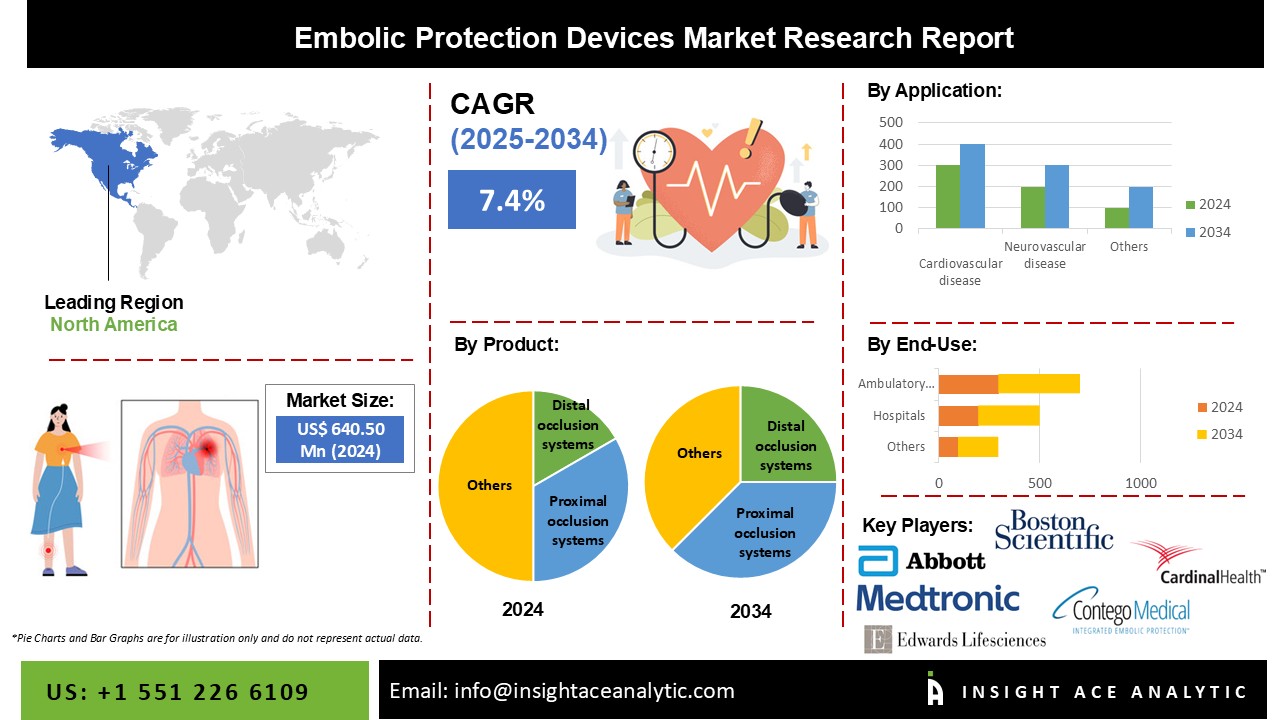

Embolic Protection Devices Market Size is valued at 640.50 Million in 2024 and is predicted to reach 1282.97 Million by the year 2034 at an 7.4% CAGR during the forecast period for 2025-2034.

Stenting reduces distal embolization because embolic protection devices (EPDs) catch blood and luminal particles inside the SVG. It offers the most dependable evidence-based strategy for stopping major adverse cardiovascular events (MACE) and periprocedural MI during SVG operations. This tool is intended to capture and remove any debris that might be released during processes. By preventing or decreasing plaque particles from entering the distal bed, embolic protection devices (EPDs) can potentially improve clinical outcomes.

The market for embolic protection devices will grow more quickly due to the increased demand for minimally invasive procedures. Embolic protection devices (EPD) during percutaneous cardiac surgeries have reduced the issues brought on by debris entering the bloodstream and obstructing smaller capillaries. This will boost the market's growth rate by increasing demand for embolic protection devices.

The increase in the population of older people is a crucial factor contributing to the market's growth. Additionally, rising healthcare costs and technological innovation are the main factors that will accelerate market expansion. The prevalence of cardiovascular and neurovascular illnesses is also expected to benefit the market's growth rate. On the other hand, substantial R&D expenditures and a rise in product failure and recall rates will restrain market expansion. Additionally, a rigorous regulatory environment and unfavourable government regulations will pose a hurdle to the market for embolic protection devices.

The Embolic protection devices market is segmented on the product, application, material and end-use. Based on the product, the market is segmented into distal occlusion systems, distal filters and proximal occlusion systems. Based on application, the embolic protection devices market is segmented into neurovascular disease, cardiovascular disease and peripheral disease. Based on the material, the embolic protection devices market is segmented into nitinol and polyurethane. Based on the end-user, the embolic protection devices market is segmented into ambulatory surgical centres, hospitals and others.

Based on the product, the market is segmented into distal occlusion systems, distal filters and proximal occlusion systems. The distal filters category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time attributed to the procedural advantages distal filter devices provide, including user comfort, enhanced visibility, and the device's crossing profile. In addition to the device's benefits, the global rise in the prevalence of cardiovascular and neurovascular disorders has further encouraged the segment's growth. According to the American Heart Association, almost 801,000 deaths in the United States are attributed to cardiovascular disease (CVD), accounting for around one in three fatalities in the nation. About 2,200 Americans every day, or one every 40 seconds, pass away from cardiovascular disease. According to statistics, the growing patient base leads to an increase in angioplasty operations and surgeries that call for an embolic prevention device, which drives the segment's expansion.

Based on application, the embolic protection devices market is segmented into neurovascular disease, cardiovascular disease and peripheral disease. The cardiovascular disease category is anticipated to grow significantly over the forecast period. Cardiovascular operations primarily involve embolic protection devices, then peripheral vascular diseases (PVDs). The prevalence of cardiovascular diseases (CVDs) is predicted to increase in line with the growing elderly population, which will be advantageous for the industry. A blood ailment called PVD causes arteries and veins outside the brain and heart to narrow due to plaque accumulation following surgery. According to the Centers for Disease Control and Prevention (CDC), PVD affects 12 to 20% of Americans who are 60 years or older in the United States. Because of the growing prevalence of lifestyle problems and increased knowledge of minimally invasive techniques, it is projected that the peripheral diseases market will have significant growth.

The North American embolic protection devices market is expected to register the highest market share in revenue shortly. Transcatheter aortic valve replacement (TAVR) procedures are becoming more popular in the area, and the number of patients with chronic illnesses is rising. These trends will influence the industry's future. The rise in obesity instances brought on by lifestyle modifications, unhealthy eating habits, and the large concentration of leading industry players in the region are additional factors that will favourably affect North American market statistics. Additionally, the Asia Pacific is anticipated to expand at a significant rate over the course of the forecast period. The market for embolic protection devices will grow more quickly due to end users being encouraged to use new products and technologically advanced methods. Additional factors fueling the market's growth include rising R&D expenditures, technologically advanced infrastructure in the region, and rising healthcare costs.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 640.50 Million |

| Revenue Forecast In 2034 | USD 1282.97 Million |

| Growth Rate CAGR | CAGR of 7.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million, volume (units) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, Application, Material, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Abbott Laboratories, Allium Medica, Boston Scientific Corporation, Cardinal Health, Contego Medical, LLC, Edwards Lifesciences Corporation, W. L. Gore & Associates (Gore Medical), Innovative Cardiovascular Solutions, LLC, Keystone Heart, Medtronic, Metactive Medical, and Transverse Medical, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By Application-

By Material-

By End-Use-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.