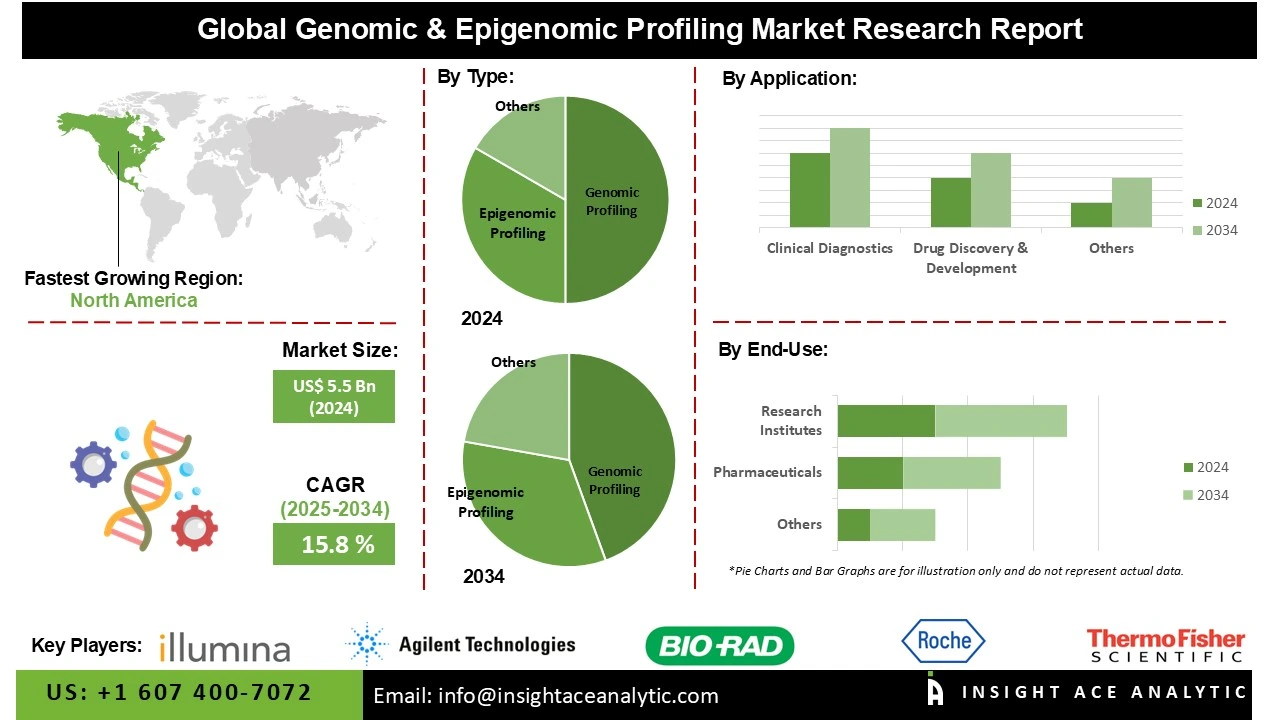

Genomic & Epigenomic Profiling Market Size is valued at US$ 5.5 Bn in 2024 and is predicted to reach US$ 23.2 Bn by the year 2034 at an 15.8% CAGR during the forecast period for 2025-2034.

Genomic and epigenomic profiling are advanced analytical approaches used to understand the genetic blueprint of an organism and the regulatory mechanisms that control gene expression. Genomic profiling identifies variations in DNA sequences, such as mutations, copy-number changes, and structural alterations that influence disease susceptibility and therapeutic response.

Epigenomic profiling, on the other hand, examines reversible chemical modifications such as DNA methylation, histone modifications, and chromatin accessibility that determine how genes are turned on or off without altering the underlying DNA. Together, these profiling techniques provide comprehensive insights into disease mechanisms, enabling precision medicine, biomarker discovery, and targeted therapeutic development. The market's expansion is primarily attributable to advancements in genomic and epigenomic sequencing technology, rising rates of cancer and uncommon diseases, and a growing emphasis on individualized healthcare solutions worldwide.

In addition, increased investments by pharmaceutical and biotech companies in the development of targeted medicines will accelerate the expansion of the genomic and epigenomic profiling market over the forecast period. Increased government financing, expanded research activities, and increased clinical trial inclusion for genetic profiling are all contributing to market growth.

The surge in precision medicine, driven by genetic insights, as well as the development of regulatory approvals for companion diagnostics, is driving global expansion of the genomic and epigenomic profiling market. Furthermore, improvements in NGS have become a cornerstone in the global genomic and epigenomic profiling market. These NGS technologies offer a paradigm leap in genomic analysis, providing unsurpassed speed, scalability, and cost-efficiency when compared to traditional sequencing approaches.

Some of the Key Players in Genomic & Epigenomic Profiling Market:

· Illumina

· Thermo Fisher Scientific

· Agilent Technologies

· Bio-Rad Laboratories

· Roche

· Qiagen

· PerkinElmer

· Pacific Biosciences

· BGI Genomics

· New England Biolabs

· Merck KGaA

· Diagenode

· Promega Corporation

· 10x Genomics

· Oxford Nanopore Technologies

· QIAGEN

· Zymo Research

· Fulgent Genetics

· GENEWIZ

· Eurofins Scientific

· Invitae

· Myriad Genetics

· Adaptive Biotechnologies

· Guardant Health

· Invivoscribe

· Others

The genomic & epigenomic profiling market is segmented by type, application, technology, and end-use. By type, the market is segmented into genomic profiling and epigenomic profiling. By application, the market is segmented into clinical diagnostics, agriculture & animal research, and drug discovery & development. By technology, the market is segmented into NGS, PCR-based, and microarray. By end-use, the market is segmented into hospitals, pharmaceuticals, and research institutes.

The genomic profiling segment held the largest share in the market. The expanding demand for gene therapy, customized medicine, and drug development, the rising incidence of cancer, and the notable rise in consumer genomics demand in recent years are all factors contributing to the growth of the genomics profiling category in the genomic and epigenomic profiling market. Additionally, it is anticipated that the expansion of this segment would benefit from increased joint ventures and collaborations among market participants.

In 2024, the global genomic and epigenomic profiling market was dominated by the hospitals segment. This is because the application of genomic and epigenomic profiling technologies for precision medicine, especially in oncology, is heavily influenced by hospitals. They have the infrastructure, knowledge, and patient data needed to facilitate the smooth integration of genomic and epigenomic profiling into standard clinical procedures. Additionally, the segemnt’s dominance is partly due to patients' and healthcare professionals' growing knowledge of the advantages of personalized medicine.

In 2024, the North American region dominated the genomic and epigenomic profiling market. The existence of cutting-edge healthcare infrastructure, high adoption of advanced diagnostic tools, and substantial investments in genomic and epigenomic research and development provide the foundation for this leadership position. Leading genomic and epigenomic technology suppliers, academic institutions, and reference labs are concentrated in the United States, in particular, which propels market expansion and innovation. Additionally, the region's dominance in the worldwide genomic and epigenomic profiling market is further enhanced by favorable reimbursement policies, supportive regulatory frameworks, and a strong emphasis on precision medicine.

During the projection period, the Asia Pacific region is expected to grow at the fastest rate in the genomic and epigenomic profiling market, driven by rising healthcare costs, greater awareness of chronic illnesses, and increased investments in healthcare infrastructure. Furthermore, the growing healthcare industry and the increasing emphasis on precision medicine have made countries such as China, Japan, and India significant contributors to the genomic and epigenomic profiling market. The market expansion in this area is also anticipated to be fueled by the rising incidence of chronic illnesses and the growing curiosity about their origins.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 5.5 Bn |

| Revenue Forecast In 2034 | USD 23.2 Bn |

| Growth Rate CAGR | CAGR of 15.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Technology, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Illumina, Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, Roche, Qiagen, PerkinElmer, Pacific Biosciences, BGI Genomics, New England Biolabs, Merck KGaA, Diagenode, Promega Corporation, 10x Genomics, Oxford Nanopore Technologies, QIAGEN, Zymo Research, Fulgent Genetics, GENEWIZ, Eurofins Scientific, Invitae, Myriad Genetics, Adaptive Biotechnologies, Guardant Health, and Invivoscribe |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Genomic & Epigenomic Profiling Market by Type

· Genomic Profiling

· Epigenomic Profiling

Genomic & Epigenomic Profiling Market by Application

· Clinical Diagnostics

· Agriculture & Animal Research

· Drug Discovery & Development

Genomic & Epigenomic Profiling Market by Technology

· NGS

· PCR-based

· Microarray

Genomic & Epigenomic Profiling Market by End-use

· Hospitals

· Pharmaceuticals

· Research Institutes

Genomic & Epigenomic Profiling Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.