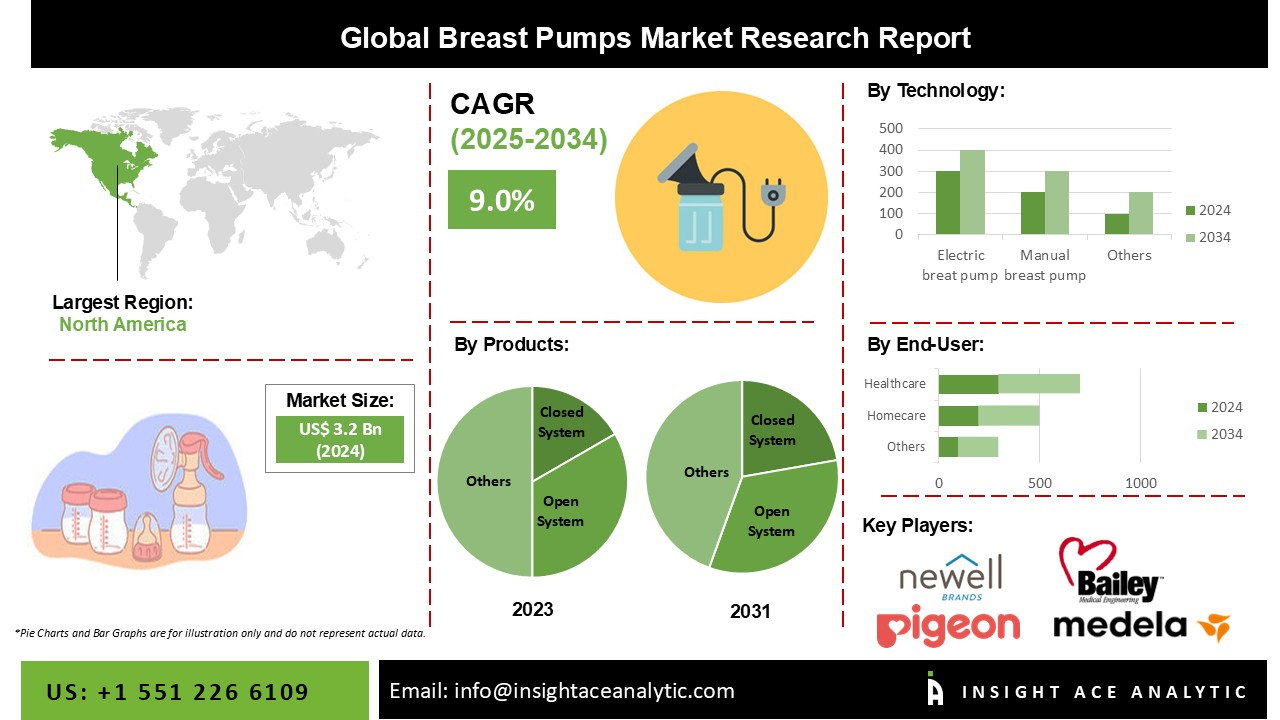

Breast Pump Market Size is valued at 3.2 Billion in 2024 and is predicted to reach 7.5 Billion by the year 2034 at a 9.0% CAGR during the forecast period for 2025-2034.

Breast pumps are primarily used to ease breast pain and deliver breast milk to babies who cannot sip milk on their own. The market is expected to rise due to increasing innovation in breast pumps by industry participants. Additionally, factors such as advancing knowledge of the advantages of using a breast pump, such as convenience, affordability, ease of soothing, and enhanced milk production, as well as insufficient maternity leave periods, are likely to drive market expansion throughout the forecast period.

The availability of breast milk substitutes, declining birth rates, an ageing population, and concerns about pumping efficiency are projected to restrict market growth throughout the projection period. Launching innovative products that are easy to carry and use is expected to provide profitable growth opportunities for breast pump market players in the future. Furthermore, laws allowing public breastfeeding for the protection of mothers and the development of infant health are expected to raise knowledge about the benefits of breastfeeding and, as a result, boost the market growth over the upcoming years. However, the high cost of breast pumps, the availability of synthetic chemicals, and the COVID-19 outbreak may impede the growth of the target market throughout the projection period.

The breast pump market is segmented based on product type, technology, end-users and region. Based on product type, the market is segmented as closed system breast pumps and open system breast pumps. Based on technology, the market is segmented into manual breast pumps and electric breast pumps. Based on end-users, the market is segmented as homecare settings and healthcare facilities.

The closed system breast pump category is expected to hold a significant share in the global breast pump market in 2021. Breast pumps with a secure system are safer for the child's health, assure optimum impurity removal, and are simple to clean. Over the forecast period, the development of portable instruments such as Amanda Hygienic by Amanda is expected to drive market growth. The closed breast pump has a more hygienic milk collection mechanism because it is not exposed to air, whereas the open system lacks a barrier between the milk collection kit and the pumping unit, posing a risk of milk contamination from impurities in the air such as bacteria, smoke, and dust, as well as a mound.

The electric pumps segment is projected to grow rapidly in the global breast pump market. A motor drives electric breast pumps, which deliver suction through plastic tubing to a horn that fits over the nipple. It has a lot higher suction, which makes pumping faster and allows you to pump both breasts at the same time. Electric pumps are preferred by working women because they can extract more milk in less time. When compared to a regular pump, the double pumping device saves time. Electric pumps are sometimes heavy and noisy, but manufacturers are continuing to apply modern technologies to make lighter, quieter pumps., especially in countries such as the US, Germany, UK, China, and India.

The North America breast pump market is expected to register the highest market share in terms of revenue soon. This is due to a growth in breastfeeding awareness, a surge in the use of technologically improved items, and an increase in healthcare spending in the region. However, due to its large baby boomer generation, rising disposable budgets, and unmet desires, Asia-Pacific is expected to see a significant rise in the breast pump market size. Furthermore, legislation enabling public breastfeeding for the protection of mothers and the promotion of infant health is expected to raise knowledge about the benefits of breastfeeding and, as a result, boost the market growth.

Breast Pump Market Report Scope

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 3.2 Billion |

| Revenue Forecast In 2031 | USD 7.5 Billion |

| Growth Rate CAGR | CAGR of 9.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, Technology, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Newell Brands, Amada Inc., Hygeia Health, Bailey Medical, Coinlike Philips N.V., Medea LLC, May born Group Ltd., Pigeon Corporation, Linc Baby Merchandise Works Co., Ltd, Ardo, Bedlike, BISTOS , Breed, CA-MI, Freebie |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Products

By Technology

By End-Users

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.