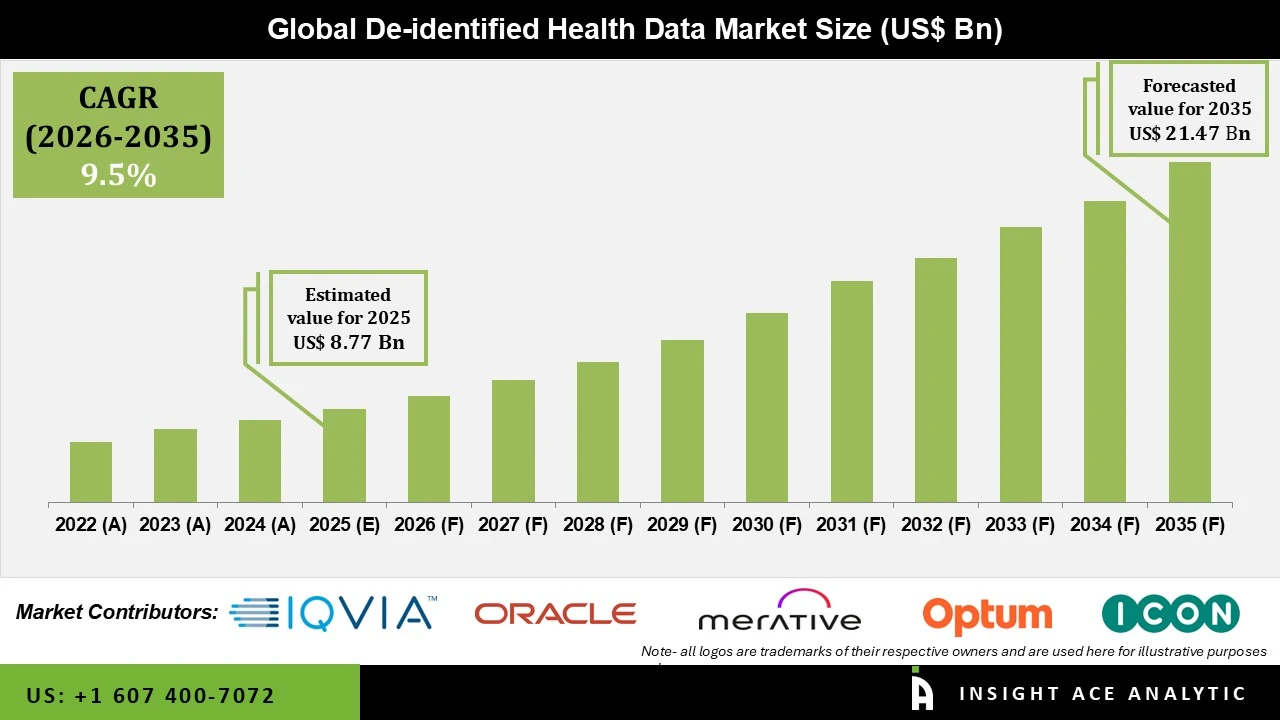

De-identified Health Data Market Size is valued at USD 8.77 Bn in 2025 and is predicted to reach USD 21.47 Bn by the year 2035 at an 9.5% CAGR during the forecast period for 2026 to 2035.

De-identified Health Data Market, Share & Trends Analysis Report, By Type of Data (Clinical, Genomic and Others), By End-use (Pharmaceutical Companies, Biotechnology Firms and Others), By Application, By Region, and Segment Forecasts, 2026 to 2035

De-identification is an organizational method used to eliminate personal information from data that is gathered, utilized, stored, and shared with other organizations. Rather than being a single strategy, it encompasses a set of approaches, algorithms, and tools applied to various types of data with differing levels of effectiveness. More aggressive de-identification algorithms typically provide stronger privacy protection, though they can reduce the dataset's overall usefulness. For enterprises, government agencies, and other organizations that seek to make data accessible to external parties, de-identification is especially crucial. It safeguards individuals' privacy by preventing the unauthorized disclosure of their personal health information. This allows de-identified data to be used for diverse research purposes without compromising patient confidentiality and facilitates the sharing of health data for collaborative research and analysis.

Section 164.514(a) of the HIPAA Privacy Rule provides the standard for de-identification of protected health information, stating that health information is not considered individually identifiable if it does not identify an individual and if the covered entity has no reasonable basis to believe it could be used to identify one. Similarly, the General Data Protection Regulation (GDPR) in the European Union sets strict standards for data protection, including the processing of personal data, which can include de-identified health data. Both regulatory frameworks, HIPAA and GDPR, impose stringent requirements for managing personal health information. De-identification serves as a key method for organizations to comply with these regulations while still making health data available for research and collaboration. As healthcare systems become increasingly interconnected, the need for collaboration between institutions, researchers, and pharmaceutical companies grows. De-identified data facilitates the exchange of health information across organizations, supporting joint research, drug development, and clinical trials without compromising patient confidentiality.

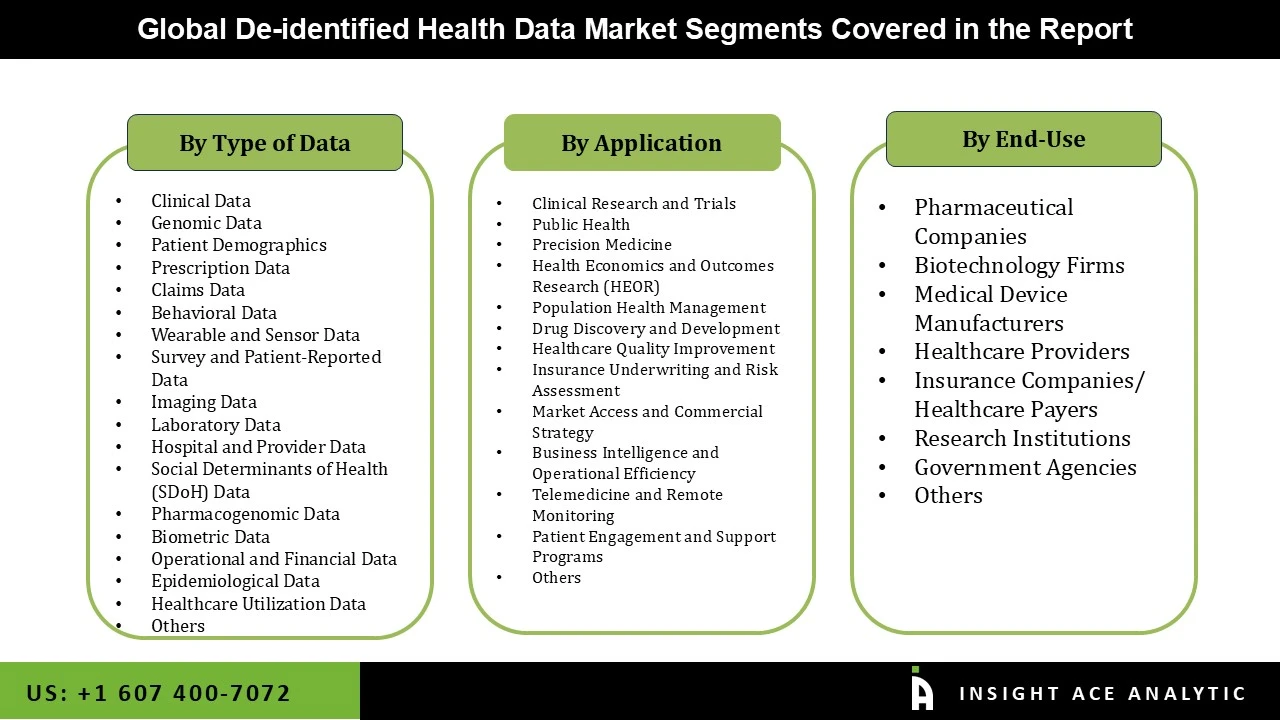

The de-identified health data market is segmented based on the type of data, end-use, application. Based on the type of data, the market is divided into clinical, genomic, patient demographics, prescription data, claims data, behavioral data, wearable and sensor data, survey and patient-reported data, imaging data, laboratory data, hospital and provider data, social determinants of health (SDOH) data, pharmacogenomic data, biometric data, operational and financial data, epidemiological data, healthcare utilization data, others. Based on the end-use, the market is divided pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers, insurance companies/ healthcare payers, research institutions, government agencies and others. Based on the application, the market is divided into clinical research and trials, public health, precision medicine, health economics and outcomes research (HEOR), population health management, drug discovery and development, healthcare quality improvement, insurance underwriting and risk assessment, market access and commercial strategy, business intelligence and operational efficiency, telemedicine and remote monitoring, patient engagement and support programs, others.

Based on the type of data, the market is divided into clinical, genomic, patient demographics prescription data, claims data, behavioral data, wearable and sensor data, survey and patient-reported data, imaging data, laboratory data, hospital and provider data, social determinants of health (SDOH) data, pharmacogenomic data, biometric data, operational and financial data, epidemiological data, healthcare utilization data, others. Among these, the clinical data segment is expected to have the highest growth rate during the forecast period. Clinical data includes a wide range of information such as medical histories, diagnoses, treatments, procedures, outcomes, and lab results. This data provides a detailed view of patient health, making it highly valuable for research, healthcare optimization, and decision-making. Clinical data is essential for advanced healthcare analytics, machine learning, and AI-driven models aimed at improving diagnostics, predicting health outcomes, and optimizing healthcare delivery. The use of this data fuels advancements in personalized medicine and value-based care.

Based on the application, the market is divided into clinical research and trials, public health, precision medicine, health economics and outcomes research (HEOR), population health management, drug discovery and development, healthcare quality improvement, insurance underwriting and risk assessment, market access and commercial strategy, business intelligence and operational efficiency, telemedicine and remote monitoring, patient engagement and support programs, others. Among these, the clinical research and trials segment dominates the market. Clinical research and trials require access to vast amounts of health data to generate statistically significant results. De-identified health data provides researchers with large, diverse patient datasets while protecting individual privacy. This is essential for understanding disease progression, treatment effectiveness, and potential side effects across different populations. Pharmaceutical and biotech companies are major consumers of de-identified health data, as they are constantly conducting research for drug discovery and clinical trials. The continuous demand for de-identified data by these industries ensures that the clinical research and trials segment remains dominant.

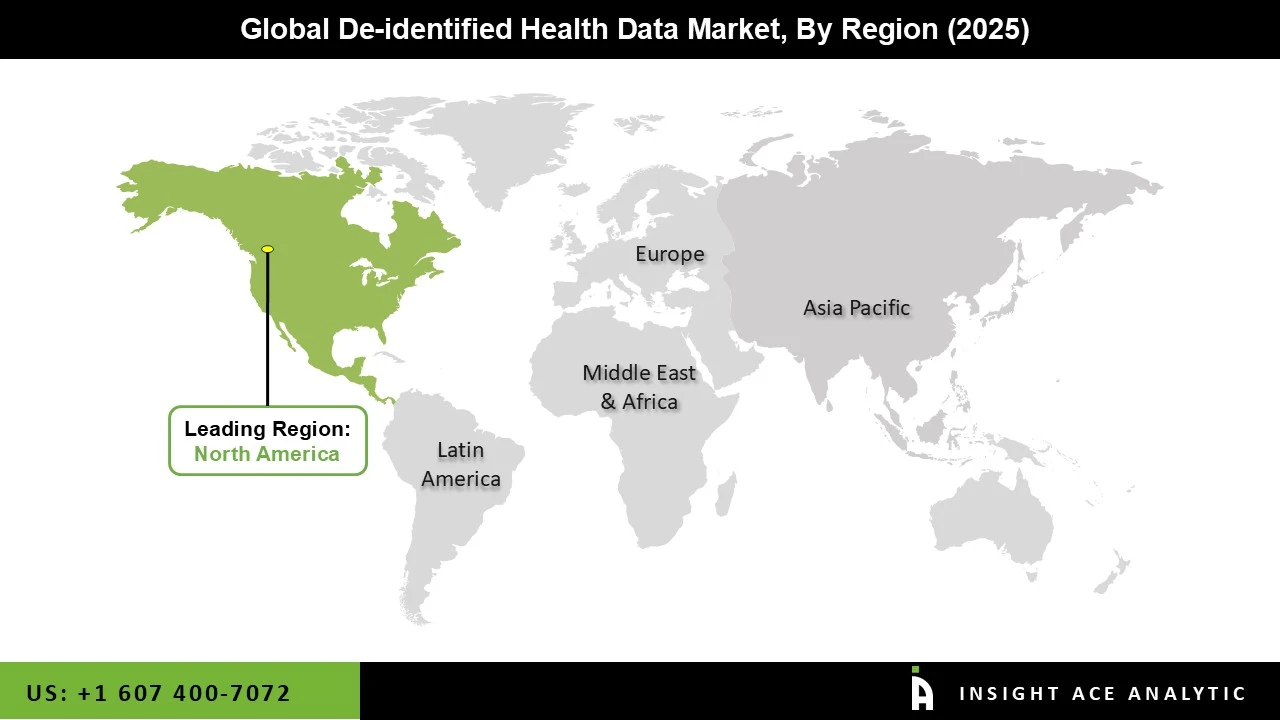

North America leads in the development and adoption of advanced healthcare analytics, machine learning, and AI technologies. These innovations require large volumes of health data to train algorithms and develop predictive models. De-identified health data is critical to feeding these technologies, driving further demand in the region. The rise of precision medicine in North America, especially through initiatives like the All of Us Research Program in the U.S., requires vast amounts of diverse and de-identified health data to understand genetic, environmental, and lifestyle factors that influence health. North America's leadership in precision medicine drives the demand for de-identified datasets to enable tailored treatments and interventions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 8.77 Bn |

| Revenue Forecast In 2035 | USD 21.47 Bn |

| Growth Rate CAGR | CAGR of 9.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type Of Data, By End-Use, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | IQVIA, Oracle (Cerner Corporation), Merative (Truven Health Analytics), Optum, Inc. (UnitedHealth Group), ICON plc, Veradigm LLC (Formerly known as Allscripts), IBM, Flatiron Health (F. Hoffmann-La Roche Ltd), Premier, Inc., Shaip, Komodo Health, Inc., Evidation Health, Inc., Medidata, Clarify Health Solutions, Satori Cyber Ltd., Kitware, BioData Consortium, Akrivia Health, iMerit |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global De-identified Health Data Market- By End Use

Global De-identified Health Data Market – By Application

Global De-identified Health Data Market – Type of Data

Global De-identified Health Data Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.