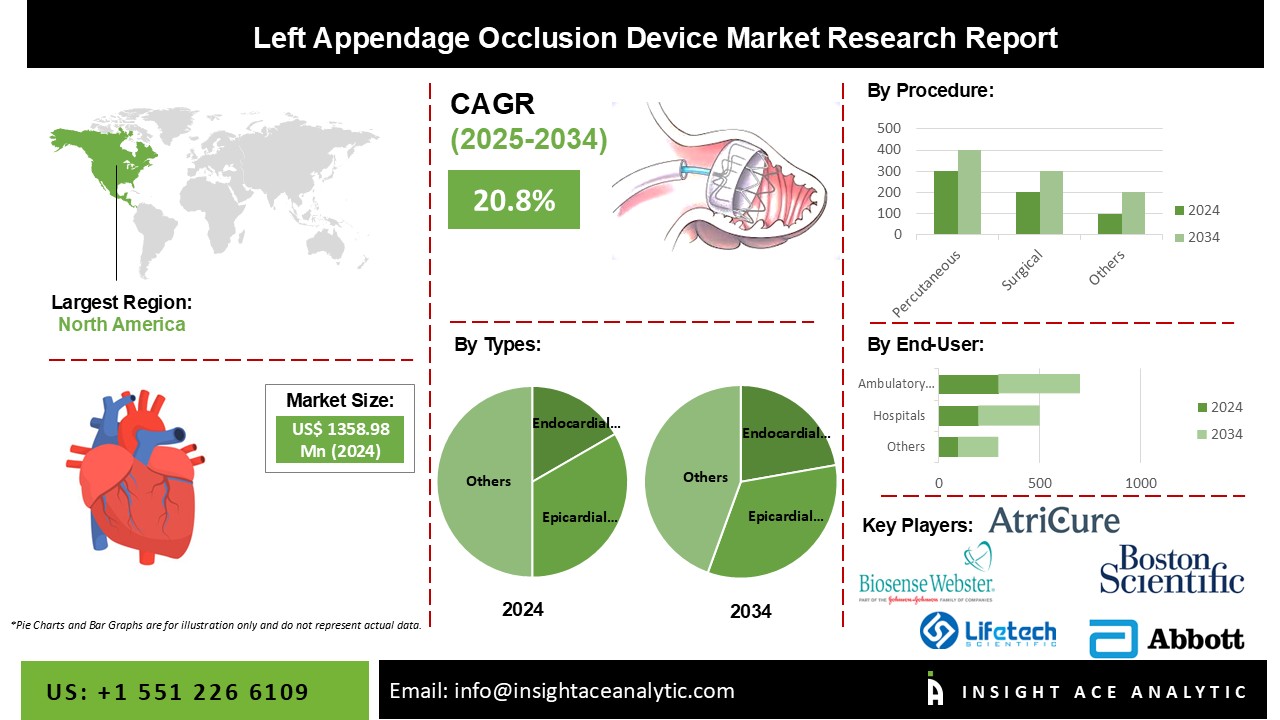

Left Appendage Occlusion Device Market Size is valued at 1358.98 Million in 2024 and is predicted to reach 8879.24 Million by the year 2034 at a 20.8% CAGR during the forecast period for 2025-2034.

The left appendage occlusion device is used in procedures such as percutaneous transluminal left atrial appendage occlusion and thoracoscopic left atrial appendage closure. Left appendage occlusion device controls the electrical impulses during atrial fibrillation. During atrial fibrillation, blood clots are pumped out of the heart. This blood can form clots in the atria and LAA. This medical condition can cause a stroke. Left appendage occlusion device is an interventional device used to prevent stroke in atrial fibrillation. Left appendage occlusion device helps in reducing the risk of secondary stroke and emboli because of atrial fibrillation.

The global left appendage occlusion device market is expected to grow rapidly during the forecast period. Clinical evidence of the efficiency of left appendage occlusion devices compared to the standard therapeutic treatment such as warfarin and dabigatran increased awareness levels, and new product launches in new countries are key factors boosting the market growth. However, the complicated implantation procedures and need of experienced surgeons are restraining factors for the market. The stringent regulation procedures for the approval of devices are hindering the new product launches. The vendors focus on clinical trials for new product launches in the high potential market such as the US and the Asia Pacific.

The global left appendage occlusion device market is segmented on the basis of Types, Procedures, End-Users and region. Based on the Type, maket is devided into Endocardial LAA Devices and Epicardial LAA Devices. Secondly, as per produres, the market is segmented into Percutaneous, and Surgical. On the basis of End-User, the market is segmented into Hospitals, Ambulatory Surgical Centers, and Heart Clinics. Based on region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. Among that, North America held the largest share of the market, followed by Europe. On the other hand, Asia-Pacific is expected to dominate the market during the analysis of the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1358.98 Million |

| Revenue Forecast In 2034 | USD 8879.24 Million |

| Growth Rate CAGR | CAGR of 20.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Types, By Procedure, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Atricure, Biosense Webster, Boston Scientific, Abbott Laboratories, Aegis Medical, Cardia, Lifetech Scientific, and Sentreheart, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Left Appendage Occlusion Device Market by Type

Global Left Appendage Occlusion Device Market Based on Procedures

Global Left Appendage Occlusion Device Market Based on End-User

Global Left Appendage Occlusion Device Market Based on Region

Europe

North America

Asia Pacific

Latin America

Middle East & Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.