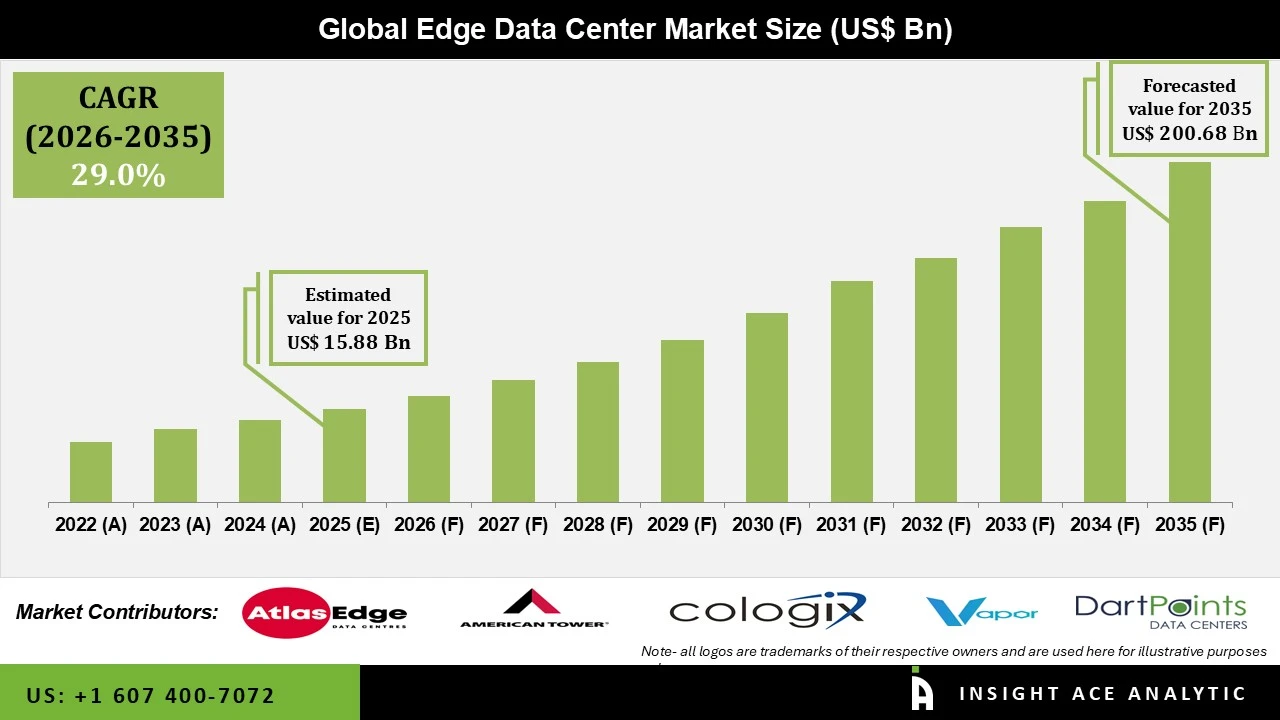

Edge Data Center Market Size is valued at USD 15.88 Bn in 2025 and is predicted to reach USD 200.68 Bn by the year 2035 at an 29.0% CAGR during the forecast period for 2026 to 2035.

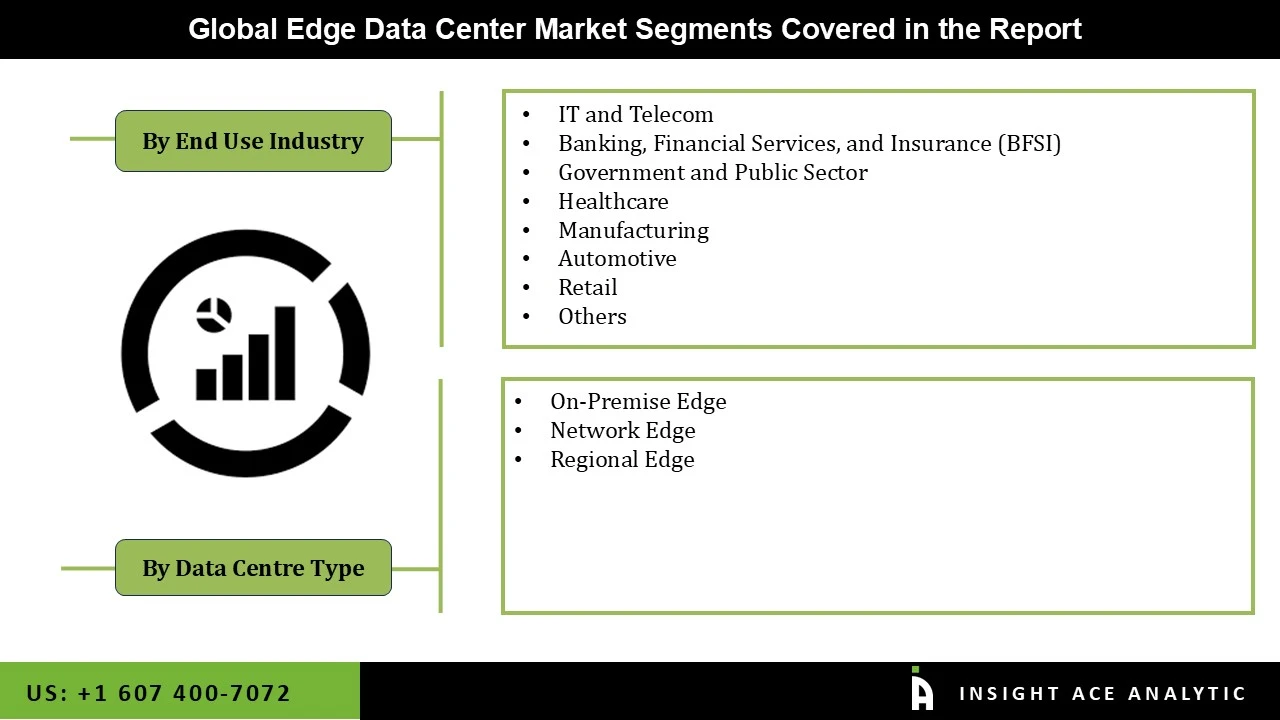

Edge Data Center Market, Share & Trends Analysis Report, By End-Use Industry (IT and Telecom, Banking, Financial Services, Insurance (BFSI), Government and Public Sector, Healthcare, Manufacturing, Automotive, Retail, Others), By Data Center Type (On-Premise Edge, Network Edge, Regional Edge), By Region, and Segment Forecasts, 2026 to 2035

An Edge Data Center is a small-scale data center strategically located near end-users or devices to bring computing power, storage, and network services closer to where data is generated and consumed. Its primary purpose is to reduce latency, improve performance, and enable faster data processing by avoiding the need to send information to distant, centralized data centers. Typically positioned near population centers or within local networks, edge data centers minimize data travel time. These smaller, more distributed centers often work alongside larger, centralized cloud data centers and are designed to scale based on demand, especially in areas with high user density. Unlike traditional data centers, edge data centers support localized workloads without requiring massive infrastructure.

Implementing robust security measures, such as access controls, encryption, and physical security, is essential to protect sensitive data and infrastructure in edge data centers from cyber threats and unauthorized access. With stricter data privacy regulations like the General Data Protection Regulation (GDPR) and the Central Consumer Protection Authority (CCPA), the need for enhanced security at the edge has become more pressing. Key measures, including data encryption, access controls, and regular security audits, are critical for safeguarding data processed at the edge. For example, in May 2023, Vertiv Group introduced modular data centers designed for rapid deployment and scalability, addressing the growing demand for flexible and agile edge solutions.

Micro data centers are also gaining popularity for edge deployments, offering compact and efficient solutions for specific use cases. As businesses prioritize digital transformation projects to support advanced applications and technologies, investments in edge infrastructure are likely to increase. In response to rising concerns over data breaches and regulatory compliance, edge data centers are expected to implement stronger security measures, enhancing consumer trust. Additionally, the need for edge computing solutions to reduce latency and boost performance is expected to drive market growth, as user experience becomes a key differentiator for businesses.

The Edge Data Center market is segmented based on end-use industry, and data center type. Based on the end-use industry, the market is divided into IT and telecom, banking, financial services, insurance (BFSI), government and public sector, healthcare, manufacturing, automotive, retail, and others. Based on the data center type, the market is divided into on-premise edge, network edge, and regional edge.

Based on the end-use industry, the market is divided into IT and telecom, banking, financial services, insurance (BFSI), government and public sector, healthcare, manufacturing, automotive, retail, and others. Among these, the IT and telecom segment is expected to have the highest growth rate during the forecast period. This sector has the highest demand for edge data centers due to the rapid expansion of 5G networks, increased data consumption, and the growing need for faster data processing and reduced latency to support cloud services, video streaming, IoT applications, and other digital services.

The telecom industry, in particular, leverages edge data centers to enhance network efficiency, provide low-latency communication, and ensure seamless connectivity. The IT and telecom sectors generate massive volumes of data from smartphones, IoT devices, cloud services, and content delivery networks (CDNs). Edge data centers help handle this data by processing it locally, reducing the load on centralized data centers, and minimizing latency. The proliferation of IoT devices, especially in telecom, requires localized data processing. Edge data centers facilitate faster data analysis and decision-making for connected devices, enhancing real-time monitoring and control.

Based on the data center type, the market is divided into on-premise edge, network edge, and regional edge. Among these, the rising demand for video streaming, online gaming, and other bandwidth-heavy services is best served by the Network Edge. By caching content closer to users, Network Edge data centers improve performance, reduce buffering, and enhance the user experience. Network Edge data centers allow for local data processing and reduce the burden on centralized data centers, ensuring quicker response times and supporting large-scale IoT deployments. The Network Edge is crucial for telecom operators and IT service providers, as it supports the infrastructure needed for low-latency applications and efficient network management. As these sectors grow, the need for network-edge data centers continues to rise.

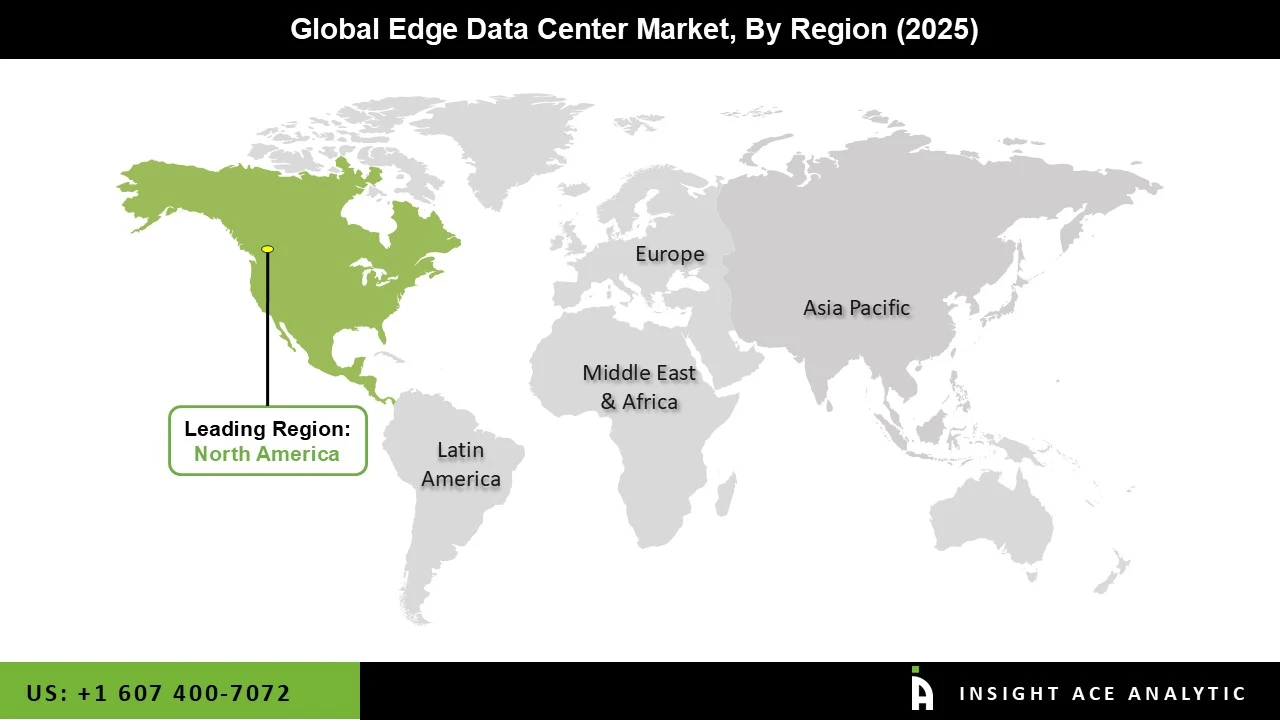

North America, particularly the United States, is a leader in the early adoption of advanced technologies like 5G, IoT, and cloud computing, which are key drivers for edge data center deployment. The rapid deployment of 5G networks across the U.S. and Canada is increasing the demand for edge data centers to support low-latency, high-bandwidth applications, such as autonomous vehicles, smart cities, and AR/VR. a high adoption rate of IoT devices across various industries, including healthcare, automotive, and manufacturing. This creates a need for localized processing power, driving the demand for edge data centers.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 15.88 Bn |

| Revenue Forecast In 2035 | USD 200.68 Bn |

| Growth Rate CAGR | CAGR of 29.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By End-Use Industry, and Data Center Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | ATLASEDGE DATA CENTRES, ATC TRS V LLC, Cologix, Vapor IO, DartPoints, Digital Realty, Edge Centres, EdgeConneX, Ubiquity Management, LLC, Leading Edge Data Centres, Proximity Data Centres, Switch, Vertiv Group Corp, Evoque Data Center Solutions, Flexential, DELL, EATON, IBM, NVIDIA, Schneider Electric, Fujitsu, Cisco, Huawei, 365 Data Centers, Rittal, Panduit, Equinix, Sunbird, Vertiv Group, Huber+Suhner, Siemon |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Edge Data Center Market- By End-Use Industry

Global Edge Data Center Market – By Data Center Type

Global Edge Data Center Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.