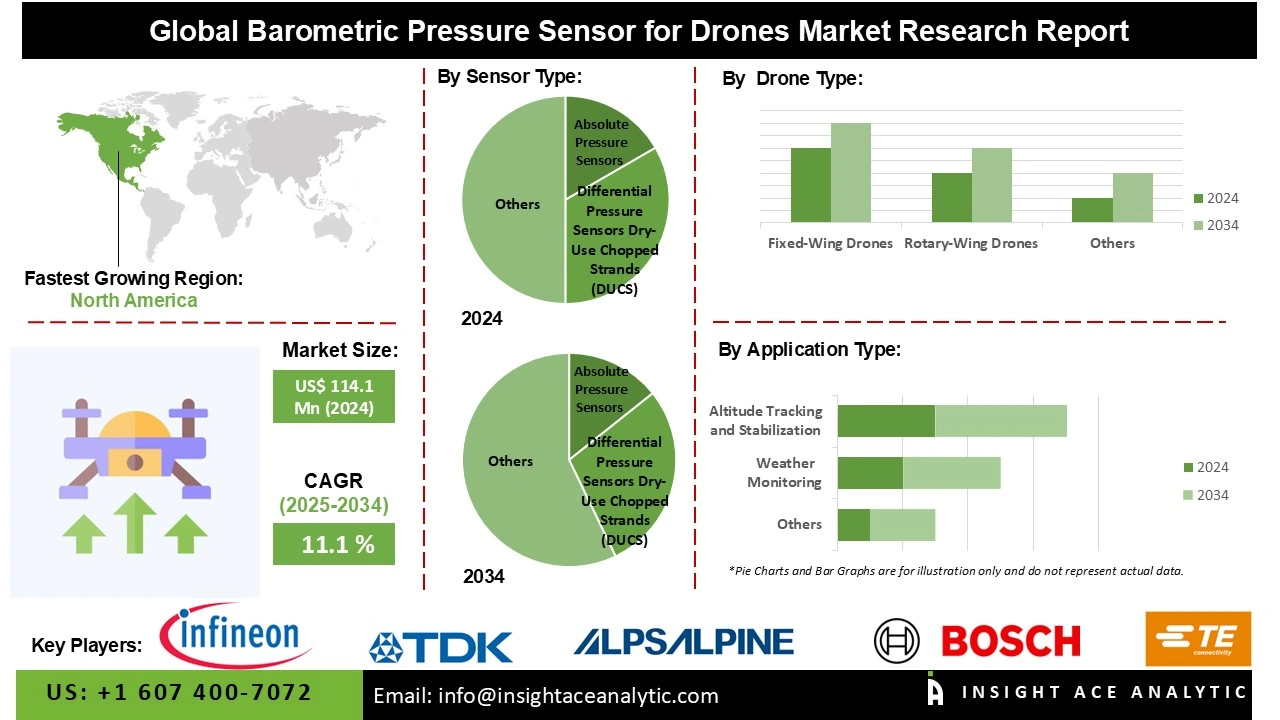

Global Barometric Pressure Sensor for Drones Market Size is valued at US$ 114.1 Mn in 2024 and is predicted to reach US$ 313.6 Mn by the year 2034 at an 11.1% CAGR during the forecast period for 2025-2034.

Drones equipped with barometric pressure sensors can recognize changes in atmospheric pressure as they ascend and descend, allowing the drones to determine their altitude and ensure a stable flight altitude for accurate navigation. Barometric pressure sensors are necessary for operation in autonomous, obstacle detection, aerial mapping, surveying, and delivery, and are essential for precision in agricultural for crop monitoring and spraying. They are also necessary for construction and infrastructure for inspections and topographic mapping. In emergency work and disaster management, drones utilize barometric pressure sensors to maneuver safely in challenging environments.

The global market for barometric pressure sensor for drones is expanding as drones with barometric pressure sensors can achieve accurate control of altitude for medical deliveries on demand that previously lacked efficiency, safety, and prompt air transport of a timely and critical healthcare supply.

The continued growth and expansion of commercial drone uses is another element propelling the barometric pressure sensor for drones market. The rapid expansion of commercial drone applications in logistics, agriculture, and aerial mapping boosts demand for barometric pressure sensors, ensuring precise altitude control, stable flight performance, and enhanced operational safety. However, medium barriers to not adopting barometric pressure sensors for drone use include high sensor cost, environmental sensitivity, complexity of integration, competition from alternative altitude sensors. Emerging factors expected to drive opportunities in the barometric pressure sensor for drone market will be increased adoption of commercial drones, technology advancements in high accuracy sensors, and application development in agriculture, logistics, surveillance, and emergency services over the projected period.

Some of the Key Players in Barometric Pressure Sensor for Drones Market:

· Infineon Technologies AG

· TDK Corporation

· ALPS ALPINE CO., LTD.

· Bosch Sensortec GmbH

· TE Connectivity

· Murata Manufacturing Co., Ltd.

· STMicroelectronics

· Honeywell International Inc

· Ams AG

· Amphenol All Sensors

· Setra Systems

· DJI Innovations

· Parrot SA

· Yuneec International

The barometric pressure sensor for drones market is segmented by sensor type, drone type, application, and end user. By sensor type, the market is segmented into absolute pressure sensors, differential pressure sensors dry-use chopped strands (DUCS), and gauge pressure sensors wet-use chopped strands (WUCS). By drone type, the market is segmented into fixed-wing drones, rotary-wing drones, and hybrid drones. By application, the market is segmented into weather monitoring, altitude tracking and stabilization, landing assistance, and defense & surveillance operations. By end user, the market is segmented into defense and security, agriculture, meteorological department, logistics and transportation, and commercial.

The absolute pressure sensors sensor type category led the barometric pressure sensor for drones market in 2024. The convergence can be attributed to their higher accuracy and the ability to report the true atmospheric pressure independent of altitude or weather. These sensors can be counted on for important, meaningful data for the purpose of stable flight control, as well as determining altitude and fulfilling navigation functions at low and high heights. The small form factor, rugged construction, and insensitivity to the environment help make absolute pressure sensors versatile for drone applications across industries such as agriculture, mapping, and surveillance. Lastly, the integration of GPS and other flight systems will serve to increase operational efficiency, which is ultimately why absolute pressure sensors will be good for the emerging drone technologies.

The largest and fastest-growing drone type is hybrid drones, since they incorporate the endurance and distance of fixed wing drones with vertical take off and landing (VTOL) capabilities of multirotors, allowing for productive operations in different settings, both a urban centers and remote areas. Barometric pressure sensors in hybrid drones perform a vital function in overseeing stable transitions while flying, hovering, or cruising. The strength of hybrid drones is their ability to conduct long-distance missions, e.g. mapping, inspection and delivery, while simultaneously being more energy efficient and capable of carrying heavier payloads. This is partly responsible for driving hybrid drone adoption across commercial, defense, and agricultural sectors, thus while fostering overall market growth.

North America dominated the barometric pressure sensor for drones market in 2024. The United States is at the forefront of this expansion. This is due to early adoption of advanced drone technologies, a strong aerospace and defense industry sector, and well-established common commercial applications of drones. Market conditions are further reinforced by high levels of investment in R&D, a positive regulatory environment from the government, and widespread use of drones in the agriculture, logistics, and security and surveillance segments. In addition, the market in North America benefits from the presence of key manufacturers of sensors and technology solutions.

Moreover, fast pace of industrialization, the ever-expanding use of drones in agriculture, construction, and logistics, and broadening infrastructure development in the Asia-Pacific area, the barometric pressure sensor for drones market is expanding at the strongest and fastest rate in this region. The increase in government initiatives in smart city projects and drone monitoring, increasing manufacturing capabilities, and higher investments from international and domestic players are propelling market growth. Furthermore, the region's sizeable untapped markets and demand for efficient and precise altitude sensing solutions present a strong growth trajectory.

Barometric Pressure Sensor for Drones Market by Sensor Type-

· Absolute Pressure Sensors

· Differential Pressure Sensors Dry-Use Chopped Strands (DUCS)

· Gauge Pressure Sensors Wet-Use Chopped Strands (WUCS)

Barometric Pressure Sensor for Drones Market by Drone Type-

· Fixed-Wing Drones

· Rotary-Wing Drones

· Hybrid Drones

Barometric Pressure Sensor for Drones Market by Application-

· Weather Monitoring

· Altitude Tracking and Stabilization

· Landing Assistance

· Defense & Surveillance Operations

Barometric Pressure Sensor for Drones Market by End User-

· Defense and Security

· Agriculture

· Meteorological Department

· Logistics and Transportation

· Commercial

Barometric Pressure Sensor for Drones Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.