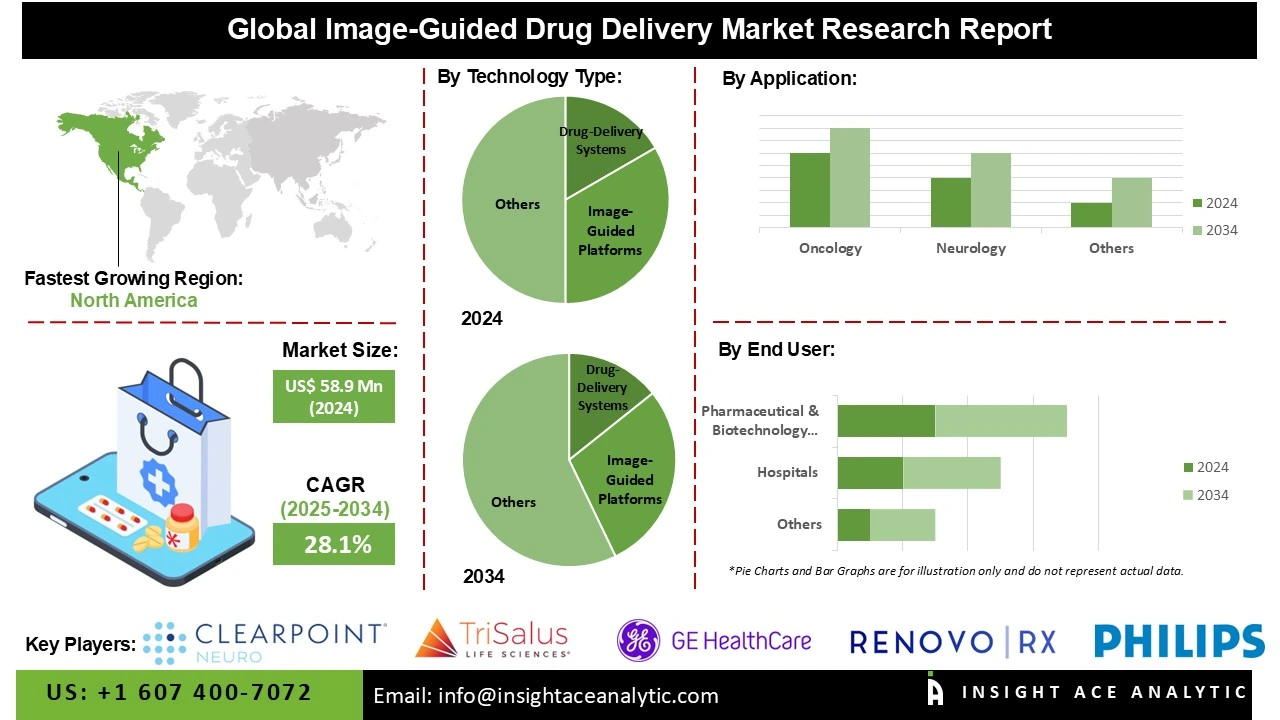

Image-Guided Drug Delivery Market Size is valued at US$ 58.9 Mn in 2024 and is predicted to reach US$ 687.4 Mn by the year 2034 at an 28.1% CAGR during the forecast period for 2025-2034.

Image-guided drug delivery (IGDD) is a novel clinical approach that maximises therapeutic efficacy, safety, and accuracy by integrating targeted drug delivery with imaging modalities. Imaging techniques, such as computed tomography (CT), positron emission tomography (PET), magnetic resonance imaging (MRI), or ultrasound, are employed to observe in real-time inside organs and tissues.

This reduces exposure to normal tissues while allowing physicians to control and guide the administration of therapeutic agents directly to the site of disease, such as a tumour or infected organ. The image-guided drug delivery market is experiencing rapid growth, driven by advancements in medical technology and an increasing demand for precision medicine.

The rising incidence of cancer and neurological conditions is another important factor for the growth of the image-guided drug delivery market. The World Health Organization (WHO) reports that neurological disorders are quickly emerging as a significant public health concern, and cancer is the second greatest cause of death worldwide.

For both of these disorders, targeted therapy is made possible by image-guided drug delivery, which holds great promise for enhancing patient outcomes. Furthermore, advancements in MRI, CT, and PET technologies have enhanced the effectiveness and reliability of this drug administration approach. Additionally, as the population ages and more people suffer from lifestyle-related ailments, there is a greater need for advanced diagnostic and treatment methods. As a result, image-guided drug delivery is being used more often in medical facilities.

Some of the Key Players in Image-Guided Drug Delivery Market:

· ClearPoint Neuro, Inc.

· AiM Medical Robotics

· TriSalus Life Sciences

· RenovoRx Inc.

· Renishaw plc.

· Occam Design

· Infuseon Therapeutics Inc

· Neurochase

· GE HealthCare

· Koninklijke Philips N.V.

The image-guided drug delivery market is segmented by technology type, application, and end-use. By technology type, the market is segmented into drug-delivery systems and image-guided platforms. By application, the market is segmented into oncology, neurology, and others. By end-use, the market is segmented into hospitals, pharmaceutical & biotechnology companies, research institutes & universities, and contract research organizations (CROS).

In 2024, the image-guided drug delivery market was dominated by the oncology segment. The global increase in cancer diagnoses is driving the desire for precise, minimally invasive treatment modalities. The WHO estimates that the number of new cancer cases will rise by 60% annually over the next 20 years, reaching an estimated 29.5 million new cases by 2040. Ablative and targeted radiation therapy are made possible by image-guided drug delivery, which preserves healthy tissue. Furthermore, intra-procedure tumor imaging has been enhanced by the development of new real-time imaging equipment, particularly the combination of MRI, CT, and PET with real-time fluoroscopy or ultrasound.

The hospitals category led the global image-guided drug delivery market in 2024. With their hybrid operating rooms, cutting-edge imaging technologies, and dedicated neurosurgery and oncology teams, hospitals remain the primary locations for the introduction of image-guided drug delivery. Their dominance is supported by their capacity to perform intricate, high-volume procedures, such as liver-directed cancer therapy and intracranial infusions. As additional next-generation medications become available for clinical use, acceptance is anticipated to increase. Additionally, hospitals gain from multidisciplinary expertise and robust reimbursement policies. These benefits, combined with an emphasis on minimally invasive techniques, guarantee that hospitals will continue to be the world's leading users of image-guided drug delivery systems.

In 2024, the North American region led the image-guided drug delivery (IGDD) market due to significant investments in precision medicine, advanced healthcare infrastructure, and technological advancements. The region is advantageous due to the presence of prominent pharmaceutical companies, imaging technology firms, and research centres that are engaged in developing integrated drug-delivery systems. The demand for minimally invasive and image-guided treatment has risen because of the high incidence of chronic illnesses such as cancer, neurological disorders, and cardiovascular disease.

In addition, the image-guided drug delivery market is expected to increase significantly in the Asia-Pacific region due to the ageing population. Furthermore, it is projected that the region's image-guided therapy market will expand in the coming years due to the rising incidence of target diseases and the improvement of healthcare infrastructure. Additionally, during the forecast period, the region's image-guided drug delivery market is expected to grow at a faster rate due to the rapid acceptance of advanced radiation therapies and technological advancements.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 58.9 Mn |

| Revenue Forecast In 2034 | USD 687.4 Mn |

| Growth Rate CAGR | CAGR of 28.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Technology Type, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | ClearPoint Neuro, Inc., AiM Medical Robotics, TriSalus Life Sciences, RenovoRx Inc., Renishaw plc., Occam Design, Infuseon Therapeutics Inc, Neurochase, GE HealthCare, and Koninklijke Philips N.V. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Image-Guided Drug Delivery Market by Technology Type-

· Drug-Delivery Systems

· Image-Guided Platforms

Image-Guided Drug Delivery Market by Application-

· Oncology

· Neurology

· Others

Image-Guided Drug Delivery Market by End-use-

· Hospitals

· Pharmaceutical & Biotechnology Companies

· Research Institutes & Universities

· Contract Research Organizations (CROs)

Image-Guided Drug Delivery Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.