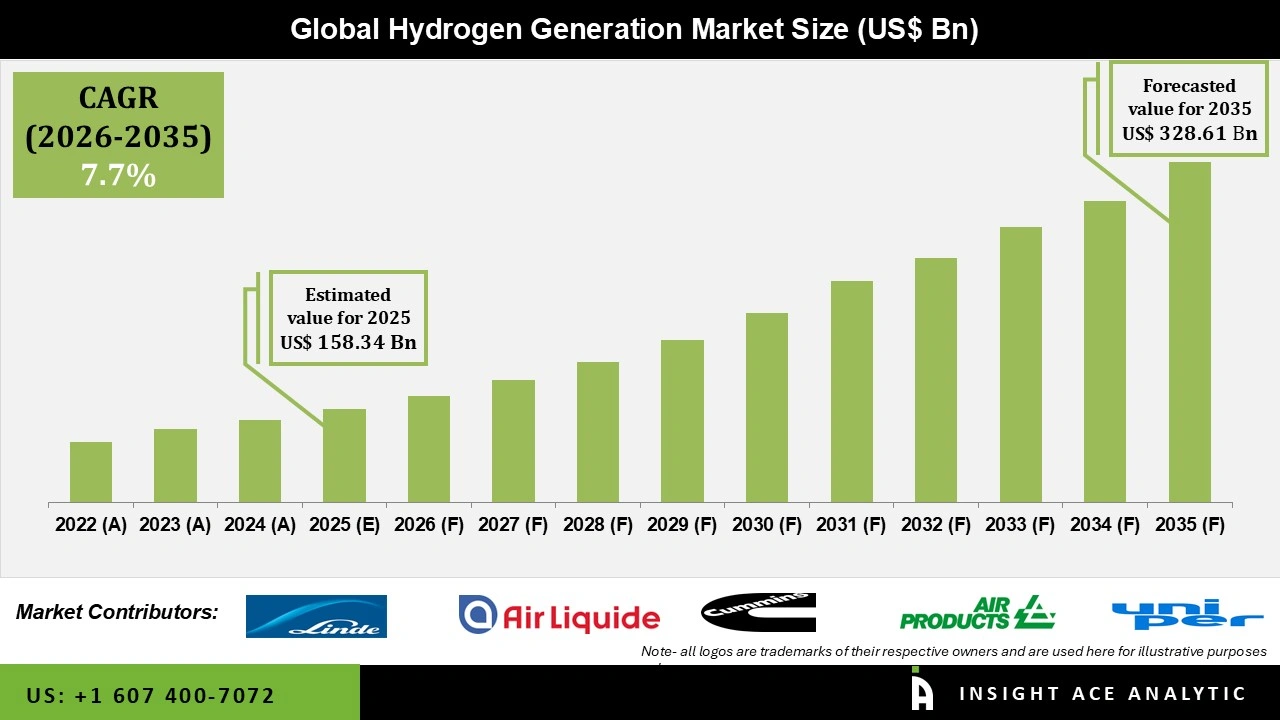

Global Hydrogen Generation Market Size is valued at USD 158.34 Billion in 2025 and is predicted to reach USD 328.61 Billion by the year 2035 at a 7.7% CAGR during the forecast period for 2026 to 2035.

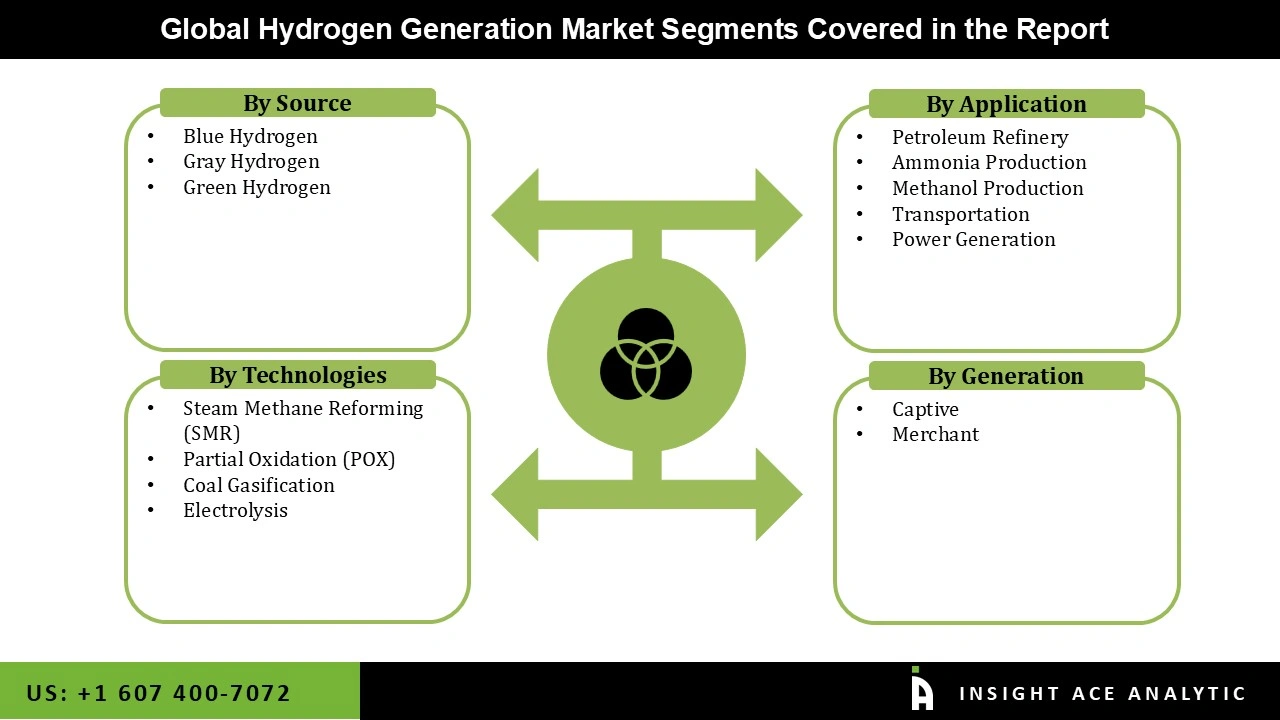

Hydrogen Generation Market Size, Share & Trends Analysis Report By Technology (SMR, POX, Coal Gasification, Electrolysis), Application (Refinery, Ammonia Production, Methanol Production, Transportation, Power Generation), Source (Blue, Green, Gray), Generation Mode, By Region, And Segment Forecasts, 2026 to 2035.

The need for cleaner fuel and the expansion of regulatory rules requiring the desulfurization of petroleum products is projected to be the global hydrogen generation market's primary drivers. Since hydrogen is a powerful energy transporter, its continued expansion into additional markets is anticipated to benefit significantly from this property.

Throughout the projected period, an increase in the worldwide electricity consumption of about two-thirds of the current demand is anticipated. Pay attention to the distributed power & utility projects that are anticipated to boost the need for the expansion of the hydrogen generation industry throughout the forecast period.

In order to create a nationwide hydrogen network and improve the hydrogen infrastructure for hydrogen filling stations, the German Ministry of Transport launched an effort in June 2012. The Ministry marked a letter of intent (LoI) with industry participants like Total, The Linde Group, Air Products and Chemicals, Inc., Daimler AG, and Air Liquide as part of this project. According to the agreement, these industry participants will build at least 50 hydrogen refueling stations in Germany's major towns and highways by 2015.

The Hydrogen Generation market is segmented on the basis of source, technology, application, and generation. Based on source, the market is segmented as blue, grey, and green hydrogen. The technologies segment includes SMR, POX, coal gasification, and electrolysis. By application, the market is segmented into petroleum refinery, ammonia production, methanol production, transportation, and power generation. The generation segment includes captive, and merchant.

Throughout the forecast period, the ammonia production segment will continue to be in the lead. Ammonia's potential as a carbon-free fuel, hydrogen carrier, and energy reservoir gives a chance to expand renewable hydrogen technology. With ammonia facilities, hydrogen is often produced on-site from a feedstock of fossil fuels. Natural gas is the most broadly used feedstock for steam methane reforming (SMR) plants. Ammonia can also be made from coal using a partial oxidation (POX) method.

Using a bulk tank, pipeline, or cylinder truck to transport and sell hydrogen to a customer is referred to as merchant generation of hydrogen. Substantial natural gas pipeline networks might be utilized to transport and distribute hydrogen in several nations, including the U.S., Canada, and Russia. Throughout the forecast period, the merchant-generating category is anticipated to maintain its lead.

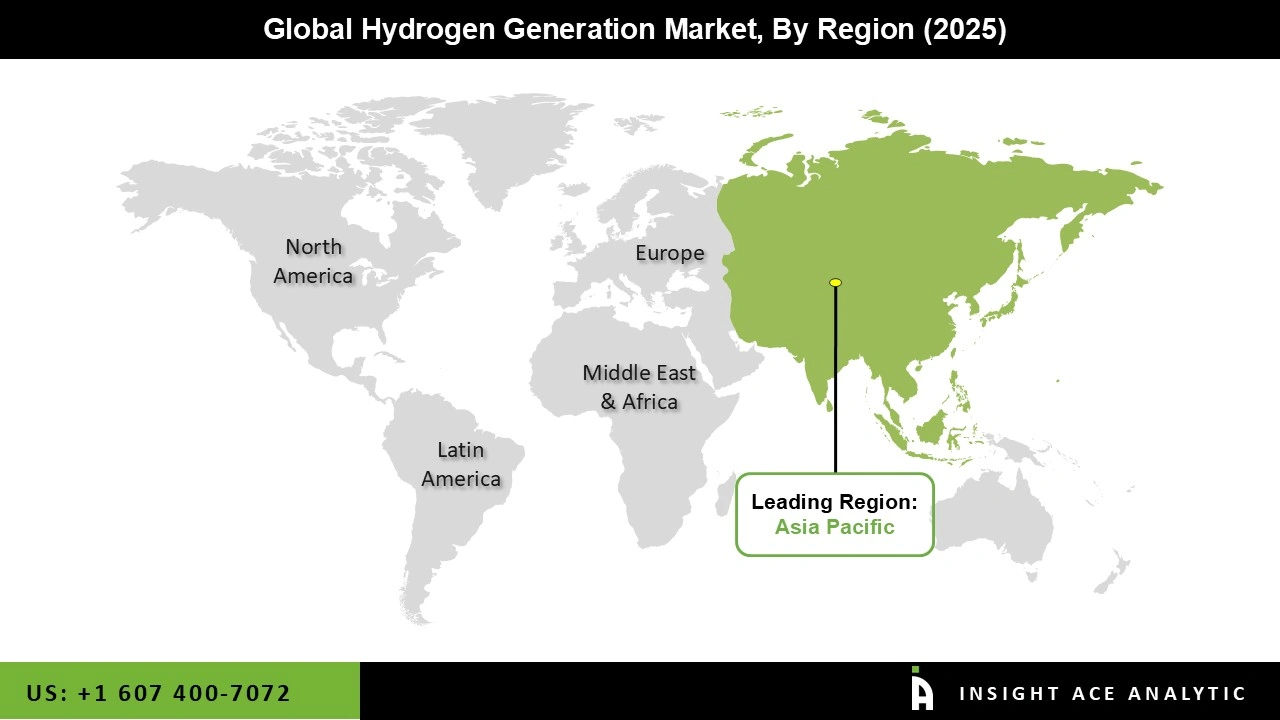

The Asia-Pacific region controlled the entire global market. China was the largest country in the Asia-Pacific region in terms of revenue in 2021. In the Asia-Pacific area, the usage of hydrogen production has expanded due to the presence of more refineries in major nations such as China and India. Certain Asia-Pacific countries, such as Australia and Japan, are also studying greener, cleaner ways of hydrogen production.

Hydrogen producers in the region intend to expand their geographic reach and concentrate on emerging nations such as South Africa, Vietnam, and Indonesia in order to improve their income. As part of their expansion objectives, U.S.-based major companies such as Praxair Inc. and Air Liquide intend to expand their operations in nations with a growing demand for hydrogen.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 158.34 Billion |

| Revenue forecast in 2035 | USD 328.61 Billion |

| Growth rate CAGR | CAGR of 7.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (Tons), and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Source, Technology, Application, And Generation. |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Linde plc, Air Liquide, Cummins Inc., Air Products Inc., Uniper SE, Engie, Siemens, Nel ASA, ITM Power, Iberdola, McPhy Energy S.A., Messer, Enapter S.r.l., Orsted A/S, Xebec Adsorption Inc., Grren Hydrogen, Plug Power Inc., Atawey, Hiringa Energy Limited. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.