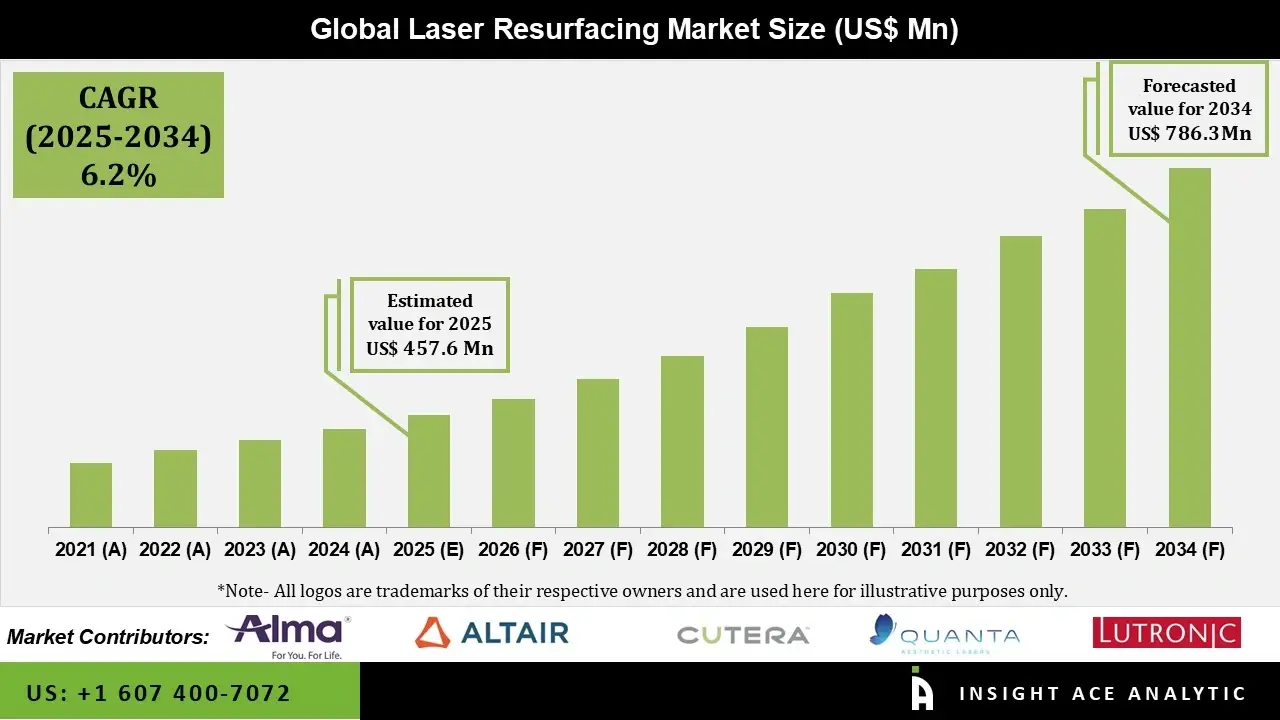

Laser Resurfacing Market Size is valued at USD 457.6 Mn in 2025 and is predicted to reach USD 786.3 Mn by the year 2034 at a 6.2% CAGR during the forecast period for 2025-2034.

A dermatological process called laser resurfacing makes use of concentrated light beams to enhance the texture, tone, and appearance of the skin. In order to promote regeneration and increase the creation of collagen, it targets damaged skin layers. Compared to conventional treatments, the method is renowned for its accuracy, low level of invasiveness, and quicker recovery durations. Wrinkles, UV damage, pigmentation problems, and acne scars are all successfully addressed by laser resurfacing. Improved skin elasticity, fewer imperfections, and better overall skin quality are some advantages of this treatment. The growing skin issues like wrinkles, acne, and skin pigmentation are key factors driving the laser resurfacing market's expansion.

Furthermore, it is projected that the growing number of elderly people will fuel market trends for laser resurfacing. In addition to reducing wrinkles, laser resurfacing equipment can be used for sagging skin and aging hands in the elderly population. As a result, the growing number of elderly people raises the need for laser resurfacing procedures, which propels the growth of the laser resurfacing market. The market for laser resurfacing is expanding due to the rise in licensed medical facilities. Moreover, the rise in non-invasive procedures like ablative and non-ablative laser treatment is the cause of the growing number of medical centers. The changes in lifestyle and an increase in skin damage are the main causes of the growth in medical spas.

Moreover, the laser resurfacing market is expected to develop as young people become more conscious of their physical appearance and as women become more conscious of various facial aesthetic procedures. Additionally, constant innovation in laser, radiofrequency, and plasma technologies has increased results, decreased downtime, and improved safety. Fractional and hybrid systems, which provide precise energy and enhance skin regeneration while reducing problems, are becoming more and more popular among clinicians. The growth in both established and emerging economies is mostly driven by this technological improvement.

• Lutronic Corporation

• Alma Lasers

• Lynton Lasers Ltd.

• Sciton, Inc.

• Cutera

• Altair Instruments

• Quanta Aesthetic Lasers USA

• Syneron Medical Ltd.

The need for aesthetic procedures in the aging population is driving the growth of the laser resurfacing market. In order to address age-related skin problems like wrinkles, fine lines, & uneven skin tone, the aging population is increasingly looking for cosmetic surgeries. By stimulating collagen production and minimizing visible signs of aging, laser resurfacing is an effective treatment. Compared to conventional surgical techniques, the process offers minimally invasive treatment with quicker recovery times. For instance, fractional CO2 lasers are frequently used to improve the overall appearance of skin by treating laxity and texture concerns. Thus, the use of laser resurfacing technology is being driven by the aging population's increasing desire for aesthetic enhancement.

One major barrier to the laser resurfacing market's expansion is the high procedure costs and restricted reimbursement. Skin resurfacing procedures can be costly, and several sessions are frequently needed to achieve the best results. The majority of insurance companies limit reimbursement choices by categorizing these procedures as elective cosmetic treatments. The adoption is hampered by this expense barrier, especially in developing nations or among consumers who are price-conscious. Additionally, the ability of the doctor determines how safe and effective resurfacing procedures are. The adoption is hampered by the lack of skilled aestheticians and dermatologists in some areas. Inappropriate usage of high-energy devices can result in problems like pigmentation changes and scarring. The expenses of certification and training requirements continue to be obstacles to laser resurfacing market expansion.

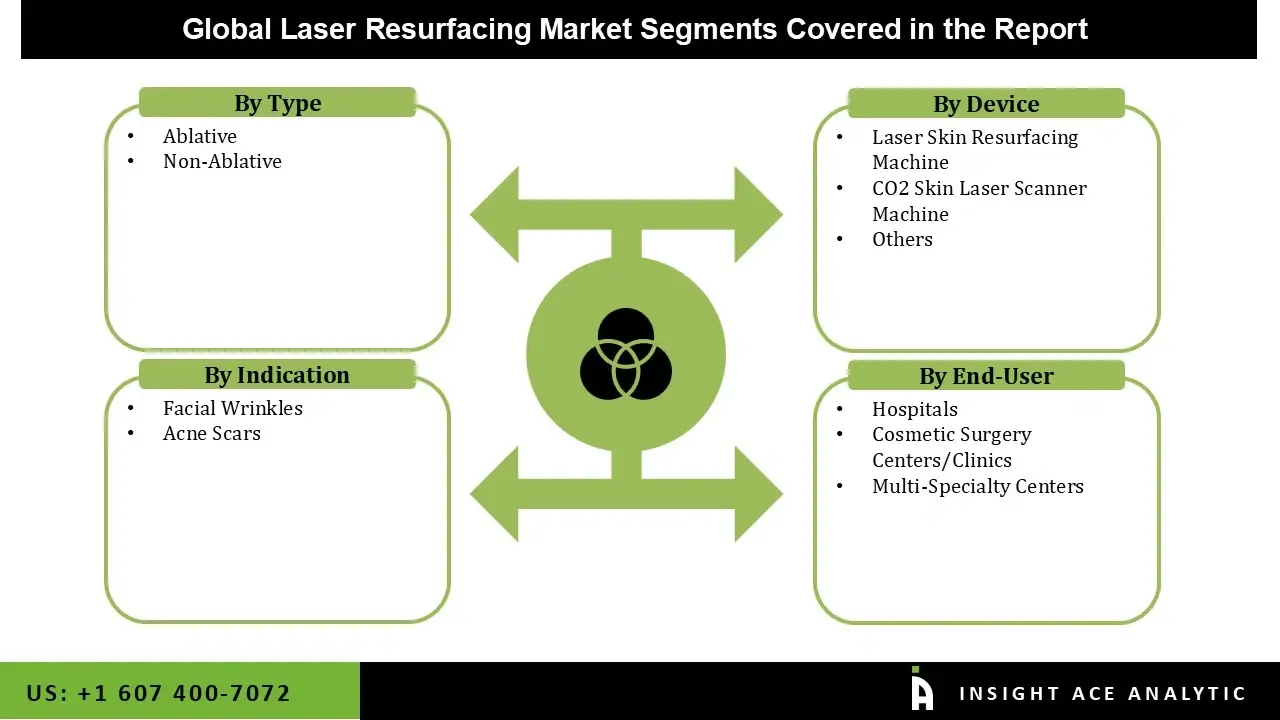

The laser resurfacing market is systematically segmented across four key dimensions. By type, it is divided into ablative and non-ablative lasers, representing the fundamental technological split between more invasive, deeper treatments and gentler, surface-level procedures. The market is further categorized by indication, with primary applications targeting acne scars and facial wrinkles. Segmentation by device includes major equipment categories such as the co2 skin laser scanner machine, general laser skin resurfacing machines, and other specialized systems. Finally, the market is analyzed by end-user, covering hospitals, specialized cosmetic surgery centers/clinics, and multi-specialty centers.

In 2024, the ablative category dominated the Laser Resurfacing market. High-intensity skin resurfacing that eliminates damaged layers to promote collagen regeneration is the main emphasis of the ablative laser segment. The most widely used ablative lasers are carbon dioxide (CO2) and erbium lasers. These lasers are primarily used to treat a variety of skin disorders, including sun damage, warts, scars, deep wrinkles, and fine lines. When compared to other non-invasive methods, these lasers are also comparatively more successful in treating certain skin disorders. The aforementioned elements are thought to play a role in the segment's large market share.

The facial wrinkles category held the largest share in the Laser Resurfacing market in 2024. The growing consumer demand for a young appearance, greater aesthetic awareness, and the aging population in developed and emerging economies are the main drivers of the facial wrinkles category's dominance. The potential of laser and radiofrequency resurfacing techniques to tighten skin, promote collagen, and minimize fine-to-deep wrinkles makes them essential components of anti-aging treatment regimens. Additionally, since non-surgical techniques are less expensive and need less recovery, patients are choosing them over invasive cosmetic operations, including facelifts.

The Laser Resurfacing market was dominated by the North America region in 2024, attributable to a well-established healthcare infrastructure, the existence of major market participants, and the high adoption rate of modern cosmetic procedures. The market for laser resurfacing is dominated by North America, especially in the US and Canada. The market's performance in this area is greatly influenced by the high demand for laser resurfacing aesthetic treatments, sophisticated healthcare infrastructure, and the rising acceptance of non-invasive procedures.

Additionally, the availability of cutting-edge technology and growing awareness of the advantages of laser resurfacing propel the growth of the laser resurfacing market. Furthermore, the market landscape in North America is significantly shaped by the existence of major market players and a strong focus on research and development.

In Jan 2024, Alma Lasers launched the Alma Hybrid platform, integrating fractional CO2 and Erbium: YAG laser technologies in a single system. The platform is designed for tailored resurfacing, allowing practitioners to combine deep ablative and superficial treatments in one session for customized results in addressing scars and wrinkles.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 457.6 Mn |

| Revenue forecast in 2034 | USD 786.3 Mn |

| Growth Rate CAGR | CAGR of 6.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Indication, Device, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Lutronic Corporation, Alma Lasers, Lynton Lasers Ltd., Sciton, Inc., Cutera, Altair Instruments, Quanta Aesthetic Lasers USA, and Syneron Medical Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Laser Resurfacing Market by Type-

• Ablative

• Non-Ablative

Laser Resurfacing Market by Indication-

• Acne Scars

• Facial Wrinkles

Laser Resurfacing Market by Device-

• CO2 Skin Laser Scanner Machine

• Laser Skin Resurfacing Machine

• Others

Laser Resurfacing Market by End-user-

• Hospitals

• Cosmetic Surgery Centers/Clinics

• Multi-Specialty Centers

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Laser Resurfacing Market Snapshot

Chapter 4. Global Laser Resurfacing Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2025-2034

4.8. Global Laser Resurfacing Market Penetration & Growth Prospect Mapping (US$ Mn), 2024-2034

4.9. Competitive Landscape & Market Share Analysis, By Key Player (2024)

4.10. Use/impact of AI on LASER RESURFACING MARKET Industry Trends

Chapter 5. Laser Resurfacing Market Segmentation 1: By Type, Estimates & Trend Analysis

5.1. Market Share by Type, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Type:

5.2.1. Ablative

5.2.2. Non-Ablative

Chapter 6. Laser Resurfacing Market Segmentation 2: By Device, Estimates & Trend Analysis

6.1. Market Share by Device, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Device:

6.2.1. Laser Skin Resurfacing Machine

6.2.2. CO2 Skin Laser Scanner Machine

6.2.3. Others

Chapter 7. Laser Resurfacing Market Segmentation 3: By End-User, Estimates & Trend Analysis

7.1. Market Share by End-User, 2024 & 2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following End-User:

7.2.1. Hospitals

7.2.2. Cosmetic Surgery Centers/Clinics

7.2.3. Multi-Specialty Centers

Chapter 8. Laser Resurfacing Market Segmentation 4: By Indication, Estimates & Trend Analysis

8.1. Market Share by Indication, 2024 & 2034

8.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Indication:

8.2.1. Facial Wrinkles

8.2.2. Acne Scars

Chapter 9. Laser Resurfacing Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. Global Laser Resurfacing Market, Regional Snapshot 2024 & 2034

9.2. North America

9.2.1. North America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.2.1.1. US

9.2.1.2. Canada

9.2.2. North America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

9.2.3. North America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Device, 2021-2034

9.2.4. North America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

9.2.5. North America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Indication, 2021-2034

9.3. Europe

9.3.1. Europe Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.3.1.1. Germany

9.3.1.2. U.K.

9.3.1.3. France

9.3.1.4. Italy

9.3.1.5. Spain

9.3.1.6. Rest of Europe

9.3.2. Europe Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

9.3.3. Europe Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Device, 2021-2034

9.3.4. Europe Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

9.3.5. Europe Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Indication, 2021-2034

9.4. Asia Pacific

9.4.1. Asia Pacific Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.4.1.1. India

9.4.1.2. China

9.4.1.3. Japan

9.4.1.4. Australia

9.4.1.5. South Korea

9.4.1.6. Hong Kong

9.4.1.7. Southeast Asia

9.4.1.8. Rest of Asia Pacific

9.4.2. Asia Pacific Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

9.4.3. Asia Pacific Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Device, 2021-2034

9.4.4. Asia Pacific Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts By End-User, 2021-2034

9.4.5. Asia Pacific Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Indication, 2021-2034

9.5. Latin America

9.5.1. Latin America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.5.1.1. Brazil

9.5.1.2. Mexico

9.5.1.3. Rest of Latin America

9.5.2. Latin America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

9.5.3. Latin America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Device, 2021-2034

9.5.4. Latin America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

9.5.5. Latin America Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Indication, 2021-2034

9.6. Middle East & Africa

9.6.1. Middle East & Africa Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.6.1.1. GCC Countries

9.6.1.2. Israel

9.6.1.3. South Africa

9.6.1.4. Rest of Middle East and Africa

9.6.2. Middle East & Africa Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

9.6.3. Middle East & Africa Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Device, 2021-2034

9.6.4. Middle East & Africa Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

9.6.5. Middle East & Africa Laser Resurfacing Market Revenue (US$ Million) Estimates and Forecasts by Indication, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Alma Lasers

10.2.1.1. Business Overview

10.2.1.2. Key Product/Service

10.2.1.3. Financial Performance

10.2.1.4. Geographical Presence

10.2.1.5. Recent Developments with Business Strategy

10.2.2. Altair Instruments

10.2.3. Lynton Lasers Ltd.

10.2.4. Cutera

10.2.5. Quanta Aesthetic Lasers USA

10.2.6. Lutronic Corporation

10.2.7. Syneron Medical Ltd.

10.2.8. Sciton, Inc.