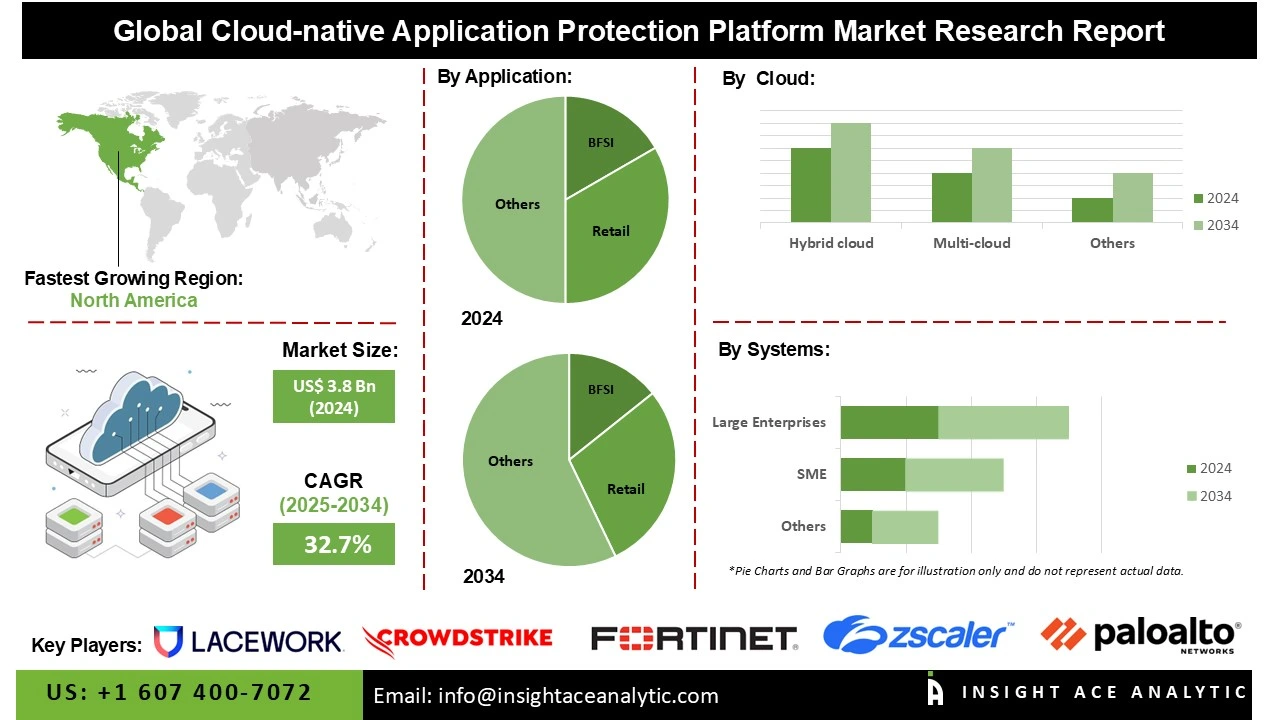

Cloud-Native Application Protection Platform Market Size is valued at US$ 3.8 Bn in 2024 and is predicted to reach US$ 61.6 Bn by the year 2034 at an 32.7% CAGR during the forecast period for 2025-2034.

Cloud-native application protection platforms (CNAPPs) offer comprehensive security for cloud-native environments, encompassing compliance management, workload protection, and runtime protection. These systems are designed to protect apps developed with cloud-native technologies, ensuring they are safe from a variety of online threats.

The shift to microservices and containerization, which has made application security more challenging and rendered conventional security methods inadequate, is a major factor driving the market for cloud-native application protection platforms over the forecast period.

Furthermore, the enormous need for cloud-native application protection platforms across various industries, including e-commerce, telecommunications, BFSI, IT & ITES, and healthcare, is driving the growth of the global cloud-native application protection platform (CNAPP) market throughout the forecast period.

Additionally, the cloud-native application protection platform (CNAPP) industry has expanded globally due to the increased acceptance of the BYOD idea and cloud-based technologies. However, the lack of qualified workers may hinder the expansion of the global market for cloud-native application protection platforms (CNAPPs). Nonetheless, the widespread adoption of cloud-native application protection platforms (CNAPPs) across various industries will create new opportunities for the global industry to expand.

Some of the Key Players in Cloud-Native Application Protection Platform Market:

· LaceWorks

· Palo Alto Networks

· Checkpoint Security

· Fortinet

· Zscaler

· CrowdStrike

· Tenable

· Orca Security

· Microsoft (Microsoft Defender for Cloud)

· Qualys

· Wiz

· Trend Micro

· Others

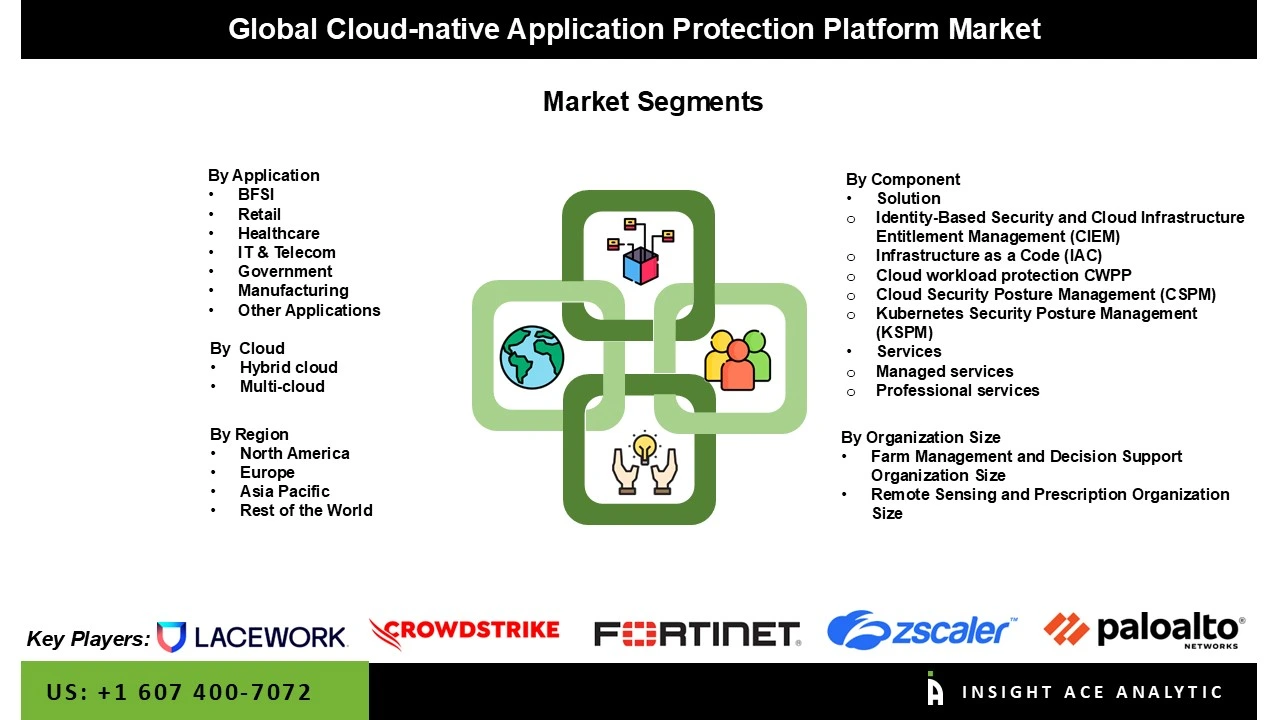

The cloud-native application protection platform market is segmented by component, organization size, cloud, and application. By component, the market is segmented into solution [cloud workload protection (CWPP), identity-based security and cloud infrastructure entitlement management (CIEM), cloud security posture management (CSPM), infrastructure as a code (IAC), kubernetes security posture management (KSPM)] and services [professional services, managed services].

By organization size, the market is segmented into SME and large enterprises. By cloud, the market is segmented into hybrid cloud and multi-cloud. By Application, the market is segmented into BFSI, healthcare, IT & telecom, manufacturing, retail, government, and others.

The solutions segment held the greatest market share in 2024. Through the integration of global threat databases and the utilisation of collective intelligence from multiple sources, cloud-native application protection platforms (CNAPPs) are enhancing their threat intelligence capabilities. To foresee possible attack pathways, comprehend new dangers, and implement defence plans, these platforms are developing sophisticated predictive security models. Context-aware security solutions that correlate threat data across domains are the major focus, leading to more sophisticated and astute risk assessments.

The cloud-native application protection platforms market's largest category is hybrid cloud, as companies progressively shift to on-premises and multi-cloud systems to strike a balance between scalability, control, and compliance. Security silos are reduced in hybrid environments by CNAPP, which provides visibility, threat detection, and policy enforcement across all types of infrastructure within enterprises.

One example of a hybrid cloud application is Microsoft Defender for Cloud, which provides end-to-end security control across Azure, AWS, and on-premises workloads. The dominance of the category demonstrates the confidence organisations have in hybrid cloud security when shielded by comprehensive CNAPP solutions that offer automated response capabilities, real-time threat detection, and ongoing compliance monitoring.

In 2024, North America region held the largest share in the cloud-native application protection platforms market. In terms of infrastructure and security technology use, it is among the most developed regions.

Cloud technology usage and digitization have increased significantly in the region. The amount of money spent by IT on system infrastructure is gradually moving from conventional to cloud-based solutions. Organisations are rapidly adopting cloud services to replace outdated systems or launch new projects. The market expansion in North America is fueled in part by the regional presence of major industry players providing CNAPP. The region's CNAPP market is expanding due to the increasing number of cyberattacks occurring there.

During the projection period, the market for cloud-native application protection platforms in Europe is expected to expand at a substantial rate. Stringent data protection laws and a strong emphasis on privacy drive the demand for cloud-native application protection platforms in the European Union.

The introduction of the GDPR has been a significant motivator for businesses to adopt thorough security protocols for cloud applications. High regulatory compliance standards, an established cloud adoption landscape, and a proactive cybersecurity strategy are essential components. Furthermore, the region's need for CNAPP is being fueled by the growing adoption of cloud services in critical industries such as banking, healthcare, and government, as well as the expansion of remote working and digital transformation initiatives.

Cloud-Native Application Protection Platform Market by Component-

· Solution

o Cloud workload protection (CWPP)

o Identity-Based Security and Cloud Infrastructure Entitlement Management (CIEM)

o Cloud Security Posture Management (CSPM)

o Infrastructure as a Code (IAC)

o Kubernetes Security Posture Management (KSPM)

· Services

o Professional services

o Managed services

Cloud-Native Application Protection Platform Market by Organization Size -

· SME

· Large Enterprises

Cloud-Native Application Protection Platform Market by Cloud-

· Hybrid cloud

· Multi-cloud

Cloud-Native Application Protection Platform Market by Application-

· BFSI

· Healthcare

· IT & Telecom

· Manufacturing

· Retail

· Government

· Others

Cloud-Native Application Protection Platform Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.