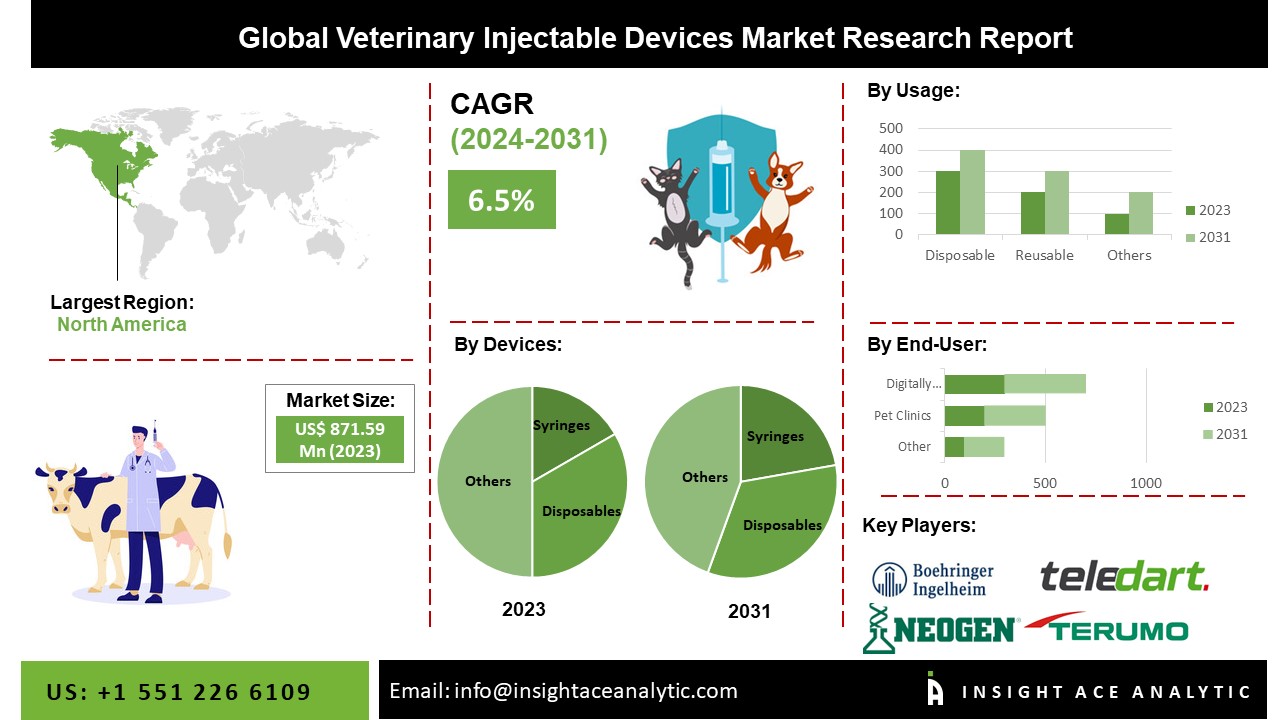

The Veterinary Injectable Devices Market Size is valued at USD 871.59 Million in 2023 and is predicted to reach USD 1406.96 Million by the year 2031 at a 6.5% CAGR during the forecast period for 2024-2031.

The market for veterinary injectable devices is predicted to expand significantly throughout the forecast period. The rising prevalence of numerous diseases among animals, as well as rising healthcare costs, are increasing the demand for veterinary injectable devices. Compared to companion animals, poultry and agricultural animals are at a higher risk of contracting sickness. If the disease spreads to farm animals or poultry, it can be fatal to all animals and humans. Farm animals and poultry mortality will result in financial losses. As a result, farm animals are vaccinated to prevent disease, resulting in increased sales of veterinary injectable devices. Syringes and needles are the top revenue-generating sectors of veterinary injectable devices and are likely to boost the market growth over the forecast period. The needle-free veterinary injectable systems market is growing and is likely to expand significantly over the next few years.

However, plastic is the preferred material for veterinary injectable devices as it's employed in the production of disposable injectable devices. Due to low prices and increased use of disposable injections, the plastic sector is projected to continue leading the veterinary injectable devices market.

The global veterinary injectable devices market is segmented based on devices, usage, and end-users. Based on devices, the market is segmented as syringes, needles, remote injection systems, and other device types. The other usage segment includes disposable, reusable, sterile, and other users (safety, etc.). By end-users, the market is categorized into animal research institutes & labs, veterinary hospitals, pet clinics, veterinary pharmacies, and other end-users.

The veterinary hospital's category is expected to hold a significant share in the veterinary injectable devices market in 2021. Advanced diagnostic imaging, innovative therapeutics, nuclear and regenerative medicines, laser diagnostics, and specialist operations, all of which are available in veterinary hospitals and clinics, are contributing to the growth. Market growth is expected to be aided by companies' strategic developments in the veterinary hospital segment. For instance, AAD recently announced a USD 7 million investment to extend its platform for rapid, point-of-care animal and human health choices. Moreover, the reference veterinary pharmacies sector is also predicted to grow at the fastest rate over the projection period, as these labs can test for a variety of illnesses, hazardous substances, and chronic disorders in animal specimens.

The syringes segment is projected to grow at a rapid rate in the global veterinary injectable devices market, owing to the high availability of syringes in the market. Market players' initiatives in this segment are also expected to boost market growth. As a result of technological advancements, Veterinary Syringes are now simple to use. In addition, they take less effort from animal keepers and deliver accurate and prompt findings.

North America is the most attractive and highest revenue-generating veterinary injectable devices market owing to better veterinary healthcare facilities and increased expenditure on companion animals. North America is one of the world's largest meat-consuming markets, with tight regulations requiring that meat come from healthy animals. Moreover, market growth is likely to be aided by the increased acceptance of pet health insurance in the United States. On the other hand, Asia Pacific is projected to proliferate in the global veterinary injectable devices market owing to rising animal healthcare infrastructure and the presence of many farm animals and big poultry businesses. Furthermore, market expansion in this region has been aided by factors such as increased adoption of companion animals and rising animal health concerns. In addition, the Asia Pacific region's market is predicted to be driven by increasing expenditure on animal health and veterinary services, as well as the growing cattle population.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 871.59 Million |

| Revenue forecast in 2031 | USD 1406.96 Million |

| Growth rate CAGR | CAGR of 6.5 % from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Devices, By Usage, By End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Boehringer Ingelheim, TeleDart USA, H. Hauptner Und Richard Herberholz GmbH & Co. KG, Schippers Export BV, Akra Dermojet, Allflex Livestock Intelligence (SCR Engineers Ltd.), Terumo Medical Corporation, Neogen Corporation, Quick Shot Corporation, Syrinjector Ltd, Accesia, Aesthetic Group, AVID Pet MicroChip, Genia, Millpledge Veterinary, Nordson Efd, Pharma Supply Inc, UID Identification Solutions, Ultimed, and Vygon Vet. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Devices -

By Usage -

By End-Users -

By Region -

North America -

Europe -

Asia-Pacific -

Latin America -

Middle East & Africa -

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.