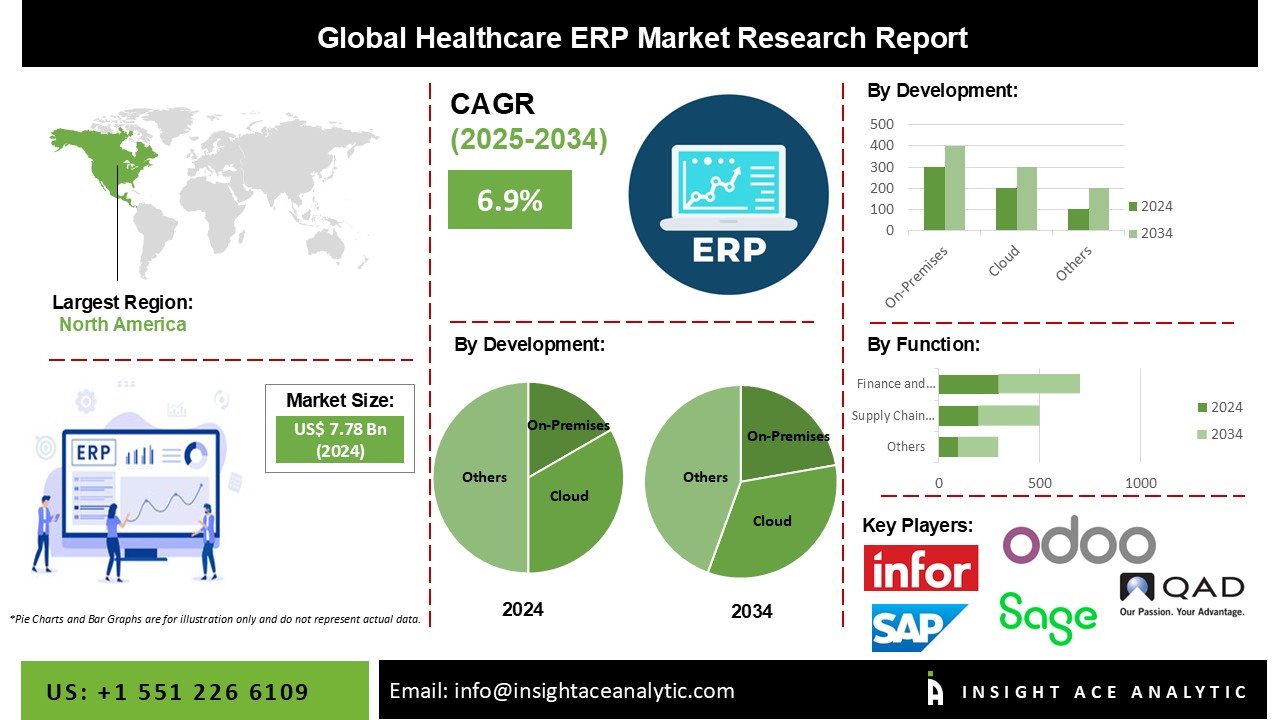

Healthcare ERP Market Size Was valued at USD 7.78 Bn in 2024 and is predicted to reach USD 15.04 Bn by 2034 at a 6.9% CAGR during the forecast period for 2025-2034.

Healthcare ERP, also known as Healthcare Enterprise Resource Planning, is a software system that operates and streamlines the operations and activities of healthcare organizations. ERP systems are widely utilized in various industries, including healthcare, to combine and automate multiple activities, increase efficiency, and improve data management.

Healthcare ERP enables healthcare organizations to engage with patients successfully throughout their healthcare experience. This enhances patient satisfaction, communication, and the whole experience. Growing healthcare spending, poor hospital service management, a growing workforce scarcity, and a rapidly growing patient population at healthcare facilities are driving public and private partners to develop new forms of healthcare delivery. Clinicians are becoming more aware of the advantages of advanced technological solutions, such as providing high-quality patient care, lowering operational costs, and eliminating data silos in back-end operations, which is expected to grow demand for enterprise resource planning (ERP) solutions.

However, the COVID-19 epidemic put global healthcare systems to the test. The pandemic taxed the workforce, highlighted flaws in established systems, and shattered supply and demand cycles. Businesses are using cloud services to easily access data, optimize workflow, automate inventory and supply chain management operations, and improve the sector's financial and clinical outcomes as the industry shifts towards remote healthcare and remote working.

The Healthcare ERP market is segmented on the basis of function and deployment. Function segment includes inventory & material management, supply chain & logistics, patient relationship management, finance & billing, and others. Deployment segment includes On-premises and cloud.

The on-premises category is expected to hold a major share of the global healthcare ERP market in 2022. This is attributed to less maintenance, low dependency on vendors, ease of access from remote places, minimized expenses, complete control over operations, security & privacy, and easy customization. On-premises software deployment is commonly referred to as "shrink-wrap" and covers the installation of systems and solutions on computers available within the firm.

Although these solutions are installed on-premises computers and servers, they can be accessed from anywhere, lowering implementation costs and power usage. However, the expansion of cloud computing and its increasing acceptance rates are likely to limit the growth of the on-premises segment. Furthermore, the physical area cost and maintenance cost of server rooms is projected to stifle the expansion of the on-premises category.

The finance & billing segment is projected to grow at a rapid rate in the global healthcare ERP market. Healthcare organizations are quickly using ERP systems in order to optimize operations and reduce barriers between front-end revenue cycle management activities and back-end activities such as claims management. These systems are being implemented by businesses to eliminate financial data silos, track profitability, manage ledgers, manage fixed assets, risk management, multi-currency management, reporting, and tax management. ERP solutions, which are predicted to boost the segment, enable comprehensive financial transparency, informed planning and budgeting, improved productivity, and real-time financial monitoring

The North America Healthcare ERP Market is expected to register the highest market share in terms of revenue shortly. This is due to the quickly evolving healthcare infrastructure, rising demand for innovative technological solutions, and the considerable presence of leading market participants. North American consumers are rapidly adopting ERP systems to improve productivity and cost savings through streamlining procedures.

Key North American players are developing and growing their product portfolios to serve small and medium-sized businesses. Due to rising healthcare costs and developing labor scarcity, Asia Pacific is expected to increase at the quickest rate during the projection period. Furthermore, poor health facility service management, an expanding patient community, the rising use of innovative technological solutions, and the introduction of start-ups are supporting the Asia Pacific market's growth.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 7.78 Bn |

| Revenue forecast in 2034 | USD 15.04 Bn |

| Growth rate CAGR | CAGR of 6.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Function And Deployment |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | SAP, Sage Group PLC, QAD, Inc., Odoo, Infor, Aptean, Microsoft, Oracle Corporation, McKesson Corporation, and Epicor Software Corporation. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Healthcare ERP Market By Function-

Healthcare ERP Market By Deployment -

Healthcare ERP Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.