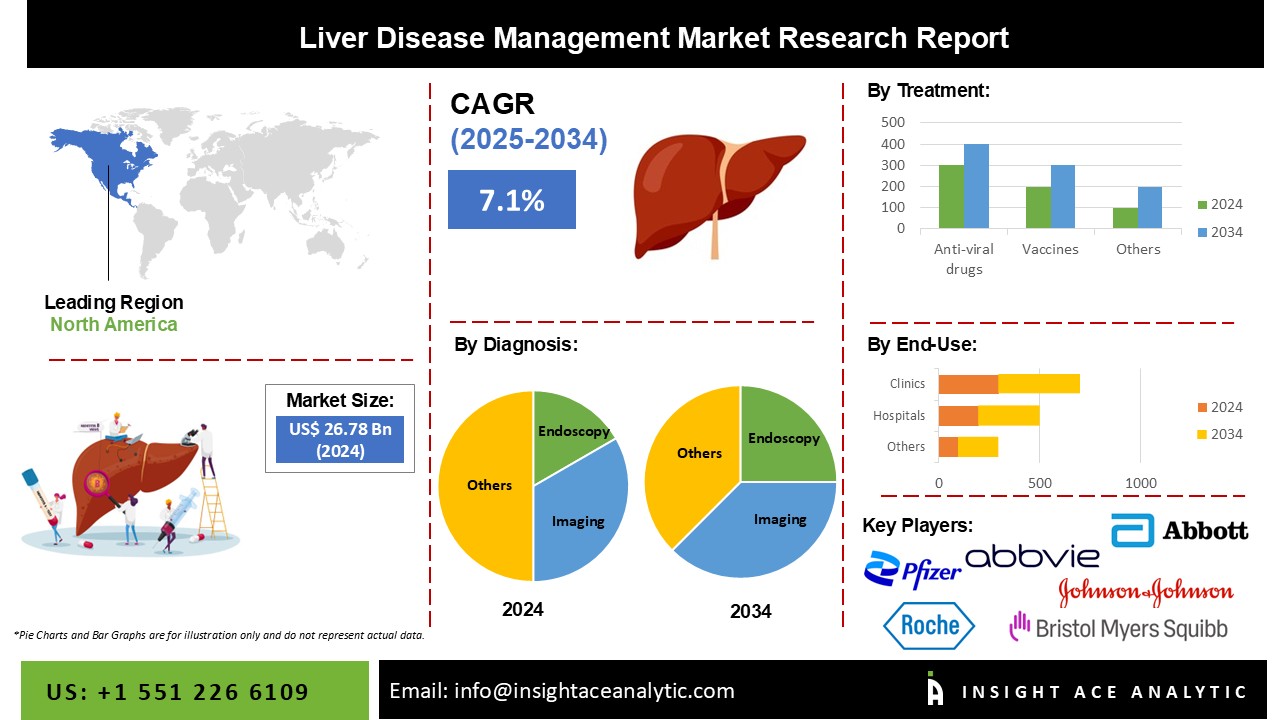

Liver Disease Management Market Size is valued at USD 26.78 Billion in 2024 and is predicted to reach USD 52.28 Billion by the year 2034 at a 7.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Liver disease can be acquired (genetic) or caused by liver-harming causes such as viruses (hepatitis A, B, and C) and alcohol usage. Obesity has been connected to liver disease as well. The liver is required for food digestion as well as to regulate the toxicity of chemicals in the body. One of the primary key factors driving the market's growth is the world's growing geriatric population, which is susceptible to various chronic diseases, including liver disease. Changing dietary habits and sedentary lifestyles are driving market expansion. The rising prevalence of fatty liver disease due to excessive cholesterol, obesity, hypertension (high blood pressure), and diabetes is boosting market growth.

Furthermore, significant technological breakthroughs, such as the creation of the bioartificial liver, are driving market expansion. It replaces liver functions with regenerated liver cells and is commonly utilized in individuals with acute liver failure. By this, the quick acceptance of anti-viral medications, safe and efficient in suppressing the hepatitis B virus and lowering the risk of developing cirrhosis and hepatocellular carcinoma, is favorably impacting the market growth. Aside from that, increased research and development (R&D) efforts, significant increases in the healthcare industry, and implementation of different government measures to enhance public health are producing a good outlook for the market.

The liver disease management market is segmented on diagnosis, treatment and end-use. Based on the diagnosis, the market is segmented into endoscopy, imaging, biopsy, and others. Based on treatment, liver disease management market is segmented into anti-viral drugs, targeted therapy, chemotherapy and others. Based on end-use, the liver disease management market is segmented into clinics, hospitals, diagnostics laboratories and others.

The imaging segment is expected to hold a significant share of the market due to an increase in the number of initiatives launched by key companies in the liver disease diagnostics market to create new imaging techniques. Laboratory tests are performed using urine, blood, and other fluid samples to diagnose liver function. Ultrasound, X-ray, Magnetic Resonance Imaging (MRI) scan, Computed Tomography (CT) scan, and more imaging procedures are available.

Hospitals grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Since most patients rely on hospitals with diagnostic testing instruments, hospitals give excellent treatment to patients and enable early identification and diagnosis, enhancing the market for liver disease diagnostics. Furthermore, continued healthcare infrastructure development is expected to improve existing hospital facilities.

The Asia Pacific Liver disease management market is expected to register the highest market share in revenue in the near future. The growing elderly population and increased awareness of the importance of regular check-ups are driving the expansion of the market for liver disease diagnostics in this area. Furthermore, it is expected that regulatory approval of innovative technologies that can be combined with imaging systems would boost regional growth. In addition, North America is projected to grow rapidly in the global Liver disease management market. High R&D investments and prominent players are projected to drive the growth of the region's market for liver disease diagnostics. Furthermore, organizations that supply patients with information about disease diagnosis are projected to boost the expansion of the market for liver disease diagnostics.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 26.78 Billion |

| Revenue Forecast In 2034 | USD 52.28 Billion |

| Growth Rate CAGR | CAGR of 7.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Diagnosis, Treatment, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Abbott, AbbVie Inc., Hoffmann-La Roche Ltd., Bristol-Myers Squibb Company, Astellas Pharma Inc, Lilly, Merck & Co., Inc, Pfizer Inc., Novartis AG, Johnson & Johnson Private Limited. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Diagnosis

By Treatment

By End-Use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.