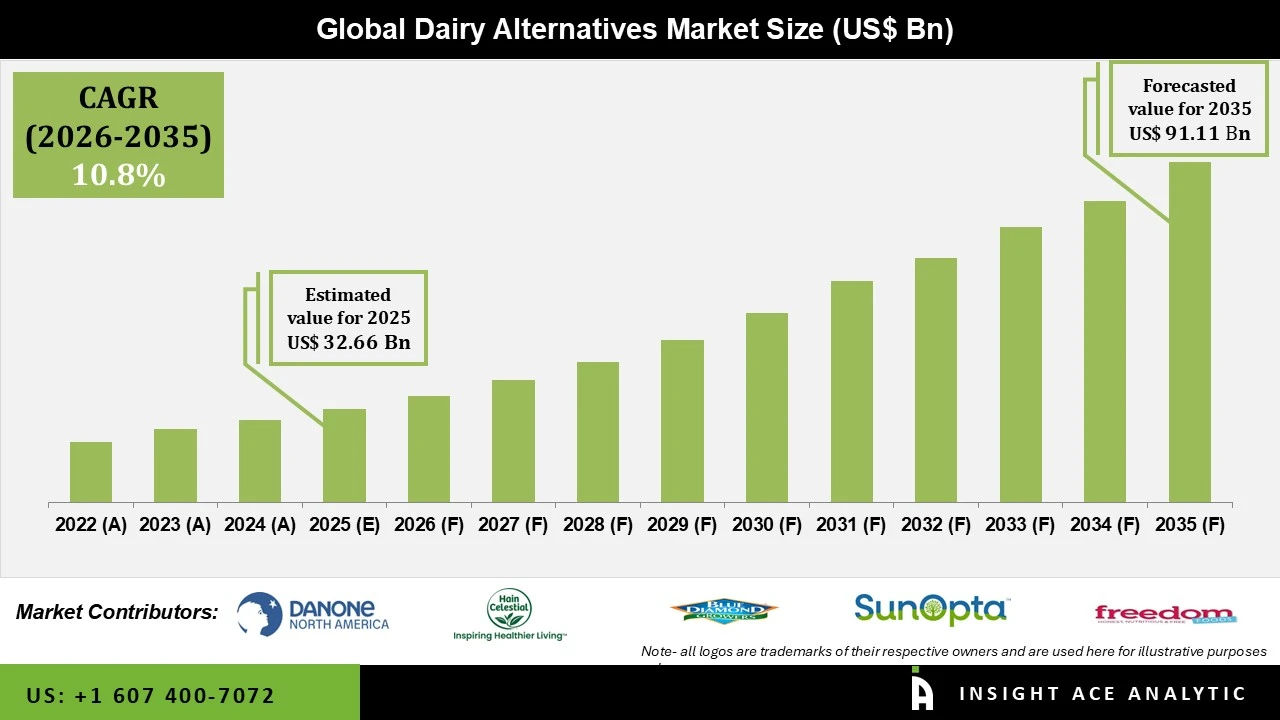

Dairy Alternatives Market Size is valued at USD 32.66 Bn in 2025 and is predicted to reach USD 91.11 Bn by the year 2035 at a 10.89% CAGR during the forecast period for 2026 to 2035.

Dairy alternatives refer to plant-based goods that substitute conventional dairy items such as milk, cheese, and yoghurt. These options are consumed by individuals who experience lactose intolerance, possess dairy allergies, or adhere to vegan or plant-based dietary preferences. These products are crafted using components such as soy, almonds, oats, and coconut and provide choices that cater to different gourmet and dietary requirements. Dairy substitutes have experienced a surge in popularity and are regarded as more ecologically sustainable than conventional dairy farming. Dairy alternatives have garnered considerable interest from both traditional and emerging markets.

The rising prevalence of dairy allergy is likely to be blamed. Increases in health awareness and consumer purchasing have contributed to the development of the dairy alternatives industry. However, the market growth could be improved by the lack of awareness of the safety and health of dairy alternatives and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high humidity. Some people react adversely to certain foods because their immune systems react negatively to specific proteins in certain foods.

Some of the most common allergens are nuts and soy, which can trigger a wide range of reactions in sensitive people, from moderate hives to potentially fatal anaphylaxis. Soy proteins are a common allergen, and they are found in many dairy alternatives, such as soy milk, soy cheese, and soy yoghurt. Those with soy allergies were once told they could safely consume soybean oil and soy lecithin, but it's now been shown that these products still contain tiny amounts of soy protein and could trigger allergic reactions. The global dissemination of new coronaviruses is to blame. As a result of the COVID-19 pandemic, many sectors were shut down to limit the spread of the virus inside communities. The primary reasons that lead to slower market growth are a need for more available personnel, a shortage of available resources, and a slowed supply chain.

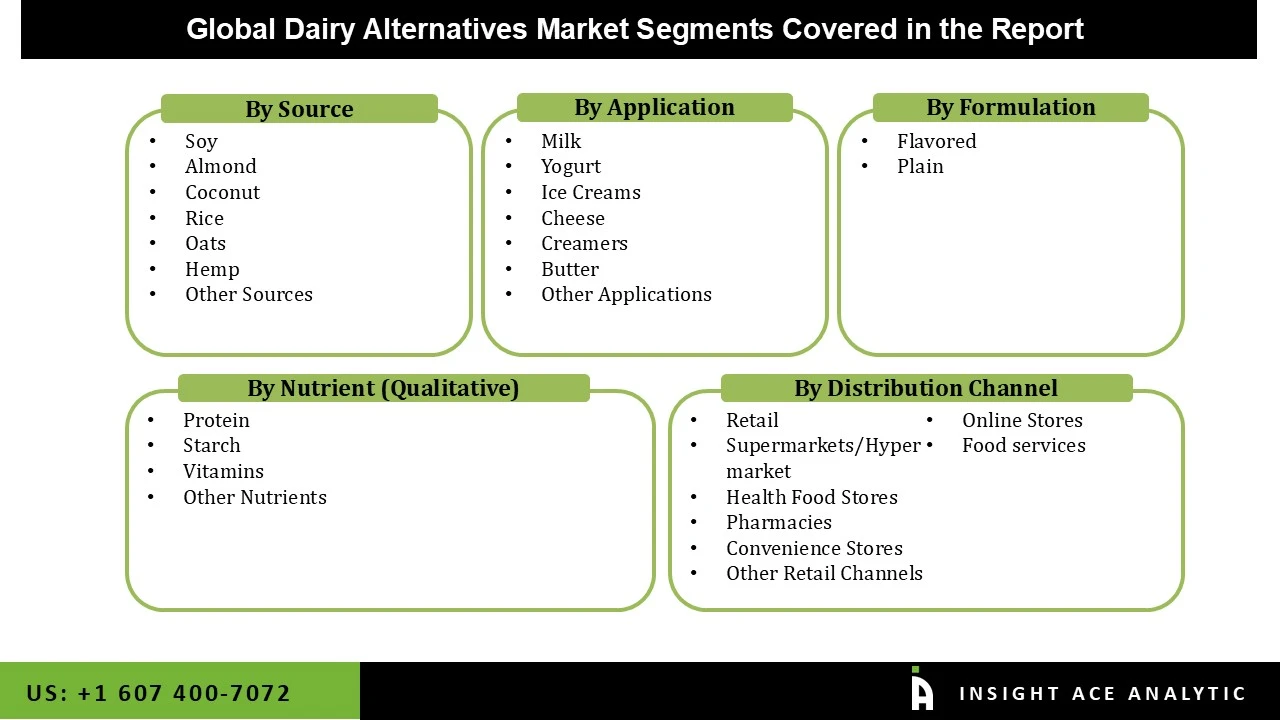

The dairy alternatives market is segmented based on source, application, and distribution channel. As per the source, the market is segmented into soy, almond, coconut, oats, and hemp. The application segment is segmented into milk, yoghurt, ice creams, cheese, and creamers. The distribution channel segment consists of retail, online stores, and food services.

The soy dairy alternatives market is expected to hold a significant global market share in 2024. Soy-based products are growing in popularity and consumption because of their high nutrient density. These items are considered superior dairy alternatives due to their high protein and calcium content.

The milk segment is projected to grow rapidly in the global dairy alternatives market. Plant-based milk is gaining popularity among customers as a healthier alternative to conventional cow's milk. Health concerns, including lactose intolerance and dairy allergies, have led many to switch to plant-based milk, especially in countries like the US, Germany, the UK, China, and India.

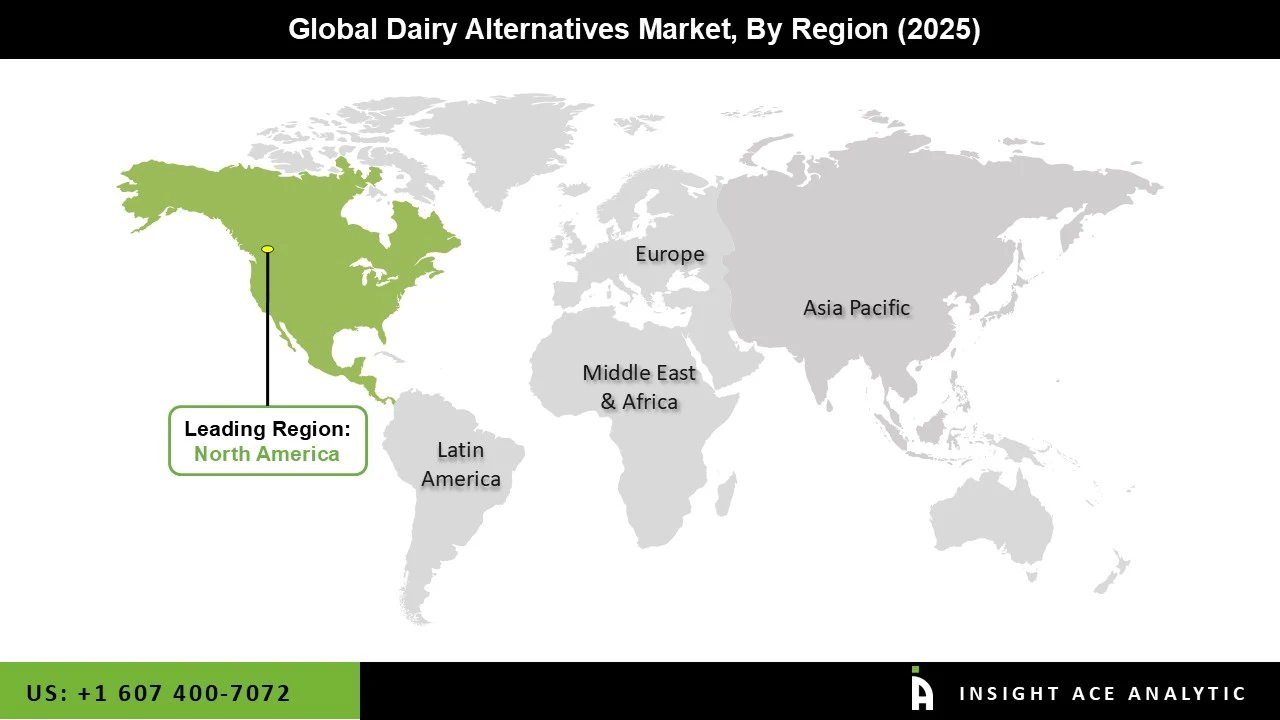

The North American dairy alternatives market is expected to register the maximum market share in revenue in the near future. It can be attributed to the increase in the use of soymilk, which is cheap and abundant. In response to the rising demand for non-dairy beverages and pasteurized soymilk as dairy alternatives, food producers are releasing new varieties of soymilk with a wide range of flavour profiles. In addition, Asia Pacific is estimated to grow rapidly in the global dairy alternatives market because people have less spare time and more money to spend. Within this movement, the popularity of dairy-free alternatives is forecast to expand at a quicker rate as a result of customer demand.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 32.66 Bn |

| Revenue Forecast In 2035 | USD 91.11 Bn |

| Growth Rate CAGR | CAGR of 10.89% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Source, By Application, By Formulation, By Nutrient, By Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East |

| Competitive Landscape | Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), SunOpta (Canada), Freedom Food Group Limited, Valsoia S.P.A, Oatly GROUP AB, Sanitarium, EDEN Foods Inc, NUTRIOPS, SL, Earth's OWN, Triballat noyal, Green spot co., LTD, Hiland dairy, Elmhurst milked direct LLC, Panos brands, Pureharvest, One good, VLY, Miyoko's Creamery, Daiya foods INC. and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Dairy Alternatives Market By Source-

Dairy Alternatives Market By Application-

Dairy Alternatives Market By Formulation

Dairy Alternatives Market By Nutrient (Qualitative)

Dairy Alternatives Market By Distribution Channel-

Dairy Alternatives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.