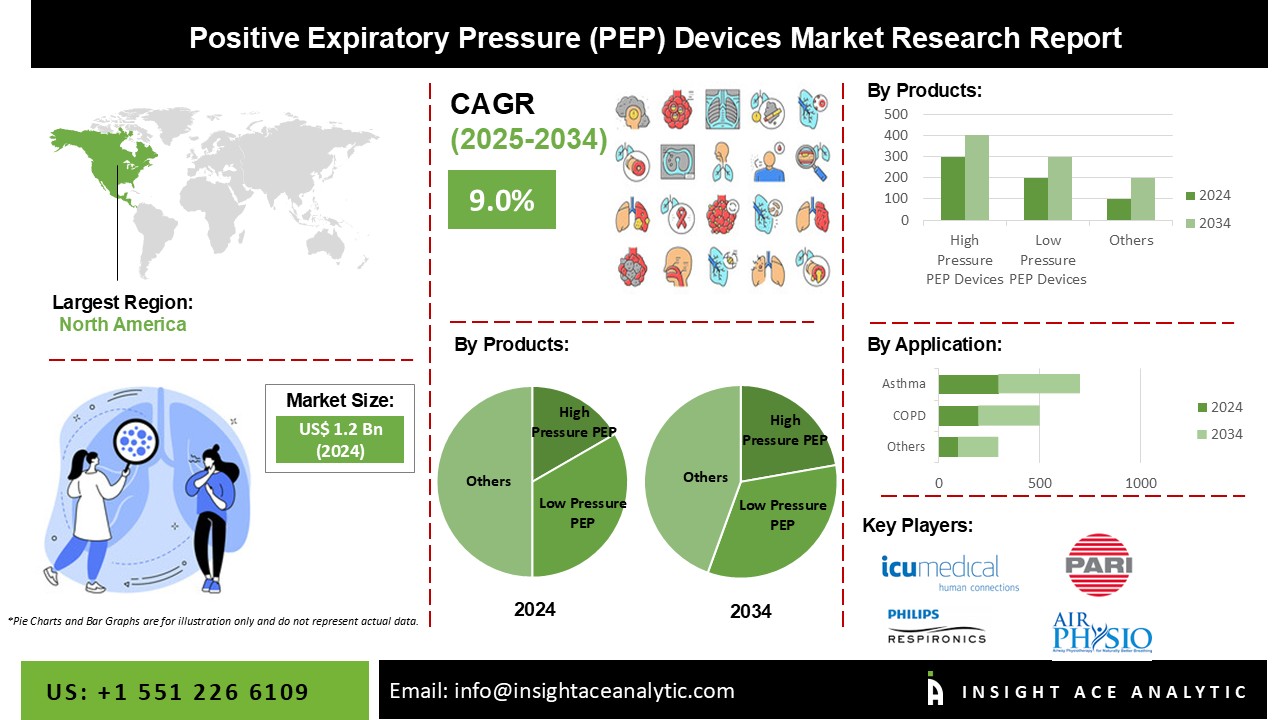

Positive Expiratory Pressure (PEP) Devices Market Size is valued at 1.2 Billion in 2024 and is predicted to reach 2.8 Billion by the year 2034 at a 9.0% CAGR during the forecast period for 2025-2034.

Positive expiratory pressure therapy (PEP) is performed for airway clearance therapy. A participant in this therapy breathes through a portable mouthpiece or mask. This allows air to pass past the mucus in the lungs and away from the airway walls. The device facilitates unrestricted air passage and requires active inhaled air expiration against resistance. The growth in COPD prevalence due to increased smoking and drinking in industrialized countries, as well as the recent introductions of innovative oscillatory PEP, are pushing the positive expiratory pressure devices market. The rising frequency of chronic pulmonary disorders and technological developments drive market expansion. The PEP devices market is growing due to an ageing population and an increase in chronic disease occurrences.

However, in low-income countries, a lack of awareness regarding technologically advanced airway clearing medicines is projected to stymie the worldwide Positive Expiratory Pressure Devices market growth. Furthermore, the market is expected to advance due to the time-consuming old airway clearance techniques.

The Positive Expiratory Pressure (PEP) Devices market is segmented on the basis of Product Type, Application. By product, the market is segmented as High Pressure PEP (26-102cm H2O) Devices, and Low Pressure PEP (5-20cm H2O) Devices. The Application segment includes Chronic Obstructive Pulmonary Disease (COPD), Asthma, Atelectasis, Bronchitis, Bronchiectasis, Cystic Fibrosis, and Others.

The global PEP devices market can be divided into two product types: high-pressure PEP (26-102cm H2O) and low-pressure PEP (5-20cm H2O). The high-pressure PEP category earned the most revenue, owing to increased patient compliance with high-pressure devices and increased bronchodilation achieved by pressures more significant than 26 cm H2O. The enhanced patient initiatives to shorten hospital stays are expected to grow the high-pressure PEP segment. PEP devices with high pressure are used to give high levels of positive expiratory pressure (PEP) to the lungs. These devices are commonly utilized in individuals suffering from the chronic obstructive pulmonary disease (COPD), asthma, or other respiratory disorders requiring improved airway clearance. High-pressure PEP devices can be mechanical or electrical, and they can generate the appropriate level of PEP through various processes. Some high-pressure PEPs can be modified to meet the needs of the patient's breathing by turning a knob on the device known as an expiratory resistance control valve, or ERV.

The market will be led by chronic obstructive pulmonary disease (COPD). COPD is caused by an obstruction in the airways, causing difficulty breathing, and is primarily caused by tobacco smoking. According to a 2019 WHO (World Health Organization) report, the chronic obstructive pulmonary disease is the third leading cause of death worldwide. Growing patient awareness for the creation of a shared platform for COPD sufferers is likely to boost the segment's growth during the forecast period.

North America dominates the positive expiratory pressure (PEP) market because of the increasing patient awareness in the region. Some of the factors driving the oscillatory positive expiratory pressure (OPEP) market during the forecast period include the rising prevalence of chronic obstructive pulmonary disease (COPD), increasing technological advancements, rising prevalence of asthma, and continuous technological and research development. The increasing frequency of chronic illnesses, on the other hand, will create several opportunities, resulting in the rise of the positive expiratory pressure (PEP) market within the time period stated. Due to an expanding patient pool and raised spending on healthcare infrastructure development by developing countries, the Asia-Pacific region is projected to expand during the projected period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.2 Billion |

| Revenue Forecast In 2034 | USD 2.8 Billion |

| Growth Rate CAGR | CAGR of 9.0 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Smiths Medical, Inc. (ICU Medical), Philips Respironics (Koninklijke Philips N.V.), Monaghan Medical Corporation, D-R Burton Healthcare, PARI GmbH, AirPhysio, R. Cegla GmbH & Co. KG, Trudell Medical International, Allergan Plc. (AbbVie), Aptalis Pharma US, Inc. (Nestlé Health SoloPep, Medica Holdings, LLC,Intersurgical Ltd.,Clement Clarke International (Haag-Streit Group), Hill-Rom Holdings (Baxter International) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product Type

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.