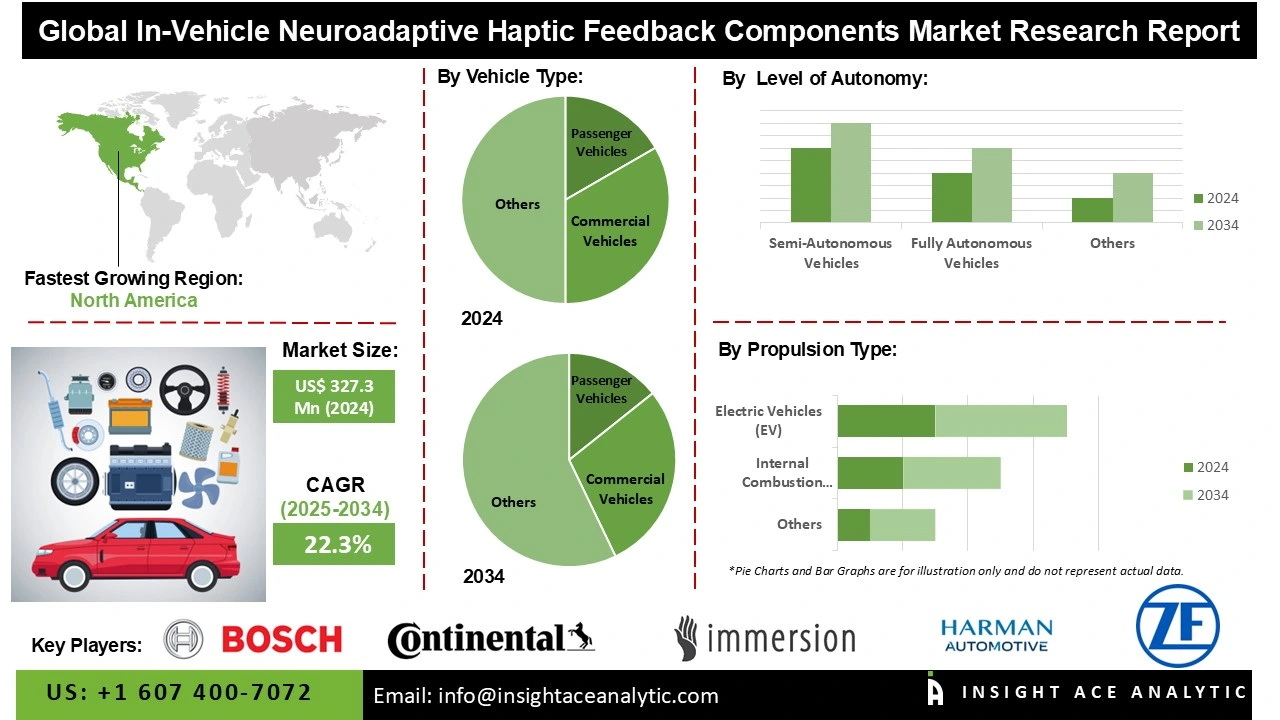

In-vehicle Neuroadaptive Haptic Feedback Components Market Size is valued at US$ 327.3 Mn in 2024 and is predicted to reach US$ 2,339.8 Mn by the year 2034 at an 22.3% CAGR during the forecast period for 2025-2034.

In-vehicle neuroadaptive haptic feedback is a sophisticated car system that adapts tactile (touch-based) alerts, such as seat or steering wheel vibrations, to the driver's mental state (e.g., fatigue, tension, distraction).

It functions by utilizing sensors (such as EEG, heart rate monitors, or eye scanners) to ascertain the driver's emotional state, and subsequently using this information to adjust the haptic feedback in real time. The global market for in-vehicle neuroadaptive haptic feedback systems is expanding significantly due to the advancements in infotainment and human-machine interface (HMI) systems.

In addition, the technological advancements in haptic feedback systems, strategic alliances between suppliers and OEMs, and government regulations supporting autonomous vehicles in industrialized nations are some of the major factors driving this expansion. However, obstacles include growing costs for raw materials, the difficulty of adjusting technology for electric vehicles, and weaknesses in the supply chain, which could hinder market expansion. On the other hand, the market offers substantial chances for participants to profit from the rising need for effective, long-lasting, and cutting-edge technology in the developing automotive sector.

Some of the Key Players in the In-vehicle Neuroadaptive Haptic Feedback Components Market:

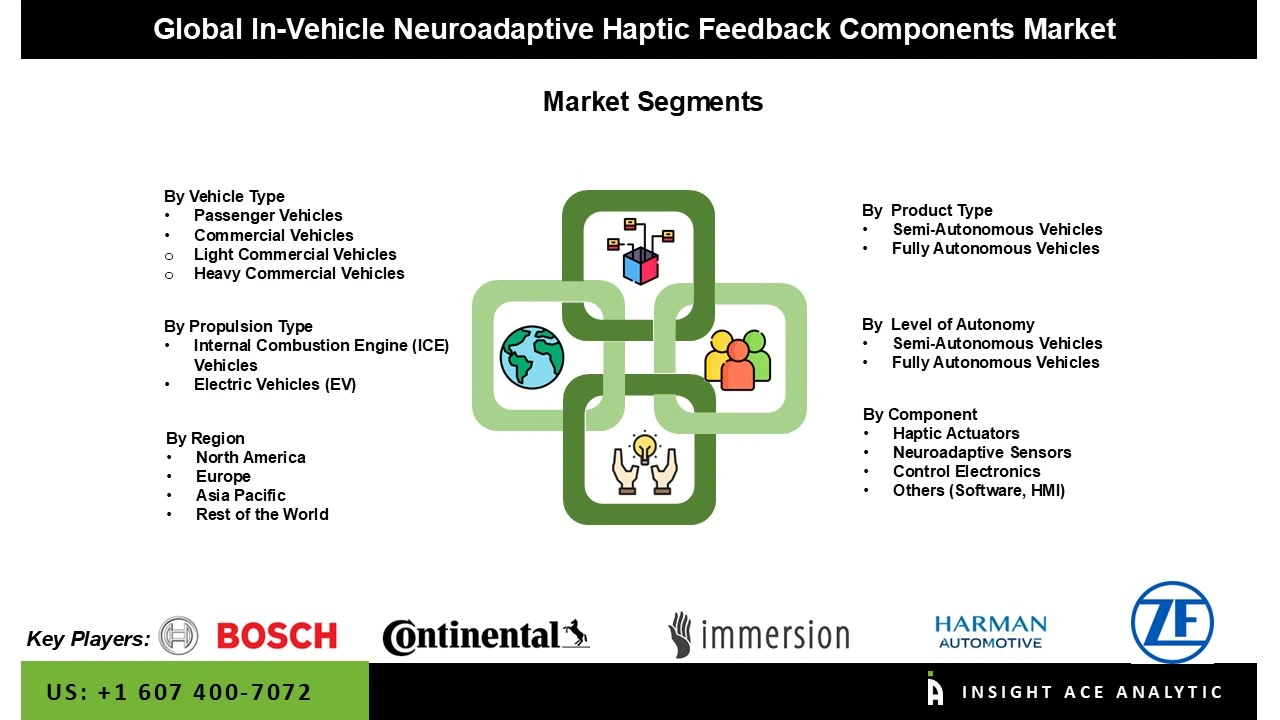

The In-vehicle neuroadaptive haptic feedback components market is segmented by product type, component, vehicle type, propulsion type, and level of autonomy. By product type, the market is segmented into steering wheel feedback system, touchscreen haptics, and others [seat-based modules, pedal/gear feedback]. By component, the market is segmented into neuroadaptive sensors, haptic actuators, control electronics, and others [software, hmi]. Whereas, as per the vehicle type, the market is segmented into passenger vehicles as well as commercial vehicles [light commercial vehicles (LCV), heavy commercial vehicles (hcv)]. The propulsion type segment is divided into internal combustion engine (ICE) vehicles and electric vehicles (EV). By level of autonomy, the market is segmented into semi-autonomous vehicles and fully autonomous vehicles.

The growing need for improved user experience and safety in automobile interfaces is propelling the remarkable expansion of the touchscreen haptics category in the market for in-vehicle neuroadaptive haptic feedback components. Capacitive and resistive touchscreens are replacing conventional mechanical buttons as cars incorporate increasingly sophisticated infotainment systems and digital control panels. Manufacturers are using haptic technologies, which mimic the feel of pressing real buttons, to preserve tactile feedback and reduce driver distraction. By adjusting the frequency and strength of feedback in response to driver behaviour, attention levels, and cognitive load, neuroadaptive haptics further maximizes this engagement.

The passenger vehicles segment was the primary driver of the in-vehicle neuroadaptive haptic feedback systems market growth in 2024. Government financing and increasing motorization are expediting the advancement of mobility solutions. For long-term market expansion, the rate of new product development is being accelerated by financial and legislative circumstances. Throughout the projected period, the demand for passenger vehicles is being driven by energy-efficient technology and the strategic emphasis placed by governments worldwide on plug-in hybrid electric vehicles and pure EVs.

The market for in-vehicle neuroadaptive haptic feedback components is expanding rapidly in Asia Pacific, mostly due to due to growing customer demand for connected and smart car technologies and rising automobile production. The growing middle class and urbanization are fueling the need for improved in-vehicle safety features and user experiences. Furthermore, the region's development and uptake of neuroadaptive haptic feedback components are being accelerated by the presence of significant electronics and component manufacturers, as well as government programs supporting smart mobility and autonomous driving technologies.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 327.3 Mn |

| Revenue Forecast In 2034 | USD 2,339.8 Mn |

| Growth Rate CAGR | CAGR of 22.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Component, By Vehicle Type, By Propulsion Type, By Level of Autonomy, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Robert Bosch GmbH, Continental AG, Immersion Corporation, Harman Automotive, ZF Friedrichshafen, Ultraleap, ALPS ALPINE CO., LTD., Panasonic Automotive Systems Europe GmbH, Hyundai Mobis, TDK Corporation, Texas Instruments Incorporated, Microchip Technology Inc., Autoliv, Valeo, and FORVIA |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

In-vehicle Neuroadaptive Haptic Feedback Components Market by Product Type-

· Steering Wheel Feedback System

· Touchscreen Haptics

· Others

o Seat-based Modules

o Pedal/Gear Feedback

In-vehicle Neuroadaptive Haptic Feedback Components Market by Component -

· Neuroadaptive Sensors

· Haptic Actuators

· Control Electronics

· Others

o Software

o HMI

In-vehicle Neuroadaptive Haptic Feedback Components Market by Vehicle Type-

· Passenger Vehicles

· Commercial Vehicles

o Light Commercial Vehicles (LCV)

o Heavy Commercial Vehicles (HCV)

In-vehicle Neuroadaptive Haptic Feedback Components Market by Propulsion Type-

· Electric Vehicles (EV)

· Internal Combustion Engine (ICE) Vehicles

In-vehicle Neuroadaptive Haptic Feedback Components Market by Level of Autonomy-

· Semi-Autonomous Vehicles

· Fully Autonomous Vehicles

In-vehicle Neuroadaptive Haptic Feedback Components Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.