Global Engineered Enzymes Market Size is valued at US$ 2.6 Bn in 2024 and is predicted to reach US$ 7.3 Bn by the year 2034 at an 11.1% CAGR during the forecast period for 2025-2034.

Biologically engineered proteins, known as "engineered enzymes," are created to carry out specific chemical reactions more effectively, selectively, or consistently than their naturally occurring counterparts. Scientists modify an enzyme's amino acid sequence to improve characteristics such as catalytic speed, temperature or pH tolerance, substrate selectivity, or resistance to inhibitors, using methods including directed evolution, site-directed mutagenesis, and protein engineering. Because they enable more accurate and sustainable chemical transformations, these tailored enzymes are increasingly used across a range of industries, including pharmaceuticals, biotechnology, food processing, biofuels, and environmental remediation. The growing use of modified enzymes in pharmaceutical manufacturing and healthcare is driving the engineered enzymes market. Through precise biological processes, these enzymes produce safer, more potent medications.

Additionally, the engineered enzymes market is expanding due to the demand for environmentally friendly, sustainable solutions. Industries are using these enzymes to minimize chemical waste and lower energy use. The biofuel and food processing industries are using them to increase productivity. Moreover, the market is expanding rapidly due to several factors, including rising demand for molecular biology, greater investment in biotechnology, and an increase in the incidence of genetic illnesses. Furthermore, the engineered enzymes market is expanding due to rising demand for personalized treatment and advances in testing technologies such as Next-Generation Sequencing (NGS). To maintain their competitive advantage, leading businesses also focus on cutting-edge R&D, strategic alliances, and technological advancements. Smaller businesses find it difficult to compete in the market due to the high investment required and the specialized nature of enzyme engineering.

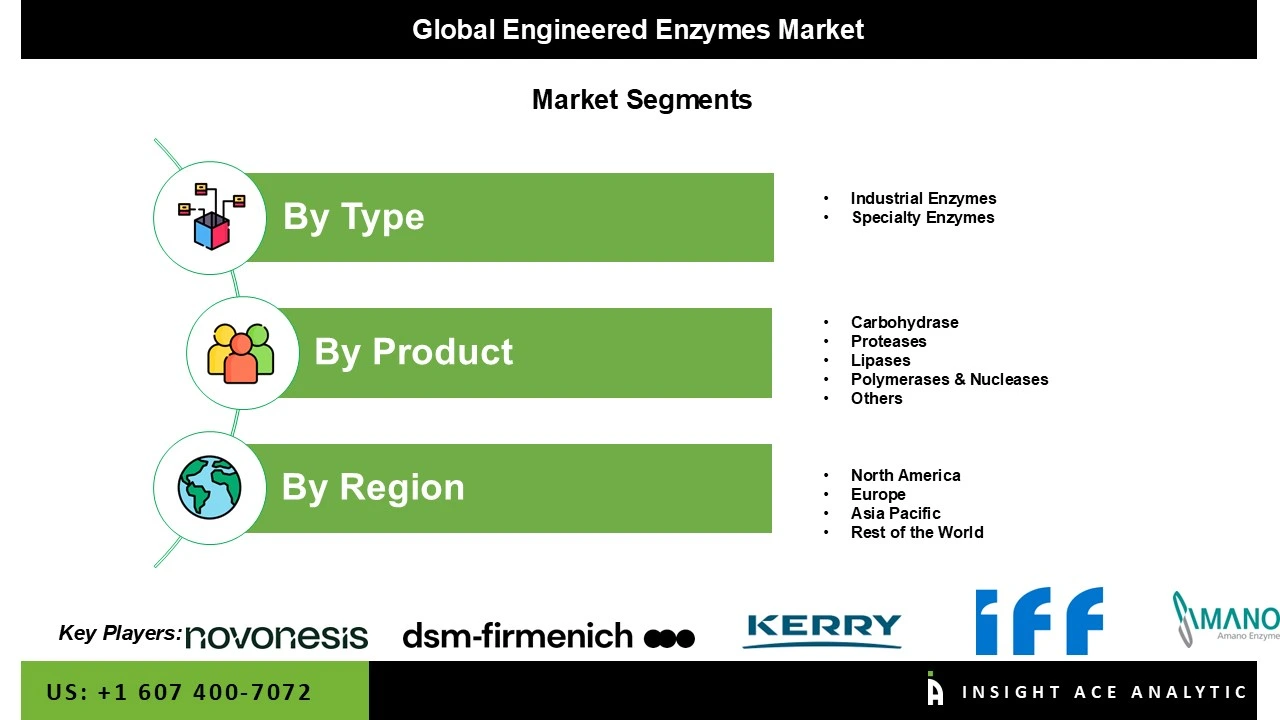

Some of the Key Players in Engineered Enzymes Market:

· BASF SE

· Novonesis

· Associated British Foods plc

· Amano Enzyme Inc.

· DSM-Firmenich AG

· Kerry Group plc

· Advanced Enzyme Technologies Ltd.

· Codexis, Inc.

· International Flavors & Fragrances Inc. (IFF)

· Archer Daniels Midland Company (ADM)

· Others

The engineered enzymes market is segmented by product and type. By product, the market is segmented into lipases, carbohydrase, polymerases & nucleases, proteases, and others. By type, the market is segmented into industrial enzymes and specialty enzymes.

In 2024, the engineered enzymes market was dominated by the carbohydrase segment. Its widespread application across the food, beverage, and biofuel industries is the main driver of the market. By converting complex carbohydrates into simpler sugars, these enzymes improve product quality and enhance the effectiveness of processes such as baking, brewing, and ethanol production. The market is expanding due to the strong demand for processed foods and sustainable energy solutions. Ongoing developments in enzyme engineering are improving enzyme performance across a variety of industrial conditions.

The industrial enzymes segment led the engineered enzymes market in 2024. Increased demand in food and beverage, biofuel, animal feed, and pharmaceutical applications is driving growth in this category. Because they use less energy, reduce waste, and produce higher-quality goods, these enzymes support sustainability and efficiency in the production process. The adoption is being accelerated by engineered enzymes and increasingly stringent environmental regulations. Additionally, key players in the market, such as Novozymes, BASF, and DuPont, are placing their bets on R&D to develop customized enzymes with a range of applications. Thus, the trend toward innovation and sustainable production will support the steady growth of the engineered enzymes market.

The North American region dominated the engineered enzymes market in 2024, driven by significant investments in biotechnology and pharmaceutical research. Businesses are focusing on developing high-performance enzymes for industrial and healthcare applications. Additionally, enzyme uptake is increased by advanced infrastructure and government support for innovation in engineered enzymes. As a result, the region has a strong need for modified enzymes. Furthermore, innovation is supported by substantial R&D investment and the existence of top biotech companies. This raises the demand for modified enzyme solutions globally. Thus, these factors are anticipated to boost the growth of the engineered enzymes market in this region.

The Asia-Pacific region is projected to record the highest CAGR in the engineered enzymes market over the forecast period. Growth is being fueled by rising demand for processed foods, increasing adoption of personalized medicine, rapid industrialization, and expanded biotechnology R&D activities. The region is also benefiting from fast-paced advancements in pharmaceutical and biotech sectors, together with continuous progress in enzyme engineering technologies. In addition, demand for next-generation, high-efficiency enzymes is increasing across pharmaceuticals, chemicals, food and beverages, environmental management, textiles, agriculture, and biofuels. Supportive regulatory policies promoting sustainable and innovative manufacturing practices further strengthen the region’s market expansion.

Engineered Enzymes Market by Product

· Lipases

· Carbohydrase

· Polymerases & Nucleases

· Proteases

· Others

Engineered Enzymes Market by Type

· Industrial Enzymes

· Specialty Enzymes

Engineered Enzymes Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.