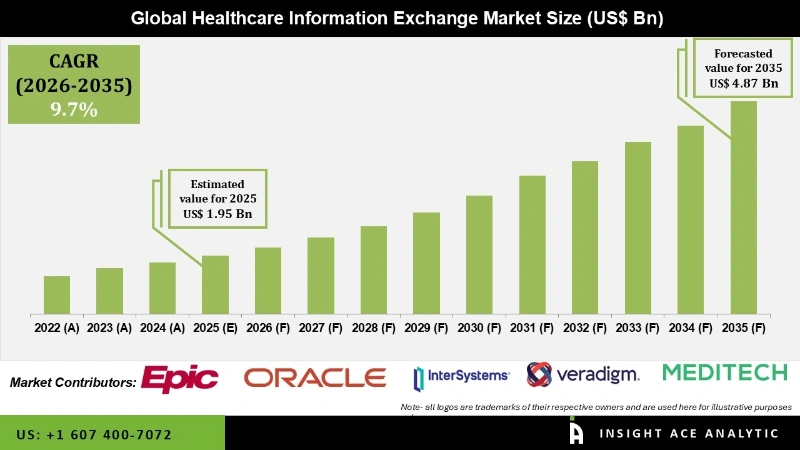

The Healthcare Information Exchange Market Size is valued at USD 1.95 Bn in 2025 and is predicted to reach USD 4.87 Bn by the year 2035 at an 9.7% CAGR during the forecast period for 2026 to 2035.

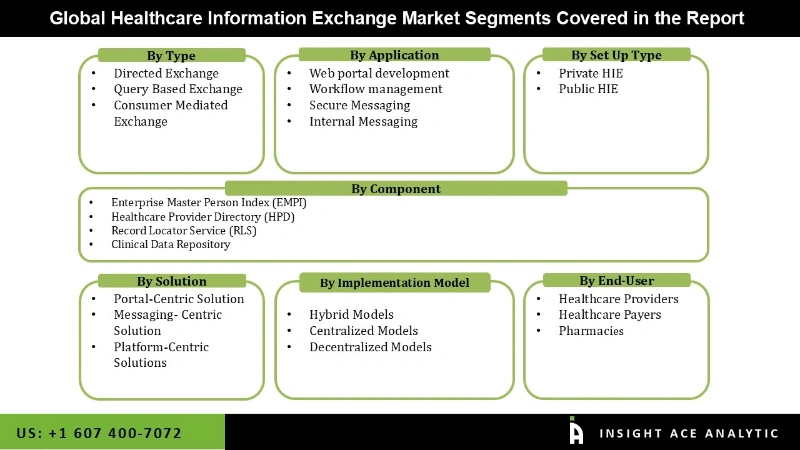

Healthcare Information Exchange Market, Share & Trends Analysis Report, By Type (Direct Exchange, Query Based Exchange, Consumer Mediated Exchange), By Implementation Model (Hybrid Models, Centralised Models, Federated Models), By Setup (Private HIE, Public HIE), By Solution, By Component, By Application, By End-user, By Region, and Segment Forecasts, 2026 to 2035.

Health Information Exchange (HIE) enables healthcare professionals to securely access and exchange patient medical records, including diagnoses, therapy recommendations, test results, and health histories. This process improves care coordination among providers, reducing errors and the duplication of services. HIE also plays a vital role in identifying trends and patterns in health data, which can guide public health initiatives and disease prevention efforts. By minimizing paperwork and administrative tasks, HIE enhances the efficiency of healthcare delivery. Moreover, by providing a thorough understanding of a patient's medical history, it helps healthcare professionals make more educated treatment decisions and makes it easier for specific information, such as test results or referrals, to be effortlessly exchanged.

Government approval is a key factor in advancing healthcare IT to enhance the quality of care. For instance, Ontario introduced the eHub Health Information Exchange (HIE) system in May 2023 to improve patient care. According to Oracle, this system allows 21 institutions to securely share patient data, enhancing communication and reducing administrative burdens. The partnership between TransForm and healthcare providers aims to boost care coordination across Ontario. Similarly, government initiatives, such as those from the Centers for Disease Control and Prevention (CDC), encourage the adoption of electronic health records (EHR) and HIE systems by offering incentives and policies. Programs like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S., along with other global initiatives, promote the use of EHRs and HIEs through regulations and incentives, such as Meaningful Use programs, which reward providers for effectively using EHRs. These efforts drive the HIE industry by facilitating efficient data exchange, reducing costs, and improving healthcare quality.

The Healthcare Information Exchange Market is segmented based on the type, setup type, implementation model, solution, component, and application, End-user. Based on the type, the market is divided into direct exchange, query-based exchange, and consumer-mediated exchange. Based on the implementation model, the market is divided into hybrid models, centralized models, and federated models. Based on the setup, the market is divided into private HIE and public HIE. Based on the solution, the market is divided into portal-centric solutions, messaging-centric solutions, and platform-centric solutions. Based on the component, the market is divided into enterprise master person index (EMPI), healthcare provider directory (HPD), record locator service (RLS), and clinical data repository. Based on the application, the market is divided into web portal development, workflow management, secure messaging, and internal messaging. Based on the end user, the market is divided into healthcare providers, healthcare payers, and pharmacies.

Based on the type, the market is divided into direct exchange, query-based exchange, and consumer-mediated exchange. Among these, the query-based exchange segment is expected to have the highest growth rate during the forecast period. It allows healthcare providers to quickly access critical information, such as lab results, medications, and prior diagnoses, which is crucial for immediate decision-making. As healthcare becomes more decentralized and patients seek care across multiple providers, query-based exchange offers the ability to seamlessly retrieve necessary information from disparate systems. Policies such as the Meaningful Use program in the U.S. and similar initiatives worldwide encourage the use of HIE systems to improve care coordination, making query-based exchange a key component in achieving these goals. This capability is especially important for emergency care, where timely access to accurate health data (like medication history, allergies, or previous diagnoses) can significantly improve treatment decisions and outcomes. This demand for efficient data retrieval boosts the adoption of HIE systems, driving market growth.

Based on the solution, the market is divided into portal-centric solutions, messaging-centric solutions, and platform-centric solutions. the platform-centric solution segment dominates the market. Platform-centric solutions are designed to facilitate the exchange of health information across multiple systems and institutions. They act as a central hub or infrastructure that connects disparate healthcare IT systems, allowing providers to query and retrieve patient data from various sources. The ability to integrate with electronic health records (EHR) systems, labs, pharmacies, and other healthcare entities makes platform-centric solutions vital for driving the growth of query-based exchange. These platforms offer scalability, allowing healthcare organizations to easily expand their data-sharing capabilities as their network grows. This flexibility is essential for large healthcare systems, regional health information exchanges, and government health programs that need to manage vast amounts of patient data efficiently.

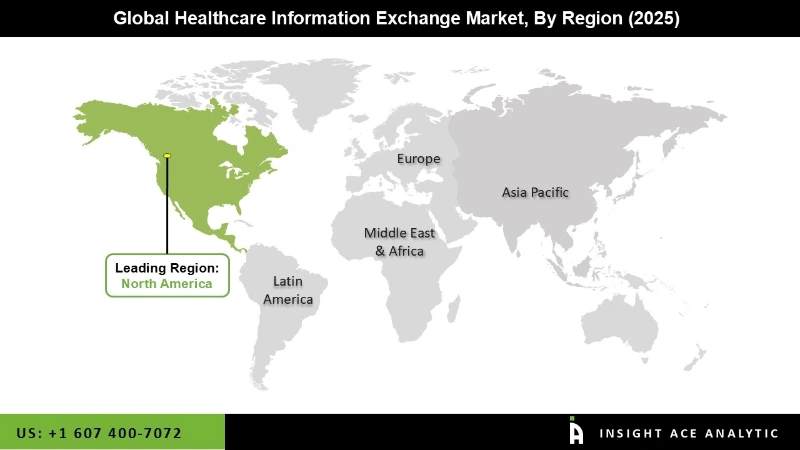

North America, particularly the U.S., has a well-developed healthcare IT infrastructure. Most healthcare providers and institutions already use sophisticated electronic health records (EHR) systems, making it easier to integrate HIE systems that facilitate the exchange of data across healthcare organizations. The presence of advanced hospitals, research institutions, and healthcare systems creates a favorable environment for HIE growth.

The presence of renowned healthcare institutions, research facilities, and healthcare provider networks in the U.S. and Canada boosts the demand for secure data sharing through HIE systems. These institutions often drive innovation and adoption of cutting-edge healthcare technology, including HIEs. The U.S. leads the world in healthcare spending, which includes significant investments in health IT infrastructure. Hospitals and healthcare providers have the financial resources to implement and maintain advanced HIE systems.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.95 Bn |

| Revenue Forecast In 2035 | USD 4.87 Bn |

| Growth Rate CAGR | CAGR of 9.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Set Up Type, Implementation Model, Solution, Component, and Application, End-user. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Epic Systems Corporation, Oracle, Intersystems Corporation, Veradigm Llc, Medical Information Technology, Inc., Health Catalyst, Kellton, Eclinicalworks, Nxgn Management, Llc, Orion Health Group Of Companies, Chetu Inc., Telstra Health, Cgi Inc., Meditab, Dreamsoft4u, Ncrypted Technologies, Glorium Technologies, Daffodil Software, Siemens Healthineers Ag, Deloitte, Excelicare, Allscripts Healthcare Solutions, Inc., General Electric, Incite, Data Trans Solutions, Mediportal, LLC., Ciracet, AXIOM Systems , Open Text Corporation, Infor, MEDITECH, IBM Corporation, Siemens Healthcare Private Limited, RelayHealth (McKinsey & Company), ZeOmega Inc., GE Healthcare, Health Catalyst, Optum, Inc., NextGen Healthcare, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Healthcare Information Exchange Market- By Type

Global Healthcare Information Exchange Market – By Set Up Type

Global Healthcare Information Exchange Market – By Implementation Model

Global Healthcare Information Exchange Market – By Solution

Global Healthcare Information Exchange Market – By Component

Global Healthcare Information Exchange Market – By Application

Global Healthcare Information Exchange Market – By End User

Global Healthcare Information Exchange Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.