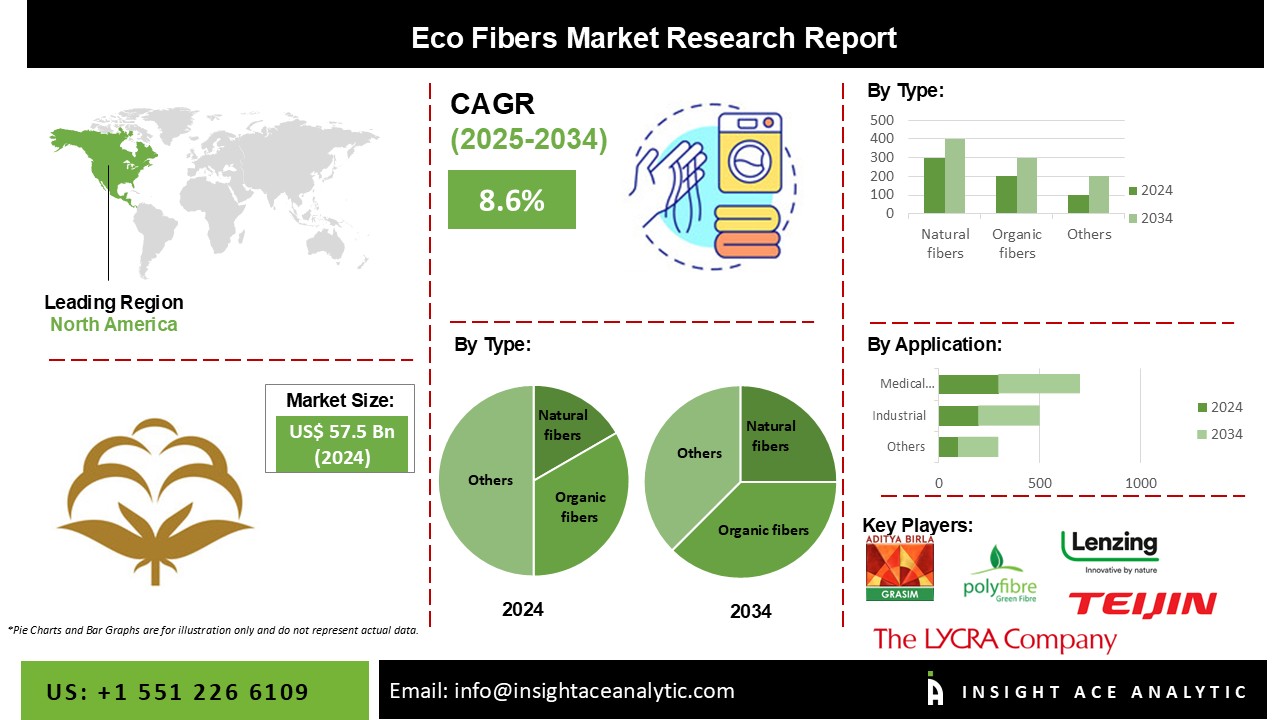

Eco Fibers Market Size is valued at 57.5 billion in 2024 and is predicted to reach 129.8 billion by the year 2034 at an 8.6% CAGR during the forecast period for 2025-2034.

Eco Fibers are a category of fibers that don't require chemicals or pesticides to thrive. These fibers are microbial, mildew, and disease-free resistant. The product's main components are hemp, bamboo, ramie, and linen, providing natural and eco-friendly fiber for clothing and textiles.

Due to advanced technologies, products with microbial resistance, UV resistance, and breathable qualities have been developed. Growing demand for textile products for commercial, residential, and garment uses is causing the industry to expand. Textile producers invest in natural and organic eco fibers to further decrease garment waste.

The adoption of bio-based and organic fibers has also been influenced by governmental restrictions that limit the excessive use of synthetic and artificial fiber, which has accelerated the expansion of the eco fiber market. The enormous amount of fabric waste generated by rising fashion has sped up the development of fiber technologies to make more environmentally friendly fibers. This is anticipated to lessen the environmental impact and open new market expansion prospects.

The textile/apparel, automotive, and medical industries are all expanding faster than the fashion industry. The demand for these fibers is rising as a result of the expansion of these industries. As a result, the demand for the product will increase due to the increasing usage of fabric in various applications, including interior design, covering, and furnishing.

The eco fibers market is segmented on product type and application. Based on product type, the market is segmented into natural fibers, regenerate/manmade fibers, recycled fibers and organic fibers. Based on application, eco fibers market is segmented into textile/apparel, industrial, medical purposes, household & furnishing and others.

The organic fibers category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time ascribed to shifting consumer tastes toward more environmentally friendly items. According to Textile Exchange, the expansion of the organic fiber market would be driven by organic cotton production, which reached 239 KT in 2019. The portion of manmade fibers that are produced from cellulose and sugar comprises synthetic fibers like rayon and lyocell. Due to the low cost and ease of processing of the fibers, this market segment has dominated.

The textile/apparel category is anticipated to grow significantly over the forecast period ascribed to the expanding fashion industry globally. The demand for fabrics is rising as a result of the rise in popularity of various clothing kinds, including formal attire, casual attire, and designer apparel. In order to stay up with trends, young people are more drawn to owning things from upscale brands thanks to the strengthening economies of various important nations.

The Asia Pacific eco fibers market is expected to register the highest market share in revenue in the near future. Due to its rapid economic expansion, which was aided by its growing population, the region represented the biggest value on the world market. The increase in demand for fiber from garments and industrial applications is driving the market in the region. Industries, including textile, automotive, and construction, are expanding, driving product consumption. In addition, North America is projected to grow rapidly in the global eco fibers market. The area's market is primarily driven by the medical industry, helped by technology advancements that allow for the environmentally friendly disposal of medical waste. The area's market is driven by efforts to reduce medical waste and create more sustainable products.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 57.5 billion |

| Revenue forecast in 2034 | USD 129.8 billion |

| Growth rate CAGR | CAGR of 8.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Kiloton and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Aditya Birla Management, Ananafit, Aquafi, Bcomp, China Bambro Textile Co Ltd., David C. Poole Company, Inc, Ecological Fibers, Enkev Bv, Envirotextiles, Esprit Global, European Industrial Hemp Association, Foss Performance Materials, Grasim Industries Limited, Greenfibres, Hayleys Fibers, Lenzing AG, Pilipinas Ecofiber Corporation, Polyfibre Industries, Shanghai Tenbro Bamboo Textile Co. Ltd., Teijin Limited, The LYCRA Company, US Fibers, Wellman Advanced Materials, and Other Prominent Players. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Eco Fibers Market By Product Type

Eco Fibers Market By Application

Eco Fibers Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.