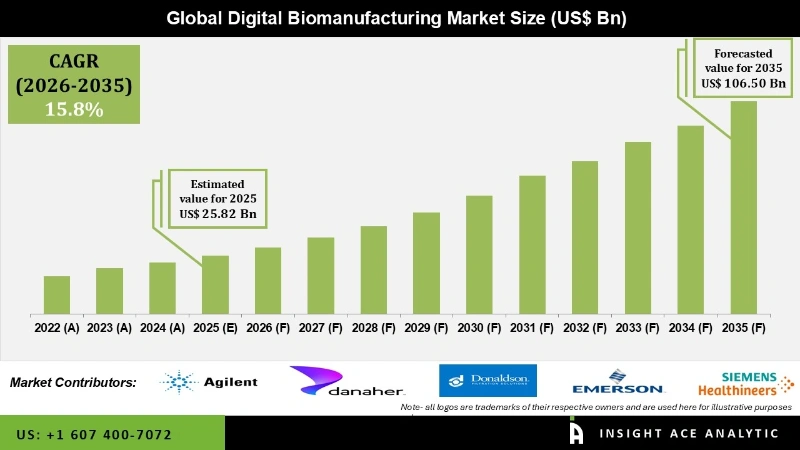

The Digital Biomanufacturing Market Size is valued at USD 25.82 Billion in 2025 and is predicted to reach USD 106.50 Billion by the year 2035 at a 15.8 % CAGR during the forecast period for 2026 to 2035.

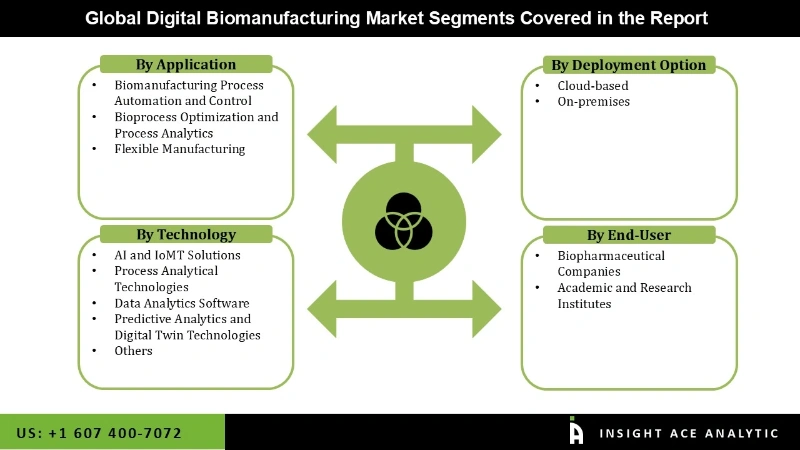

Digital Biomanufacturing Market Size, Share & Trends Analysis Report By Application (Biomanufacturing Process Automation and Control, Bioprocess Optimization and Process Analytics, Flexible Manufacturing), By Technology, Deployment option, By End-User, Region And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The biopharmaceutical industry's tremendous expansion has brought about new opportunities for patient care and difficulties in production. Numerous cutting-edge medical techniques make use of speciality medications that are designed to treat limited patient populations, and this indicates that substantially less drug production occurs. Manufacturers must therefore increase their operational effectiveness to lower total drug development and production costs in order to satisfy the public's need for affordable access to new medications. The Industry 4.0 paradigm will assist in achieving this objective. Using digital technologies in manufacturing processes, such as computer-aided design and computer-assisted machining, is known as "digital biomanufacturing." By enhancing manufacturing cycles, the use of these technologies can assist raise quality and safety requirements while also lowering costs. With robotic automation systems like microfluidic devices, digital biomanufacturing enables increased precision in cell cultures or tissue engineering. It also makes it possible to remotely monitor individual units using embedded sensors that transmit data back to operators via wireless networks, enabling more effective management of inventory levels during manufacturing.

The digital biomanufacturing market is segmented on the basis of application, end-user, deployment option and technology. Based on application, the market is segmented as Biomanufacturing Process Automation and Control, Bioprocess Optimization and Process Analytics, and Flexible Manufacturing. By end-user, the market is segmented into Biopharmaceutical Companies and Academic and Research Institutes. As per the Deployment Option, the market is categorized into Cloud-based and On-premises. Technology segments the market into AI and IoMT Solutions, Process Analytical Technologies, Data Analytics Software, Predictive Analytics and Digital Twin Technologies, and Others.

Digital biomanufacturing is utilized in process analytics and bioprocess optimization to track, enhance, and manage bioprocesses. By processing algorithms on a computer to be tuned for the process before being moved to an industrial system where it can run automatically without human involvement, it helps. As a result of these systems' greater accuracy and ability to decrease errors made during manual operation processes, activities become more efficient. These features are driving the bioprocess optimization and process analytics segment in the market.

The Internet of Medical Things (IoMT) was formed as a result of the increase in linked medical devices, improvements in the hardware and software that enable the collection and transfer of medical-grade data, and connectivity technologies and services. The IoMT integrates the physical and digital worlds to enhance diagnostic and treatment speed and accuracy as well as to track and adjust patient behaviour and health status in real-time. Streamlining clinical processes, information, and workflows also raises the operational productivity and effectiveness of healthcare organizations. An increasing geriatric population, with more people living longer but with many comorbidities, is partly responsible for the increase of AI and IoMT solutions.

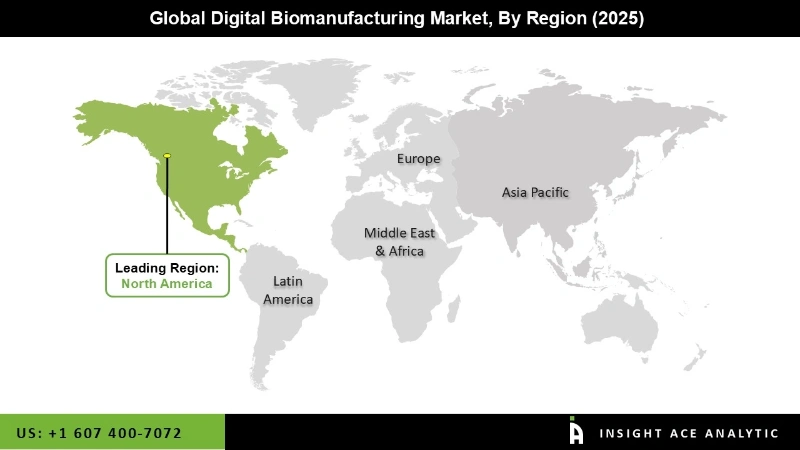

North America has the largest revenue share owing to its sophisticated healthcare system and substantial demand for biologics. North American businesses are increasingly opting to digitize their biologics. Furthermore, industrial organizations are investing a lot in digital technology and related assets to improve production efficiency and lower operating costs. Governments in the area are sponsoring research and development programmes to set up cutting-edge sensor networks, process controls, and data analytics in industrial firms to boost productivity and energy efficiency. Canadian manufacturers are investing in the conversion of physical factories into digital factories. They are largely concentrating on supply chain collaboration, automation and robotics, and intelligent floor sensors. As a result, the Canadian market is anticipated to display an extraordinary CAGR over the forecast period.

Recent Developments:

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 25.82 Billion |

| Revenue Forecast In 2035 | USD 106.50 Billion |

| Growth Rate CAGR | CAGR of 15.8 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Technology, By Application, By End-User, Deployment option |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies Inc., Danaher Corporation, Donaldson Company, Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., SAP SE, Siemens Healthineers AG, Bota Biosciences, Culture Biosciences, e-matica srl, Exponential Genomics, Inc. (Xenomics), FabricNano, OVO Biomanufacturing, Symphony Innovation, LLC, Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Application -

By End-user-

By Deployment Option-

By Technology-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.