Global Lithium Iron Phosphate Batteries Market Size is valued at USD 17.54 Bn in 2023 and is predicted to reach USD 48.95 Bn by the year 2031 at a 13.85% CAGR during the forecast period for 2024-2031.

Lithium iron phosphate (LFP) battery is a popular form of lithium-ion rechargeable battery that may be rapidly charged and discharged. Power density, voltage, energy density, cycle life, discharge rate, temperature, and safety are all improved with LFP battery packs. Industrial adoption of LFP batteries can be partly attributed to the government's efforts to rein in rising pollution levels through rigorous regulation.

Energy companies worldwide are investing in renewable energy generation and storage facilities. LFP batteries are increasingly used in grids and energy storage devices because of their inexpensive price, low self-discharge rate, and small installation footprint. These batteries are superior to others because they can withstand higher temperatures, making them useful in thermal control and other out-of-the-way places. Furthermore, rising global demand for electric vehicles and energy storage is expected to create substantial growth opportunities for the lithium-iron phosphate batteries market throughout the forecast period. Manufacturers of lithium-iron phosphate batteries are increasingly valuing novel, custom-fit solutions to cut costs and boost output.

However, the market growth is hampered by the high-cost criteria for the safety and health of the lithium iron phosphate batteries market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity lithium iron phosphate batteries market. The expansion of LFP batteries is predicted to be hampered by the rising demand for other batteries, such as lead-acid batteries, sodium-nickel chloride batteries, flow batteries, and lithium-air batteries in consumer electronics, electric vehicles, and energy storage systems. The emergence of novel energy technologies like flywheel batteries also restricts market expansion. As COVID-19 has spread, it has impeded the development of LFP batteries. Because of the serious interruptions to industry and the global economy brought on by the epidemic, the demand for LFP batteries has been steadily decreasing.

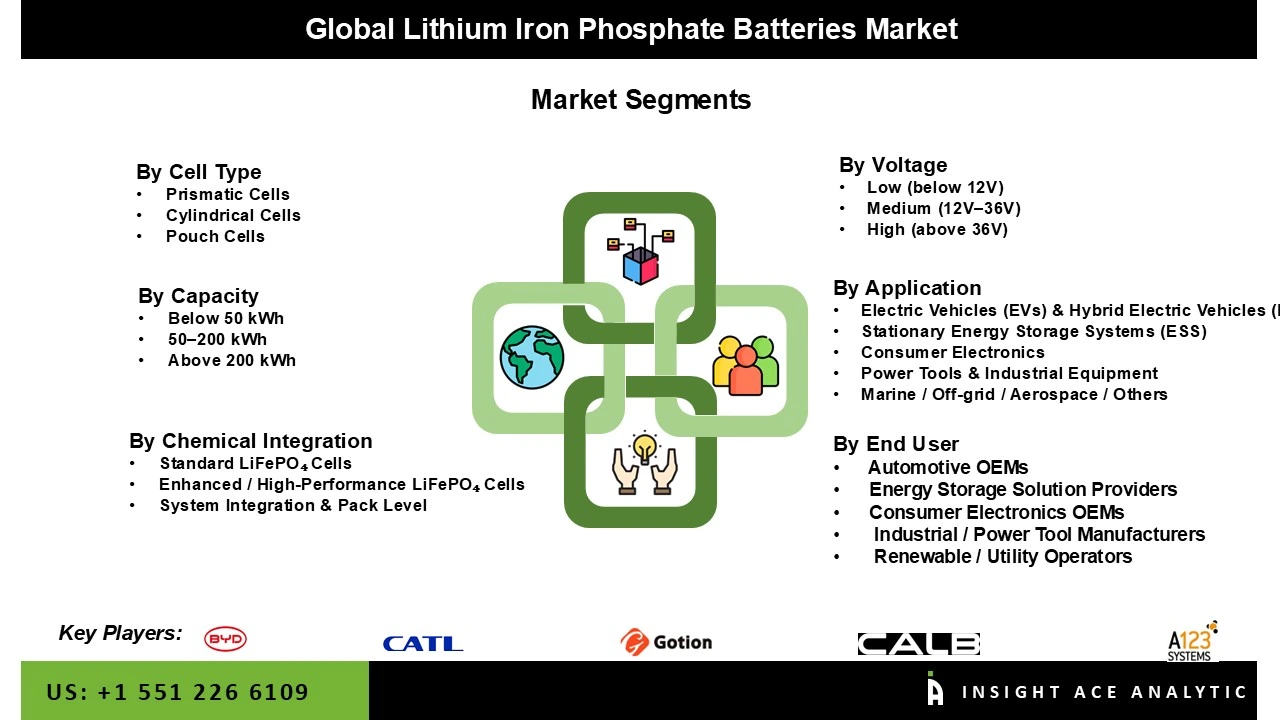

The lithium iron phosphate batteries market is categorised based on Design, Industry, application, Capacity and voltage. As per the Design, the market is segmented into Cell and Battery Pack. According to voltage, the market is divided into Low (Below 12 V), Medium (12-36 V), and High (Above 36 V). The Capacity segment comprises (0–16,250 MAH, 16,251–50,000 MAH, 50,001–100,000 MAH, 100,001–540,000 MAH). In comparison, the Application segment consists of Portable and Stationary. As per the Industry segment, the market is divided into Automotive (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), 2- & 3-wheelers, Hybrid Electric Vehicle (HEV), Bus & Truck), Power (Stationary, Residential), Industrial (Forklifts, Mining Equipment, Construction Equipment), Consumer Electronics (UPS, Camping Equipment, Others), Aerospace, Marine (Commercial, Tourism, Navy), Others (Telecommunications, Medical)).

The power lithium iron phosphate batteries market is expected to hold a highest global market share in 2024. The power sector is actively researching renewable energy generation and storage options. Smart grid technology is used to generate, regulate, and distribute this stored energy. Lithium iron phosphate batteries are increasingly used in smart grids and renewable energy storage systems due to their many advantageous properties.

The portable industry makes up the bulk of lithium iron phosphate battery usage because of the increasing use of these batteries in cars. When building electric or hybrid electric vehicles, the auto industry frequently uses LifePO4 batteries, especially in countries like the US, Germany, the UK, China, and India.

The North American lithium iron phosphate batteries market is expected to record the maximum market share in revenue in the near future. It can be attributed to because all the major producers are located here. Growth in the region is likely if the government adopts an upbeat stance and offers incentives. As the market for EVs grows, so too will the demand for LFP batteries. In addition, Asia Pacific is projected to grow rapidly in the global lithium iron phosphate batteries market because of the increasing demand for zero-emission vehicles as the demand for electronics like smartphones, laptops, and power tools grows globally.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 17.54 Bn |

| Revenue Forecast In 2031 | USD 48.95 Bn |

| Growth Rate CAGR | CAGR of 13.85 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Cell Type, End User, Battery Cell Chemistry & Integration, Capacity Range, Voltage and Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Contemporary Amperex Technology Co., Limited (CATL), BYD Company Limited, Gotion High-Tech Co., Ltd., EVE Energy Co., Ltd., CALB (China Aviation Lithium Battery Co., Ltd.), LG Energy Solution Ltd., Samsung SDI Co., Ltd., Tesla, Inc., A123 Systems LLC, K2 Energy Solutions Inc., Farasis Energy Inc., Svolt Energy Technology Co., Ltd., REPT Battery Co., Ltd., HiNa Battery Technology Co., Ltd., Sunwoda Electronic Co., Ltd., Phylion Battery Co., Ltd., Lithium Werks B.V., EnerSys, Valence Technology Inc., Simpliphi Power (Briggs & Stratton), American Battery Factory (ABF), Ufine Battery (Dongguan Ufine Electronic Technology Co., Ltd.), Shenzhen Bestray New Energy Co., Ltd., Must Energy (Guangdong) Technology Co., Ltd., OptimumNano Energy Co., Ltd., Panasonic Corporation, Hitachi Energy Ltd., Molicel (E-One Moli Energy Corp.), Lithium Australia Ltd., Fortum Recycling & Battery Solutions, Enertech International Inc., Stellantis N.V., VinFast Energy (Vingroup), Amperex Technology Limited (ATL), Li-Time Energy |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Lithium Iron Phosphate Batteries Market By Cell Type:

Lithium Iron Phosphate Batteries Market By Voltage

Lithium Iron Phosphate Batteries Market By Capacity

Lithium Iron Phosphate Batteries Market By Application

Lithium Iron Phosphate Batteries Market By Chemical Integration-

Lithium Iron Phosphate Batteries Market By End User-

Lithium Iron Phosphate Batteries Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.