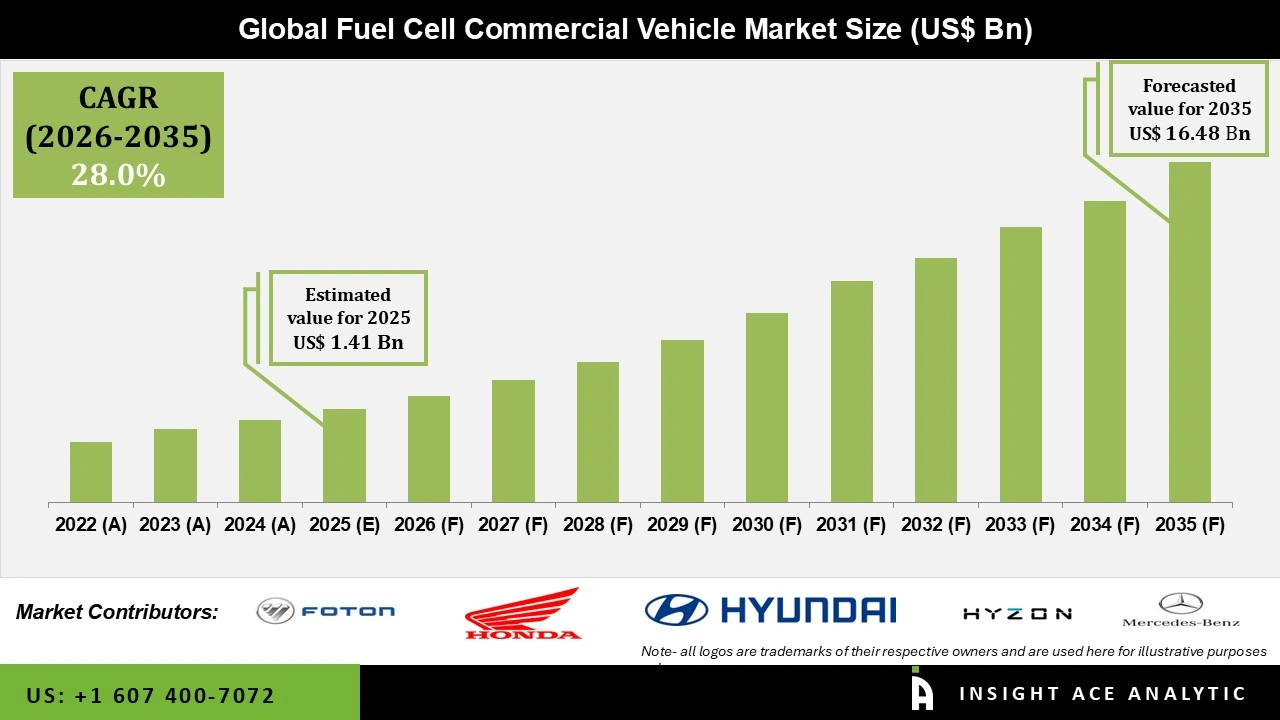

Global Fuel Cell Commercial Vehicle Market Size is valued at USD 1.41 Bn in 2025 and is predicted to reach USD 16.48 Bn by the year 2035 at an 28.0% CAGR during the forecast period for 2026 to 2035.

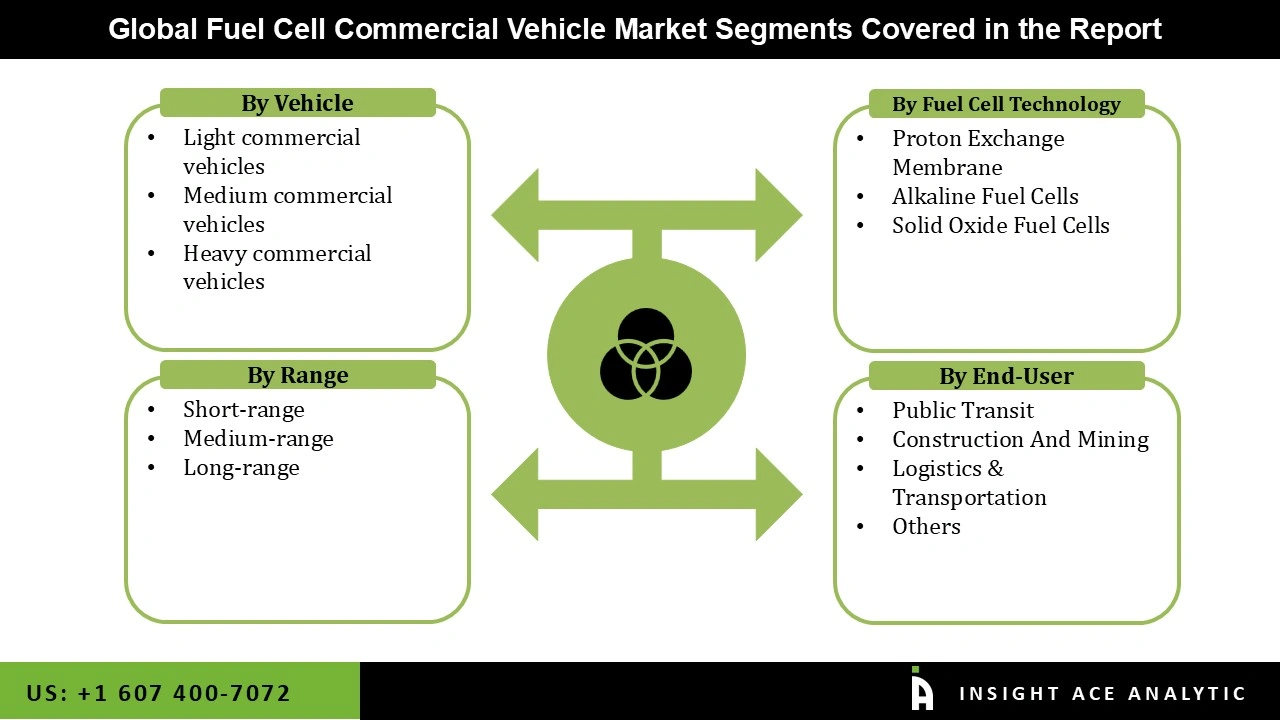

Fuel Cell Commercial Vehicle Market Size, Share & Trends Analysis Distribution by Vehicle (Light Commercial Vehicles, Medium Commercial Vehicles, Heavy Commercial Vehicles), Fuel Cell Technology (Proton Exchange Membrane, Alkaline Fuel Cells, Solid Oxide Fuel Cells), Range (Short-Range, Medium-Range, Long-Range), End User and Segment Forecasts, 2026 to 2035.

The commercial vehicle market for fuel cells is rapidly taking off as a sustainable solution for the transportation sector. Hydrogen-fueled cells produce electricity by combining hydrogen and oxygen, and vehicles emit just water vapor, which makes it clean compared with most options that are transported via fossil-based transport vehicles. Applications range from logistics to public transportation systems and heavy-duty trucking in cities with strict emissions regulations. In some cases, this has led to the designing of buses, trucks, and forklifts.

The primary driver for this market's growth is the global interest to reduce greenhouse gas emissions. Hydrogen fuel cells become a more viable alternative in achieving sustainability targets as governments step up the implementation of strict climate regulations. Hydrogen fuel cells enable faster refueling and greater driving ranges than those of battery electric vehicles, making them an attractive option for fleet operators seeking to improve operational efficiency without increasing their carbon footprint.

The fuel cell commercial vehicle market is vehicle, fuel cell technology, range, end user. By vehicle the market is segmented into light commercial vehicles, medium commercial vehicles, heavy commercial vehicles, by fuel cell technology market is categorized into proton exchange membrane, alkaline fuel cells, solid oxide fuel cells. By range market is categorized into short-range, medium-range, long-range. By end user the market is categorized into public transit, construction and mining, logistics & transportation, others.

Light commercial vehicles will drive growth in the market because they offer efficiency and suitability for sustainable transport. Hydrogen fuel cell light commercial vehicles average five minutes at refuelling, which is much faster than any battery electric vehicle and, therefore, marketable for businesses whose days are stitched up around uptime, such as courier and delivery services. These zero-emission vehicles emit only water vapor. Hydrogen fuel cell LCVs meet stricter urban emission standards and align with corporate sustainability initiatives. Like their diesel counterparts, they preserve full payload capacity without compromising cargo space, ensuring efficient operations. This versatility makes them useful in grocery delivery, parcel services, and utility operations. This in turn aids better penetration of hydrogen technology into the market by increasing interest in hydrogen technology as a viable solution for diverse commercial applications.

Proton Exchange Membrane Fuel Cells (PEMFCs) drive significant growth in the fuel cell commercial vehicle market, particularly in light and medium commercial vehicles. Their high efficiency, quick start-up times, and ability to operate at low temperatures make them ideal for commercial vehicles requiring rapid acceleration. PEMFCs produce zero emissions, emitting only water vapor, aligning with regulatory demands for cleaner cars. Additionally, they are more compatible with existing hydrogen production and distribution infrastructure than other fuel cell technologies, which eases adoption. Their versatility across various applications, from buses to trucks and vans, further enhances their appeal in the market.

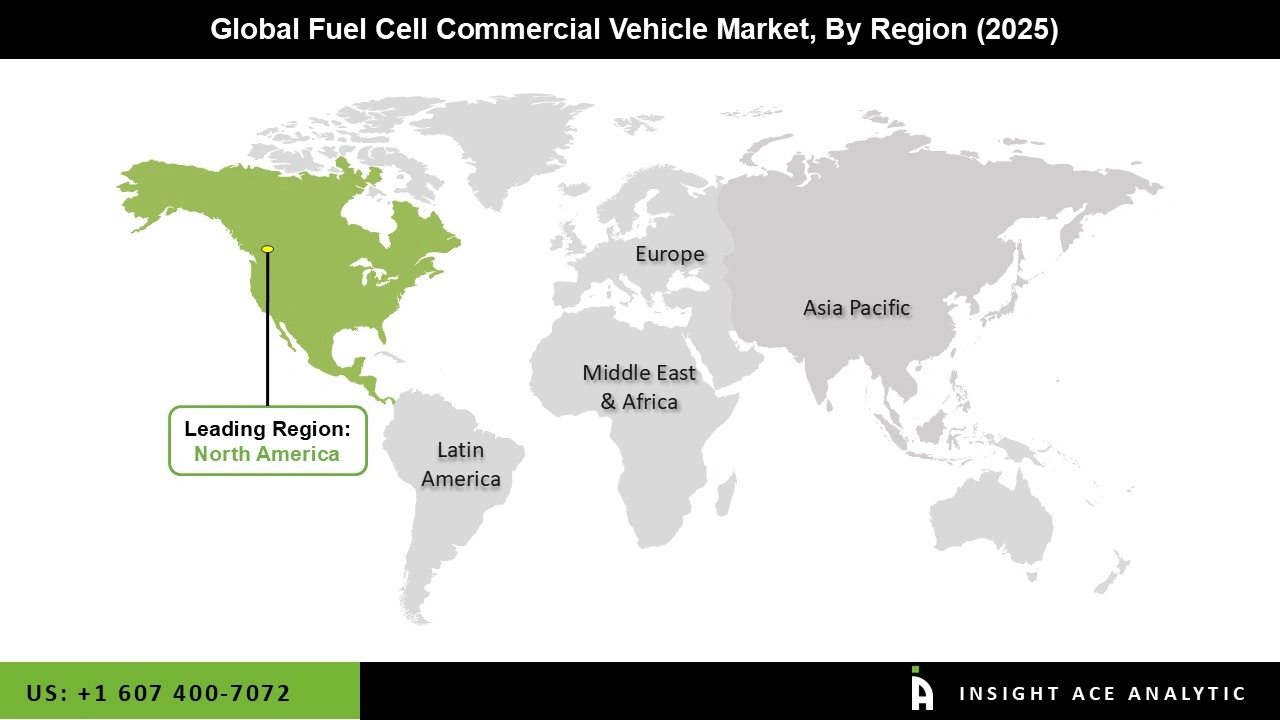

The APAC region dominates the fuel cell commercial vehicle market, motivated by support from governments and an increasing demand for zero-emission vehicles with investment in a well-placed infrastructure. Countries such as China and Japan have launched fiscal incentives and subsidies to fuel the adoption of hydrogen fuel cells, while Japan has implemented a strategic plan along with a road map to develop hydrogen fueling stations.

Drivers for fuel cell-based commercial vehicles include rising environmental awareness and rigorous emissions regulation, which is yet another factor driving the demand for cleaner solutions to transportation. The strong manufacturing base in APAC, especially with companies such as Toyota and Hyundai now producing hydrogen-powered vehicles besides Geely, further cements the region's leadership in this market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.41 Bn |

| Revenue Forecast In 2035 | USD 16.48 Bn |

| Growth Rate CAGR | CAGR of 28.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Vehicle, Fuel Cell Technology, Range, End User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Foton Motor, Honda Motor, Hyundai Motor, Hyzon Motors, Mercedes-Benz Group, New Flyer, Nikola, PACCAR, Renault, Solaris Bus & Coach, Tata Motors, Toyota Motor Company, Volkswagen Group (Scania), Volvo Group, Zhejiang Geely Holding Group |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.