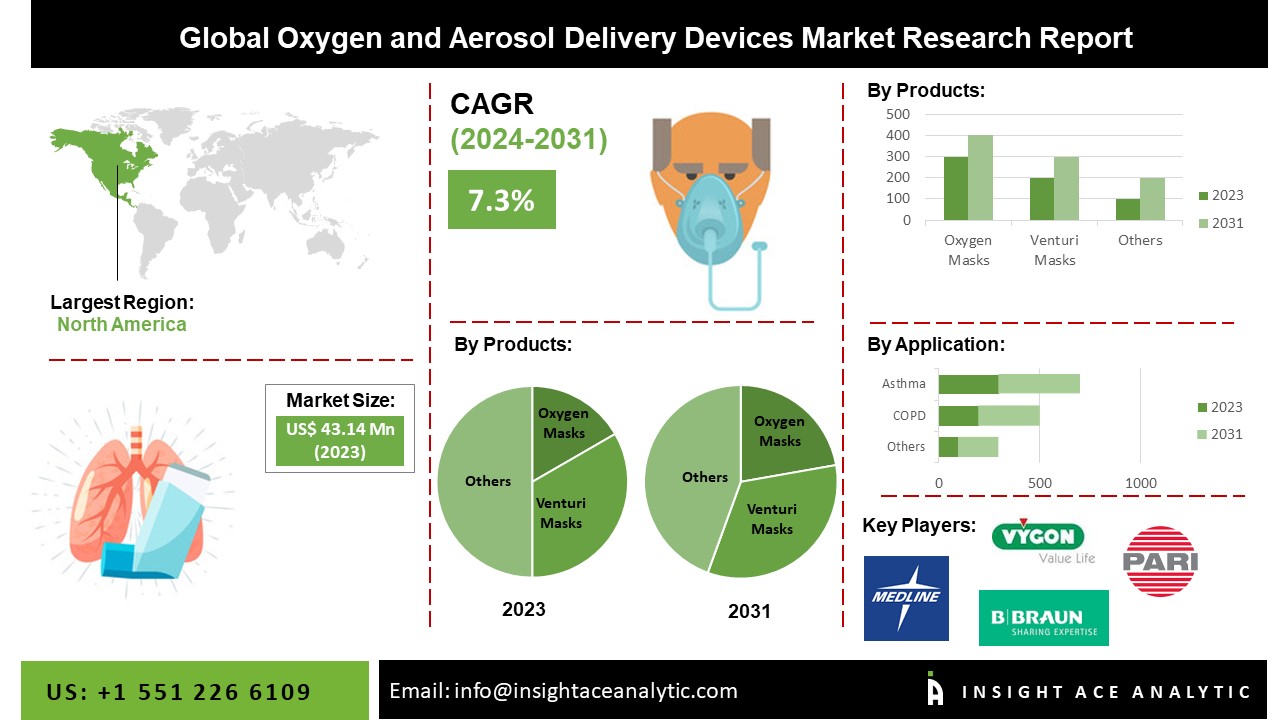

The Oxygen and Aerosol Delivery Devices Market Size is valued at 43.14 Billion in 2023 and is predicted to reach 74.64 Billion by the year 2031 at a 7.3% CAGR during the forecast period for 2024-2031.

As rescue therapy or long-term treatment, oxygen and aerosol delivery systems are used to treat respiratory and non-respiratory illnesses. A chemical is delivered directly to the lungs for a systemic impact; this is the most sophisticated method of medication administration. In the treatment of asthma and COPD, oxygen and aerosol delivery devices such as dry powder inhalers, metered-dose inhalers, and nebulizers are often used. These devices are also used to treat non-respiratory illnesses such as diabetes, analgesia, and Parkinson's disease. The rising prevalence of respiratory disorders such as COPD, asthma, and cystic fibrosis is anticipated to be a prime market driver. Increased emphasis by manufacturers on producing portable inhalation devices for rescue equipment treatment during a sudden asthmatic attack, demand for short-term, effective asthma and COPD medication, and government initiatives to raise awareness of COPD and asthma symptoms, all of which are driving the oxygen and aerosol delivery market forward.

Technological advancements in inhaler devices, patient adoption of oxygen and aerosol delivery devices, urbanization, and pollution levels, as well as a rise in the number of R&D initiatives aimed at developing optimal inhalation therapy are all factors that contribute to market growth. However, issues and adverse effects connected with drug inhalation, as well as the high cost of nebulized, are expected to impede the market.

The Oxygen and Aerosol Delivery Devices market is segregated on the basis of Product and application. By Product, the market is segmented as Oxygen Masks, Nasal Cannulas/ Oxygen catheters, Oxygen Connecting Tube, Venturi Masks, Non-rebreather Masks, Reusable Nebuliser, Disposable Nebuliser and Other Oxygen Delivery Devices. By application, the market is segmented into COPD, Asthma, Cystic Fibrosis, Respiratory Distress Syndrome, Pneumonia and Other Diseases.

The oxygen masks category is predicted to grow at a constant rate as a result of these masks being an essential part of the O2 delivery system, resulting in increased consumption and so serving as a key contributing factor to the oxygen and aerosol delivery device market growth in the future. Furthermore, these devices enable correct O2 concentration delivery, continuous flow and pressure, and patient comfort, which is expected to drive segment demand.

COPD accounted for most of the oxygen and aerosol delivery device market. Sleep apnea, asthma, and viral diseases came in second and third, respectively. The rising prevalence of smoking and environmental factors can be blamed for COPD's significant market share. This segment, followed by asthma, is predicted to expand the fastest in the market. Furthermore, the latest COVID-19 outbreak will have an impact on COPD sufferers. While they are not at an increased risk of developing the disease, it can have severe consequences for them. As a result, demand for respiratory care devices is likely to rise during the forecast period due to the high incidence of COPD and the rising number of deaths caused by COPD.

The Asia Pacific is anticipated to evolve significantly over the forecast period. It presents lucrative opportunities for key players operating in the oxygen and aerosol delivery devices market due to the enormous population base susceptible to asthma and COPD, increased public awareness of the use and benefits of these devices, affordability of medical devices, development of the R&D sector, rise in healthcare reforms, and technological advancements in aerosol delivery devices products. Furthermore, an increase in demand for inhalers and nebulizers, as well as an increase in demand for home healthcare equipment, all contribute to market expansion. Moreover, the increased focus of major manufacturers on expanding their geographical presence in rising Asia-Pacific countries in order to acquire a large portion of the oxygen and aerosol delivery devices market is likely to fuel the region's growth. APAC is also becoming a medical tourism hotspot and one of the most rapidly expanding medical operations and devices markets. APAC countries, notably India and China, have attracted medical tourists due to their developed healthcare infrastructure, affordable treatment options, and availability of highly trained clinicians.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 43.14 Billion |

| Revenue forecast in 2031 | USD 74.64 Billion |

| Growth rate CAGR | CAGR of 7.3 % from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Product and Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Medline Industries, Inc., Salter Labs Inc., Vygon SA, Smiths Medical, Inc., Medicoplast International GmbH, Purple Surgical, Pennine Healthcare, Besmed Health Business Corp., Intersurgical Ltd, B. Braun Melsungen AG, ConvaTec Inc., Flexicare Medical Ltd., GaleMed Corporation, PARI GmbH, Polymedicure, Teleflex Incorporated, HSINER CO., LTD., ASID BONZ GmbH and Sumi spó?ka z ograniczon?. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.