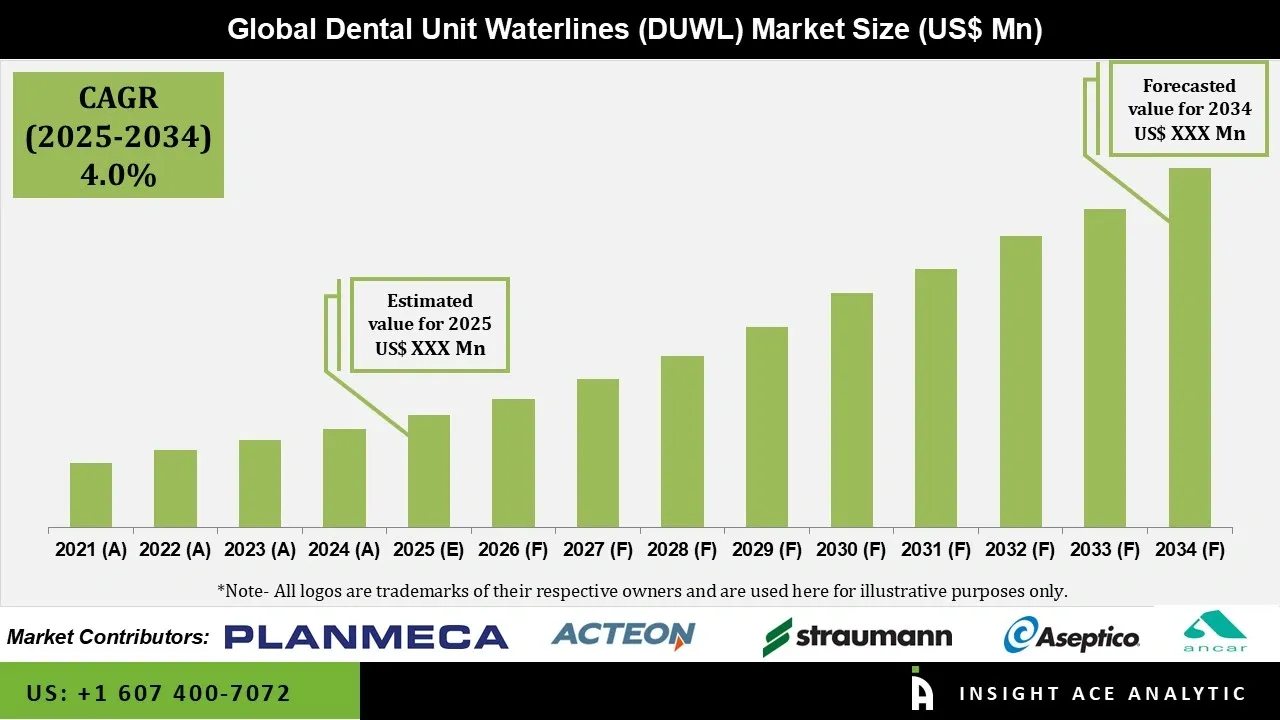

Dental Unit Waterlines (DUWL) Market is predicted to reach at a 4.0% CAGR during the forecast period for 2025-2034.

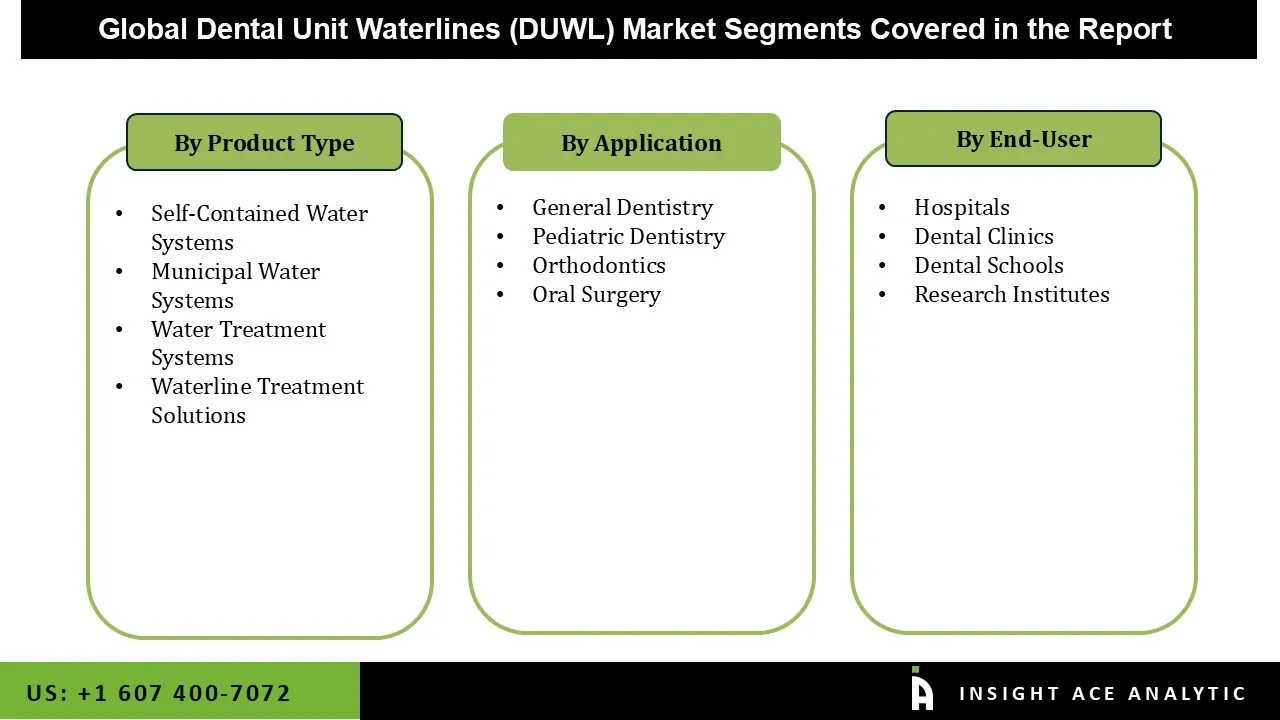

Dental Unit Waterlines (DUWL) Market Size, Share & Trends Analysis Distribution by Type (Self-Contained Water Systems, Waterline Treatment Solutions, Water Treatment Systems, and Municipal Water Systems), Application (General Dentistry, Orthodontics, Pediatric Dentistry, and Oral Surgery), End-user (Dental Clinics, Hospitals, Dental Schools, and Research Institutes), and Segment Forecasts, 2025-2034

The thin, flexible tubing systems in dental chairs that provide water to handpieces, air-water syringes, and ultrasonic scalers are called Dental Unit Waterlines (DUWL). These lines can readily form biofilms—layers of bacteria that stick to the inner surfaces—because they are tiny in diameter and frequently contain stagnant or slowly moving water. DUWL can contain high quantities of germs if it is not properly maintained, which could put patients and dental personnel at risk for infection.

These lines are necessary to ensure seamless clinical operations, cool tools, and to rinse the mouth. The growing awareness of dental hygiene and the significance of infection control in dental practices is driving the market expansion for dental unit waterline testing. Additionally, the demand for sophisticated DUWL solutions is increased by the expansion of the dentistry business and the rise in dental units installed globally.

The industry is also being driven ahead by growing regulatory demand on dental clinics to maintain sterile and safe conditions. Additionally, the requirement for effective waterline test kits indicates a promising future for the market, as dental professionals are more than ever seeking to provide a safe environment where both patients and staff can enjoy peace of mind. The industry is also being driven by technological improvements in waterline testing techniques.

Dental practices can more easily comply with health requirements due to the development of modern testing kits and methods that are quick, accurate, and user-friendly. Furthermore, advanced DUWL systems with greater antibacterial qualities, better self-cleaning mechanisms, and better water quality monitoring systems have been developed as a result of dental technological improvements. Thus, the need for sophisticated DUWL systems that are both economical and effective for dental offices has increased as a result of these developments.

In addition, stricter regulations from health authorities like the U.S. Centers for Disease Control and Prevention (CDC), which advise that water used in non-surgical dental procedures contain no more than 500 colony-forming units per milliliter (CFU/mL) of heterotrophic water bacteria in accordance with the Environmental Protection Agency's (EPA) standards for drinking water, further encourage the adoption of such technologies. Moreover, the CDC states that the microbiological guidelines for water used in dental units should be the same as those for drinking water.

The need for high-quality DUWL systems is increasing due to the significance of safe and clean water in dental offices, which is driving market expansion. However, the technological complexity of efficiently maintaining and cleaning waterlines is one of the primary obstacles in the DUWL business. Despite the sophisticated features of contemporary DUWL systems, many dental offices still find it difficult to establish efficient cleaning procedures.

• KaVO Dental

• ACTEON GROUP

• Aixin Medical Equipment

• Planmeca

• Castellini

• ANCAR Dental

• Straumann

• Aseptico Inc.

• Bien-Air Dental

• Cefla Dental

The need for high-quality waterlines is rising as a result of the growing emphasis on preventative care and the ageing of the global population. The need for safe and efficient waterline systems will keep growing as more people seek dental care to address age-related oral health issues.

For businesses providing cutting-edge DUWL solutions that satisfy the changing demands of the dental sector, this change offers a huge opportunity. Additionally, the businesses can profit from the growing need for safe, effective water systems that enhance patient outcomes and uphold high standards of care by focusing on both new and current dental practices. Thus, this is anticipated to boost the dental unit waterlines (DUWL) market expansion.

The high expense of waterline cleaning technologies and sophisticated DUWL systems is one of the main obstacles. It may be challenging for small and medium-sized dental offices to make the costly investments in waterline maintenance systems, especially in developing nations. Due to the delayed adoption of cutting-edge dental equipment in these areas compared to developed markets, this restricts the market potential.

In certain areas, there is also a dearth of knowledge and instruction regarding the significance of DUWL upkeep. Dental professionals may not prioritize waterline cleaning in many regions of the world because of the perceived expenses and time commitment associated with maintaining these systems. This may lead to microbiological contamination, which raises the possibility of infection and cross-contamination, ultimately compromising patient safety and the reputation of the clinic.

The self-contained water systems category held the largest share in the dental unit waterlines (DUWL) market in 2024, mostly due to tighter water quality regulations in dental settings and growing awareness of infection control. The clinics can better control water quality and reduce the risk of microbial contamination by using self-contained systems, which use independent reservoirs (typically bottle-based) instead of depending only on municipal water.

Additionally, the need for self-contained systems has increased as dental offices implement stricter procedures to adhere to regulations suggesting water quality at or below drinking water levels and to lower dangers associated with biofilm for patients and employees. Dental practitioners have been urged to invest in cutting-edge water distribution and treatment technologies due to the emphasis on patient safety and regulatory compliance; self-contained systems offer a workable solution for constant water quality.

The dental unit waterlines (DUWL) market is structured by three key segmentation categories. By type, it encompasses the various water delivery and treatment systems used in practice, including self-contained water systems, waterline treatment solutions, water treatment systems, and reliance on municipal water systems. Segmentation by application reflects the different dental specialties driving demand, such as general dentistry, orthodontics, pediatric dentistry, and oral surgery. Finally, the market is analyzed by end-user, identifying the primary settings where these systems are implemented: dental clinics, hospitals, dental schools, and research institutes. This framework organizes the market by technology, clinical use, and operational environment.

In 2024, the hospitals category dominated the dental unit waterlines (DUWL) market because the number of dental operations carried out in hospital settings is increasing. Hospitals frequently have specialized dentistry units with cutting-edge equipment, and keeping waterlines clean in these settings is essential to preventing infections. The risk of cross-contamination is decreased by installing advanced waterline systems, which guarantee that water used in dental treatments is cleaned, filtered, and sterilized. Furthermore, hospitals usually handle more dental patients, which raises the need for DUWL systems to guarantee constant water quality and patient safety throughout treatments.

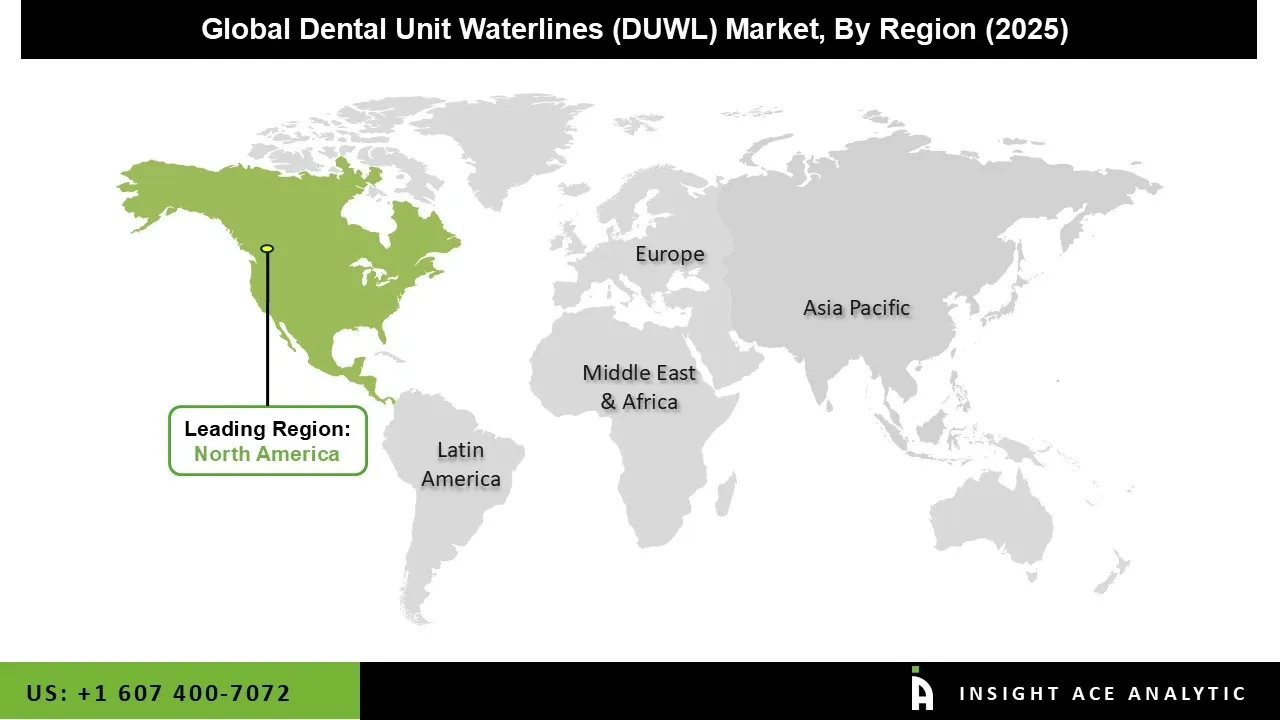

The dental unit waterlines (DUWL) market was dominated by the North America region in 2024, mostly due to extremely strict guidelines and rules on infection control in the medical industry, particularly dentistry offices.

The most important factors driving the need for and demand for such services and goods in this region are patient safety, high-quality care, and the widespread use of the newest dental technologies and procedures. Furthermore, North America continues to hold the top spot in the dental unit waterlines (DUWL) market due to the presence of numerous important industry participants and initiatives to inform the public about good dental hygiene in this area.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 4.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | KaVO Dental, ACTEON GROUP, Aixin Medical Equipment, Planmeca, Castellini, ANCAR Dental, Straumann, Aseptico Inc., Bien-Air Dental, and Cefla Dental. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Dental Unit Waterlines (DUWL) Market by Type-

• Self-Contained Water Systems

• Waterline Treatment Solutions

• Water Treatment Systems

• Municipal Water Systems

Dental Unit Waterlines (DUWL) Market by Application-

• General Dentistry

• Orthodontics

• Pediatric Dentistry

• Oral Surgery

Dental Unit Waterlines (DUWL) Market by End-user-

• Dental Clinics

• Hospitals

• Dental Schools

• Research Institutes

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Dental Unit Waterlines (DUWL) Market Snapshot

Chapter 4. Global Dental Unit Waterlines (DUWL) Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2025-2034

4.8. Global Dental Unit Waterlines (DUWL) Market Penetration & Growth Prospect Mapping (US$ Mn), 2024-2034

4.9. Competitive Landscape & Market Share Analysis, By Key Player (2024)

4.10. Use/impact of AI on DENTAL UNIT WATERLINES (DUWL) MARKET Industry Trends

Chapter 5. Dental Unit Waterlines (DUWL) Market Segmentation 1: By Product Type, Estimates & Trend Analysis

5.1. Market Share by Product Type, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Product Type:

5.2.1. Self-Contained Water Systems

5.2.2. Municipal Water Systems

5.2.3. Water Treatment Systems

5.2.4. Waterline Treatment Solutions

Chapter 6. Dental Unit Waterlines (DUWL) Market Segmentation 2: By Application, Estimates & Trend Analysis

6.1. Market Share by Application, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Application:

6.2.1. General Dentistry

6.2.2. Pediatric Dentistry

6.2.3. Orthodontics

6.2.4. Oral Surgery

Chapter 7. Dental Unit Waterlines (DUWL) Market Segmentation 3: By End-User, Estimates & Trend Analysis

7.1. Market Share by End-User, 2024 & 2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following End-User:

7.2.1. Hospitals

7.2.2. Dental Clinics

7.2.3. Dental Schools

7.2.4. Research Institutes

Chapter 8. Dental Unit Waterlines (DUWL) Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. Global Dental Unit Waterlines (DUWL) Market, Regional Snapshot 2024 & 2034

8.2. North America

8.2.1. North America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.2.1.1. US

8.2.1.2. Canada

8.2.2. North America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.2.3. North America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.2.4. North America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.3. Europe

8.3.1. Europe Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.3.1.1. Germany

8.3.1.2. U.K.

8.3.1.3. France

8.3.1.4. Italy

8.3.1.5. Spain

8.3.1.6. Rest of Europe

8.3.2. Europe Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.3.3. Europe Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.3.4. Europe Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.4. Asia Pacific

8.4.1. Asia Pacific Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.4.1.1. India

8.4.1.2. China

8.4.1.3. Japan

8.4.1.4. Australia

8.4.1.5. South Korea

8.4.1.6. Hong Kong

8.4.1.7. Southeast Asia

8.4.1.8. Rest of Asia Pacific

8.4.2. Asia Pacific Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.4.3. Asia Pacific Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.4.4. Asia Pacific Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts By End-User, 2021-2034

8.5. Latin America

8.5.1. Latin America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

8.5.1.1. Brazil

8.5.1.2. Mexico

8.5.1.3. Rest of Latin America

8.5.2. Latin America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.5.3. Latin America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.5.4. Latin America Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

8.6. Middle East & Africa

8.6.1. Middle East & Africa Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.6.1.1. GCC Countries

8.6.1.2. Israel

8.6.1.3. South Africa

8.6.1.4. Rest of Middle East and Africa

8.6.2. Middle East & Africa Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

8.6.3. Middle East & Africa Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.6.4. Middle East & Africa Dental Unit Waterlines (DUWL) Market Revenue (US$ Million) Estimates and Forecasts by End-User, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. ACTEON GROUP

9.2.1.1. Business Overview

9.2.1.2. Key Product Type/Service

9.2.1.3. Financial Performance

9.2.1.4. Geographical Presence

9.2.1.5. Recent Developments with Business Strategy

9.2.2. Planmeca

9.2.3. Aixin Medical Equipment

9.2.4. ANCAR Dental

9.2.5. Straumann

9.2.6. Aseptico Inc

9.2.7. Bien-Air Dental

9.2.8. Castellini

9.2.9. Cefla Dental

9.2.10. KaVO Dental