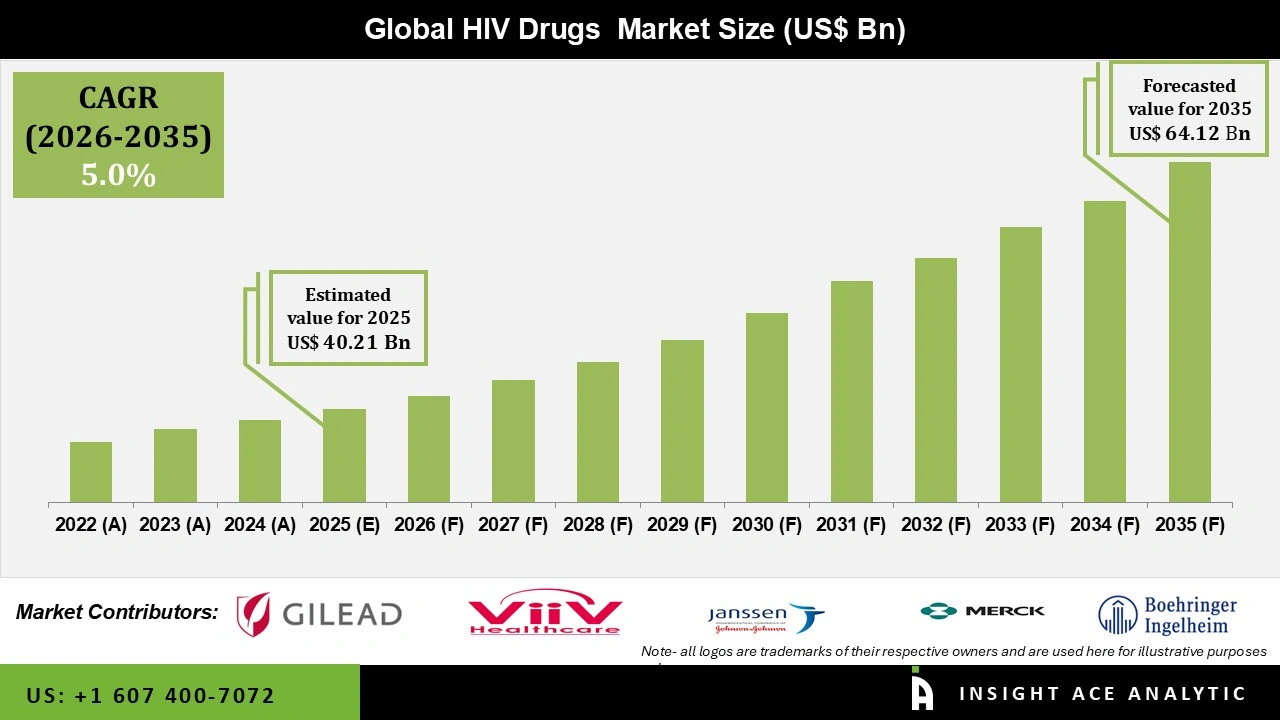

Global HIV Drugs Market Size is valued at USD 40.21 Billion in 2025 and is predicted to reach USD 64.12 Billion by the year 2035 at a 5.0% CAGR during the forecast period for 2026 to 2035.

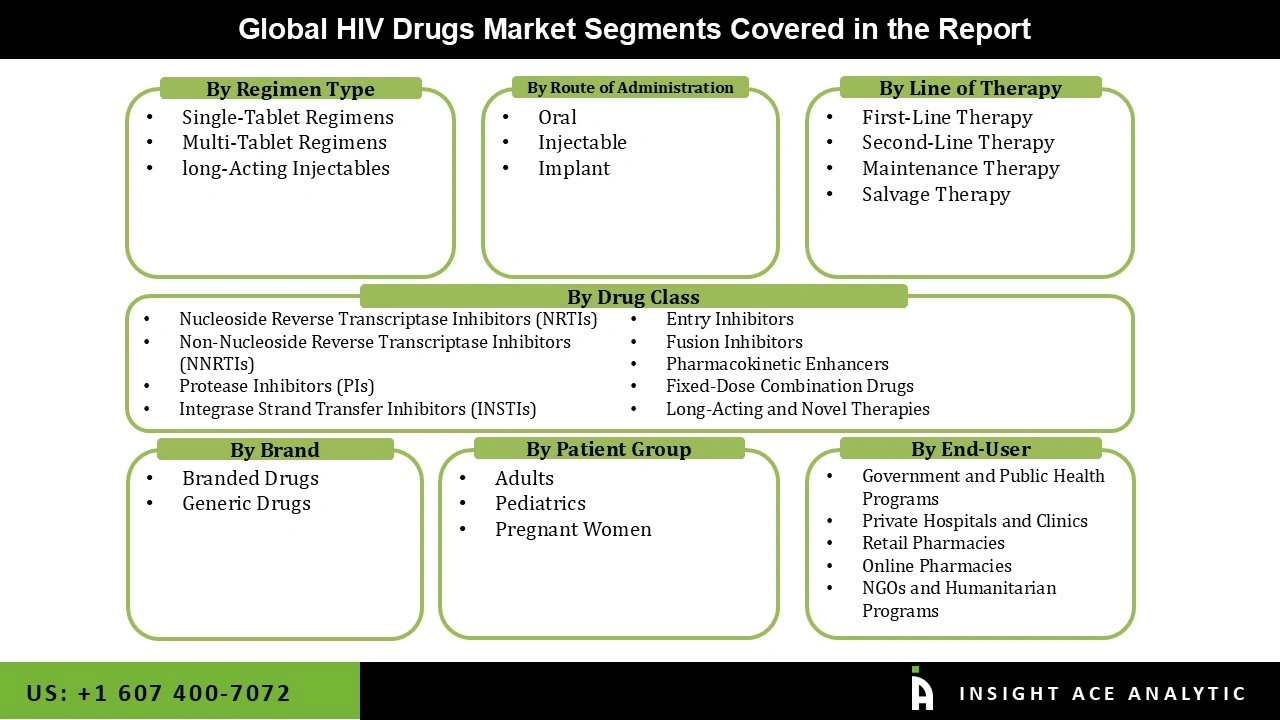

HIV Drugs Market Size, Share & Trends Analysis Report By Drug Type (Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, Entry and Fusion Inhibitors, Combination Class Drugs), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region, and Segment Forecasts, 2026 to 2035

Acquired immunodeficiency syndrome (AIDS) is caused by the human immunodeficiency virus (HIV). The virus damages the immune system and thus interferes with the body’s ability to fight organisms that cause disease. HIV attacks immune cells, specifically CD-4 cells, and makes the body susceptible to infections and other diseases.

AIDS is a life-threatening and chronic disease that can be transmitted from one person to another through various routes, including sexual intercourse, direct injection with HIV-contaminated drugs, needles, syringes, blood or blood products, and from HIV-infected mothers to fetuses. As of now, no cure for AIDS. However, antiretroviral regimens (ARVs) are recommended for patients with HIV as it can dramatically slow the disease progression as well as prevent other infections and complications.

The increasing prevalence of HIV/AIDS worldwide catalyzes the growth of the global HIV drugs market. According to UNAIDS, in 2019, the total number of patients with HIV/AIDS was around 38 million across the globe. The adult and children population was 36.2 and 1.8 million, respectively.

Additionally, several initiatives are undertaken by governments/associations/organizations in respective countries and globally to educate and raise awareness, availability of generic HIV drugs, and new drug development and regulatory approvals for HIV treatment are expected to drive the market further. For instance, in March 2020, ViiV Healthcare, the subsidiary of GlaxoSmithKline, received regulatory approval for its long-acting regimen for the treatment of HIV; CABENUVA by Health Canada.

The Global HIV drugs market is segmented on the basis of drug type and distribution channel. By Drug Type (Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, Entry and Fusion Inhibitors, Combination Class Drugs), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies).

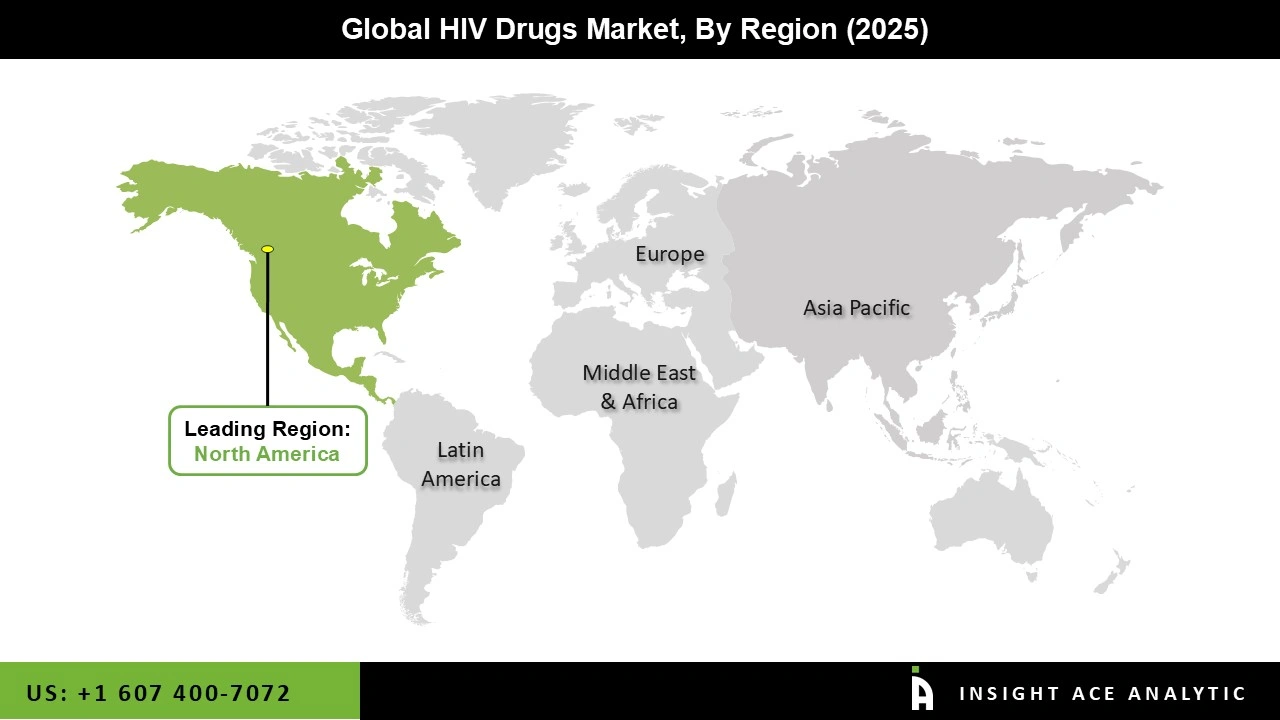

Based on the region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. Among that North America held the largest share of the market in 2024, followed by Europe and Asia Pacific. On the other hand, the Asia Pacific is projected to have the highest growth rate during the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 40.21 Billion |

| Revenue Forecast In 2035 | USD 64.12 Billion |

| Growth Rate CAGR | CAGR of 5.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Drug type and Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Gilead Sciences, ViiV Healthcare, Janssen, Merck & Co., Bristol-Myers Squibb, TaiMed Biologics, CytoDyn, Boehringer Ingelheim International GmbH, AbbVie, F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Johnson & Johnson, Cipla Limited, Daiichi Sankyo, Emcure, Hetero Drugs, and Mylan among others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.