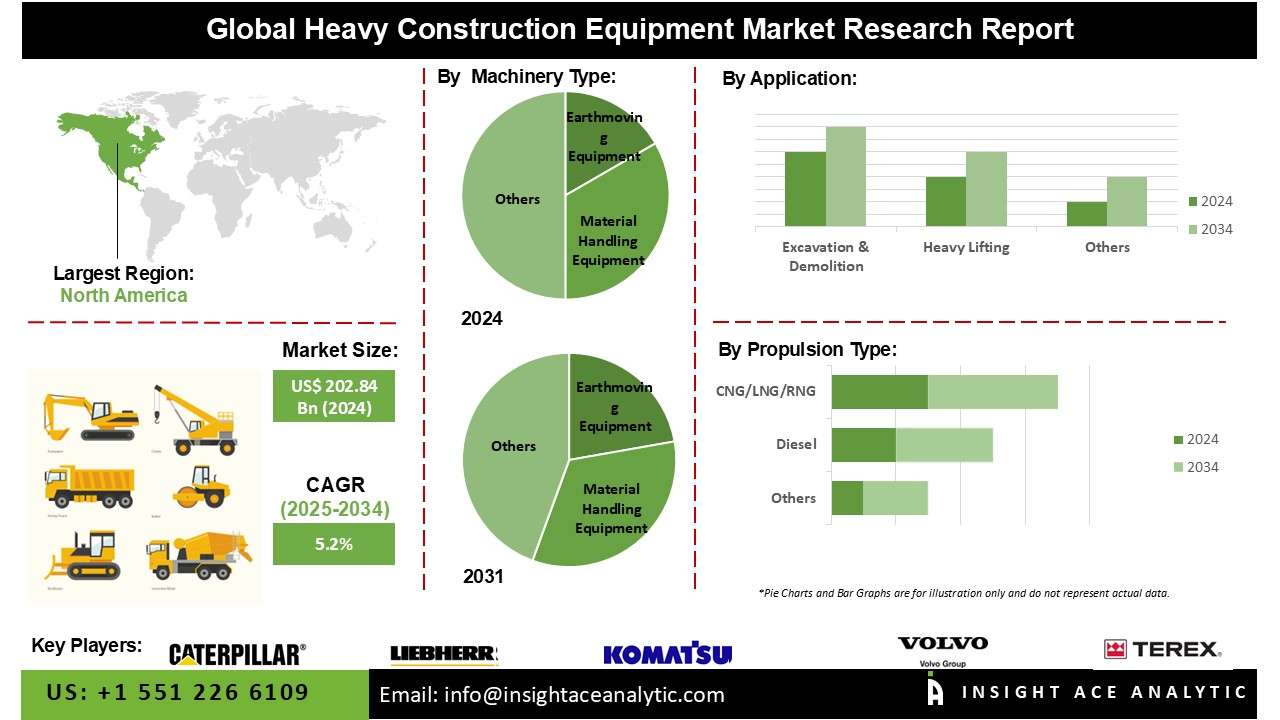

Global Heavy Construction Equipment Market Size is valued at USD 202.84 Bn in 2024 and is predicted to reach USD 333.52 Bn by the year 2034 at a 5.2% CAGR during the forecast period for 2025-2034.

Heavy construction equipment refers to a variety of robust machines specifically intended for a wide range of operations in construction and earthmoving. Some examples of heavy machinery used in construction are excavators for digging, bulldozers for grading, loaders for transporting materials, backhoes for both digging and loading, cranes for lifting, dump trucks for material transport, graders for levelling, compactors for compressing soil, pavers for laying surfaces, drilling rigs for creating holes, and concrete mixers for mixing cement. This equipment is crucial for optimizing and specialized construction processes.

The increasing need for new homes is mostly attributable to rapid urbanization, industrialization, and population growth, which has, in turn, increased the allure of the heavy construction equipment industry. Infrastructure initiatives, including smart city development, rail and road construction, bridge construction, and other mining undertakings, are also driving the expansion of the heavy construction equipment market. The reason for this is that the success of such endeavours depends on both cost-effectiveness and high-quality construction.

The most productive use of labour and materials is ensured when a backhoe excavator or comparable heavy machinery is employed. Market growth is also supported by the ongoing need to refurbish or replace outdated infrastructure. Furthermore, the electrification of construction equipment creates new possibilities and openings in the industry. Vehicles, public transportation, and even heavy machinery are all seeing a rise in the prevalence of electric models. The maturation and decreasing cost of cutting-edge technology and stricter emission regulations have made this possible in the construction equipment business.

However, the market growth is hampered by the high-cost criteria for the safety and health of heavy construction equipment and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity. The high cost of capital is a major obstacle for the heavy construction equipment market. Providers of rich construction equipment services must make large financial investments in the equipment's acquisition and upkeep. A healthy equilibrium must be kept between the need for such industries to purchase certain pieces of equipment and their ability to turn a profit or secure finance. The high barrier to entry posed by these massive investments limits the market's potential for volume demand for the equipment, which limits the opportunity for price reductions due to economies of scale. Due to the COVID-19 outbreak, governments have adopted lockdown measures, delaying the production and manufacturing of heavy equipment used in infrastructure, construction, oil & gas, and other end-user industries.

The heavy construction equipment market is divided based on machinery type, propulsion types, engine capacity, power output, application and end-use industry. The machinery Type segment comprises Earthmoving equipment, (Excavators (Crawler Excavators, Mini Excavators, Wheeled Excavators), Loaders (Wheeled Loaders, Skid-Steer Loaders), Dozers, Motor Graders, Others), Material handling equipment (Cranes, Telescopic Handlers, Others (Conveyors, Forklifts)), Heavy construction vehicles, Others (Compactors & Road Rollers, Pavers/Asphalt Finishers, Drilling/Boring Machines). Secondly, By Propulsion Type, the market is divided into Diesel, CNG/LNG/RNG and Electric. According to Engine Capacity, the market is segmented as <5L, 5-10 L, and >10 L. The Power Output segment includes 400 HP. The Application segment comprises Material Handling, Transportation, Excavation & Demolition, Heavy Lifting, Tunneling, Recycling & Waste Management. By End-Use Industry, the market is segmented into Mining, Infrastructure, Building & Construction, Forestry & Agriculture, and Others.

The material handling equipment heavy construction equipment market is expected to lead with a major global market share in 2024. The requirement for material-handling equipment has grown in recent years due to the rising construction of high-rise buildings. Dozers, cranes, telescopic handlers, and forklifts are all used to construct tall buildings.

The electric segment is projected to grow rapidly in the global heavy construction equipment market. The largest market for electric heavy construction equipment during the forecast period because of the rise in the number of large-scale construction projects. Increased electrification and the presence of numerous industry leaders in the equipment manufacturing sector, especially in countries like the US, Germany, the U.K., China, and India.

Construction machinery equipped with engines ranging from 5 to 10 liters in size is typically utilized for tasks such as ground leveling in construction projects, building roads, railways, dams, and urban infrastructure. The surge in investment in commercial developments is a significant driver for the increasing demand for engines with a capacity ranging from 5 to 10 liters.

The Asia Pacific heavy construction equipment market is expected to record the maximum market share in revenue in the near future. It can be attributed to the growing awareness of reducing carbon emissions. The market in the region is expected to grow rapidly because of the high concentration of prosperous businesses in the area and their willingness to adopt innovative technologies. In addition, North America is estimated to grow rapidly in the global heavy construction equipment market because of the brisk economic growth experienced by many countries in the area.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 202.84 Bn |

| Revenue Forecast In 2034 | USD 333.52 Bn |

| Growth Rate CAGR | CAGR of 5.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Units) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Machinery Type, By Propulsion Type, By Engine Capacity, By Power Output, By Application, By End-Use Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Deere & Company, Hitachi Construction Machinery Co., Ltd., Liebherr-International AG, SANY Heavy Industry Co., Ltd., XCMG Group, HD Hyundai Construction Equipment, J C Bamford Excavators Ltd (JCB), CNH Industrial N.V., Doosan Infracore (now part of HD Hyundai Group), Zoomlion Heavy Industry Science & Technology Co., Ltd., Terex Corporation, Wirtgen Group (a John Deere company), Kobelco Construction Machinery Co., Ltd., Sumitomo Heavy Industries, Ltd., Manitou Group, Wacker Neuson SE, Escorts Kubota Limited, Hidromek A.S., Hiab (part of Cargotec Corporation) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Heavy Construction Equipment Market By Machinery Type

Heavy Construction Equipment Market By Propulsion Type

Heavy Construction Equipment Market By Engine Capacity

Heavy Construction Equipment Market By Power Output

Heavy Construction Equipment Market By Application

Heavy Construction Equipment Market By End-Use Industry

Heavy Construction Equipment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.