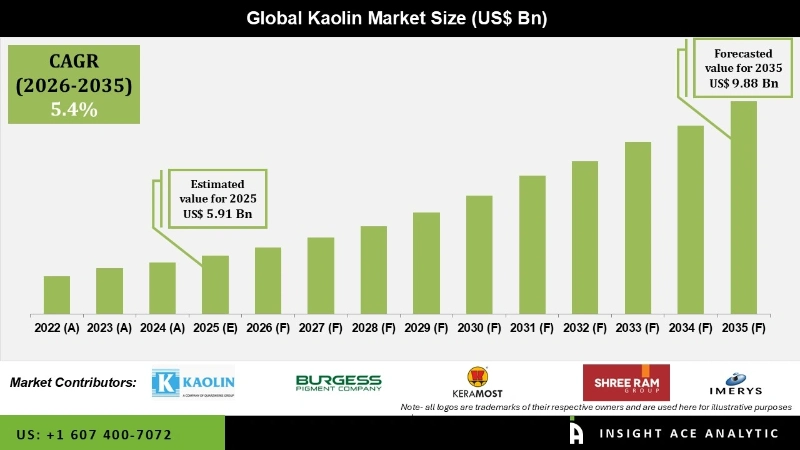

Kaolin Market Size is valued at USD 5.91 Bn in 2025 and is predicted to reach USD 9.88 Bn by the year 2035 at a 5.4% CAGR during the forecast period for 2026 to 2035.

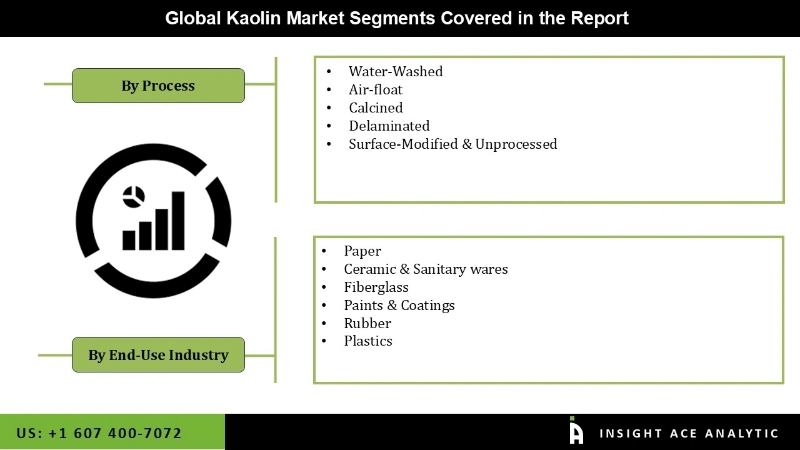

Kaolin Market Size, Share & Trends Analysis Report By Process (Water-Washed, Air-float, Calcined, Delaminated, Surface-Modified & Unprocessed), By End-Use Industry (Paper, Ceramic & Sanitary wares, Fiberglass, Paints & Coatings, Rubber, Plastics), By Region, And By Segment Forecasts, 2026 to 2035.

Kaolin, often known as china clay, is a soft white clay with many industrial applications. The market is likely to be driven by the product's increasing application as a coating and filling agent in the expanding paper sector. Combined with the adhesives, the product gives coated paper opacity, colour, and good printability. This substance is also useful for making porcelain and refractory in the ceramic industry. China clay's great demand in the ceramic industry can be attributed to its lack of alkalis or iron.

In addition, this material's use as a filler in rubber production increases the latter's mechanical strength and abrasion resistance. Furthermore, the material's constant colour, strength, brightness, and grit make it a top choice for use in ceramic and refractory applications. Because of these qualities, there is a greater demand for dinnerware and other ceramic-based products. The rising demand from end-use sectors, including the plastics, cosmetics, and rubber industries, also supports product consumption.

However, The market expansion is hindered by the elevated cost associated with the resurgence of print media, mostly due to the exponential increase in the prevalence of content disseminated through digital and electronic platforms. Many newspaper, magazine, and journal publishers now prioritize online distribution. Because of this, sales of books, magazines, newsletters, and journals in paper format have fallen.

As a result of the lockdown measures taken in reaction to the COVID-19 epidemic, paper use has declined in both industrial and commercial applications. As a result, it is predicted that the rise of digital and electronic media will impact paper consumption in the print media business. These shutdowns have also affected the commercial and industrial use of commodities, including ceramics and fibreglass, paints and varnishes, rubber, and plastics.

The kaolin market is segmented based on process and end-user industry. Based on process, the market is segmented into water-washed, air-float, calcined, delaminated, and surface-modified & unprocessed. The end-user industry segments the market into paper, ceramic & sanitary wares, fibreglass, paints & coatings, rubber, and plastics.

The paper kaolin market is expected to hold a major global market share in 2022. Fluoropolymers are in high demand because there is such a great need for paper in industries like packaging and printing. Demand is being boosted even further by the expansion of international e-commerce. This additive improves the performance and printability of the piece by increasing its brightness, opacity, and strength. These advantages have led to widespread adoption, which has propelled the market forward.

The calcined segment is projected to grow rapidly in the global kaolin market. With the rising trend to boosting the durability of concrete, calcining clay makes it easier to work with and less porous. Both the flexural and compressive strengths benefit from its high reinforcing qualities, especially in countries like the US, Germany, the UK, China, and India.

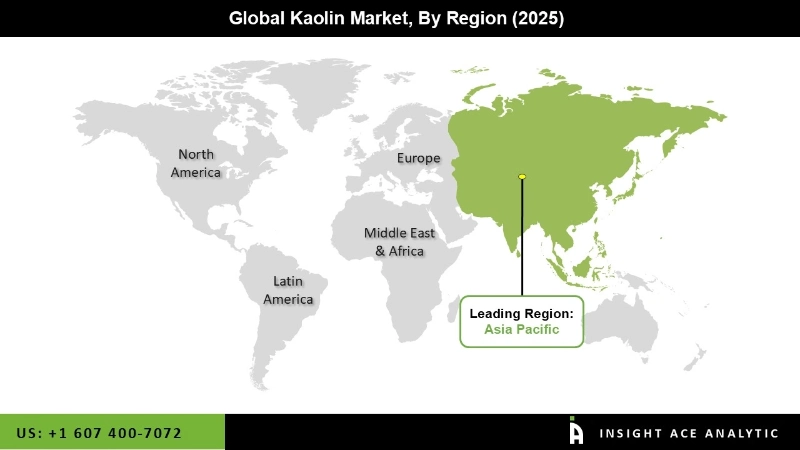

The Asia Pacific kaolin market is expected to record the maximum market share in revenue in the near future. It can be attributed to the increasing wealth and technical development in the area. The regional market is being bolstered by the rising demand for paper from the packaging and printing industries. This, together with growing commercial actions like regional exports, fuels demand. In addition, Europe is estimated to grow rapidly in the global kaolin market because increasing demand from industries including ceramics, refractories, cement, and paper has led to an increase in overall product consumption.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.91 Bn |

| Revenue Forecast In 2035 | USD 9.88 Bn |

| Growth Rate CAGR | CAGR of 5.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Process, By End-Use Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Imerys S.A. (France), Ashapura Group (India), EICL Limited (India), SCR-Sibelco N.V. (Belgium), KaMin LLC (US), Thiele Kaolin Company (US), LASSELSBERGER Group (Hungary), Quarzwerke GmbH (Germany), Sedlecký kaolin a. s. (Czech Republic), I-Minerals lnc. (Canada), 20 Microns Limited (India), Andromeda Metals Limited (Australia), W. R. Grace & Co. (US), Shree Ram Group (India), KERAMOST, a.s. (Czech Republic), Uma Group of Kaolin (India), Jiangxi Sincere Mineral Industry Co., Ltd. (China), and Active Minerals International, LLC (US) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

The Kaolin Market By Process-

The Kaolin Market By End-Use Industry-

The Kaolin Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.