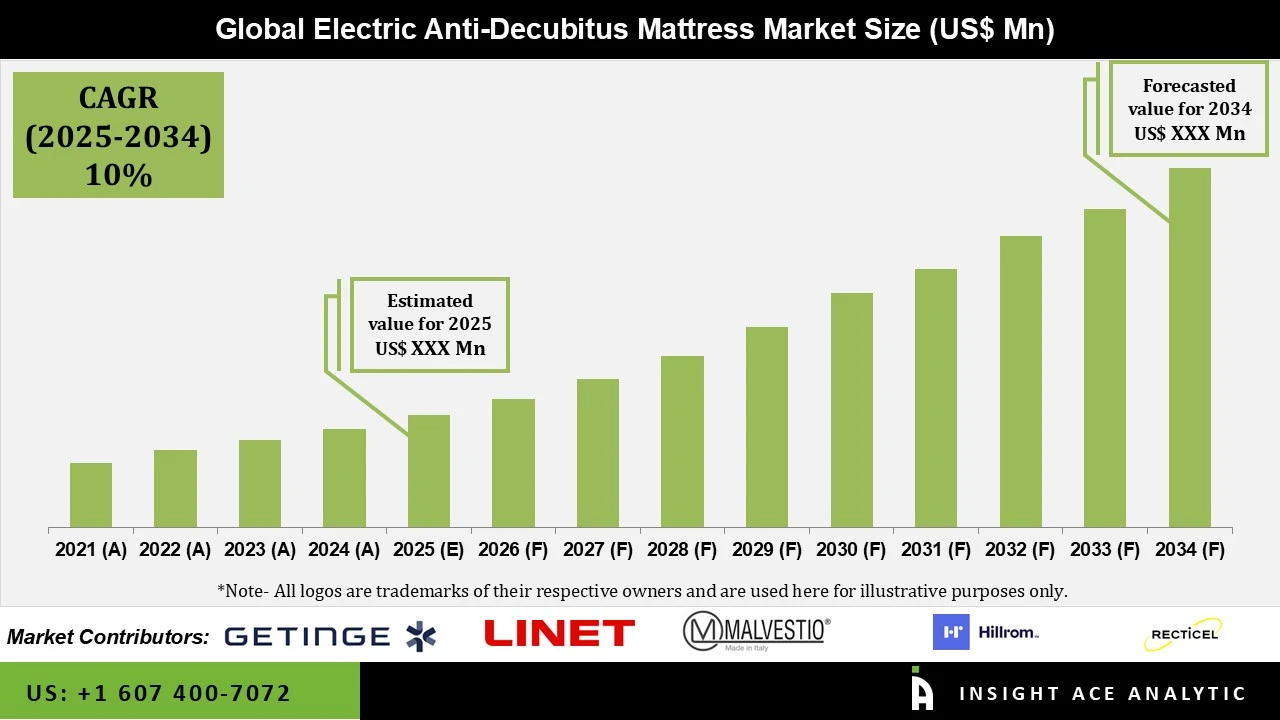

Global Electric Anti-Decubitus Mattress Market is expected to grow at a 10.0% CAGR during the forecast period for 2025-2034.

A medically designed support surface, an electric anti-decubitus mattress, is used to treat and prevent pressure ulcers, also often known as bedsores, in patients who are bedridden or have restricted mobility. To distribute pressure across the body, it uses an electronic air pump that continuously inflates and deflates several air cells within the mattress in a predetermined cycle. This alternating pressure minimizes tissue damage, enhances blood circulation, and lessens sustained stress on any one place. The need for specialized medical equipment to prevent bedsores and decubitus ulcers among bedridden patients is driving the electric anti-decubitus mattress market, a fast-rising segment of the healthcare industry.

The demand for electric anti-decubitus mattresses is expected to rise as the global population ages and the prevalence of pressure ulcer-inducing conditions increases. Additionally, the use of electric anti-decubitus mattresses as part of all-encompassing wound care solutions has expanded due to the greater awareness of patient care in hospitals and nursing homes. Government programs and financing targeted at enhancing healthcare infrastructure, such as the purchase of modern hospital equipment, also boost the electric anti-decubitus mattress market. For instance, pressure ulcer prevention equipment has been reimbursed by the U.S. Centers for Medicare & Medicaid Services (CMS), which has contributed to the market's expansion.

In addition, the growing usage in hospitals and home care settings, improvements in mattress technology, including smart features and automated pressure adjustments, and increased patient safety awareness are among some of the major factors shaping the electric anti-decubitus mattress market dynamics. However, obstacles, including exorbitant product pricing and disparities in adoption rates among various healthcare systems, could limit expansion. Market participants also face obstacles due to strict regulations and the ongoing demand for innovation. On the other hand, prospects in developing nations with better healthcare infrastructure create a conducive environment for growth. Additionally, there are opportunities to improve the effectiveness of pressure ulcer prevention by integrating telemedicine and remote monitoring tools.

Which are the Leading Players in the Electric Anti-Decubitus Mattress Market?

Driver

Increasing Technological Developments Due to Strong Consumer Demand

The electric anti-decubitus mattress market is undergoing a paradigm shift due to strong demand from a variety of industrial sectors, changing customer tastes, and technological improvements. The electric anti-decubitus mattress market has evolved from a supporting sector to a key driver of innovation and economic power in the fast-paced global economy of today. Performance optimization, environmental consciousness, and growing digitization are the main forces behind this change. Additionally, the development, distribution, and consumption of goods and services in the electric anti-decubitus mattress market are being completely transformed by the incorporation of digital technologies such as the Internet of Things, blockchain, AI, and machine learning. These solutions provide a strategic approach for enterprises to improve service delivery while lowering carbon footprints and inefficiencies. Thus, this developing ecosystem offers significant development prospects, particularly for those who adopt flexible business models, strategic partnerships, and innovations with a sustainability focus.

Restrain/Challenge

High Cost Associated with Electric Anti-Decubitus Mattresses

Compared with traditional mattress options, electric anti-decubitus mattresses have a higher upfront cost, which is cited as a hurdle for healthcare facilities with limited funding. Many patients and healthcare organizations remain concerned about high product costs. Thus, the adoption of electric anti-decubitus mattresses may be discouraged by their high initial cost, particularly in healthcare settings with limited funding. Additionally, supply chain disruptions, worsened by current world events, could affect availability and raise manufacturing costs. Manufacturers depend on a network of interconnected suppliers for their resources, and any disruptions could result in delays or higher costs, further complicating the economy. In a market that is increasingly competitive, pricing pressures may emerge, forcing businesses to lower prices to improve profitability.

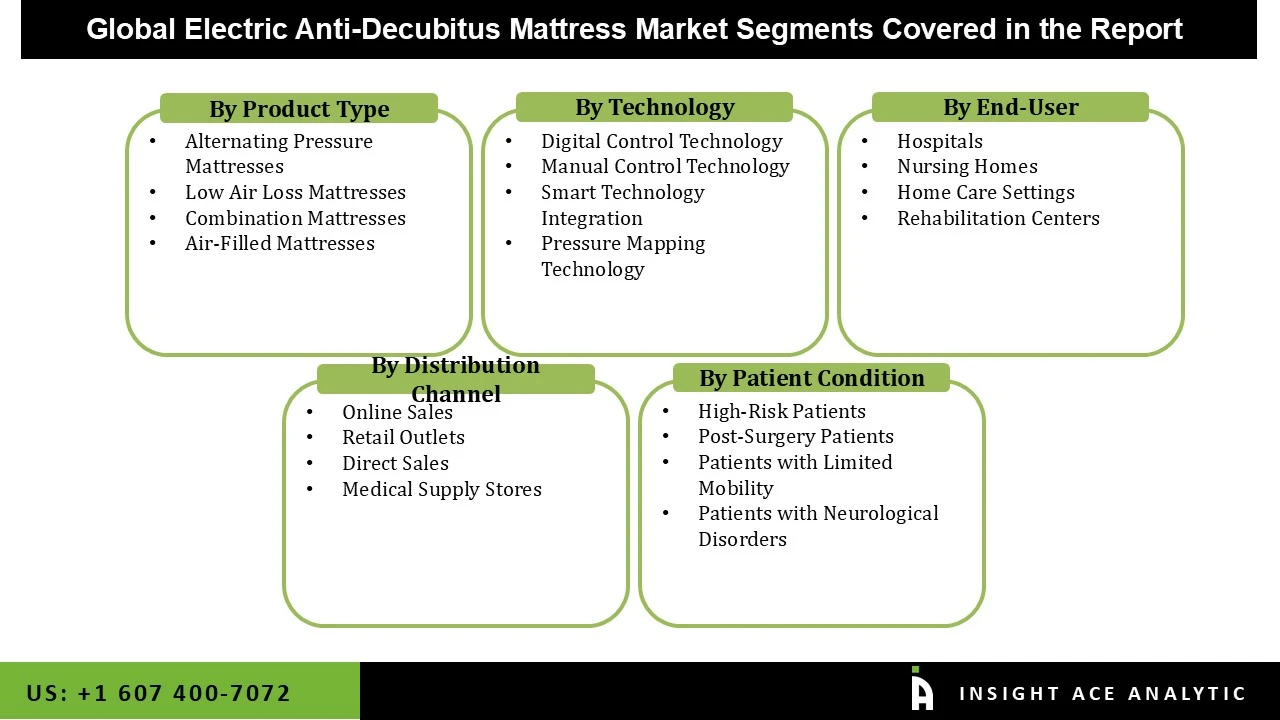

The electric anti-decubitus mattress market is segmented by type, application, and end-use. Product types are primarily categorized into alternating pressure mattresses, lateral rotation mattresses, as well as low air loss mattresses. Key applications driving demand include pressure ulcer prevention, post-surgical recovery, long-term care, pressure ulcer treatment, and critical care management. The primary end-users of these specialized support systems are hospitals, home healthcare settings, long-term care facilities, and nursing homes, reflecting the widespread need for advanced pressure injury prevention and management across both acute and chronic care environments.

The pressure ulcer prevention category held the largest share in the Electric Anti-Decubitus Mattress market in 2024 due to increased hospital admissions in ICUs, cancer, and post-surgical wards, where immobility is widespread, as well as the rising prevalence of pressure injuries, particularly among the elderly and long-term bedridden patients. Healthcare facilities are being forced to switch from simple foam mattresses to sophisticated electric anti-decubitus devices due to stricter clinical guidelines on pressure injury prevention, hospital accreditation standards, and fines or lower reimbursements for pressure ulcers acquired in hospitals. Additionally, these mattresses are becoming increasingly popular for proactive pressure ulcer prevention due to technological advancements, including alternating pressure, low-air-loss systems, improved microclimate management, and enhanced infection-control materials.

In 2024, the hospitals category dominated the Electric Anti-Decubitus Mattress market. This segment is at the forefront of patient care; they frequently treat patients who need electric anti-decubitus mattresses due to lengthy hospital stays and certain medical conditions. Hospitals are under pressure to provide patients with the best possible comfort and pressure relief to prevent pressure ulcers, also known as bedsores. Additionally, growing patient safety regulations, regulatory compliance standards, and the growing need for sophisticated patient care solutions in acute care facilities and medical centers throughout developed and emerging economies all support the hospital segment's market leadership.

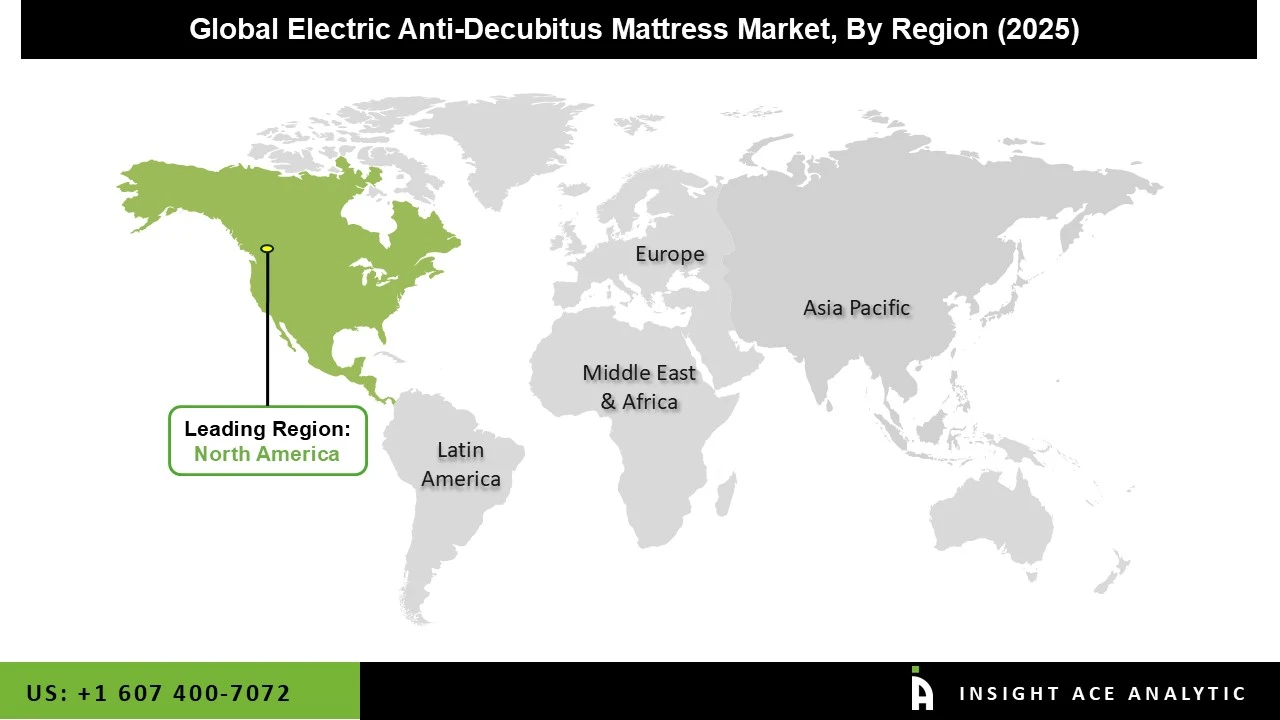

The Electric Anti-Decubitus Mattress market was dominated by North America in 2024 due to increased government spending on healthcare and the adoption of cutting-edge technologies to raise the standard of care. Furthermore, the popularity of electric anti-decubitus mattresses in hospitals and care facilities is also a result of increased healthcare spending and greater awareness of pressure ulcer prevention among medical professionals.

The North American electric anti-decubitus mattress market is also significantly influenced by consumer behavior that prioritizes patient comfort and recovery, as well as infrastructure advancements.

In February 2024, Arjo AB launched the arjofloat therapy surface with integrated patient turn assist and pressure mapping. This new electric mattress replacement system combines low air loss therapy with a powered turn aid function, designed to reduce caregiver strain during patient repositioning while providing continuous pressure relief. It includes a digital interface for monitoring patient mobility and pressure redistribution.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 10.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Medline Industries, Inc., Span America Medical Systems, Arjo AB, Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, Permobil AB, Invacare Corporation, Stryker Corporation, Getinge AB, and Joerns Healthcare LLC. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.