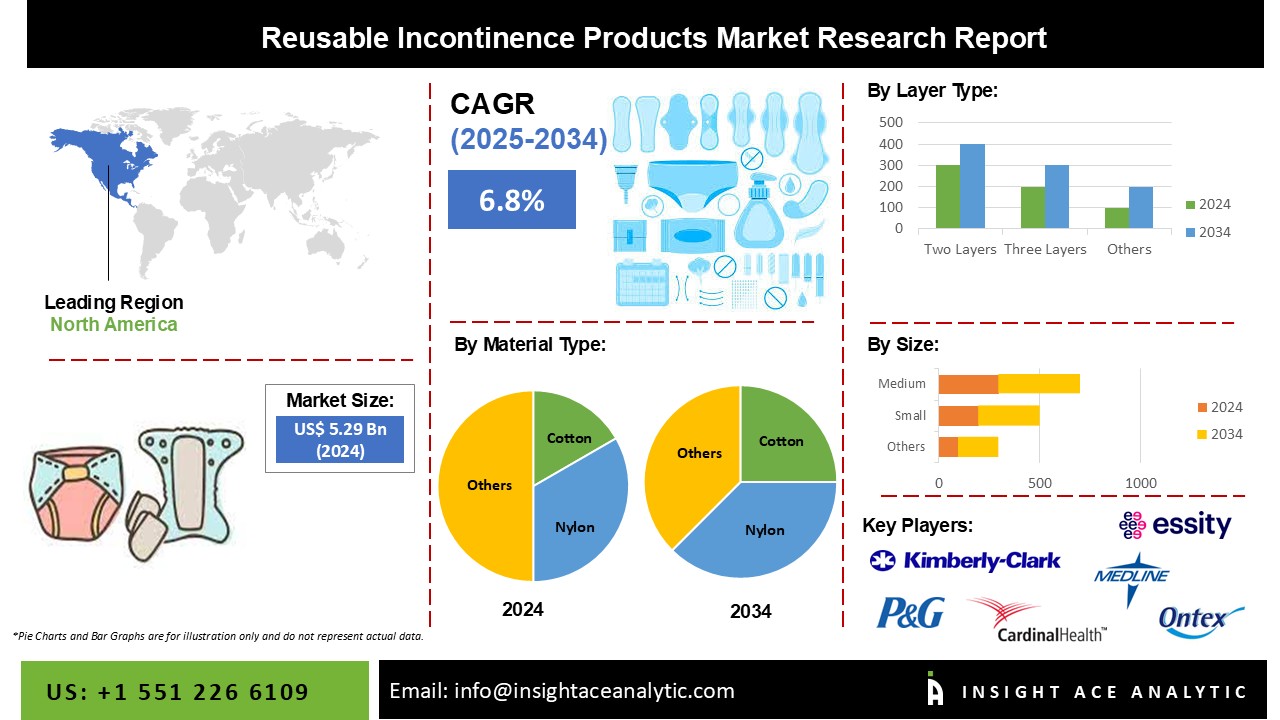

Reusable Incontinence Products Market Size is valued at USD 5.29 Billion in 2024 and is predicted to reach USD 10.07 Billion by the year 2034 at a 6.8% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Adult incontinence is a recognized health issue; in addition to aging, other health issues like obesity, posttraumatic stress disorder (PTSD), and childbirth are essential contributors to incontinence. Given the emphasis on sustainability and enhancing patient care, reusable incontinence solutions are in high demand. The market for disposable incontinence products has been driven by the increased prevalence of incontinence globally, which is expected to continue. Additionally, the rise in the frequency of incontinence comprises advancing age, polypharmacy, functional impairment, comorbidities and kidney illness, which is also helping the target market's growth. The prevalence of bladder infections, chronic kidney disease, neurologic traumas, and an aging global population further drive demand for reusable incontinence products. Furthermore, the target market is expanding because of the rising acceptance and preference for reusable incontinence products.

Additionally, the market for reusable incontinence products would benefit from several growth prospects during the projection above period due to ongoing technical breakthroughs and new product developments. The market for reusable incontinence products won't expand much due to a lack of consumer awareness and a shifting preference for reusable products.

The reusable incontinence products market is segmented on the product type, end user, price range, size and sales channel. Based on product type, the market is segmented into adult cloth diapers, reusable incontinence pads, reusable underpads and reusable briefs. Based on end-user, the reusable incontinence products market is segmented into men's reusable incontinence products, women's reusable incontinence products and kids' reusable incontinence products. Based on the price range, the reusable incontinence products market is segmented into mass/economic (US$ 10-75) reusable incontinence products and premium (US$ 75 & above) reusable incontinence products. Based on the size, the reusable incontinence products market is segmented into small reusable incontinence products, medium reusable incontinence products, large reusable incontinence products and x-large reusable incontinence products. Based on the sales channel, the reusable incontinence products market is segmented into direct sales, hypermarkets/supermarkets, convenience stores, departmental stores, mono-brand stores, speciality stores, drug stores, online retailing and others.

Based on end-user, the reusable incontinence products market is segmented into men's reusable incontinence products, women's reusable incontinence products and kids' reusable incontinence products. The women reusable incontinence products category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time because more women are giving birth, post-menopausal difficulties are more common, and people are becoming more aware of incontinence and ostomy care items. Due to pregnancy, childbirth, and menopause, incontinence affects women more frequently than it does men. In contrast, the male market is predicted to rise significantly during the projection period. Introducing products specifically geared toward men and growing public awareness of incontinence and male grooming are the main reasons responsible for the growth of the male market.

Based on the sales channel, the reusable incontinence products market is segmented into direct sales, hypermarkets/supermarkets, convenience stores, departmental stores, mono-brand stores, specialty stores, drug stores, and online retailing. The online retailing category is anticipated to grow significantly over the forecast period. There has been a sharp increase in internet penetration year over year. Customers may easily acquire information about the many incontinence products on the market thanks to it. This aspect has prompted several manufacturers to advertise and market their goods on social media and e-commerce platforms. According to the results of an e-commerce consumer study done by the Federal Association of German E-Commerce and Mail Order Business (both), e-commerce turnover in 2019 climbed by a whole eleven per cent compared to 2019.

The North American reusable incontinence products market is expected to register the highest market share in revenue shortly. As the top producer of reusable incontinence products in North America, the United States will see a significant increase in demand in the years to come. Product innovation is receiving much attention as a major trend in the US market, promoting the penetration and adoption of high-end reusable incontinence solutions. Additionally, the Asia Pacific is anticipated to expand at a significant rate over the course of the forecast period. Due to the vast range of incontinence patients, producers now have more options to develop in this area and gain greater rewards by raising product absorbency levels, skin friendliness, breathability, and odor management. Additionally, the region's growing senior population and incidence of chronic renal failure, mental illness, diabetes, and other diseases drive demand for reusable incontinence products.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 5.29 Billion |

| Revenue Forecast In 2034 | USD 10.07 Billion |

| Growth Rate CAGR | CAGR of 6.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ B`illion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Price Range, Size, Sales Channel, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Kimberly-Clark Corporation, The Proctor & Gamble Company, MediFabrik SRL, Cardinal Health, Inc., Essity AB, Medline Industries, Inc., Ontex International N.V., Attindas Hygiene Partners, Activ Medical Disposable, Paul Hartmann AG, Nexwear, Prime Life Fibers, Royal Medical Solutions, Inc., Abena Group, Unicharm Corporation, Prevail and Dryloch Technologies NV. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product Type-

By End User-

By Price Range-

By Size-

By Sales Channel-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.